BradMatheny

PremiumThis short video is to provide my followers with an update. I'm still here. I'm still working on projects and new TV code. I have developed a couple of new strategies that I like and that seem to continue to perform. Overall, I'm still doing my best to deliver superior analysis/results for my followers. This video covers the SPY/QQQ, Gold/Silver, and BTCUSD...

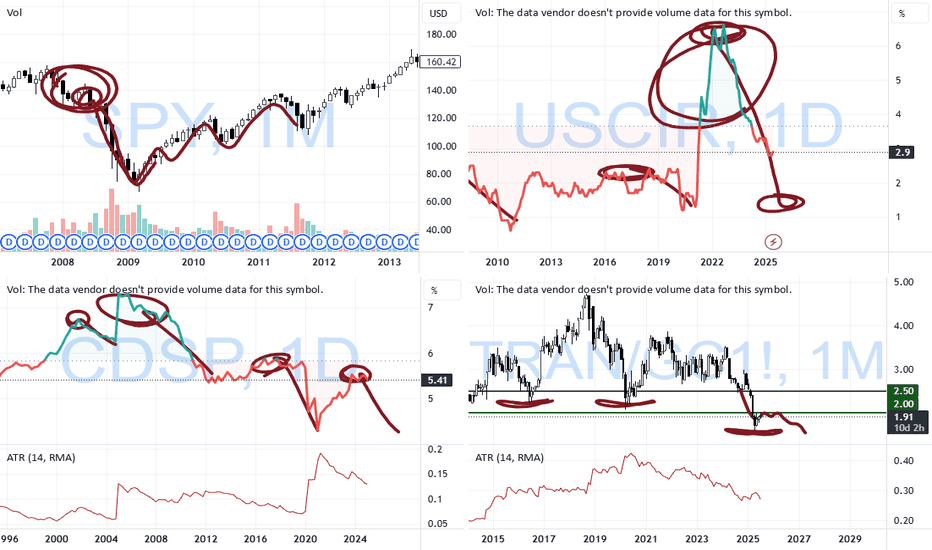

This special update is to highlight why I continue to believe traders should stay very cautious of this rally in the SPY/QQQ/BTCUSD. Underlying economic data suggest that this is one big speculative rally following the April Tariff collapse. And, the economic data I see from my custom indexes suggests the markets are moving into a very volatile and potentially...

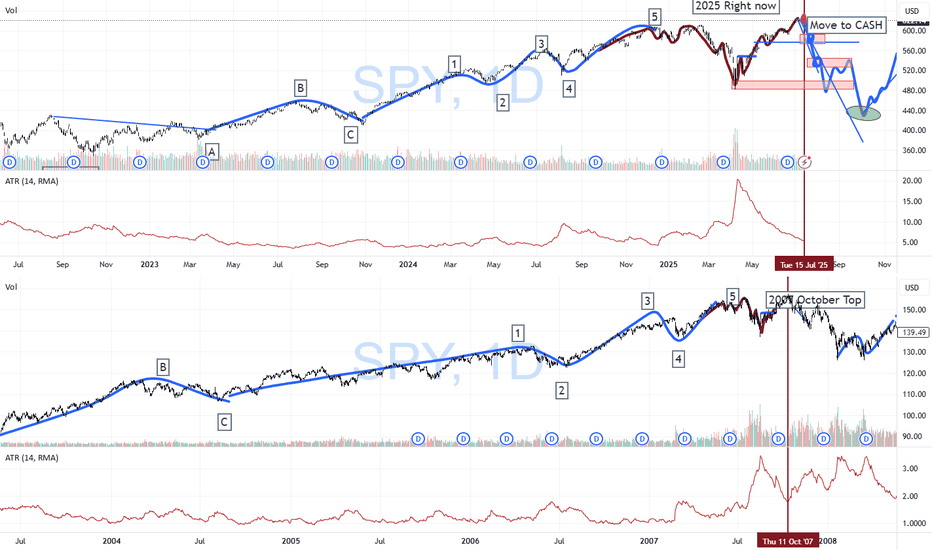

This video is a special update for all TradingView members. I felt I needed to share this information and present the case that I believe poses the most significant risk to your financial future - and it's happening right now. Several weeks ago, I identified a very unique mirror setup in the SPY and kept an eye on how it was playing out. I needed to see...

Happy 4th of July I've been very busy with projects and new tools for traders, as well as the new book I'm working on, and thought I would deliver an End Of Week update for everyone. In this video, I cover the past Cycle Patterns and how they played out for the SPY/QQQ, Gold/Silver, and Bitcoin, as well as add some of my own insight related to the market...

Today was a very powerful day for the Cycle Patterns - particularly for Gold and BTCUSD. Gold rallied as the Cycle Pattern predicted a RALLY in TREND mode. BTCUSD collapsed on a CRUSH Cycle Pattern. The SPY Cycle Pattern predicted a Gap Reversal pattern. We did see the Gap today and a moderate reversal in price. But the SPY, as usual, continued to try to melt...

Today's pattern suggests the SPY will attempt to create a GAP at the open. It looks like the markets may attempt to move higher as the SPY is already nearly 0.35% higher as I type. Last week was very exciting as we watched the QQQ and the SPY break into new All-Time Highs. I suspect the markets will continue a bit of a rally into the early Q2 earnings season...

Today's Breakaway pattern suggests the SPY/QQQ may attempt to move into another breakaway price move - very similar to yesterday's price move. I will add that I believe the SPY cycle patterns have already moved through a breakaway phase with the ceasefire news early this week. I believe the gap and breakaway move yesterday may be the breakaway trend we are...

This post-market update highlights the weakening volume while my primary proprietary modeling system continues to stay BULLISH. The markets are really quite interesting right now. Weakening volume in this Gapping uptrend, today, suggests traders are not buying into the ceasefire between Iran and Israel. Additionally, the move in metals suggests a PANIC phase has...

What happened to the CRUSH pattern? Everyone wants to know why the CRUSH pattern didn't show up today. Well, I keep telling all of you these SPY Cycle Patterns are based on GANN, Tesla and Fibonacci price structures. They do not take into consideration news, global events, or anything outside of PRICE. They are predictive - meaning they attempt to predict...

Today's CRUSH pattern suggests the markets will struggle to find any support for a rally. A CRUSH pattern is usually a large breakdown type of price bar that moves aggressively against the dominant trend. Som, today I'm expecting some fairly large price action and I believe the markets may start a breakdown move this week as we continue to get more news related...

Today's Pause Bar pattern suggests the SPY/QQQ will slide into a sideways type of PAUSE in price action today. I'm not expecting much to happen and if we do see any breakaway or breakdown trending it will likely be related to news. While we have options expiration today and a host of other things that could drive the markets, I believe the markets are struggling...

Today's pattern is a GAP Reversal in Counter Trend mode. I believe this could represent a breakdown in the ES/NQ as the US stock market is closed for the Juneteenth holiday. Obviously, after the Fed comments yesterday (stating "uncertainty") and with the continued Israel/Iran conflict playing out, it makes sense to me that the US markets would move into a...

Today's GAP Potential pattern suggests the SPY/QQQ may GAP a bit higher at the open, then move into a melt-up phase, trying to identify resistance, then roll into a topping pattern and move downward. I believe the recent "rollover" of the markets (initiating last Friday with the Israel/Iran conflict) is still dominating the markets and news related to the ongoing...

Today's pattern suggests the SPY/QQQ will move into a type of topping pattern, attempting to identify resistance, then roll away from that resistance level and trend downward. I suggest the news related to the conflict between Israel & Iran may continue to drive market trends with traders moving away from uncertainty near these recent highs. Silver makes a big...

Today's Up-Down-Up Pattern suggests the markets will transition into a moderate upward trending price bar - which is quite interesting in the world we have today. War and a big weekend of events, protests and other new items could drive market trends over the next few days. Still, the SPY Cycle Pattern for today is an Up-Down-Up - which suggests last Thursday...

Today's pattern suggests the markets may stall into a sideways price range. After the news of Israel targeting Iran in a preemptive strike late yesterday afternoon, the markets moved dramatically lower while Gold & Silver moved higher on the news. I, personally, see this market trend as a shift in thinking ahead of a long Father's Day weekend. I see traders...

Today's pattern suggests the markets may attempt to identify a base and move higher (rally) off that base level. Given the overnight price activity, I suggest the process of identifying the base level could prompt a deeper early decline in price - possibly attempting to retest 595-597 lows before finding support and attempting to rally. As I've been warning over...

Today's counter-trend Bottom-Base Rally pattern suggests the markets may attempt to find a peak and roll over into a downtrend. The normal Bottom-Base Rally pattern is similar to the start of a moderate price base/bottom, then moving into a moderate rally phase. In counter-trend mode this pattern would be inverted - forming a Top and then moving into a downward...