FOREXN1

PremiumOne of the most common — and costly — mistakes in trading is holding onto a losing position for too long. Whether it's driven by hope, ego, or fear, this behavior can damage your portfolio, drain your capital, and block future opportunities. Successful trading requires discipline, objectivity, and the willingness to accept when a trade isn’t working....

Cocoa futures (CC1) are approaching a key demand zone previously tested in March 2025. This area, highlighted on the chart, presents a potential for a pullback, fueled by likely buy orders from commercial traders, as indicated by bullish sentiment evident in the latest Commitment of Traders (COT) report. We're watching for a reversal pattern within these...

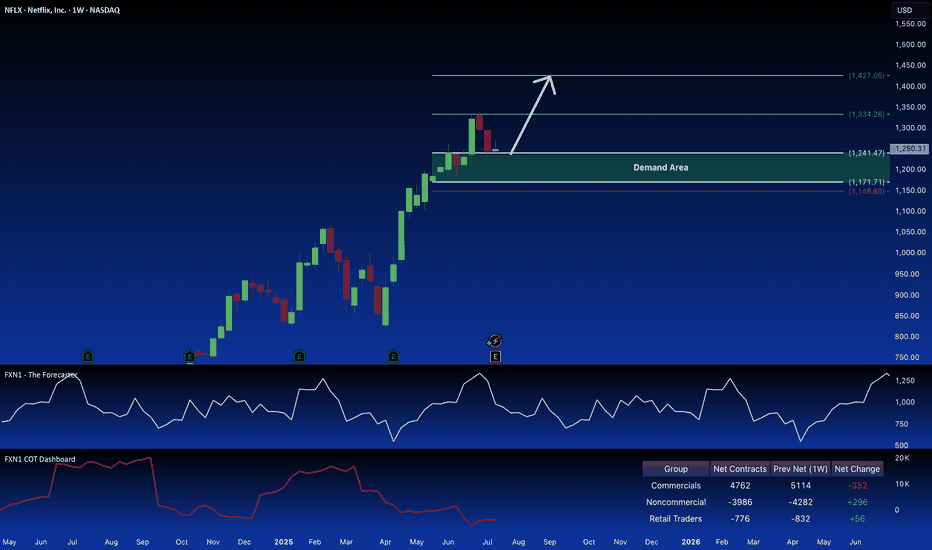

Netflix (NFLX) recently retraced within a key weekly demand zone, potentially presenting a long opportunity. Non-commercial traders are also accumulating long positions in the stock. This suggests a possible bullish setup. Your thoughts? ✅ Please share your thoughts about NFLX in the comments section below and HIT LIKE if you appreciate my analysis. Don't...

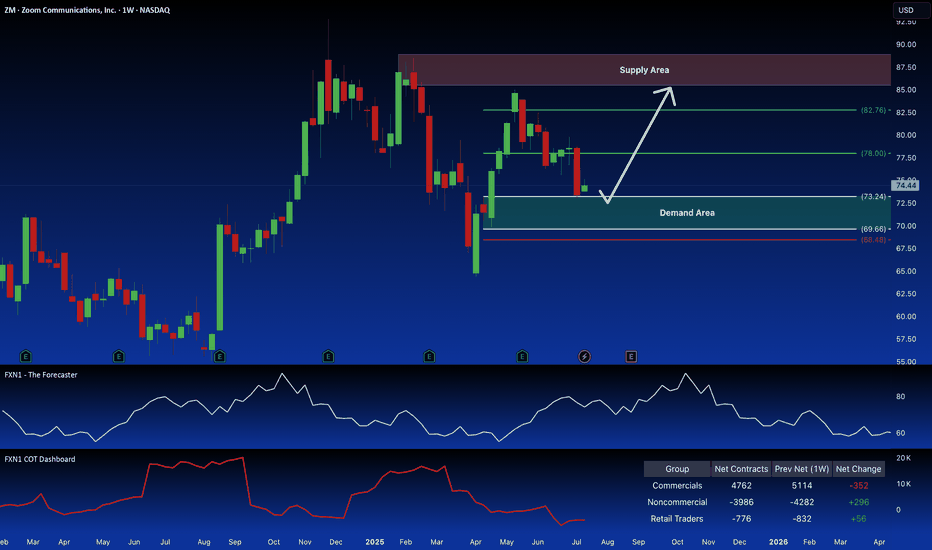

Zoom Video Communications (ZM) recently experienced a rejection at a key demand zone on its weekly chart. Non-commercial traders have increased their long positions, and forecasts suggest a potential upward trend. I'm considering a long trade setup based on a retest of that demand zone. What are your thoughts? ✅ Please share your thoughts about ZOOM in the...

Pound Futures: 6B1 Area Tests Bearish Resolve Pound Futures are approaching a critical weekly supply zone (6B1). Today's price action saw a touch and rejection of this level, marked by a bearish candlestick. This suggests a potential for a short-term pullback, and we're eyeing a re-entry opportunity at this level, watching for a drop to the next significant...

I'm anticipating a potential daily reversal in silver prices. Retail traders are maintaining a bullish stance, while commercial traders remain heavily short. The current price action suggests a possible reaction to a key supply area. What are your thoughts on the likelihood of a reversal, and what technical indicators might support or refute this potential...

The EUR/USD futures (6E1!) are currently trading at 1.1858, already inside a key monthly supply zone. With price action approaching higher resistance levels, traders should prepare for potential reversals—especially near the 1.20395 – 1.22710 range, where a major bearish reaction could unfold. Key Technical Levels to Watch Current Price: 1.1858, testing the...

The Canadian Dollar Futures (6C1!) remain in a downtrend, now testing a critical monthly supply zone after an initial rejection. With Commercials heavily short, Smart Money flat, and Retail traders still bullish, this setup favors another potential downside move. Traders should watch for a retest or breakout spike for optimal short entries. COT Report: Who’s...

Palladium Futures (PA1!) Approach Key Supply Zone: Is a Reversal Imminent? June 30, 2025 – Palladium Futures (PA1!) opened the new trading week with a bullish candle, reaching a fresh high at 1,161 after last week’s uncertain Doji rejection near 1,193.5. The metal is now approaching a critical supply zone between 1,199 and 1,255, where traders should watch for...

After recent declines, crude oil futures (CL1!) staged a modest recovery during Thursday’s session, trading near $59.10 per barrel. The rebound comes as US crude inventories unexpectedly dropped, easing concerns about oversupply and providing a short-term lift to prices. Key Drivers Behind the Rebound US Inventory Drawdown – The latest EIA report showed a...

The GBP/USD currency pair faced downward pressure on Wednesday, largely due to disappointing data from the UK’s Purchasing Managers Index (PMI). This index showed a contraction in private sector business activity for April, signaling potential challenges in the UK economy. As a result, the Pound Sterling weakened against its major counterparts during European...

NZD/USD Climbs on US-China Optimism and RBNZ Rate Cut Expectations The NZD/USD currency pair edged higher during European trading hours on Thursday, recovering from two consecutive sessions of losses. Trading near 0.5982, the pair benefited from renewed optimism surrounding potential US-China trade negotiations, a key factor given New Zealand's strong economic...

The AUD/USD exchange rate is approaching a key supply zone on the weekly chart, a region where significant long positions are concentrated. This presents a potential reversal point for the currency pair. Adding to the market's focus is the imminent release of Australia's inflation data on Wednesday. This report will be crucial in shaping expectations for the...

The Mexican Peso is approaching a significant supply area, a confluence of factors that suggests a potential short-term bearish trend. Daily retail trader positions show a notable concentration of long positions, while seasonal patterns hint at a shift in market sentiment. This combination creates an environment ripe for a short position on futures or a long...

The Japanese Yen maintains its strength in relation to the recovering US Dollar. However, recent improvements in global risk sentiment are beginning to weaken the JPY's appeal as a safe-haven currency. At this point, the Yen is positioned within a significant supply zone, where we are closely monitoring for potential reversal opportunities. According to the...

The USD/JPY currency pair is currently pulling back into a significant weekly demand area, presenting a promising opportunity for traders looking to enter long positions. This area historically denotes strong buying interest, suggesting potential upward momentum. In contrast, the 6J1! Yen futures market displays a bearish sentiment, with many retail traders...

In the early stages of the European session on Friday, GBP/USD is struggling to maintain its footing, trading below the 1.2925 mark as I compose this article. The pair faces pressure from a robust demand for the US dollar amid a backdrop of cautiousness from the Federal Reserve and prevailing economic uncertainties. This selling pressure persists despite the Bank...

As I write this article during the European session on Wednesday, the EUR/USD currency pair has slipped below the 1.09035 mark, following its recent ascent to a five-month peak of approximately 1.0955 just a day earlier. The decline in this prominent currency pair can be attributed to the strengthened performance of the US Dollar (USD) in anticipation of the...