ForexAnalytixPipczar

PremiumAfter the copper market exploded higher on the Trump Administration’s 50% tariff headline, the market has been quietly consolidating above the breakout level at 5.33. While above this level the risk is higher, and in case of a break back below the 5.30 level, the risk would be a larger retracement. This would likely be caused by the Trump Administration abandoning...

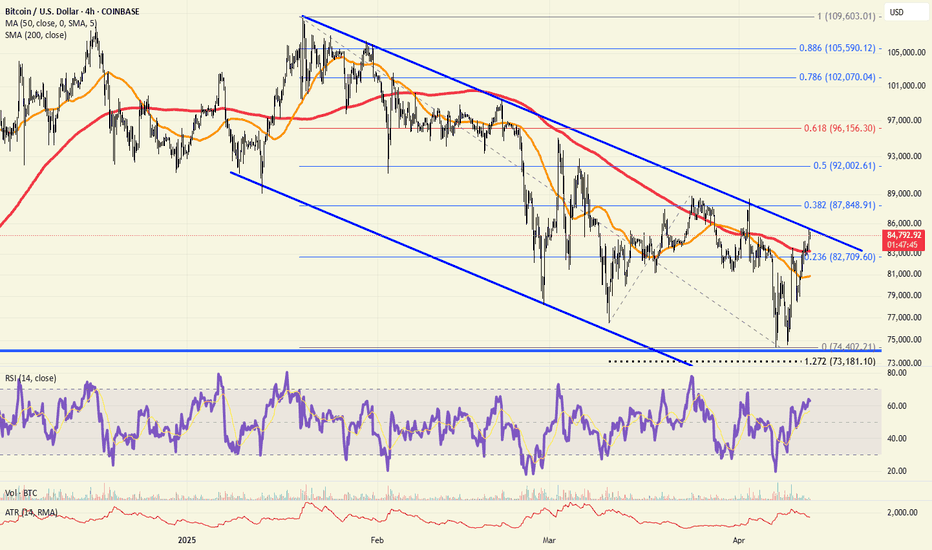

After almost 3 decades as a trader, if there is one thing I have learned over the years, significant highs are made when sentiment is at extremes. Whether it is "mom and pop" or the "shoeshine guy" calling the top, it's when the buying (or selling) by retail is at a fever pitch. These days, you can't find a bear in Bitcoin, and the days on end of reports preaching...

Table is set! The GBPUSD is in a rising wedge, with the test (today) of the 61.8% Fibonacci level once again and now ascending wedge support and horizontal support as well. A break of the 1.3530 would put the 1.3440 breakout point (high from Sept 2024) and a possible breakdown back below the 1.3370 level. Bulls should be cautious with this technical setup.

The USDMXN has been in a descending channel since spring of this year, but is near channel support with a strongly divergent RSI. Since the MXN has gained about 10% against the US Dollar since the beginning of the year, however rate differentials are tightening, the appetite for MXN at current levels may be waning. It's not time to be outright bullish the USD over...

Gold is at a key trend line of support. Most of the world is watching the 3285 level near term, and a break of this level would put the 61.8% Fibonacci retracement at 3248 back in view. A break of this level would target the 3120 level once again. Bulls are nervous, but this key support will be watched carefully into the next trading session.

The EURUSD is developing a bull flag pattern, and reinforced the pattern on the dip to the 1.1686 level, or 38% retracement. For bulls, this level will be critical to hold in the session ahead. A break back above the flag resistance at 1.1750 would reengage the dip buyers. For the traders looking for a bigger US Dollar bounce, a move back below the 1.1686 level...

Intraday Update: Silver is at the 127% extension of the March 28th highs to April 7th lows, RSI is divergent which may stall the rally, but dips back to the 35.50 level should find buyers now. Keep in mind we trade well above the long term 61.8% retracement still at 35.48

Asian Session Update: The AUDNZD has found support at the multi year channel as noted yesterday near the 1.0650 level. Now the pair is in a descending wedge, which is typically a reversal pattern (bullish) so a breakout of the 1.0710 level would suggest a move back towards the 1.0800 level.

Intraday Update: The USDCAD slipped to bear flag support following the interest rate decision. The market was trading short CAD in hopes of a cut, and was disappointed. A break of the 1.3830 level would open up channel support at 1.3760. The BOC presser is ongoing at time of writing.

Intraday Update: Bitcoin over the weekend is challenging the descending channel trend line and above the channel is the 38% retracement at 87848. This level is being tested as headlines over the weekend suggest that tariffs will not be applied to phones, computer and chips. This should allow for risk assets like Bitcoin to continue to rise higher over the weekend.

Intraday Update: Long term, the USDCHF is testing the key support that has held since the end of 2024. A break of the .8300 level would put the .8127 level in play (longer term). This is not uncharted territory, see 2011

Intraday Update: The SPX stalled at previous (flag) support at the 5500 level as noted in the end of day analysis. The "line in the sand" has been drawn intraday for the session now. A break above this level would continue yesterday's epic squeeze

Intraday Update: The EURAUD pullbacks have been shallow and the risk still remains higher when headlines like this keep popping up: CHINA IMPOSES 84% TARIFF ON US . A move back below the 1.8200 level may allow for a deeper pullback now.:

Intraday Update: Crude oil broke the 161% extension (lower) of the March 5th lows to April 2 lows, this is also below the support of the May 2021 lows and major horizontal support. ONLY a break back above the 61.70 level would take the downside pressure off.

Intraday Update: Bitcoin has hit major support at the 74000 level (today's lows at 74420) which should allow for a move back above the 80K level. A move below 74K level could put the 68848 level in view,

This is a strong reversal pattern which points to below the 1.7900 level. This is a complex H&S pattern, but targets the 1.7840 level in the days ahead. We'd need to see some bounce in the equity market to assist a move lower here.

Intraday Update: The EURAUD has completed the bull flag pattern. However, with the headlines today out of China, the risk is we could continue to squeeze, and target is a guess at this point. Some traders will fade this, I would wait till after US stocks markets reopen

Intraday Update: The AUDUSD has broken flag support following the headline from China that they are going to impose a 34% retaliatory tariff. The AUDUSD just surpassed the 127% extension and now may target the .6118 level intraday. Long term targets the post covid lockdown lows.