Chad_Sniper

We can see weakening in AO. Price is sitting in a pivot zone. Price could make a pullback.

Bearish overall trend. Price could swing downwards after finding liquidity.

Higher TF, gold is sitting in a resistance level. Last 5 day session, gold consolidated and formed a triangle. Price could potentially break downwards and start mitigating the gaps left after weeks of bullishness.

Price is sitting on a SBR zone. Price could potentially short after finding liquidity.

We saw a bullish rally last week. It could continue the trend as it has not yet hit the premium/supply just yet. If it is bullish then expect it to find support in the demand/discount zone.

After the huge dump last week, this pair could possibly do a retracement to the upside before continuing its bearish trend.

Overall trend is bearish. Price is sitting at a key level. This could mean a potential scalp buy short term. We wait for accumulation of price and a clear breakout to the upside, we can trade the small retracement going up.

Gold is looking bearish after seeing divergence. Hope the news later will be in favor of the bears.

The red arrow was my prediction of the movement of price. It failed overall but took small profits before it went the opposite direction. Price made a drop-base-rally, which acts as a demand zone at this point. Later today with the news, price could either go up to meet the supply, or break the current demand (formed yesterday) and mitigate the demand zone at 1.26327.

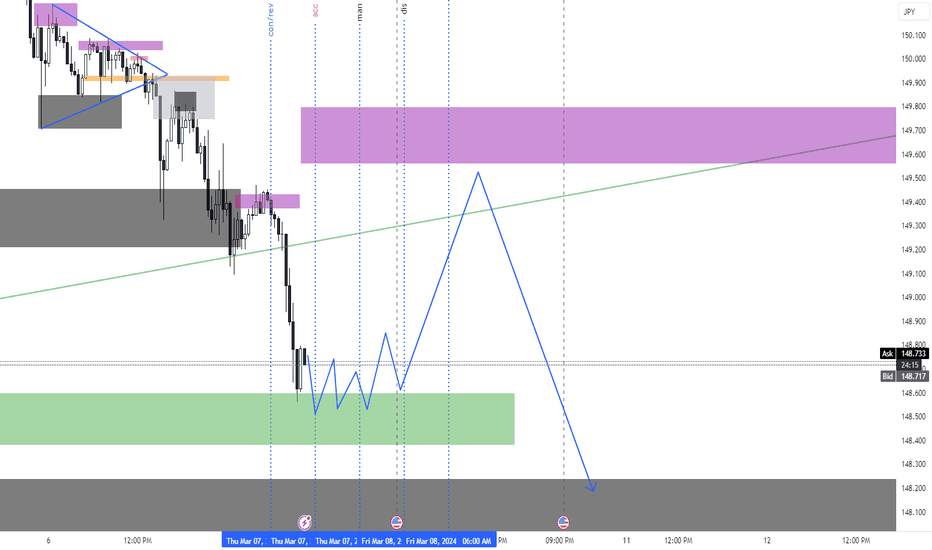

This pair is bearish at this point. Looking to sell at High (Buy Low, Sell High). If to buy, only on small pullbacks. 150.332 is a good sell zone.

Price is sitting at supply zone. Assuming price will continue bullish, it will bounce off a fib level to continue bullish run.

I saw a change of character feb 29. This could mean a potential short for UJ. I saw price respected the supply zone / premium at 150.720. Price is approaching that area again which will cause it to sell, potentially.

The overall trend is still bullish. Price is sitting near a strong demand zone. Price could tap into that zone and continue bullish run.

The February 5 bull run has not diminished yet and it looks like this pair will reach the supply area at 1.27420 and could potentially go more bullish from there.

UJ is still in the bull run since 12.28.2023. This entry is just riding with that. We see a triple bottom which could act as a support. We can wait for a breaker bull candle to go past the last bearish candle.

Overall trend is bullish. 1.3487 - 1.3618 is a strong seller's zone/supply and price tried that level 4x already. This pair could continue going up or just break the overall trend

GU started going bearish in the first week of Feb. Assuming the trend continues, price could either: 1 - go up a little bit more to reach the premium area before continue selling 2 - as price sits in a golden zone, then it could just very well continue selling at that point

0.65038 is a fibonacci .618 zone for buyers. If Michigan Consumer Sentiment news is bullish then it is a perfect buy entry.