BDripTradess

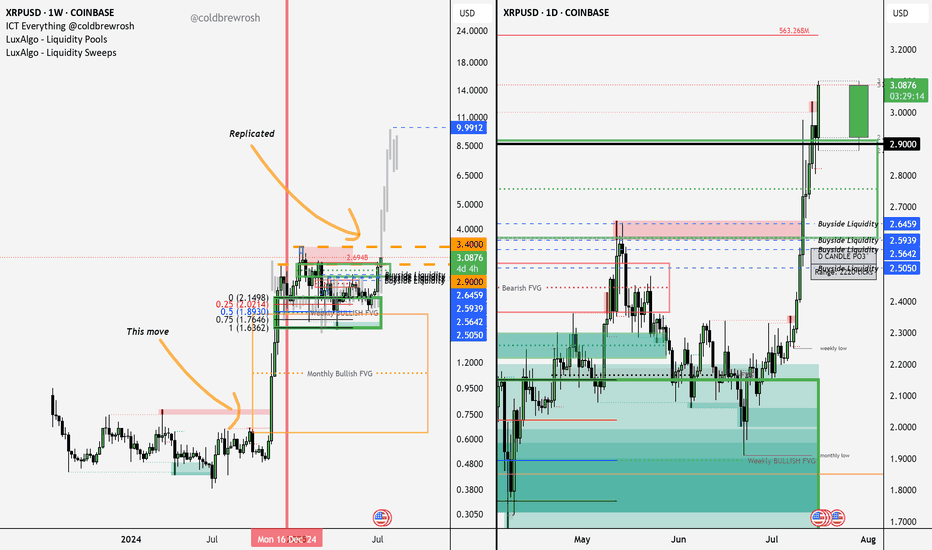

EssentialThis chart illustrates a replication of XRP’s previous bullish move, with key price action and structure aligning closely with historical behavior. Here's the breakdown: Accumulation Phase: XRP consolidated between the $1.90–$2.20 range. This zone acted as a monthly bullish fair value gap (FVG), serving as a springboard for accumulation before the...

There is potential for trade to reverse here since its taking quite a bit for it to move lower. If we fail to go lower here, It will most likely go to buyside liquidity's 1SD.

Follow this post for the result of the trade idea! Explained my bias in the video.

My bias for MNQ this morning with this trade of 2 contracts running. Would like to see price trade lower to 9:30am lows. What do you guys think will happen? Will post results of the trade below. Thanks for watching! Give a like if you enjoyed the explanation and a comment on what you'd like me to share with you guys about my trading journey.

In today’s trade, we captured over 550 points on MNQ, banking a solid $288 profit on one clean, high-probability setup. Here’s the breakdown: Sunday’s open left a gap above, creating a clear target for buy-side liquidity. During Asia, price dipped into a validated Daily Bullish FVG, which had previously been traded through and reclaimed — a powerful sign of...

A little post for transparency, down -$225 for the day. Made some error trading mistakes. I should've just closed the charts and been content with my $60 profit. But I still learned a lot through staying on the charts and watching price. 10am candle not breaching its highs and failing to take it was a great indication that the candle wanted to target sell-side --...

Continuation of the first video entry of this trade. We were aiming for $200 in profits today but failed to get that, ending with $61 in profits. I don't think we will be entering another trade due to the time and also that I want to focus on reading my book "The Trading Game" by Ryan Jones. If you guys found this insightful give it a 🚀, it helps me see that you...

Targeting buy-side with this 10AM candle. Wanted price to take the highs of the 10am open, but we seemed to have failed to as of 11am, SL was hit unfortunately for a final profit of $61 for today. This will be all for me as I am taking it easy and not pushing/forcing any trades. I will be uploading part 2 to this video once this one is rendered for those interested.

Today’s trade was a perfect execution using an inverse fair value gap. I spotted a bearish fair value gap that had been disrespected, and instead of fading it, I flipped the bias and used it as an inverse gap, anticipating price would not trade under it. With my stop just below, I targeted the buy-side liquidity near the London kill zone highs. The result? A...

In this final video, I’m reflecting on the trade and the key lessons learned throughout the session. Looking back, I realize I should have taken profits when price tested the 9:33 AM fair value gap, which would have given us a nice profit. Although I expected lower prices, considering we had a bearish daily bias, I underestimated the strength of the daily fair...

Position Management – Consolidation, Inverse Head & Shoulders, and Missed Exit Opportunity In this video, we continue managing the position, which remains in consolidation. Price taps the 50% level where we took our first partial, retraces higher, and taps the inverse fair value gap that previously held support for the sell-off. From there, we rush lower to the...

In this video, we continue managing the position after taking our first partial. Price consolidates around the 50% retracement level before pushing lower to the 21,188.75 level, which aligns with the 9:33 AM fair value gap we identified earlier. We find support here, and at this point, we’re still hoping to see a continuation lower. However, the inverse fair...

In this video, we’re already inside the 10 AM trade from the previous setup. At this point, we’re up 290 ticks, and we’re managing the position carefully. To mitigate risk, we decided to take our first partial near the 50% retracement of the trend, just in case the price reversed and went against us. This step allowed us to lock in some profit while still leaving...

After the 10 AM candle formed, price quickly expanded higher, as we had anticipated, taking out the buy-side liquidity before tapping into a new week opening gap low. Once this manipulation played out, I observed the price action on smaller timeframes, particularly the 1-minute chart, where we saw a bullish break for value gaps. I used this as an inverse setup to...

In this trade, we executed a sell before the Flash PMI at 9:45 AM, following our setup and market analysis. We were in the trade and managed it until we were stopped out, at which point we stayed out of the market until after the PMI release. Once the 10 AM candle opened, we observed price action closely, waiting for manipulation. Our focus was on potential...

I’m holding off on a re-entry as we approach the Flash PMI at 9:45 AM. My bias is that there’s a potential for price manipulation to push higher above buy-side liquidity, taking out the highs before continuing lower. I’m waiting for the PMI release to confirm this idea and get better clarity on the market direction. Bias: Expecting a possible manipulation higher...

Execution, Risk management and Profit taking shown live in the next 3 posts I am about to share with you guys. I wanted to use that 4H 10am Low as an entry and we caught it. Now we are watching to see if that was just a manipulation to trade into that bearish FVG I outlined near that Buyside liquidity area we were targetting. Closing the day out with $110 in...

Execution, Risk management and Profit taking shown live in the next 3 posts I am about to share with you guys. I wanted to use that 4H 10am Low as an entry and we caught it. Now we are watching to see if that was just a manipulation to trade into that bearish FVG I outlined near that Buyside liquidity area we were targetting. Closing the day out with $110 in...