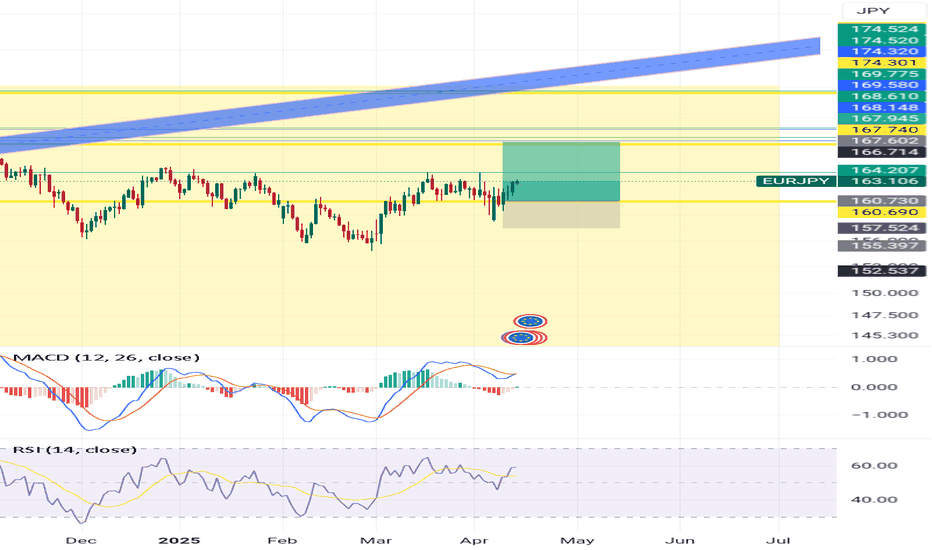

The JPY sector is going to be the most promising sector, for the next half of the year, low risk, huge margin of safety, economic indicators are supportive of the pairs intrinsic value . It's advisable to place huge amount of your portfolio into this sector

audnzd as been netrual compared to the marke, a very low beta. But there are more risk on the set up.

AUD is selling and nzd is buy at recent.. The market structure of AUDNZD as been on a down trend since last year .. by evaluating the pair and discounting the candlesticks we can tell it's below it's intrinsic value we an understandable margin of safety

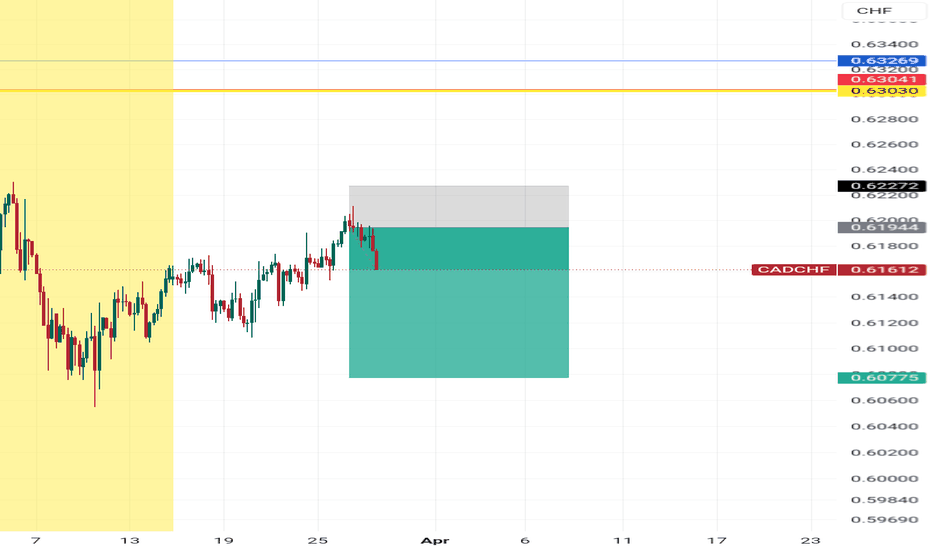

All CHF pairs has been showing signs of a reversal setup for 2-3 weeks now, Since gold price dropped on the 22/4/2025, all USD major paired currencies have all been reversing .. this effect will help boot all the CHF pairs reversal set-up. Additional catalyst to the move will be the release of the manufacturing PMI (USA)

So trump reduced the China tariff, which caused the gold buying momentum to reduce , but it continues this week . For all gold pairs

The jpy pairs real value as been clear since last month but tho to different factors such as USA trade war and other .. it asn't been able to move according to its value .. buy EUR and CAD as managed to show it's value will all that as happed since last month ... It's well positioned for a strong buy whenever jpy choose to go up

saw this trade last MONTH but TRADING VIEW don't always me to past it publicly There is still a 1:1 profit if the market do not change

CADCHF structure as been on a down trade for weeks, the I a selling momentum on the chf pair presently I can't tell how long it's going to last for but the set up is okay

market as changed for both GPBAUD & GBPNZD Something is wrong I don't understand why it's happening yet, still trying to figure it out

the Chf sector is beginning to show signs of a change is direction this will take a while to fully develop , it's at the first stage . It might that months or probably continue, having that in mind since all the pairs in the sector as different valuations from the sector apart from USDCHF . Both GBPCHF & EURCHF closely have the same valuation, so there many...

the Chf sector is beginning to show signs of a change is direction this will take a while to fully develop , it's at the first stage . It might that months or probably continue, having that in mind since all the pairs in the sector as different valuations from the sector apart from USDCHF . Both GBPCHF & EURCHF closely have the same valuation, so there many...

do to the industries (pairs) in the GBP sectors, which as a weak beta less then 1 .. as not increased in value for week the recent few weeks of upward move was cause by AUD & NZD .. which it isn't the real value Of the pair , so it's moving down aggressively

do to the industries (pairs) in the GBP sectors, which as a weak beta less then 1 .. as not increased in value for week the recent few weeks of upward move was cause by AUD & NZD .. which it isn't the real value Of the pair , so it's moving down aggressively

same has EURCAD, GBPCAD is also selling downward aggressively for a risk to reward of 4:1 as 70% probability move downward

The weekly timeframe as shown signs of weakness since last year .. lucky the D1 pushed it down since yesterday and it moved aggressively today

USDCAD is over bought and it is currently moving with the DXY , Since the DXY is showing since of a fall on the W1 timeframe, with time it will caught up with USDCAD, which is overbought and will aggressive fall it's a 3:1 trade and 45% probability

AUDNZD as being ranging for since October I'm guessing it as finally chose to fall .. while AUDUSD and NZDUSD are selling against the dollar for the past few months .. this indicates the AUDNZD will fall down as a fast rate only if DXY start going down it's a 4:1 trade will a 60% probability

AUDNZD as being ranging for since October I'm guessing it as finally chose to fall .. while AUDUSD and NZDUSD are selling against the dollar for the past few months .. this indicates the AUDNZD will fall down as a fast rate only if DXY start going down it's a 4:1 trade will a 60% probability