Dave1147

Date: July 31,2025 Session: New York Session Pair: GBPJPY Bias: Long Liquidity from Monday's London session was swept in today's (Thursday) New York and London Session. Now I see price following the trend downward. Entry: 199.080 Stop Loss: 199.387 Target: 198.207 RR: 2.90

Date: July 28,2025 Session: London and New York Session Pair: USDJPY Bias: Long Looks like Sundays liquidity pool from last NYC open has been swept and it looks like price action wants to follow/continue its trend long. Entry: 148.197 Stop Loss: 147.884 Target: 148.740 RR: 1.77

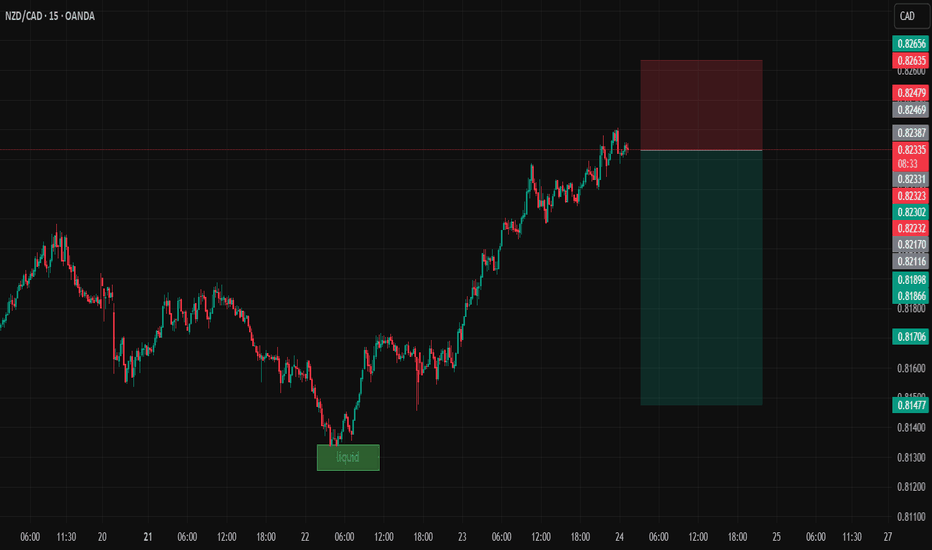

Date: July 24,2025 Session: Tokyo and London session Pair: NZDCAD Bias: Short liquidity pool that is waiting to be swept this week. Looks like price is gonna be magnetized towards that pool level during London and Tokyo. The trade may even stretch into NYC. Entry: 0.82331 Stop Loss: 0.82635 Target: 0.81475 RR: 2.81

Date: July 23,2025 Session: Tokyo and London session Pair: GBPCAD Bias: Long 2 liquidity pools that are waiting to be swept this week. Looks like price is gonna be magnetized towards these levels during London and Tokyo. The trade may even stretch into NYC. Entry: 1.83970 Stop Loss: 1.83674 Target: 1.84811 RR: 2.82

Date: July 22,2025 Session: Tokyo and London session Pair: GBPUSD Bias: Short Price is setting up to target where liquid rests from last weeks London open on Thursday. Price action shows exhaustion after NYC and London liquidity grab. Entry:1.34795 Stop Loss:1.35103 Target:1.33853 RR:3.08

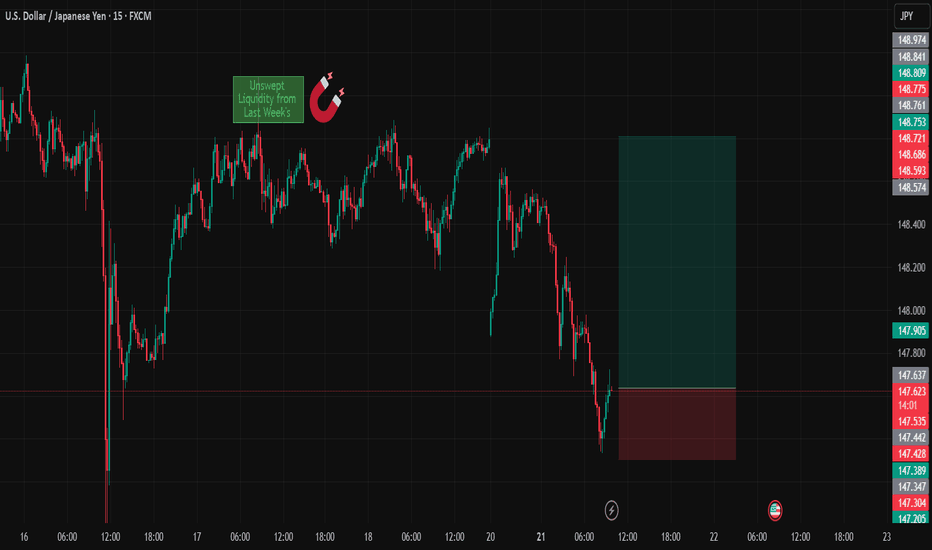

Date: July 22,2025 Session: Tokyo and London session Pair: USDJPY Bias: Long 1. Clean liquidity pool left unswept from last week's NYC Open (Thursday). Took this trade earlier today but looks like price wanted to consolidate in the liquid pool its currently in. I still hold the same idea and think the sweep will definitely take place sometime this week. Now...

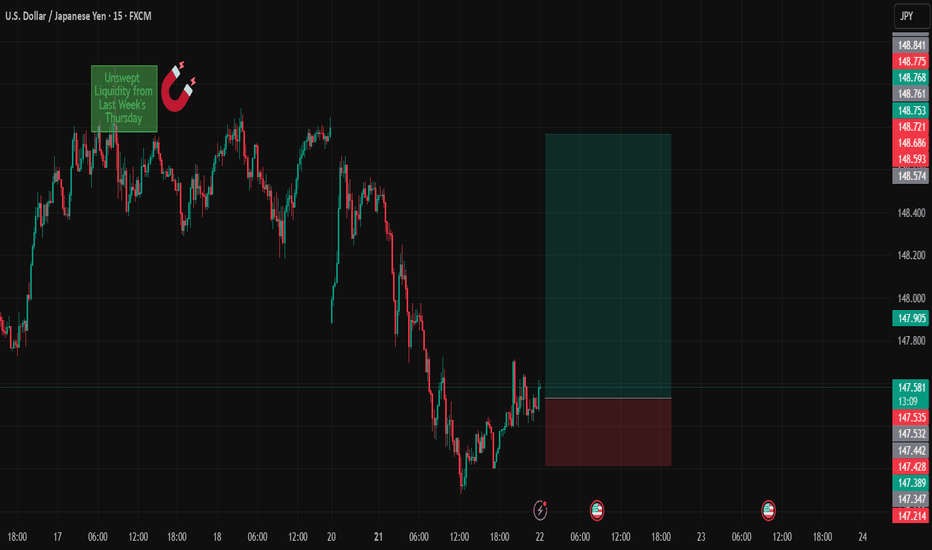

Date: July 21,2025 Session: New York Open Pair: USDJPY Bias: Long 1. Clean liquidity pool left unswept from last week's NYC Open (Thursday). 2. NY session typically retraces or extends from London reversal, giving directional momentum. Entry:147.544 Stop Loss:147.250 Target:148.794 RR:4.11

euro is bullish according to fundamentals and eceonomy. Jpy index is on a downtrend currently and I expect more bearishness from this currency. Euro is on the way up and I think its the perfect time to buy in this pair.

Euro is gaining strength while the cad is at a weakpoint and dumping. I expect EURCAD to reach the major resistance zone indicated on the chart.