JTRADERCO

PremiumOn the 1-hour ES chart we identified an hourly oversold condition against our JLines bands and flagged a long plan this morning (see the 2:39 PM alert). We held the JLines 60 min curl as support, pulled the trigger near 5,375, and rode the move up to 5,475+ for a clean win. Setup Details Timeframe: 1 hour Signal: Hourly JLines curl held in oversold zone Entry:...

“🔍 BTC has just bounced off our weekly support—here’s why I’m eyeing $110k next…” Analysis bullets: 🛑 Risk: stop-loss around $78–80k (weekly close below red band) ▶️ Entry: current weekly close above the descending trendline 🎯 Target: $110k resistance (green zone) Call to action: “What do you think — will we break out or retest lows? Comment below! 👇”

TSLA – Watching for Main Short Setup 📉 1H Chart Breakdown Tesla is approaching a critical area. If the market starts to unwind, this could offer a main short opportunity. Price is currently hovering above a key support zone (highlighted on chart). A confirmed break below this level could accelerate the downside. 🟣 First Target: ~$216 🔻 Main Target: $180 if...

Do not short on ssr + microfloat + high volume These are my key levels on chart where I want to short Nothing more.

📈 Idea: Bitcoin continues to hold above key weekly support, consolidating after its recent move up. Using the Laguerre system as confirmation, we’re now watching a high-stakes setup with two clear paths: 🔸 Bullish Scenario: A breakout from the current wedge structure could ignite momentum toward the $110,000 target zone, aligning with Laguerre mid-band strength...

Bear Flag breakdown on 15m chart If we break down the 50% fib then TSLA has chances to go all the way back to yesterday's low Market not showing any kind of trust in this bull move

Each morning I connect at 9am italian time. I look at Asian indexes, then FTMIB, FDAX to see how Europe is responding to the tariffs story. I start watching ES NQ YM GC CL in early US premarket. If volatility is good we can have some shots otherwise waiting for news (often 8:30 ET ) or 9:30 US open. This morning is a waiting for me. FTMIB is rejecting now the...

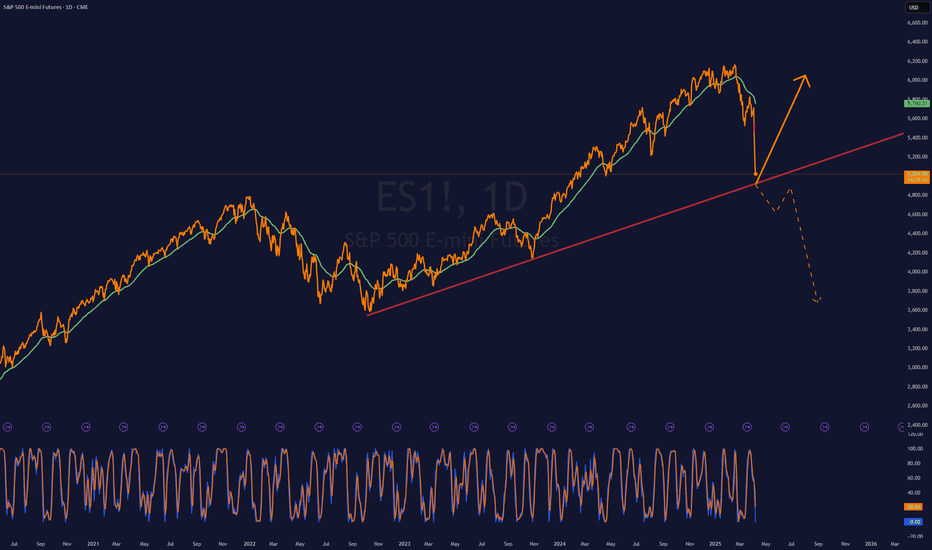

📉 ES1! - S&P 500 E-mini Futures (Daily) We’re approaching a critical point on the long-term trendline. 🟠 Price has bounced sharply after a steep pullback, reacting right at the dynamic support that’s held since the 2022 lows. 🟢 Two possible scenarios: Bullish Continuation: support holds, the index regains momentum and pushes back toward the highs. Bearish...

"Technical bounce on NASDAQ:TSLA at 160-180? – Possible long???" 📉 Nasty drop on TSLA, broke below the $250 level. 🎯 Potential short setup now, with a target around $160-180. That’s where I’ll start buying—if we get a daily or weekly reversal candle, with a stop just below support. 👉 Follow me for more updates on stocks and futures.