GoldMindsFX

PremiumGold is a master of deception. It shows a clean wick into a zone, but reacts just enough to pull in early buyers or sellers — then rips straight through their stops like they weren’t even there. The reversal looked real and the candles seemed perfect. But the move? It was never meant for them. This isn’t bad luck, but traders who survive aren’t trying to guess,...

Summer light reading between trades💫 From Ancient Gods to modern banks — Gold never needed marketing to be priceless. Gold was never invented. It was found, worshipped, stolen, buried, and bled for. Long before charts, before forex pairs, before brokers — it was power. So if you're wondering why this metal moves the world? Let’s take it back — way back. But...

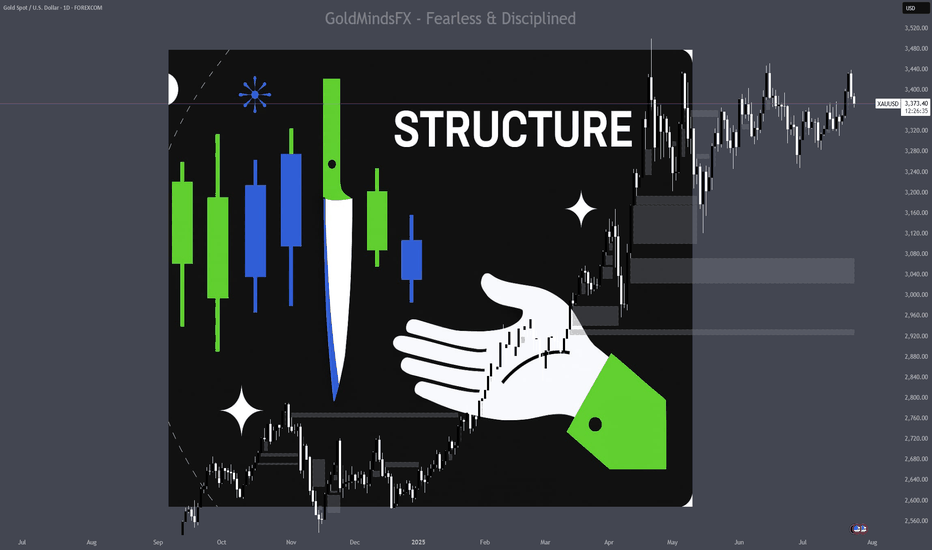

Gold Doesn’t Just Teach Trading. It Teaches You Discipline. 1. Why Gold? Why Not Everything Else? Gold is the most honest manipulator in the market. It respects structure down to key intraday levels—but builds traps around it like a pro. It fakes direction, sweeps liquidity, teases early entries, then moves beautifully for anyone patient enough to wait. And it’s...

"$100K Funded? Or $1K account you own?? Welcome to the Inside Battle of Every Trader" You want capital, freedom and win big. But the question is: do you do it with your own money, or someone else’s? You’ve got the $100K funded dream on one side. Big leverage, strict rules, payout drama. And on the other side? Your own $1K account. Zero limits, zero support, and a...

☀️ Summer Trading Blues? Here’s How to Stay Sharp Without Burning Out Summer trading on Gold isn’t for the impulsive or the greedy. Liquidity dries up, sessions lose momentum, and the clean, aggressive price action we love? It goes on vacation too. But that’s not a bad thing. It’s an opportunity. This is the season where traders either burn out... or...

From Chaos to Control: Mastering the Art of Balanced Trading on Gold Trading gold is exhilarating. It’s fast, volatile, emotional — and addictive. But what most traders don’t realize is this: it’s not the market killing your account. It’s you, pressing buy and sell like it’s a video game. Over-trading is the silent account killer. It doesn’t scream. It...

📔 “I’ll just scalp Gold on the 1-minute” — said the future blown account Gold doesn’t care about your emotions. It doesn’t care that you think you can catch a move before it happens. And it definitely doesn’t care about your $50 dream from a 20-pip scalp. Real Gold traders don’t come for 20 pips. They come for precision, for structure, and for 80–100 pip setups...

⭐It’s not about how much you know. It’s about how much you risk.⭐ The lesson you only learn after blowing up your account. You’ve read hundreds of articles, watched countless hours of YouTube. Joined 5 groups.Subscribed to 10 channels. Maybe you even tried a prop firm challenge and failed it in two days. Paid for mentorship. Kinda know structure. See price...

⭐The Setup Was Perfect, and You... You did everything right. Marked the zone. Waited for price. Saw the reaction. But you didn’t take the trade — or you hesitated, entered late, and missed the real move. Sound familiar? This article isn’t about strategy. It’s about what happens between your plan and your execution — and why even the most perfect setups won’t...

🎯 You Knew the Zone but the trade failed. Execution psychology for Gold traders who are tired of guessing. You marked the zone. You waited for price to tap into it. Maybe you even caught a reaction — but the trade failed anyway. Not because the zone was wrong. Because the execution broke down. 🧠 1. The Problem Isn’t the Zone. It’s the Trader. There are two valid...

🎯 You Don’t Need 20 Trades a Week. You Need One Good Trade a Day. Let’s be real. Most traders aren’t losing because they lack a good strategy. They’re losing because they can’t sit still. They chase every flicker. Every micro pullback. Every illusion of momentum. 20 pips here. minus 30 pips there. A breakeven day, again. But the truth is this: One clean setup...

Gold is walking on a tightrope today — and below it is a pit full of retail stops. With a full lineup of high-impact USD news and price tapping into key supply zones, you already know: The first move is bait. The second pays the sniper. 🧨 FUNDAMENTAL MINEFIELD – MAY 22 Today is packed with market-moving data — every piece adds fuel to the fire: 🕒 15:30 –...

🔥 XAUUSD MARKET OUTLOOK – MAY 15, 2025 🧠 MACRO CONTEXT – CHAOS COOKING AT GMT+3 Today is a high-impact fundamental day with U.S. Unemployment Claims and Powell’s speech at 15:30. After CPI surprised to the downside yesterday, the market is recalibrating fast. Gold dropped aggressively into discount zones, but no clean structural reversal is confirmed. This is a...

🧠 XAUUSD – Market Outlook & Tactical Watchlist (May 14) GoldMindsFX Chart Update 📉 Bias: Still bearish on H1–H4. Price structure remains heavy, with compression beneath resistance and weak bullish rejections off demand. Momentum is stuck between hopeful dips and unforgiving supply. 🧭 Macro Context: CPI data yesterday gave the market a good shake, but instead of...

🧠 GOLD (XAUUSD) – Reaction Zones & Ideas – May 13, 2025 🔹 Bias: Bearish with Corrective Bounce - potential flip to bullish Gold is currently retracing after reacting off the 3220 liquidity sweep zone. While price is moving upward intraday, the overall structure remains bearish on the higher timeframes. This is a corrective bounce unless we break decisively above...

🔍 Key Intraday Demand Zones (Potential Bounce Areas) 🔵 3220–3200 Current area of interest with short-term absorption signs May serve as temporary reaccumulation base if bulls defend this area Ideal zone for intraday reaction → confirmation required before acting 🔵 3180-3165 Strong historical reaction level Previously held structure before rally If price breaks...

🔹 XAUUSD – Daily Sniper Plan | May 9, 2025 🎯 Precision Mode: Activated. No recycled zones. Only real-time flow. 🧠 Macro Context: • Market digested FOMC + Powell ✅ • Price dipped into 3284 sniper zone (✅ Reaction Confirmed) • Asia printed fresh CHoCH from discount → Now retesting • Bias: HTF bullish — LTF shift confirmed after deep mitigation • Today = Thursday →...

🎤 Context: FOMC day just dropped the mic. Market’s fidgety. Fed held rates steady (no shocker), Powell said plenty (but meant little), and Gold just tap danced at resistance like it’s auditioning for Wall Street’s Got Talent. Let’s dissect it all and get sniper-precise. 🔍 MACRO CONTEXT 💣 FOMC Rate Decision: Rates unchanged. Dovish tilt in Powell’s tone – soft...