ElliottChart

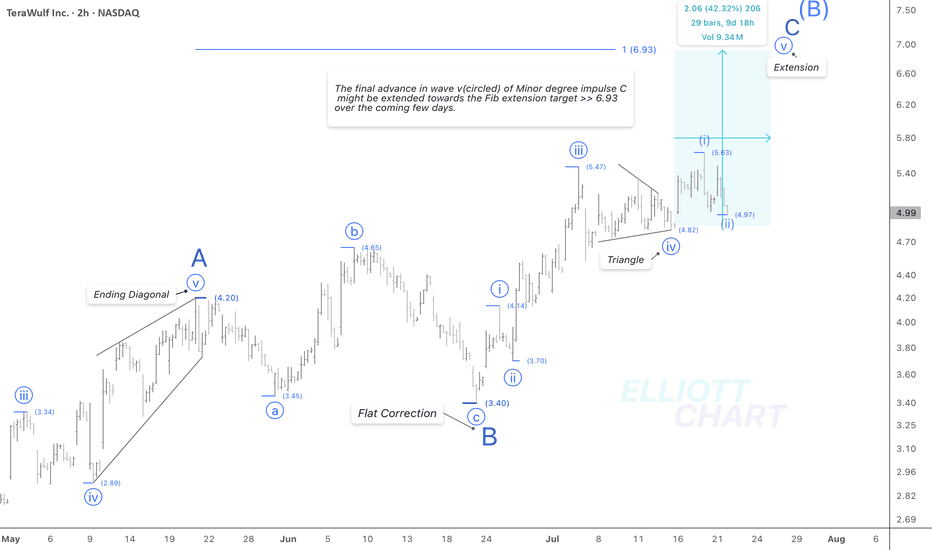

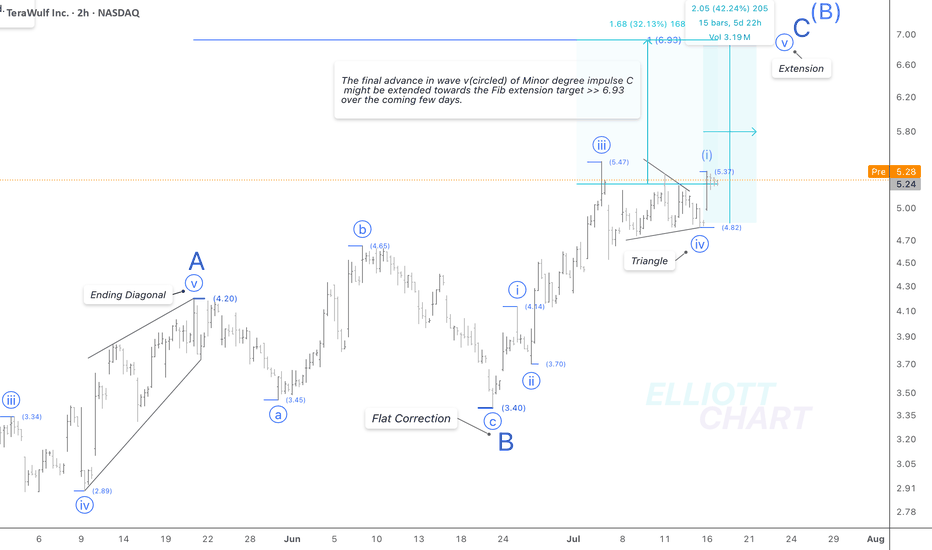

PremiumThere is no change in the NASDAQ:WULF 's analysis; it might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C, in which the first and second subdivisions were done. An impulsive 3rd wave is anticipated. Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of...

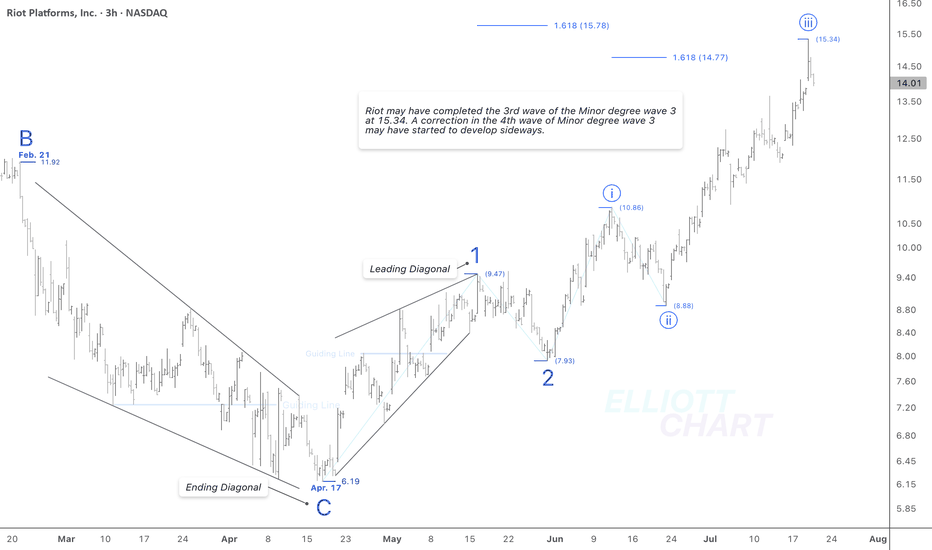

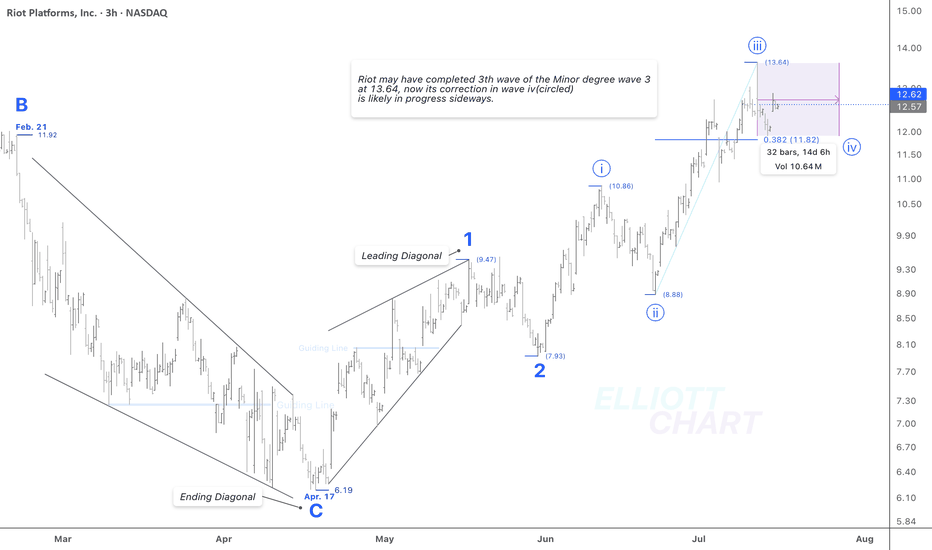

NASDAQ:RIOT may have completed the 3rd wave of Minor degree wave 3 at 15.34. Now, an expected correction in the 4th wave of Minor degree wave 3 may have started to develop sideways. #CryptoStocks #RIOT #BTCMining #Bitcoin #BTC NASDAQ:RIOT CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

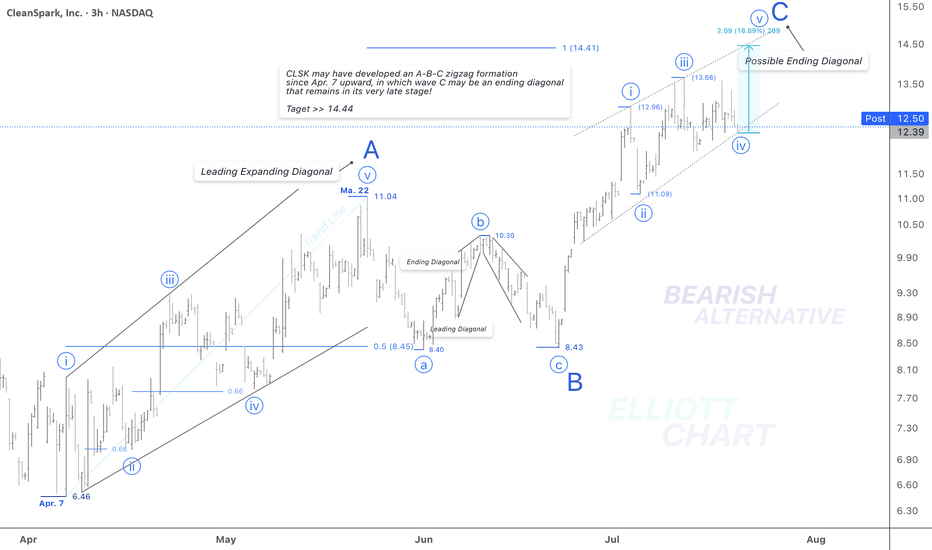

According to a bearish alternative in my weekly frame(not posted!), I'd analyzed the rising wave since April 7 as an A-B-C zigzag formation in correction of the Intermediate degree wave (B) >> Not shown in this 3h-frame. Wave Analysis >> As depicted in the 3h-frame above, the Minor degree wave C of the countertrend advance in wave (B) may thoroughly develop...

As depicted in the 2h-frame above, NASDAQ:WULF might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C. Hence, the target would adjust to the Fib extension target at 6.93. Wave Analysis >> The triangle correction in wave iv(circled) worked well, followed by an initial swift advance of the same degree wave...

There is no change in the NASDAQ:RIOT 's trend analysis. Wave Analysis >> As illustrated in the 3h-frame above, NASDAQ:RIOT may have completed the 3rd wave of the ongoing Minor degree wave 3 at 13.64, its correction in wave iv (circled) is likely in progress sideways. #CryptoStocks #RIOT #BTCMining #Bitcoin #BTC NASDAQ:RIOT CRYPTOCAP:BTC MARKETSCOM:BITCOIN

According to the prior analysis, NASDAQ:WULF rose by 10.5% intraday in a swift advance as expected. Wave Analysis >> The triangle correction in wave iv(circled) worked, followed by a swift advance in the same degree wave v(circled), which its 6% is left to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance...

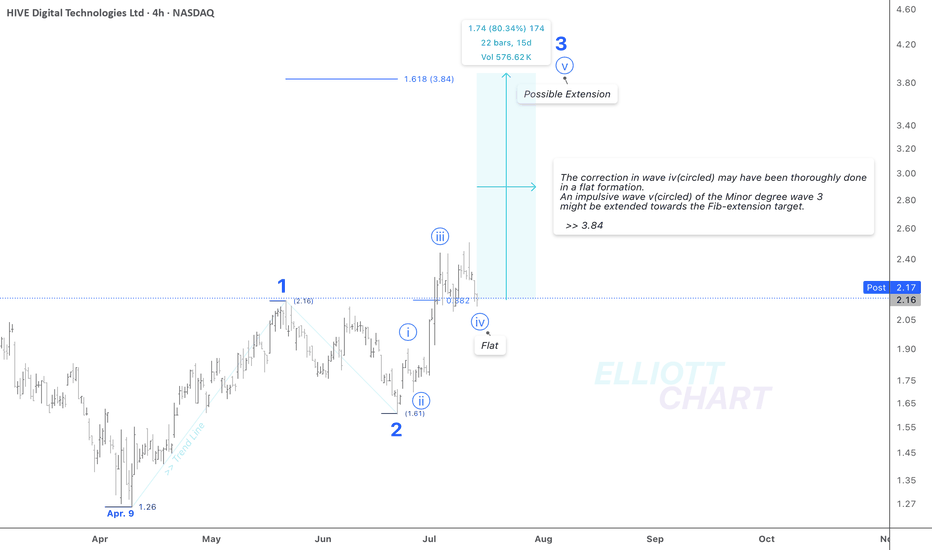

According to the prior analysis, NASDAQ:HIVE may have developed a sequence of Minor degree waves, in which the waves of 1 and 2 both were completed, and impulse 3 has remained in progress. Wave Analysis >> The correction in wave iv (circled) may have been thoroughly done in a flat formation. An impulsive wave v(circled) of the Minor degree wave 3 might be...

As a second alternative, NASDAQ:WULF may have developed a five-wave impulsive sequence as the Minor degree wave C, in which its 4th wave correction in a triangle appears to be over at 4.82. So, the final advance by 15% in the same degree wave v(circled) lies ahead to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend...

As depicted in the 4h-frame above, NASDAQ:HIVE may have developed a sequence of Minor degree waves upward >> 1, 2, and an impulse 3, which remains in progress, since April 9. Wave Analysis >> After completion of the ongoing correction in wave iv(circled), an impulsive wave v(circled) of the Minor degree wave 3 might be to 80% extended towards the...

NASDAQ:WULF According to the bearish alternative in my weekly frame (not the chart below and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an adjusted expanding diagonal as the thorough Minor degree wave C remains...

NASDAQ:WULF According to the bearish alternative in my weekly frame (not the chart above and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an expanding diagonal remains at the start point of a final advance as its...

NASDAQ:CLSK resumed advancing in its ongoing wave iii(circled) as anticipated, by 10.44% intraday today. Wave Analysis >> According to the prior analysis, the advance will likely achieve the extension Fib-target at 20.06 as the extreme point of the impulsive third wave of the sequence of C. Trend Analysis >> The Minor degree UPtrend would remain in...

According to the prior analysis, NASDAQ:WULF has risen by 13.5% today. Wave Analysis >> The ongoing impulsive wave c(circled) seems to be extending in its fifth wave. Trend Analysis >> The Minor degree trend is up now in an impulsive wave c(circled). #CryptoStocks #WULF #BTCMining #Bitcoin #BTC

According to the prior analysis, NASDAQ:CLSK continued to advance 12.6% today. Now, 70% of the anticipated rally lies ahead on the ongoing impulsive wave iii(circled). Trend Analysis >> The Minor degree trend is up, now in an impulsive third wave in Minute degree towards the expected target. The first Fib extension target >> 20.06 #CryptoStocks #CLSK...

NASDAQ:RIOT has exceeded 12.12, which I'd considered as a validating line at the extreme high of that leading diagonal in my prior analysis. Hence, the leading diagonal as the entire wave (1) is not valid now. Wave Analysis >> According to this adjusted wave count, wave 1 and 2, i(circled) and ii(circled) all are over, and advance in wave iii(circled) of Minor...

NASDAQ:CLSK has extended an impulse since last week, that's gone beyond the May high >> 11.04. That may be just an initial advance of the anticipated impulsive wave iii(circled). So, the correction in Minute degree wave ii(circled) could be thoroughly over at 8.43. And an impulsive & same degree wave iii(circled) should have begun its way up. Trend Analysis ...

NASDAQ:WULF has revealed an impulsive sequence that's gone beyond the June high >> 4.65. And it would suggest a bullish alternative in which the correction of wave b(circled) could be thoroughly over at 3.40. So, an impulsive advance in anticipated wave c(circled) should be underway. Trend Analysis >> Trend has turned upward in impulse...

According to the adjusted wave count in this 3h-frame, the continuous advance in NASDAQ:RIOT may be considered as an ending diagonal in the 5th wave of the one larger degree leading diagonal as wave (1), which could have remained in the late stages! Wave Analysis >> The Minor degree wave 5 might continue to advance just to 7.7% >> 12.12 as an extreme high of...