JinDao_Tai

PremiumThe DAX Index continues to hold strength just beneath all-time highs, popping higher above 24,000 after three consecutive sessions of gains. Bulls are keeping control through strong earnings in tech and auto sectors, combined with supportive macro tailwinds. However, the major resistance and previous ATH remain to be tested. U.S. Interest Rate Path in Focus...

Bitcoin is currently trading around $114,500 price level and continues to be held below the $116,000 level. Price remains in a short-term range between $112,000 and $116,000. But signs are emerging that a breakout may be brewing. Ichimoku Cloud BTC is trading into a bearish cloud, which further highlights the possibility of continuation within the range. ...

On July 25, 2025, Galaxy Digital executed one of the largest Bitcoin sales ever recorded: 80,000 BTC, valued at approximately $9 billion , on behalf of a Satoshi-era investor. Despite the size, the market absorbed the flow with minimal volatility—Bitcoin dipped from around $119,000 to $115,000, then rebounded above $119,000. Liquidity Maturity in Motion...

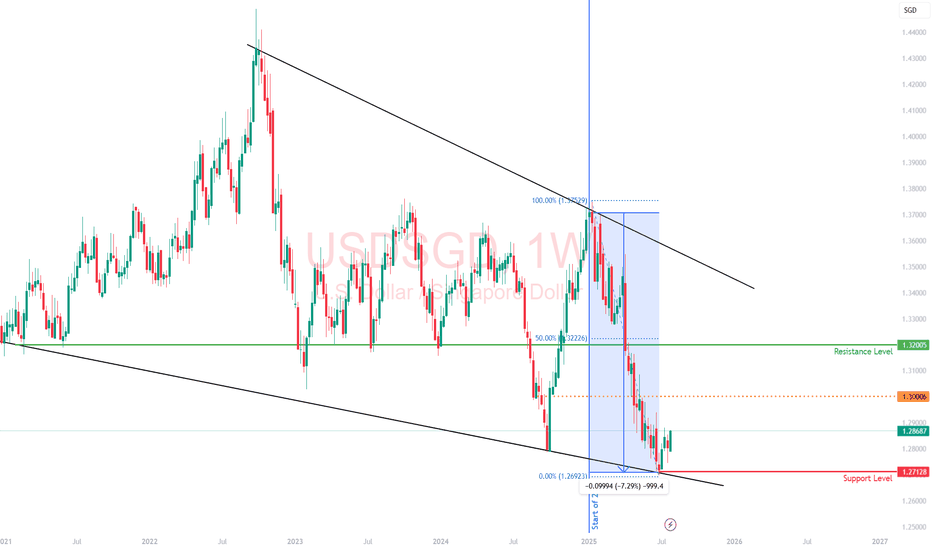

The Singapore dollar has quietly emerged as one of the strongest performers in Asia, gaining over 7% against the US dollar this year. While much of the FX world fixates on the yen or franc in times of uncertainty, the SGD is carving out a niche as a regional safe-haven, driven not by size or liquidity, but by credibility. The strength in the SGD isn’t just...

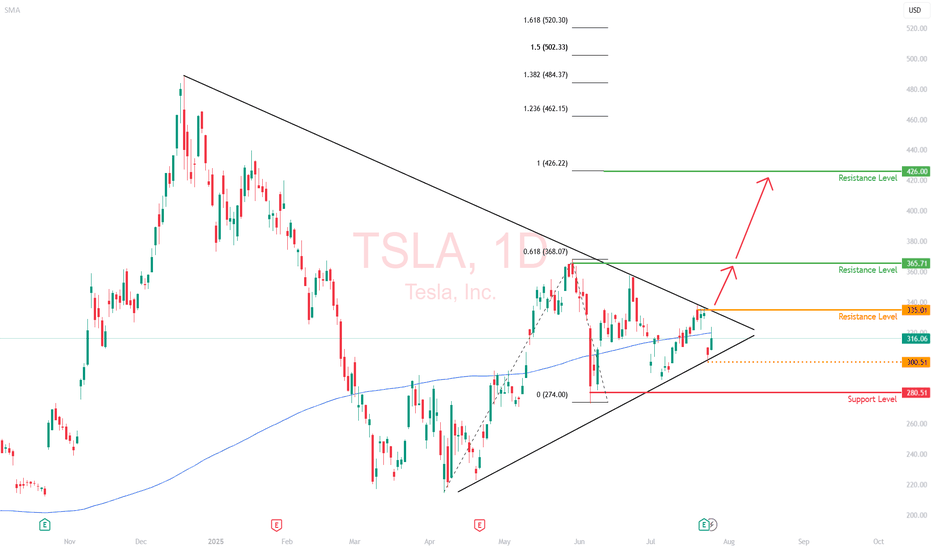

Tesla’s daily chart is coiled, with price currently trading at $316, sitting along the 200-day moving average. This looks like a consolidation phase with significant moves building up. Price Action Snapshot TSLA sold off last week, rejecting the $335 resistance level before finding footing around $300. The previous range of $280 and $365 is now tightening....

The S&P 500 just logged its best quarterly performance since Q4 2023 , surging on optimism around global trade negotiations and growing expectations that the Fed may begin cutting rates as early as September. US futures are green this morning, thanks to developments like Canada backing off digital taxes, ongoing dialogues with China ahead of the July 9 deadline,...

Fundamentals First: Why is Gold Falling While DXY is Too? Normally, gold and the U.S. dollar share an inverse relationship (which means, when DXY weakens, gold rises). But recently, this correlation has broken down, and that divergence is a loud macro signal. What’s Happening: Trade Deal Optimism: Headlines suggest the U.S. is nearing a resolution with...

Currently, Bitcoin (BTC/USD) is trading around $104,800. Up slightly but still digesting a sharp reversal that rattled short-term bulls. Recent Price Action: Rejection From $112K Back on 22nd May, Bitcoin surged to a new high near $112,000, fueled by bullish momentum, institutional flows, and strong on-chain accumulation. However, that breakout was swiftly...

Moody’s has downgraded the US credit rating for the first time since 2011, citing rising debt levels and long-term fiscal challenges. This move sends a clear warning signal about America’s fiscal path and adds fresh uncertainty to markets already navigating interest rates, inflation, and geopolitical risks. Focus on the US 10-Year Treasury Yield as the market’s...

Japan’s Q1 GDP came in worse than expected: -0.2% QoQ (-0.7% annualized). Weak consumption, soft exports, and a fading external boost despite a weak yen isn't a great combo for Asia’s largest export economy. The Nikkei 225 reacted immediately, and the H4 chart is starting to reflect deeper structural pressure. 🔍 Technical Outlook: - Price reversed from the...

The Nasdaq 100 has bounced, but under the surface, the “Magnificent Seven” are no longer marching in sync. And this divergence matters, especially if you’re trading QQQ or using it as a momentum proxy. ⚔️ Leadership Rotation in Real Time - Nvidia (NVDA): Still a beast. Making fresh highs, clear institutional momentum. - Microsoft (MSFT): Quiet strength — not...

Trump's “Liberation Day” reciprocal tariff announcement triggered a sharp selloff in the S&P 500 on the 2nd April. A classic policy shock! But the market has since clawed back every point. So what now? Let’s break it down by strategy. 🔎 Long-Term Investors: Stay the Course 1) This recovery reinforces one truth: When you own quality businesses, Volatility ≠...

In the earlier analysis, the expectation is for DXY to trade slightly lower to the round number level of 100. With Gold's inverse relationship with the US Dollar, anticipating further downside for the DXY should mean that we expect to see some upside on XAUUSD. However, the current price action on Gold is still signalling further downside. The good thing is...

Overnight, the DXY traded lower, driven by 2 main factors. 1) The release of lower-than-expected CPI data at 2.3% 2) Rejection of the long-term bearish trendline and the area of confluence formed by the 61.8% and 38.2% Fibonacci retracement levels from the longer term. If the DXY breaks below the 38.2% Fibonacci retracement level of the shorter term, we could...

10th Feb 2025 DXY: Could trade down to 108 (or consolidate here) before climbing higher to 108.90 or 109 (61.8%). NZDUSD: Sell 0.5620 SL 20 TP 70 (hesitation at 0.5580) AUDUSD: In abit of a range, look for test and reaction at 0.6363 resistance level. GBPUSD: Sell 1.2350 SL 30 TP 85 (watch the trendline) EURUSD: Sell 1.0290 SL 25 TP 65 USDJPY: Buy 152.40 SL 40...

6th Feb 2025 DXY: Retracing from 107 support area, look for reaction between 107.90 and 108.30, above 108.30 could trade up to 109. NZDUSD: Sell 0.5640 SL 20 TP 50 AUDUSD: Buy 0.6280 SL 30 TP 80 (hesitation at 0.6330) GBPUSD: Straddle Rates Decision Pending Sell 1.2430 SL 30 TP 100 Buy 1.2510 SL 30 TP 100 EURUSD: Sell 1.0320 SL 30 TP 90 USDJPY: Buy 153.65 SL...

5th Feb 2025 DXY: Trading lower, needs to break 107.50 to retest 107 round number support level. NZDUSD: Wait and look for reaction at 0.57 resistance area AUDUSD: Buy 0.6280 SL 25 TP 80 (hesitation at 0.6325) GBPUSD: Buy 1.2530 SL 30 TP 80 EURUSD: Sell 1.0440 SL 30 TP 100 USDJPY: Looking for reaction at current support level. Buy 154.10 or Sell 152.30 (SL...

3rd Feb 2025 DXY: If price stays above 109.30, could see it trade up to 110, beyond that 111 NZDUSD: Sell 0.5530 SL 25 TP 60 AUDUSD: Sell 0.6080 SL 30 TP 80 GBPUSD: Sell 1.2230 SL 40 TP 120 (hesitation at 1.2164) EURUSD: Sell 1.0160 SL 50 TP 150 USDJPY: Buy 156 SL 35 TP 70 EURJPY: Sell 159.40 SL 50 TP 100 GBPJPY: Sell 191.70 SL 50 TP 110 USDCHF: Wait and...