GODOCM

Plus📉 Gold Short Setup Analysis – 4H Chart Entry: $3,370.15 Stop Loss: $3,392.65 (22.50 points / 0.65%) Target: $3,270.22 (99.92 points / 2.96%) Risk/Reward Ratio: 4.63 Trade Duration (Projected): ~3 days, 4 hours 🔍 Technical View: Price reached a high-volume node and faced resistance near $3,370–$3,380. MACD histogram shows waning bullish momentum. Bearish...

XAU/USD 4H Analysis 🟠 Gold is currently testing the 3,333 resistance zone after a temporary pullback. With visible rejection and weak bullish momentum, I’ve entered a short position at 3,333.54. 📉 Sell Setup Details: Entry: 3,333.54 Stop Loss: 3,346.90 (Above key structure) Target: 3,247.63 Risk/Reward Ratio: 6.53 Target Profit: 85.91 pts (2.58%) 📊 MACD...

📉 XAU/USD 4H Bearish Setup Gold is showing signs of continued downside after a failed breakout near the 3,367 resistance zone. 🔹 Entry: 3,336.38 🔹 Stop Loss: 3,367.51 🔹 Target: 3,246.50 🔹 Risk/Reward: 2.86 📊 Analysis Highlights: Price rejected the value area high with a clean bearish engulfing setup. MACD crossed down, and histogram momentum continues to...

🟠 XAU/USD Short Setup – 4H Analysis Price tapped into resistance near 3,388–3,404 (low volume area) and showed rejection. 🔻 Short triggered at 3,387.87 🎯 Target: 3,311.21 (key demand zone & mid-range support) 🛑 Stop: 3,404.11 (above supply zone) 🔁 Risk/Reward: 4.91 💡 Volume profile shows weak participation above, suggesting failure to accept higher. Looking for a...

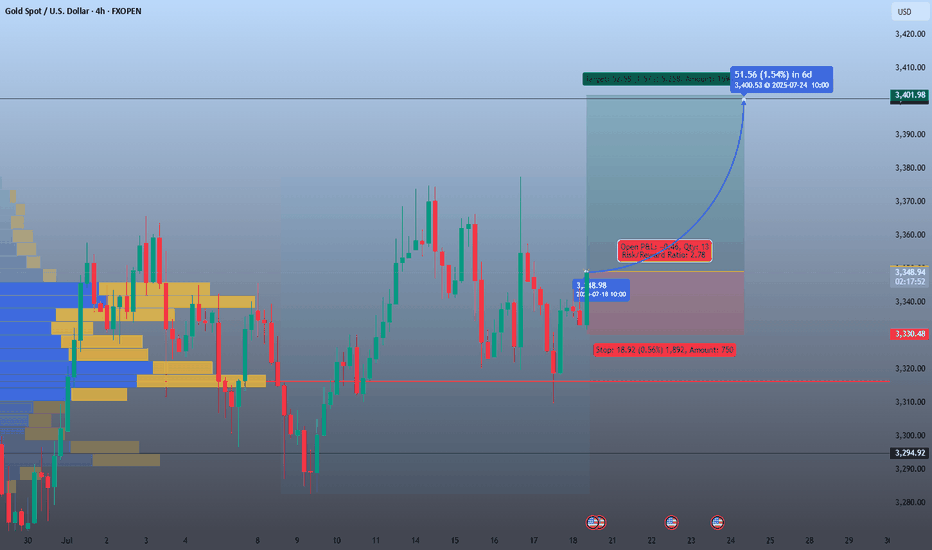

📊 Trade Overview: Entry Price: 3,348.98 Stop Loss: 3,329.48 (-0.57%, -18.92 pts) Take Profit Target: 3,400.63 (+1.54%, +51.65 pts) Risk-to-Reward Ratio: 2.78 Volume Profile shows a strong support base at the entry zone 🟩 Bullish View Justification: Support Zone: Price is rebounding from a high-volume node on the volume profile (yellow zone). MACD Histogram:...

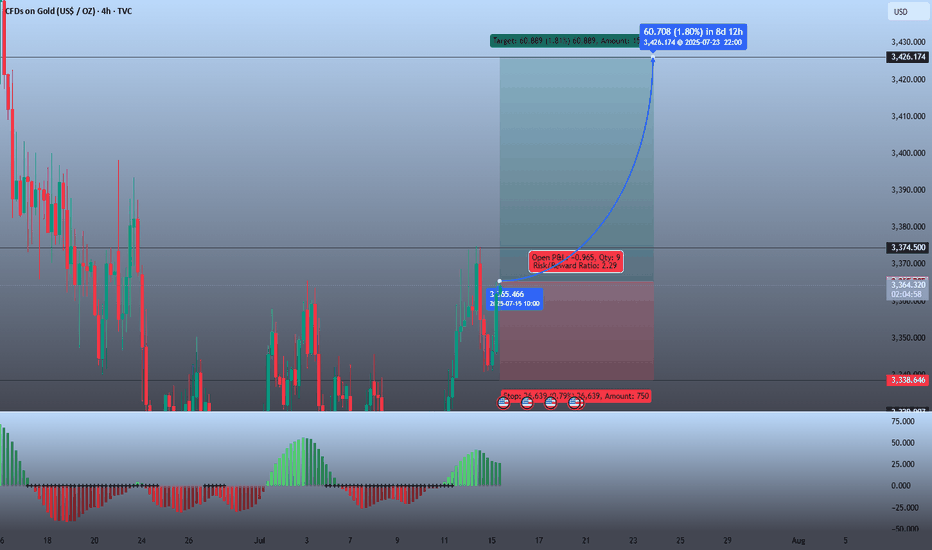

🟢 Trade Idea Summary Entry: Around 3,365.466 Take Profit (TP): 3,426.174 Stop Loss (SL): 3,338.646 Risk/Reward Ratio: 2.29 Projected Gain: ~+60.7 points (+1.8%) Projected Loss: ~-26.63 points (-0.79%) Time Horizon: Estimated to hit TP in ~8 days 12 hours (by July 23) 📈 Technical Indicators on Chart Histogram (possibly MACD or Awesome Oscillator) shows...

📉 XAU/USD 30-Min Bearish Setup – July 10, 2025 Gold is currently showing signs of short-term exhaustion after a steady climb from sub-$3,300 levels. Price action is stalling just below $3,326, aligning with a low-volume node on the volume profile, suggesting weak continuation momentum. 🔻 Short Setup Parameters: Entry: $3,323.70 Stop Loss: $3,332.48...

📈 XAU/USD 4H Long Setup – July 7, 2025 Gold is testing a key support zone near $3,295–$3,310, with price reacting from the demand region and forming a potential reversal pattern. With bullish momentum anticipated, the setup targets a significant upside move toward $3,452+. 🟢 Long Position Details: Entry: $3,110.79 Stop Loss: $3,075.94 (-1.04%) Take Profit:...

📈 XAU/USD 4H Long Setup – July 3, 2025 Gold has bounced strongly from the recent demand zone and is currently respecting the ascending trendline. Price has reclaimed structure above $3,350, turning previous resistance into support. 🟢 Long Trade Setup in Play Entry: $3,355.16 Stop Loss: $3,327.14 (0.84%) Take Profit: $3,457.91 Target Move: +102.75 pts...

📉 XAU/USD 4H Bearish Setup – June 30, 2025 Gold is showing signs of continued downside after a brief intraday bounce. Price was rejected around the $3,295–$3,300 supply zone, and the current structure favors a continuation lower if it remains below $3,314. 🔻 Short Setup Details: Entry: $3,294.99 Stop Loss: $3,314.45 (~0.60%) Take Profit: $3,189.48 Target:...

📉 XAU/USD 4H Chart Analysis – June 25, 2025 Gold continues to respect bearish momentum, with a fresh rejection from the former support zone near $3,326, now acting as resistance. Price has broken below the ascending trendline structure, confirming downside pressure. 🔻 Short Setup in Play Entry: $3,326.20 Stop Loss: $3,356.65 (~0.92%) Take Profit:...

📉 XAU/USD 4H Bearish Setup – June 23, 2025 Gold is continuing its breakdown after a clear rejection from the previous supply zone around $3,400. The pair has failed to hold the ascending trendline and horizontal support near $3,355, confirming a bearish structure with further downside potential. 🔹 Trade Setup: Entry: $3,355 Stop Loss: $3,402 (1.40%) Take...

📉 XAU/USD 4H Breakdown Analysis – June 19, 2025 Gold is currently showing bearish momentum on the 4H timeframe after rejecting the key resistance zone around $3,410. Price has broken below the ascending trendline support, confirming a potential shift in structure. 🔻 Short Entry Triggered Entry: ~$3,365 Stop Loss: $3,410 (1.27%) Take Profit: $3,245...

Pair: EUR/JPY Timeframe: 1H Entry: Sell only below 166.680 Stop Loss: 167.230 Take Profit Targets: 165.500 Risk/Reward Ratio: ~2.2 This short trade setup on EUR/JPY (1H timeframe) is based on a potential breakdown of the ascending trendline that has been supporting recent bullish momentum. Price action shows signs of exhaustion near the 167.20 resistance area,...

BTC/USD Trade Signal Entry: $102,100 Stop Loss: $99,350 Take Profit: $110,446 Time Frame: 4H Technical Analysis: Price is currently rangebound between $102,100 and $112,000. Entering at the support level of $102,100 offers a favorable risk-reward ratio of approximately 1.3. The RSI is at 35 and facing downward, suggesting a potential rebound that could drive a...

Trade Setup: SOL/USDT Entry: $161.13 Stop Loss: $156.57 Take Profit: $176.53 Time Frame:4H Technical Analysis: SOL price has decisively broken out above a strong resistance zone between $160.48 and $162, confirming bullish price action. This breakout is likely to trigger a retest of the broken range to confirm support before continuation higher. Key resistance...

EUR/AUD is showing signs of topping out beneath the strong resistance at 1.77, with a clean lower high formation and momentum indicators weakening. A break below 1.74590 would confirm bearish continuation toward the next major support zone near 1.70709. 📉 Entry (below): 1.74590 🎯 Target: 1.70709 🛑 Stop-Loss: 1.77155 ⚖️ Risk/Reward Ratio: 1.51 🔍 Confluence...

Instrument: AVGO Entry Price: $234.70 Stop Loss (SL): $224.50 Take Profit (TP): $261.35 Time Frame: 4H Technical Analysis: Price Action: Broadcom recently hit an all-time high and is now retracing towards strong demand zones around $235.60 and $230.60. These levels have acted as significant support in the past, leading to a bounce-back. The demand levels around...