CryptoEnchanted

Pluslooks to me like bitcoin will test lows and continue the down trend after all .

There’s little buying enthusiasm in this final upward thrust as the price nears a key resistance zone—the so-called 'ice' that acts as a barrier. The automatic reaction, a classic Wyckoff response, appears to have been exhausted, as evidenced by the struggle to break into the established trading range around the 90K level. A subsequent test of the 76K support...

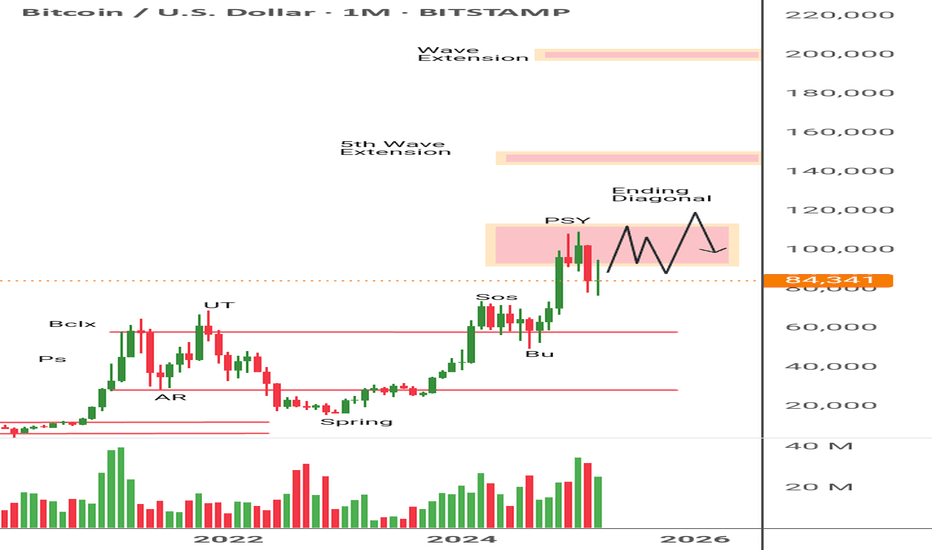

Border view on the monthly chat. Because bitcoin is testing the demand again. 113k 147k 200k are my next targets. Caution is advised thow panic selling can accour.The initial supply is now from 100k the short term local top . I can see a shake out of the sellers . Sentiment will likely be supper bullish again . Weather the strong hands won't to unload some more...

Long to test the 90k level . What's changed ? iv seen a lot of demand block orders on the 5mininte chart each higher up that before i can draw a text book example of short term accumulation range on the 4 hour .I can see on the weekly chart that prices can push much higher 113k and 148K

Had some very slight exhaustion of the down trend broke tested the bottom. Demand had been relative high a lot of effort to push market higher with little result. Personally I think on the hourly is forming another distribution range with this last leg utad to 84 k and should see another sign of weakness now . I think if it were the bottom and a continuation of...

Possible Elliot wave (expanding diagonal) to finish the cycle.

To Test 90k level of the initial reaction of the supply.absorbtion of demand had the initial test of ath on low volume. New supply entered . 2 tests of the reaction terminal shake out can occur now to the downside.

100k more than a psychological level. 100k fib target Elliot Wave 5 13 percent of the USD. Bitcoin is going to cause problems any higher and collapse the economy we dnt really want that . this could be the start of the bear market. Winter solstice ⭐ .

Looking incredibly bullish. This analysis is wycoff theory. Looking at price action and volume analysis wave by wave

Say what you see .Looks like re-accumulation to me.

Looks like the test of the all time high is starting to reverse. Nice set up with some resistance. The economy has picked up slightly and I don't really see bitcoin going any higher .I think fair value is at the bitcoin mining profit at 42k and yet new mining chips will likely set that value even cheaper.i going to say the top is in and has tested it 3 times .I'm...

Fairly shore this is a distribution trading range ...

Pretty confedent shorting on the recent shakeout it was a low volume brakeout by my vol data. This indicated lack of demand and the last point of supply from the trading range from 30k.

Major resistance 30K sellers would wont to keep under the 30k level. This is what a Wykoff distribution range looks like as a head and shoulders reversal pattern. To analyze the market volume, iv looked at data from the top 10 spot crypto exchanges, as i believe that spot trading reflects the most accurate picture of smart money activity. Compared to margin trading

When the Federal Reserve increases the federal funds rate, it typically increases interest rates throughout the economy, which tends to make the dollar stronger.

According to the Elliot Wave count, bear markets typically take on the structure of a double zig-zag at the very least. In this case, my analysis suggests a target of 2,700 which seems surprisingly low. However, based on Fibonacci ratios and this Elliot Wave count, there is a strong possibility that this target may indeed be reached. It's definitely worth keeping...

Binance volume is pretty good .The lack of demand hear is a warning sign. Drilling down into the market footprint it's the same story where you see the market going up I see selling buyers from 16k double the profits. I don't really see Btc ever going past 100k not with out a fight the recent regulation on leverage and loans it's all it takes a 60k BTC is 15% of...

Nexo Coin is currently offering interest rates of up to 12% on USDT, USD, GBP, and EUR. As a Swedish broker, Nexo provides insurance on its clients' assets in the event of a hack, a unique feature not offered by other companies to my knowledge. Based on my quick analysis of the trading range, it appears that the market is testing the lower border levels. However,...