GOLDFXCC

Premium📌 Mark your reference points — key levels or order blocks on the chart. 📌 Wait for price to reach them — there’s no need to be in the market all the time. 📌 Once price reaches your level, allow 10–40 candles to form. This is critical. Why? Because during this time, the market goes through its usual phases: 1. Accumulation 2. Manipulation 3. Distribution (which...

When you look at silver market has actually been in an uptrend for about three years. It was sideways a couple of times, and it’s very possible that we go sideways or correctionn for the short term. But over the longer term, it goes from the lower left to the upper right, and there’s really no way to dispute that.

💡Why Gold Pulled Back - Gold pulled back today after hitting $3439.04, just below resistance at $3451.53. Traders took profits ahead of key Fed and trade headlines. Right now, it’s trading around $3414.48, down 0.50%. - The dip came after the U.S.-Japan trade deal eased geopolitical tension, cutting safe-haven demand. Plus, U.S. bond yields are climbing (10-year...

The Federal Reserve meets next week and is widely expected to leave rates unchanged at 4.25%–4.50%. Still, market participants will watch for commentary on inflation and rate-cut prospects, especially after recent criticism of Fed Chair Powell by President Trump. What Should Traders Watch? With the major indexes on track for weekly gains, next week’s developments...

💡Why Gold Pulled Back - Gold pulled back today after hitting $3439.04, just below resistance at $3451.53. Traders took profits ahead of key Fed and trade headlines. Right now, it’s trading around $3414.48, down 0.50%. - The dip came after the U.S.-Japan trade deal eased geopolitical tension, cutting safe-haven demand. Plus, U.S. bond yields are climbing (10-year...

Gold Prices: Bearish Engulfing Pattern Challenges Short-Term Uptrend - Gold continues to face downward pressure after failing to break above the 20-day moving average for the sixth consecutive session. Tuesday’s price action formed a bearish engulfing candlestick, engulfing Monday’s body and closing in the lower half of the day’s range. This signals growing...

Potential for a bullish pullback on the USDCHF which could lead to a price movement towards the resistance level at 0.85600. BUY levels from 0.79600

Potential for a bullish pullback on the CADCHF 1D which could lead to a price movement towards the resistance level at 0.61200. BUY levels from 0.58400

Potential for a bullish pullback on the GBPUSD M30 which could lead to a price movement towards the resistance level at 1.37200. BUY levels from 1.36400

Potential for a bullish pullback on the USDCAD H4 which could lead to a price movement towards the resistance level at 1.13800. BUY levels from 1.13600

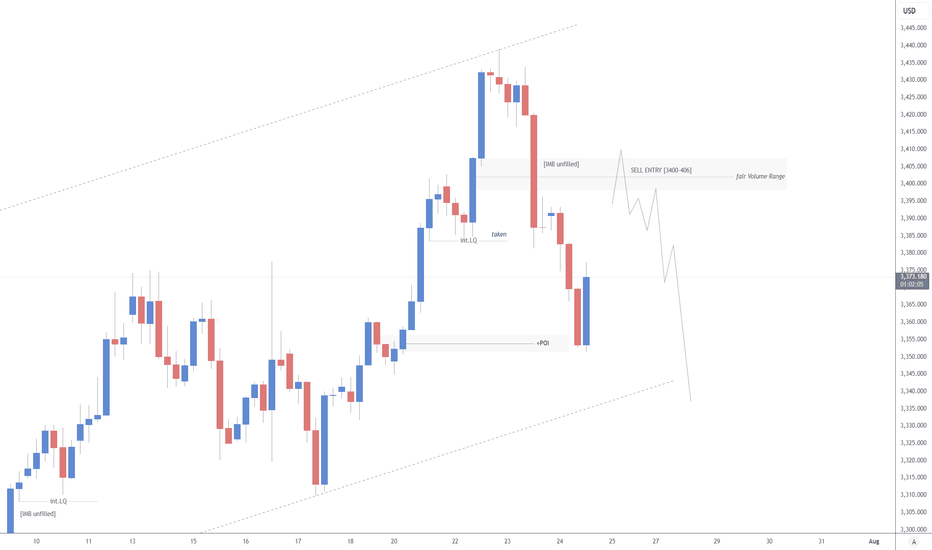

Potential for a bearish pullback on the XAUEUR H9 which could lead to a price movement towards the support level at 2800. SELL levels from 2918

Gold Holds Steady as Focus Shifts to Fed Policy Over Geopolitical Risk - Gold prices remained resilient. The US Dollar Index slipped 0.23% to 97.74, while U.S. equities ended mixed as markets braced for Federal Reserve policy signals. - The Israel-Iran ceasefire has eased geopolitical concerns, typically a bearish signal for gold. However, the metal’s continued...

Gold, Silver, Platinum Outlook – Gold Eyes Breakout as Dollar Weakens - Gold is gaining momentum and approaching a major breakout level near $3,350, supported by a weakening U.S. dollar, rising Treasury yields, and renewed safe-haven demand. A recent U.S. credit downgrade, driven by fiscal concerns, has added pressure on the dollar and boosted interest in hard...

Gold Surges Amid Escalating Trade Tensions and Geopolitical Uncertainty - Gold prices rose sharply as investors reacted to rising global uncertainties. This is the highest level gold has reached in the past three weeks. - The rally was mainly driven by two major developments. First, trade tensions between the United States and China worsened. President Trump...

Potential for a bullish pullback on the GBPCHF H4 which could lead to a price movement towards the resistance level at 1.13400. BUY levels from 1.10300

Potential for a bearish pullback on the EURUSD H12 which could lead to a price movement towards the support level at 1.08900. SELL levels from 1.13200

Potential for a bullish pullback on the AUDNZD H8 which could lead to a price movement towards the resistance level at 1.09000. BUY levels from 1.08300

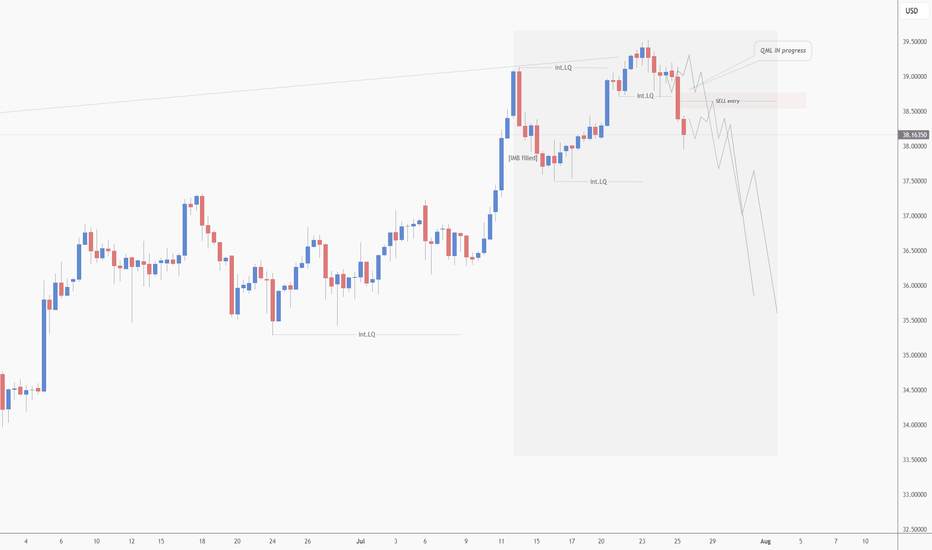

Potential for a bearish pullback on the XAGUSD H4 which could lead to a price movement towards the support level at 30.600. SELL levels from 33.600