Cherry94

Essential~+ US Tariffs on Switzerland are more than expected ~+ Yesterday's US hot data

+ US data Beat (ADP Nonfarm, GDP QoQ, Core PCE) ~+ Timing: Pre-Fed Rate Decision ~+ Latest UK Retail Sales Miss ~+ BoE is in dovish tilt (MPC 6-3 vs 6-2 expected)

~+ Pressure on Powell, Waller is dovish ~+ Anticipation of the Trade deals deadline + Risk-on general sentiment after Japan trade deal

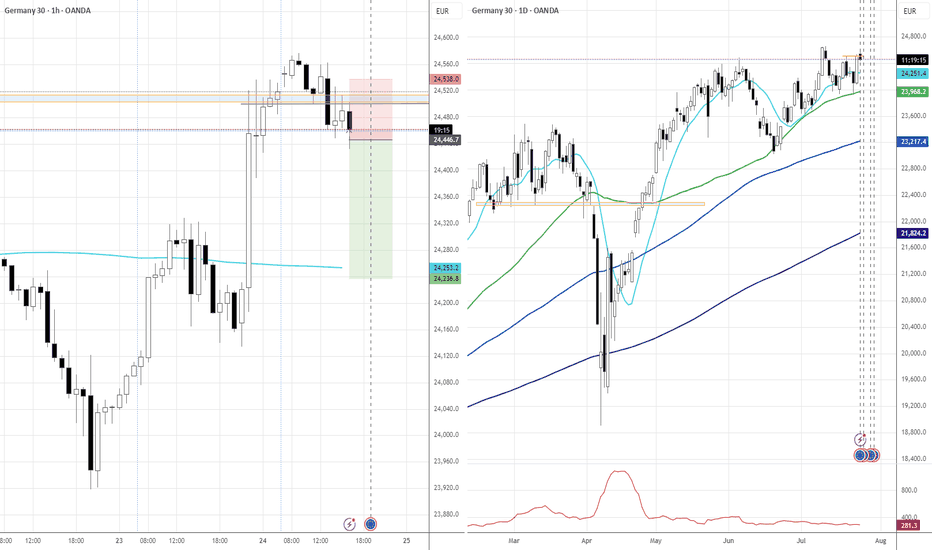

~+ Post-trade deal risk-on seems to be subsiding ~+ Profit taking towards the ECB Rate decision

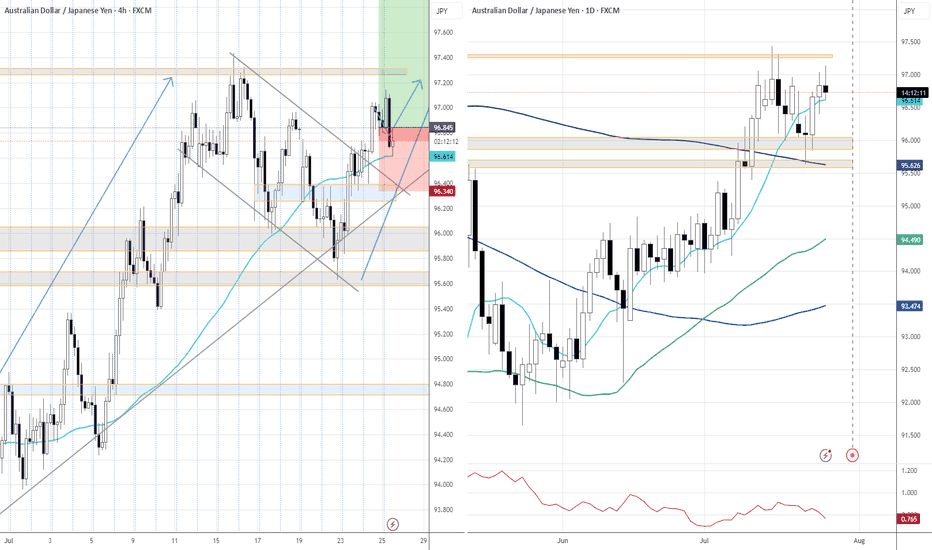

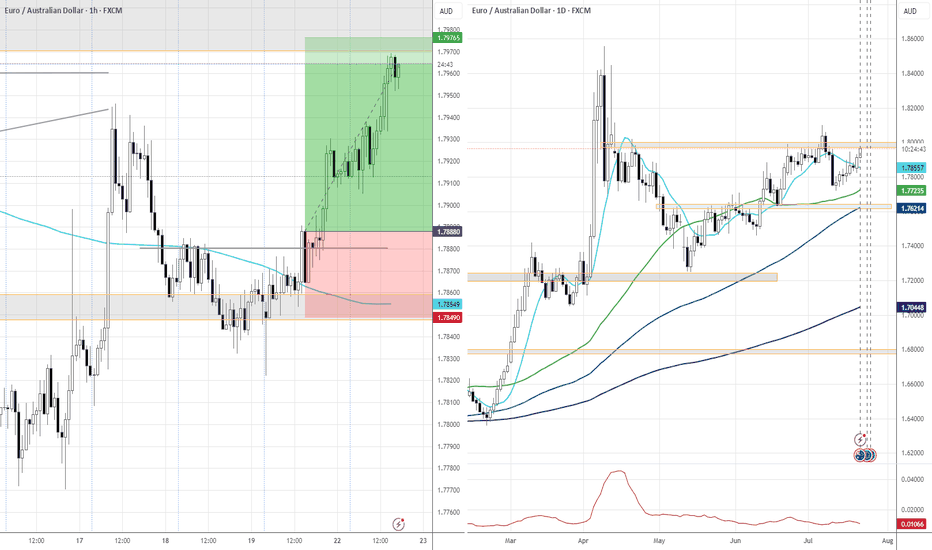

+~ RBA is relatively hawkish +~ Political uncertainty around JPY +~ Positive trade deals anticipation *Swing trade; giving a room for a reasonable pullback; will potentially look to scale in at the resolve of a newly-formed structure.

+ UK Retail Sales Miss + ECB is Hawkish (Hawkish Hold)

~+ Lack of credibility, general narrative around the USD & Fed, shaky geopolitics ~+ Timing: dollar bulls' profit-taking into the Fed Rate Decision ~+ Swiss KOF Beat * USD move from the US-EU trade deal looks overdone against multiple assets

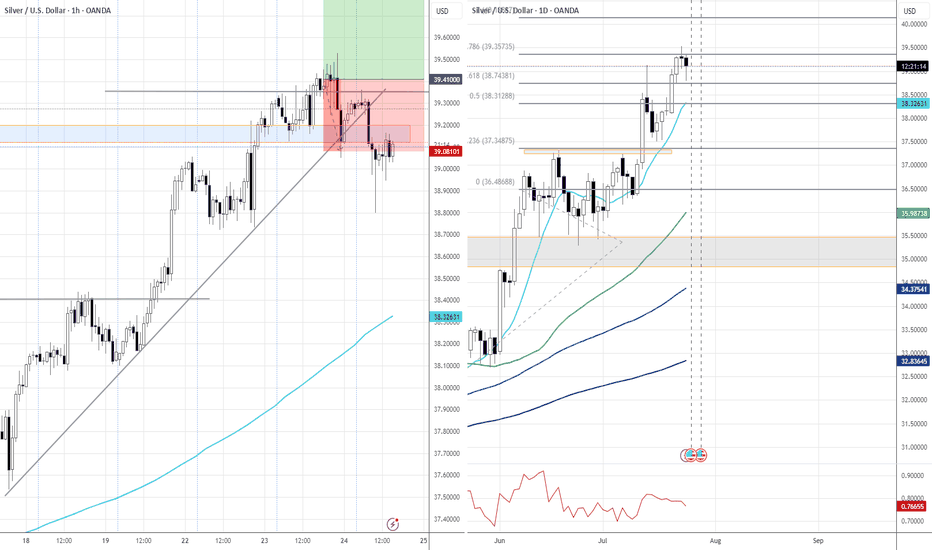

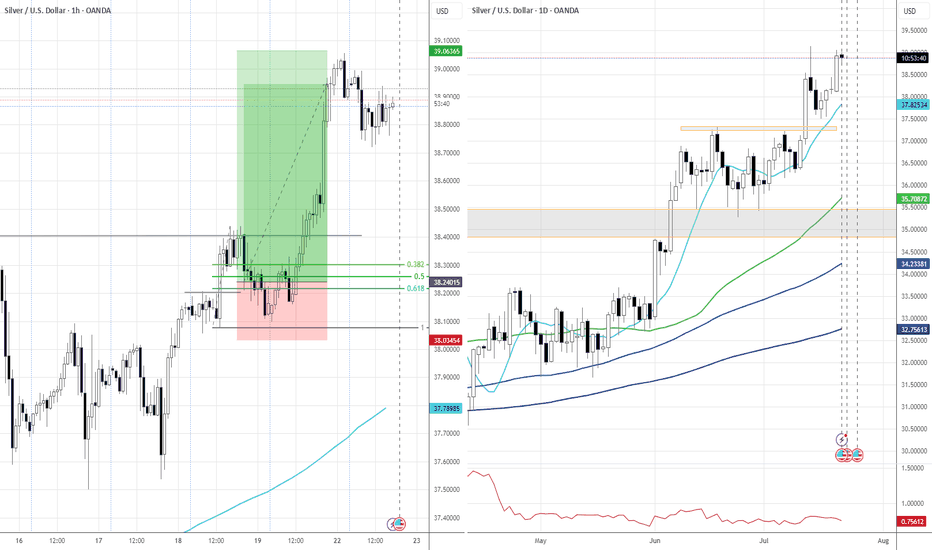

~+ Pressure on Powell, Waller is dovish ~+ Anticipation of the Trade deals deadline ~+ XAG didn't sell off immediately after the JP trade deal + XAUXAG downward breakout + Risk-on general sentiment after Japan trade deal

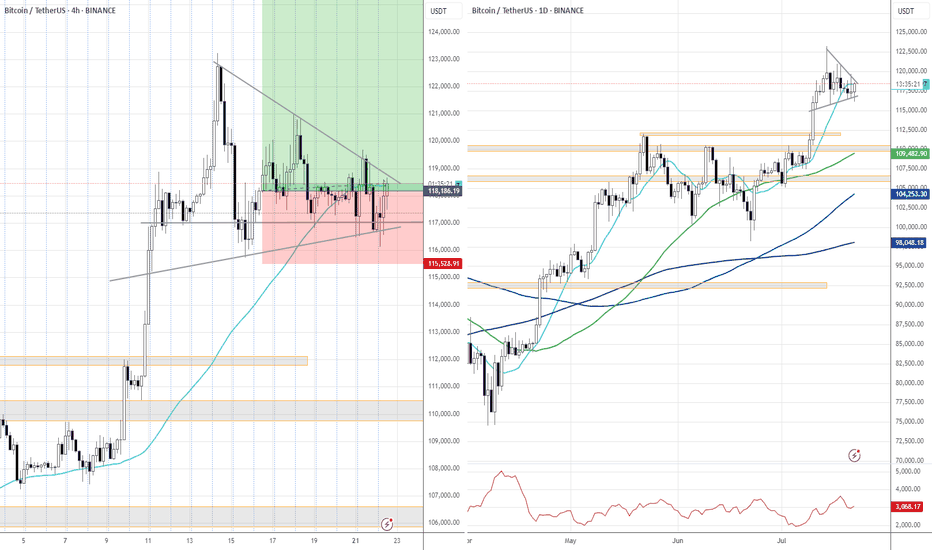

~+ General gloom over USD (pressure on Powell, tariffs, BB Bill) * Mostly technical trade

+ Dovish Waller ~+ Tariffs pressure on USD + Seasonals

+ Dovish Waller ~+ Tariffs pressure on USD + Seasonals

+ Some positive crypto policies *Mostly a technical setup

+ US data (ISM, JOLTS) Beat ~+ Powell sounded a bit hawkish ~+ Timing: not much time is left until the end of the week because of Independence Day; USD is stretched down - expected profit taking ~- US BB Bill passed

+ US data (ISM, JOLTS) Beat ~+ Powell sounded a bit hawkish ~+ Timing: not much time is left until the end of the week because of Independence Day; USD is stretched down - expected profit taking ~- US BB Bill passed

~+ Airstrikes in Iran -> Supposed Risk-off flows *Wasn't really at the desk monitoring the developments on the news.

+ Iran strikes, 2 weeks, Trump's waiting period Continuation of the mean XAU/XAG reversion to the downside

Mostly technical setup; expected to hold through a possible retest