FreedomHolding

ExpertCompany Overview ONEOK, Inc. is one of the largest U.S. operators of midstream energy infrastructure, with assets spanning natural gas gathering, transportation, processing, and storage, as well as oil and petroleum product pipelines and storage. Founded in 1906, the company is headquartered in Tulsa, Oklahoma, and derives 100% of its revenue from the U.S....

Key Arguments Supporting the Idea Strong potential for a positive earnings surprise on September 3, against the backdrop of low market expectations and several growth catalysts. Funds are increasing their positions in CRM shares, including activist investor Starboard Value. Attractive valuation levels based on multiples. Investment Thesis Market...

ServiceNow, Inc. (NOW) is an American company founded in 2004 and headquartered in Santa Clara, California. It specializes in developing cloud platforms for business process automation and digital workflows, including IT service management (ITSM), IT operations (ITOM), security (SecOps), as well as customer, HR, and creator workflows. Its key product is Now...

Sibanye Stillwater is a major global producer of precious metals, with a focus on Platinum Group Metals (PGMs) and gold. The company’s main operations are in South Africa and the U.S., alongside a growing metals recycling business. Sibanye Stillwater is also actively expanding into “green” metals, which are critical for the global energy transition. The...

PayPal Holdings, Inc. (PYPL) — one of the world’s leading technology companies in the field of digital payments. The company’s ecosystem includes the PayPal and Venmo digital wallets for consumers, as well as a full range of payment solutions for businesses: from the branded PayPal Checkout button to unbranded processing via the Braintree platform. The company...

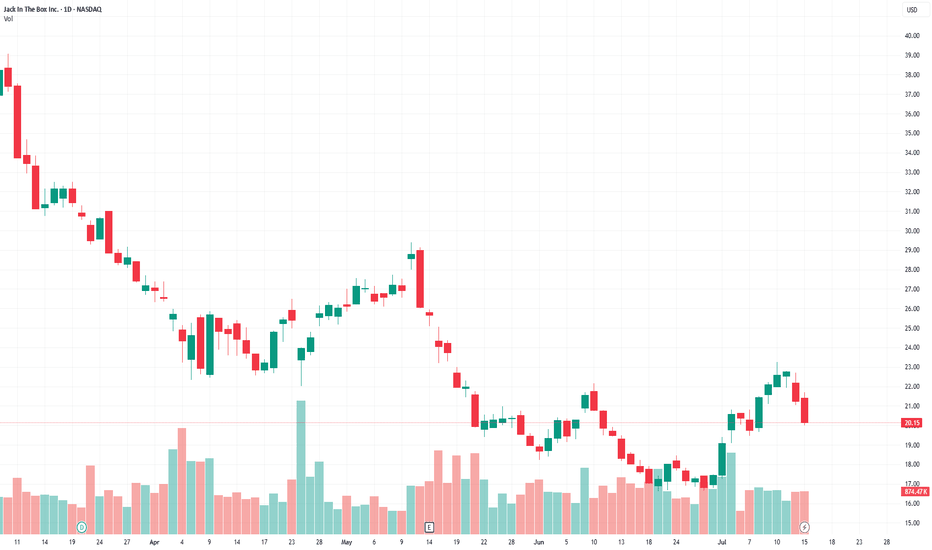

Consumer Discretionary - Restaurants Buy the dip: strategic plan, a number of shorts and the institutional interest. Supporting Arguments Strategic transformation program. Large number of shorts and high dividend yield. Interest of a large investor. Jack in the Box, Inc. (NASDAQ: (JACK) operates of two chains of quick-service and fast-casual...

ProShares Ultra VIX Short-Term Futures ETF (UVXY) is a 1.5x leveraged exchange-traded fund that aims to replicate the performance of an index of near-term VIX futures on a daily basis. This financial instrument is strategically designed for investors seeking to capitalize on short-term surges in market volatility. Following a five-week stretch of trading above...

Key arguments in support of the idea. Q1 results have room to surprise on the upside, supported by the rebound in U.S. used car prices. KMX is trading below its historical valuation averages. Investment Thesis CarMax, Inc. (KMX) is the largest used car retailer in the U.S., with 789,000 vehicles sold in the 2025 fiscal year alone. KMX runs two primary...

Key arguments in support of the idea. International routes continue to show strong demand. While the U.S. domestic market is facing challenges—especially in the low-cost carrier (LCC) segment—the company is capitalizing on inbound foreign tourism. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite trend: domestic tourism...

Key arguments in support of the idea. International routes continue to experience high demand. While the U.S. domestic market is in a less favorable position, especially the low-cost carrier (LCC) segment, the company is benefiting from foreign tourists. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite: demand from U.S....

Key arguments in support of the idea: Over the past quarter, Joby Aviation has made meaningful progress toward certification of its electric air taxi. The company has now completed 62% of Stage 4, advancing 12 ppts in just one quarter. Engineers successfully conducted piloted transition flights, and a series of fault-tolerance tests—where batteries, tilt...

Key arguments in support of the idea: Hexcel Corp. (HXL) engages in the development, manufacture, and marketing of lightweight structural materials. It operates through the Composite Materials and Engineered Products segments. The Composite Materials segment includes carbon fiber, specialty reinforcements, resins, prepregs and other fiber-reinforced matrix...

Key arguments in support of the idea The company's shipments are projected to recover in the latter half of the year. STLA's valuation appears significantly lower compared to its industry peers Investment Thesis Stellantis N.V. Stellantis N.V. (STLA), a leading global automotive manufacturer, stands as a dominant force in both North American and European...

Supporting Arguments The market's reaction to the Q1 report was excessively negative The stock possesses fundamental upside potential driven by a high revenue growth rate The technical analysis indicates a probable rebound Investment Thesis GeneDx (WGS) specializes in delivering precise medical diagnostic results, leveraging exome and genomic testing to...

Key Supporting Arguments Amidst the unpredictability of Donald Trump's tariff policies, Netflix might serve as a defensive play. Positive consumer sentiment, a surge in subscriber growth, and strategic hikes in subscription prices are poised to power robust results for the first quarter of fiscal year 2025. Investment Thesis Netflix (NFLX) is a global...

Key Supporting Arguments Spotify’s business model is resilient enough to rising tariff barriers between countries and economic downturns Spotify and other music streaming platforms are undercapitalized and may demonstrate substantial growth in 2025, driven by increasing subscription prices. Investment Thesis Spotify (SPOT) stands as the world’s...

Investment Thesis ProShares Short VIX Short-Term Futures ETF (SVXY) is a fund that allows you to bet on a decline in volatility with a 0.5x ratio. That is, with a 10% decrease or increase in volatility, this fund will respond with a 5% movement in the opposite direction. Volatility has significantly increased amid uncertainty due to mutual tariffs between the...

Key arguments in support of the idea. A potential rise in U.S. car prices may positively impact the company’s sales. DRVN is expanding its footprint in the essential automotive services market, simultaneously reducing its car wash segment with more cyclical sales. Investment Thesis Driven Brands Holdings Inc. (DRVN) is the largest automotive services...