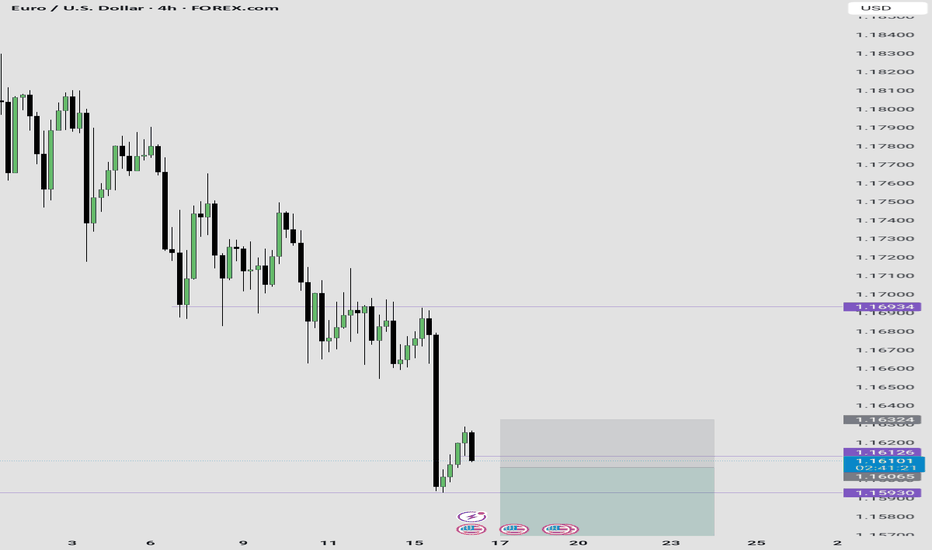

4hour structure is extremely bearish creating series of lower lows and lower highs. Couple with the fact that GBPUSD is also bearish, while DXY is bullish. So, I expect price to move lower and break the major swing low below price.

Buying Amazon shares here... Reason: Bouncing off support with good bullish price action candles. I expect the price to reach $245 per shares between now and next week Friday.... My stop loss price is on the chart.

This is a bullish trend continuation trade idea on BTC. Trend across all higher time frame is bullish.

I have been waiting for this EURJPY long setup to form for the past 2 trading sessions. This morning I saw this beautiful bullish swing low formed and that is my entry signal for to take a long trade on EURJPY. REASONS: EURJPY is super bullish right now. The Daily and 4Hour time frame trend is extremely bullish. So, am only looking to take a long buy to follow...

After a series of bearish structures on 4Hour time frame, which is actually a bullish retracement on higher time frame, Gold has now broke the bearish structure with series of bullish candles which turned the trend from bearish to bullish trend. After the bullish break of structure, Gold retrace into a fair value price level, formed a swing low plus a bullish...

FX:NAS100 I just entered this buy trade on Nasdaq on the daily time frame. The trade setup is a Swing trade following the monthly and weekly orderflow. The Monthly is bullish, the weekly is also bullish, so I entered on the daily time frame retracement. My overall take profit is a risk reward of 1:4.

NASDAQ:AMD Right now, am extremely bullish on AMD. I expect AMD to give a good bullish run to trail NVIDIA. Technically, AMD is supper bullish right now, having had a multiple bullish break of structure on the daily time frame. I took a long entry on the bullish break of structure on daily time frame. Stop loss is below the recent structure swing low. What...

OANDA:GBPUSD Has broken the bullish swing low on 4 Hour time frame with strong sell off bearish candles leaving behind a big bearish imbalances in price. Which extra confirm that price is extremely bearish on 4 Hour time frame. Now that trend has shifted from bullish trend to a bearish one, am now bearish on GBPUSD. Bearish shift in market structure that...

OANDA:USDCAD USDCAD has given a massive bullish break of structure on 4 Hour time frame after tapping to a strong key level on weekly time frame that is serving as support. Now am bullish on USDCAD for a weekly income swing trading moves. All I need right now to enter for a long to ride the move is a pull back to key level of support like old highs or...

OANDA:USDCAD USDCAD Is extremely weak I expect price to drop hard from here. TRADE BREAKDOWN Weekly Trend is Bearish. Daily Trend is Bearish. 4H Trend is also Bearish. This is 100% a trend following strategy trade. The entry is taken on 4H time frame targeting the recent weekly swing low. This is a 4RR Trade.

Since Bitcoin is super bullish on monthly and weekly time frame, my focus is to trade trend continuation pull backs on the 4HR time frame. For this particular trade, I want to see a pull back to a key level of either imbalance or the old high serving as new support for price. I will be taking a bullish trend continuation setup on that 4HR pull back. Target: I...

I'm looking forward to buying BTC in this price level if I see a good bullish price action which confirm my trade idea. Market structure on 4HR is currently bullish. Looking at the monthly and weekly time frame, BTC is extremely bullish and it's clear that BTC is not done with it's bullish run. I expect to see BTC give another good run to the 120k-150k price level

Gold has been extremely bullish in the last few months on higher time frame. Monthly : Bullish Weekly : Bullish Daily: Bullish 4HR : Bullish I will be buying this bullish trend retracement on 4HR time frame. But I want to see a bullish price action before I enter the trade for long. My overall target is the major high created in April. My RR is 1:5.

USDCHF is Ready to continue It's SELL Move to the higher time frame recent swing low of 0.803. SELL IDEA BREAKDOWN; Weekly is bearish and price is moving closer to the 0.803 swing low. Daily is also bearish, price is moving towards the weekly swing low. 4HR had a bearish break in market structure, followed by a retest of the recent swing low that was broken...

AMD is bouncing off the monthly time frame key level that is acting as support for price. On weekly time frame and daily we had a shift in market structure from bearish trend to bullish. I will be buying AMD on this retracement to the recent weekly gap created by price. Once I see a good bullish price confirming that the retracement is over, i will enter for a...

ATOM can give us a good 100% return from here, risking only 18% of the invested amount. Reason? Weekly structure has turned bullish. Daily is super bullish. My stop loss is below the recent swing low on weekly time frame.

I just bought SP500 for it's bullish move continuation. Monthly structure is bullish. Weekly is bullish. Daily is also bullish. I entered for a long buy on the daily time frame retracement.

I expect Google share price to rise by atleast 10% within the next 2 weeks. Reasons; Monthly is massively bullish. Weekly is also bullish. Daily is also bullish.