FalCol_TradingMaster

Premium1) Market Overview EURUSD fluctuates around 1.0850 - 1.0960, with a slight upward trend thanks to - US economic data is below expectations - ECB maintains a mildly dovish stance, affirming that it will continue to monitor inflation instead of declaring an end to interest rate hikes This week the market will focus on - US CPI - which can cause strong fluctuations -...

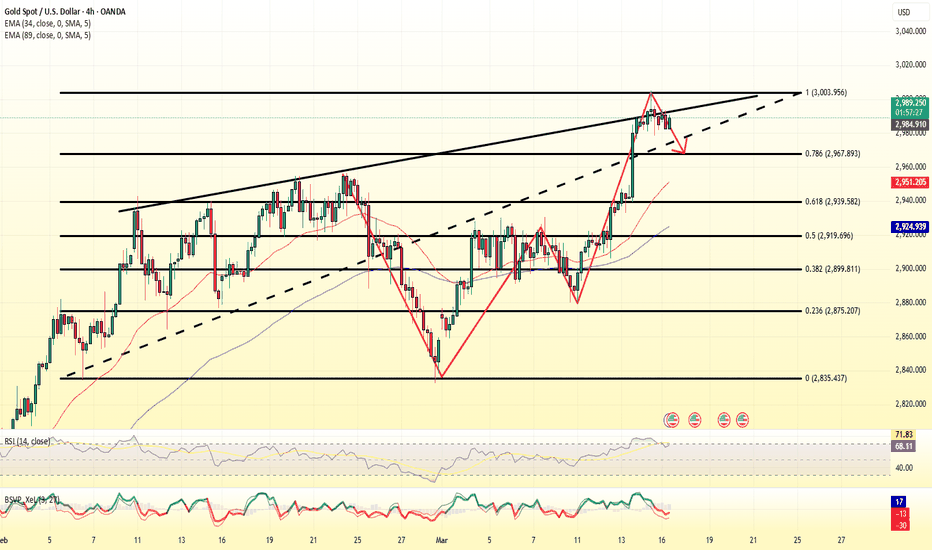

Market Overview - Gold prices rose slightly in the first trading session of the week due to geopolitical concerns in the Middle East and weak US employment data - However, selling pressure returned in the early morning today as the USD recovered and US bond yields rose slightly again - The market is waiting for the speech of the Fed officials later today, which is...

Experts say the USD is still under pressure after the US economy announced a "shocking" non-farm payrolls report for July and revised the May and June figures down sharply compared to forecasts and previous figures. Experts say the rapidly weakening job market is fueling speculation that the US Federal Reserve (Fed) will soon cut interest rates in...

The world USD price increased slightly. The USD-Index reached 98.79 points, 0.08 points higher than yesterday. According to CNBC, the USD increased in value compared to most currencies as the market focused on President Donald Trump's personnel nomination for the US Federal Reserve (Fed). Yesterday, President Donald Trump said he would soon announce decisions on...

The price is 3,400 USD/ounce. The main reason is believed to be due to the weaker-than-expected US labor market, increasing the possibility of the US Federal Reserve (FED) cutting interest rates, thereby promoting the increase of this precious metal as investors seek gold as a safe haven. Some analysts note that, since reaching a historical peak of 3,500 USD on...

Technical Scenario for Today According to the current technical analysis: If above 1.3384, resistance targets around 1.3408 or even 1.3438 could be targeted Akhbar Forex . If 1.3351 is broken, the market could test lower support around 1.3321 or deeper if the pressure continues 📉 Expected intraday range According to StockInvest's Daily Volatility model (based...

market overview Gold prices had a correction around 2325 yesterday, after recovering from a low of 2,290 USD. In the context of investors expecting the Fed to cut interest rates soon, gold is being strongly supported by the prospect of loose monetary policy and the weak USD. Factors supporting gold prices Weaker-than-expected US labor data The non-farm payrolls...

World gold prices unexpectedly reversed sharply, as Europe and the US continued to release poor economic data. Specifically, the European economic area announced the investor confidence index released monthly by Sentix GmbH, August at a decrease of 3.7 points, much lower than the increase of 4.5 points in July. In the US, factory orders released monthly by the...

Given the definition of the gold price trend, market participants remain anxious and oriented to signs of the US Federal Reserve’s stance on monetary tightening, which could shape the future course of gold prices. As the US dollar gains traction, it is also a difficult time for gold. But if the tariff war accelerates, gold will rise, especially as fears of...

Fear gripped global markets earlier this week as major economies clashed over tariffs that threatened to push the United States and the world into recession. Donald Trump said on Sunday that the United States was taking “medicine” to cure its trade “disease.” But the pressure on the Trump administration is growing as Americans’ investment and retirement accounts...

The world gold price has reversed sharply because the global market has just received information last night (Hanoi time) that US President Donald Trump has just signed an executive order to impose taxes on all goods imported into the US, many countries will have to pay high taxes of up to tens of percent. Specifically, the UK, Brazil, Singapore will be subject...

Gold prices rose again on Friday, boosted by demand for safe-haven assets amid uncertainty over US President Donald Trump’s plans to impose tariffs next week, which could fuel inflation, prompting many investors to turn to gold as a hedge against inflation. Gold futures rose 0.5% to $3,029.30. "Investors are concerned about the global situation, especially U.S....

The Conference Board (a non-profit research organization in the United States, specializing in providing reports and analysis on economic issues, jobs, labor markets and long-term trends) announced on Tuesday that the US consumer confidence index fell to 92.9, down from a revised 100 in February. This data was weaker than expected, as economists had predicted a...

Last week, the world gold price surpassed the historical peak of over 3,057 USD/ounce but quickly decreased due to profit-taking pressure from investors. However, the price remained above the psychological support level of 3,000 USD/ounce - a level that many experts predicted would be an important support in the coming time. The general sentiment in the market...

World gold prices increased by 3 USD, to 3,030 USD/ounce. In the US trading session (night of March 18), gold at one point rose to a record high of 3,035.4 USD/ounce. The safe haven demand for gold has pushed prices to a record high. Investors are worried about the increase in global trade wars and new geopolitical developments between countries, so they have...

The first notable event is the Bank of Japan (BOJ) monetary policy meeting on Tuesday, followed by the US Federal Reserve (FED) interest rate decision on Wednesday. The Swiss National Bank (SNB) and the Bank of England (BOE) will announce their interest rate policies on Thursday. These moves can directly affect the strength of the USD and capital flows into gold....

World gold prices increased in the context of the USD's decline. Recorded at 8:45 a.m. on March 10, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.632 points (down 0.17%). This week, market sentiment has changed significantly compared to last week, especially from the Wall Street experts. In the previous...

🔴US Expected to Add 170,000 Jobs in February, But Job Outlook Worsens ———— ⚫February Jobs Forecast: Nonfarm payrolls report projects 170,000 jobs added, up from 143,000 in January, while unemployment remains at 4%. ⚫Mixed Signals: While official data shows the labor market remains strong, surveys show many workers are worried about their jobs and less willing to...