FenzoFxBroker

PremiumLitecoin is currently testing a key support zone between $80.0 and $83.0, which previously marked its February low. The overall trend remains bearish, but this support level could trigger a price rebound, potentially shifting momentum in favor of buyers. If Litecoin holds above $80.0, there is a possibility of a recovery toward $100.0.

FenzoFx— The USD/CAD pair hit 1.4400 but lost momentum, pulling back from resistance. Technically, USD/CAD may dip toward the 50-period SMA near 1.4330 before resuming its uptrend. However, if USD/CAD drops below 1.4330, the bearish momentum may extend to the 1.4250 support, invalidating the bullish outlook.

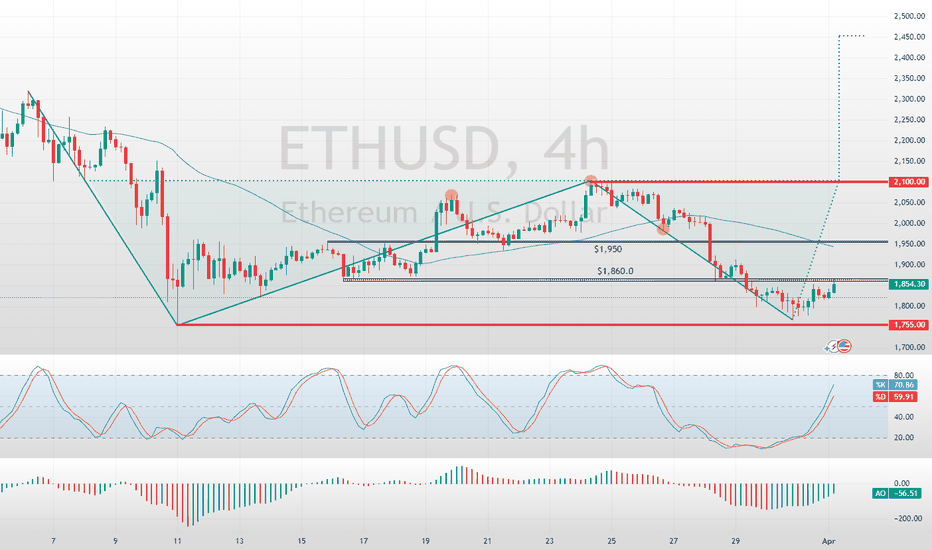

FenzoFx—Ethereum's downtrend stabilized at $1,755, a key support level. Currently, ETH/USD trades at $1,854, testing resistance. A double bottom pattern on the 4-hour chart suggests potential growth if bulls secure a close above $1,860. The next target could be $1,950, supported by the 50-period moving average.

FenzoFx—Bitcoin rebounded from the $81,160 support level and surged past $83,520, forming higher highs. If the price stays above this key support, the bullish momentum could continue. The next upside targets are $84,720 and $86,340. However, if Bitcoin drops below $81,160, the trend may reverse, potentially falling to $77,850.

FenzoFx—USD/JPY remains in a bearish trend, trading below the 50-period simple moving average (SMA). Since the price is below the moving average and has set a lower low, the overall trend remains bearish. However, the Stochastic Oscillator signals oversold conditions, suggesting the Yen may be overvalued against the U.S. dollar. If sellers push the price below...

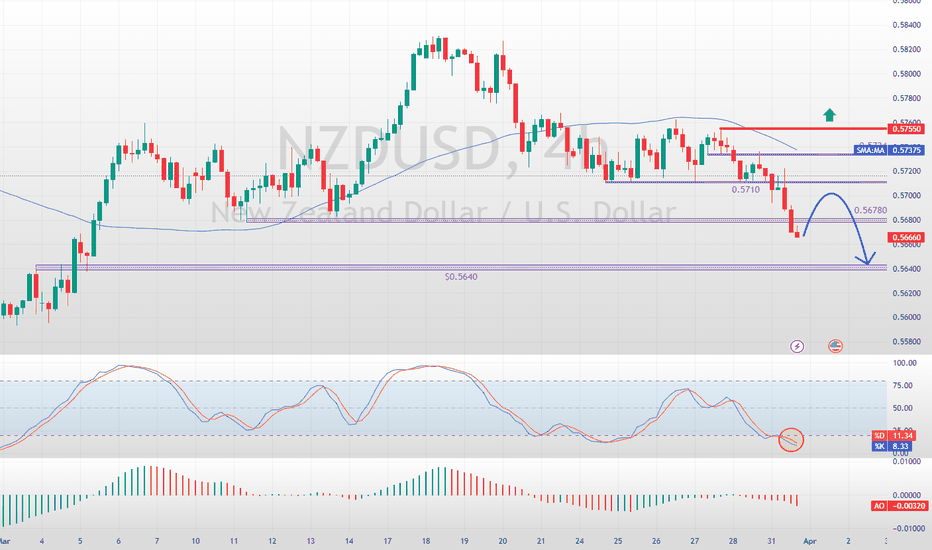

FenzoFx—NZDUSD dropped below the $0.5678 support level and is now trading around $0.5670. Selling pressure has pushed the Stochastic Oscillator into oversold territory, recording 8.0. The next bearish target is $0.5640, provided NZDUSD stays below the $0.5755 resistance.

FenzoFx—AUD/USD broke below the critical support at $0.626, heading toward the 78.6% Fibonacci level. The bearish trend remains intact while the price stays below the $0.6329 resistance.

FenzoFx—GBP/USD faces resistance at $1.3010. A breakout above this level could target $1.3268, confirming a bullish trend. However, a drop below $1.2865 would invalidate the bullish outlook, potentially driving the price toward $1.2690.

FenzoFx—EUR/USD hit a new low at $1.075 on March 27, with bearish momentum possibly extending to lower supports. It trades near $1.0820, below key resistance at $1.086. The Stochastic Oscillator signals short-term overpricing. A drop below the 50% Fibonacci level targets $1.075, while a break above $1.086 could resume the uptrend, aiming for $1.0915 and $1.0956.

FenzoFx—NATGAS broke above the trendline, surpassing $4.0, but is short-term overbought. It trades around $4.135, holding above the 50-SMA, with a bullish target at $4.26. A drop below $3.906 (50% Fibonacci) could target $3.660 instead.

F enzo F x—USD/JPY tested the 151.2 resistance but failed to make new highs, retreating to around 150.4. Bullish Scenario : The primary trend remains bullish, but a close above 151.2 is needed to target 154.8. Bearish Scenario : A break below 149.540 could spark bearish momentum toward 145.5.

FenzoFx—GBP/JPY reached a higher high above the 195.0 resistance but has pulled back from 196.0, currently trading near 194.7 and the 50-period moving average on the 2-hour chart. The bullish outlook holds as long as the price stays above the 193.5 support, with the next target around 200.0. However, a break below the ascending trendline and 193.5 support could...

FenzoFx—The NZD/USD pair formed a double bottom pattern at the $0.5710 support. The trend remains bearish, with the price below the 50-period SMA. The downtrend will stay intact unless the pair breaks above the $0.575 resistance. For bears to regain control, the price must close below $0.5710, targeting the next support at $0.5678.

A close above $0.6290 can trigger the uptrend, targeting $0.6318.