Eleazarahmath

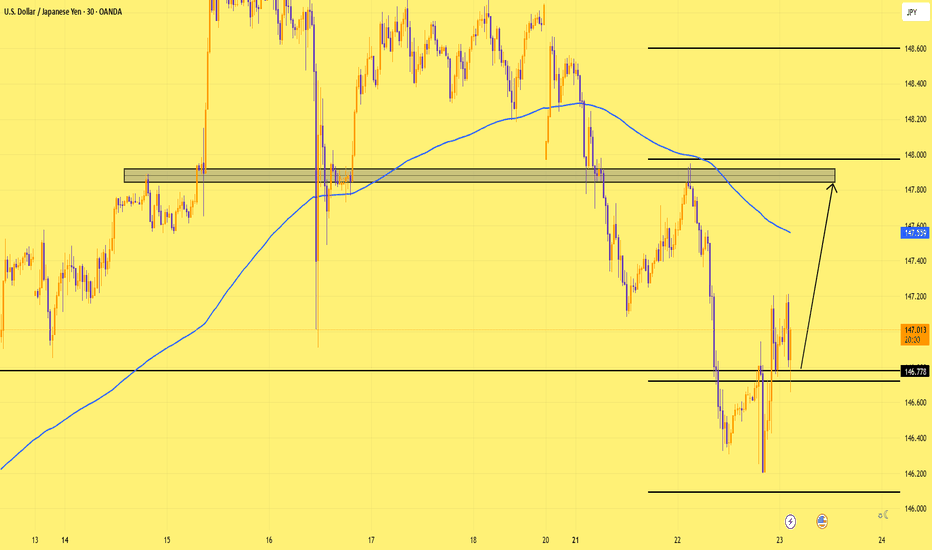

PremiumPrice might drop a little at the open, but I don’t expect it to go far. Support is around 146.77—if it holds, we could see a move back up toward 147.80.

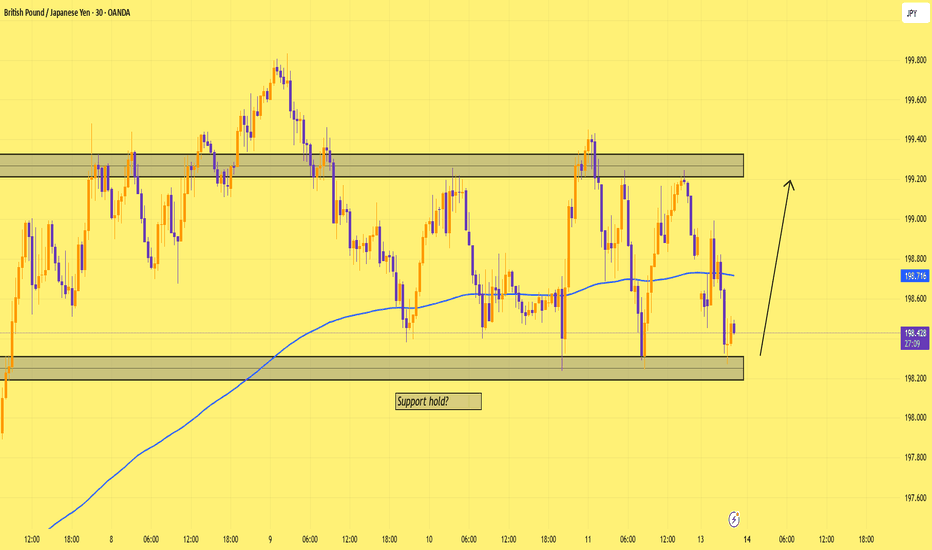

We just got a clean rejection at 1.9504—same zone price respected 3x before. If bulls step in here, next stop might be resistance at 1.9573. 1.9650 is the 2nd TP Simple range, clean bounce setup. Let’s see if it delivers.

Our last trade on this pair was well played by the market. Right now, the primary trend remains bullish. We’re in a sequence of higher highs and higher lows. But from current levels, the risk/reward ain’t it. I’d rather wait for a dip—ideally around 3350, where we’ve got solid support. No rush. The cleanest entries come to those who wait. (Tomorrows news...

Price holding the range low and bouncing near support As long as we stay above 198.200, I’m watching for bullish continuation 📈 Structure still intact — next reaction zone marked above ✅

Price tapped the 200 EMA and held. Structure still bullish, no reason to flip bias just yet. Let’s see if buyers can take it from here — nothing forced, just flow.

Our last trade on this pair resulted in profits 200 EMA + prior structure held firm — clean rejection off the zone. I’m expecting price to climb back toward 1.8090 and possibly extend higher.

The trend is still bullish, but this selloff’s showing signs of exhaustion on the daily. ❌ Not jumping in here — R/R is weak. ✅ I’d rather buy the dip into support at 3300–3305. 🎯 Targeting a clean bounce back to 3340 if we get the setup. Let’s be patient — the real move is coming

Price just tagged 2.0731 the former ceiling that’s now acting as intraday support, and printed a clean rejection wick. If that level holds, I’m looking for bulls to squeeze us back toward the 2.0810-2.0830 supply zone . From there, I’ll watch for fresh sell signals. Bias flips only if 2.0731 breaks convincingly.

Price tapped into demand with multiple rejections. Targeting 3,330. Clean setup, clear risk. Let’s see if the bulls got something left.

Silver popped through 36.40—if buyers keep that level intact on the retest, I’m looking for a run toward the 37.00 supply zone.

Price respected the zone perfectly, bouncing clean off support around 3,327. Structure still intact — bulls defending well. I'm personally expecting weaker US data, which could be the catalyst to drive us toward 3,380. Simple setup. Clear target. Now it’s up to the market to deliver.

Price is reacting off a strong support zone and the 200 EMA. This move is also based on my expectation that upcoming U.S. data will come in weaker than forecasted, which should push USD lower and support GBP strength. Target: 1.3780 📈 Let’s see how it plays out.

Price just flipped 2.2580 from resistance to support. As long as that floor holds, I’m looking for a push toward 2.2730. Invalidation below 2.2500 ⚠️ Heads-up: BoE Governor Bailey speaks tomorrow (Jun 24). A dovish tone could knock GBP lower and spoil the setup.

Demand box 3 340-3 348 defended again. If buyers keep this floor, I’m targeting the 3 375 swing high (200-EMA just above). ⛔ Invalidation below 3 330

Price just spiked into the 0.6455 zone If buyers defend it again, I’m eyeing 0.6530 for the next leg.worth keeping on the radar.

Price has stair-stepped higher all week, printing a clean series of higher highs / higher lows. We’ve just pulled back into the most recent swing-low zone (mini A-B-C correction). As long as that structure holds above 165.20–165.30, I’m looking for the next leg to extend toward 166.50. Idea is invalidated on a decisive close below the blue 200-EMA / prior...

Price just tapped the 50% fib zone around 93.95, where buyers stepped in last time. If this support holds, I’m looking for a bounce toward 94.58. A clean break below the zone cancels the idea—risk stays tight.

Price just kissed the 164.63 resistance I’ve been tracking and printed a rejection wick. Unless we close decisively above that shelf, I’m treating it as a fresh supply zone. My base case is a drift back toward the mid-range support at 164 Structure: clear descending channel; latest rally only tagged the upper rail