JoshuaDanford

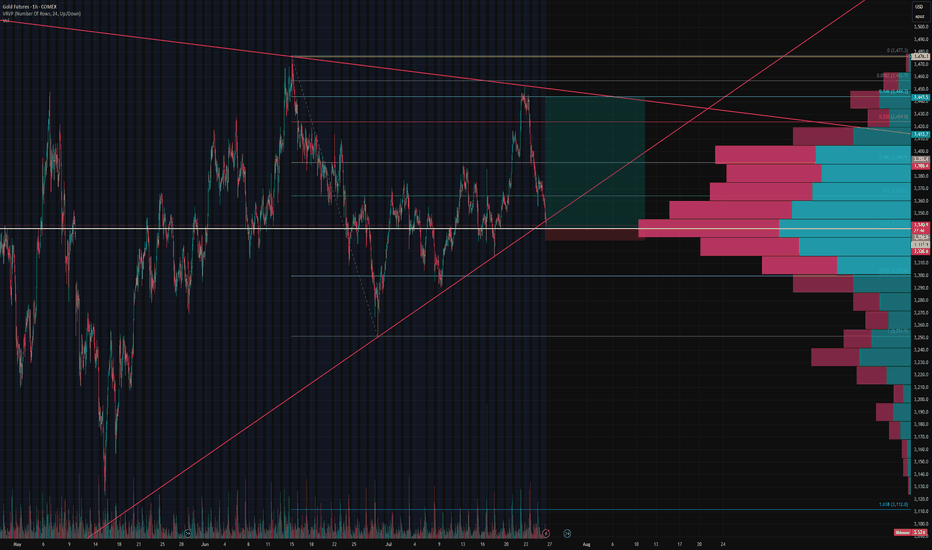

PremiumGC1! – The Wedge Strikes Back 🚀 Gold futures (GC1!) just gave us a textbook rollover move. As the front-month rolled, price faked a wedge breakdown, only to rip back inside the structure once rollover completed. That failed breakout speaks volumes – and now the wedge is back in control. Rollover Trap → Back Inside the Wedge Rollover volatility flushed price...

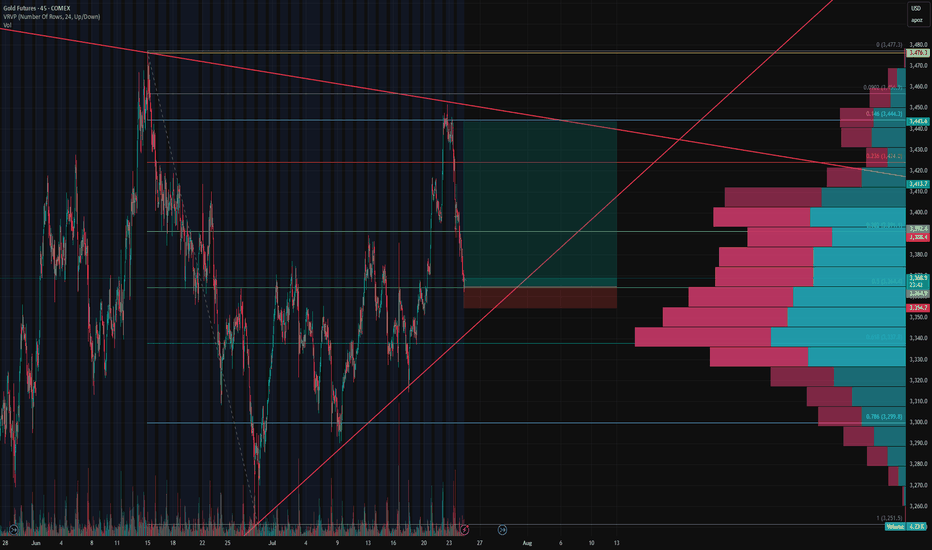

📉 Gold - Short Setup Off Major Trendline Rejection Gold has broken down through the rising trendline and is now retesting it — the moment of truth! 🧐 🔻 Short Entry: 3,336 🎯 Target: 3,236 (Fib 1.0 + HVN gap fill) 🛑 Stop: 3,346 (Above trendline retest) ⚖️ Risk/Reward: ~1:10 📊 Bonus: High volume node above adds resistance. Bearish volume profile structure confirms...

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive. Price is now approaching a key confluence zone at $3,336 , where: The 0.618 fib retracement from the recent swing low to high aligns perfectly, The ascending trendline...

🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move. 📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile. 📈 Entered long at 3,365 with a tight stop...

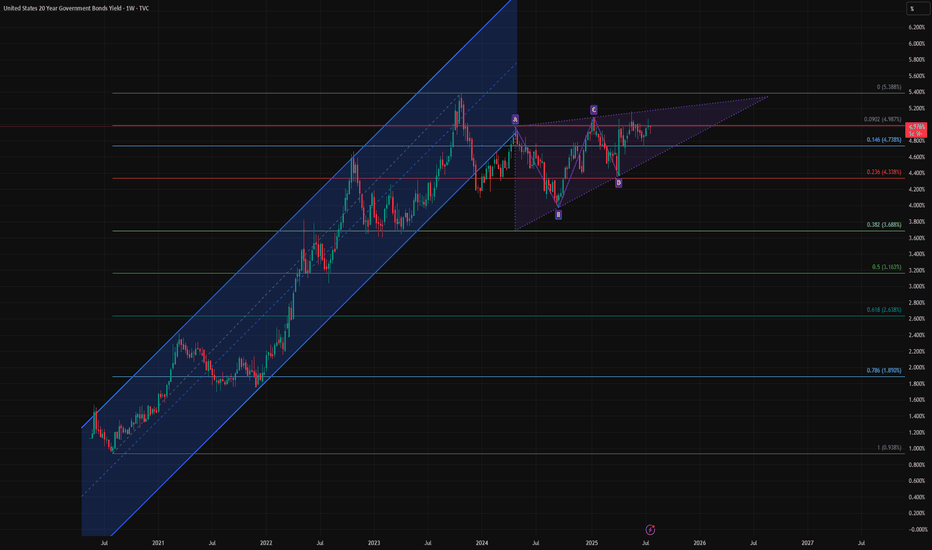

🧩 Fundamental Bear Case for 20-Year Yields 1. Recession Risk and Slowing Growth Leading economic indicators (e.g., ISM Manufacturing, Conference Board LEI) continue to suggest softening demand across key sectors. A recession or significant slowdown would drive capital into long-duration Treasuries, causing yields to fall as bond prices rise. Historically,...

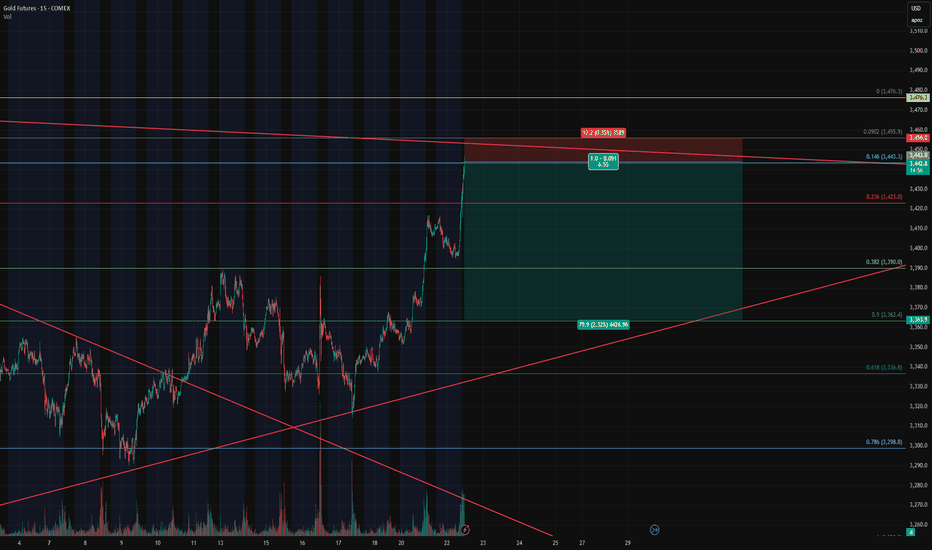

🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence Instrument : Gold Futures – COMEX ( COMEX:GC1! ) Timeframe : 15-Minute New Position : Short Entry Zone : ~3442 Target : ~3362 Stop Loss : ~3458 Risk/Reward : Approx. 6.5+ Setup Type : Reversal from Overextension / Fib Resistance 💡 Trade Recap & Strategy Shift We’ve officially...

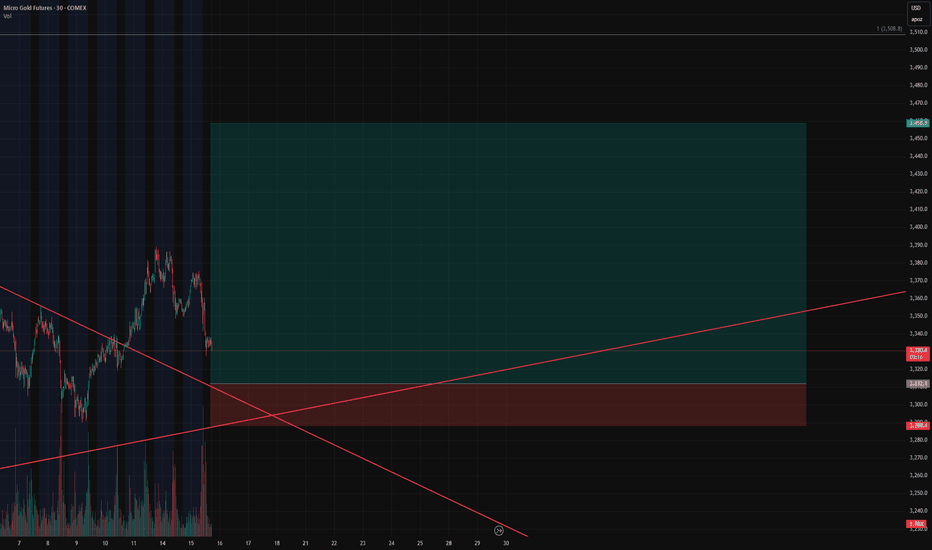

🚨 Gold Bulls Loading Up – Our Short Squeeze Trigger is Set! We’re flipping the script on COMEX_MINI:MGC1! After a prolonged downtrend and textbook wedge compression, our breakout long is LIVE – but not without trapping the late shorts first. 💥 Entry: $3,312.1 🛑 Stop: $3,288.4 🎯 Target: $3,458.9 🧮 Risk/Reward: 6.19 Price just bounced at the retest of the wedge...

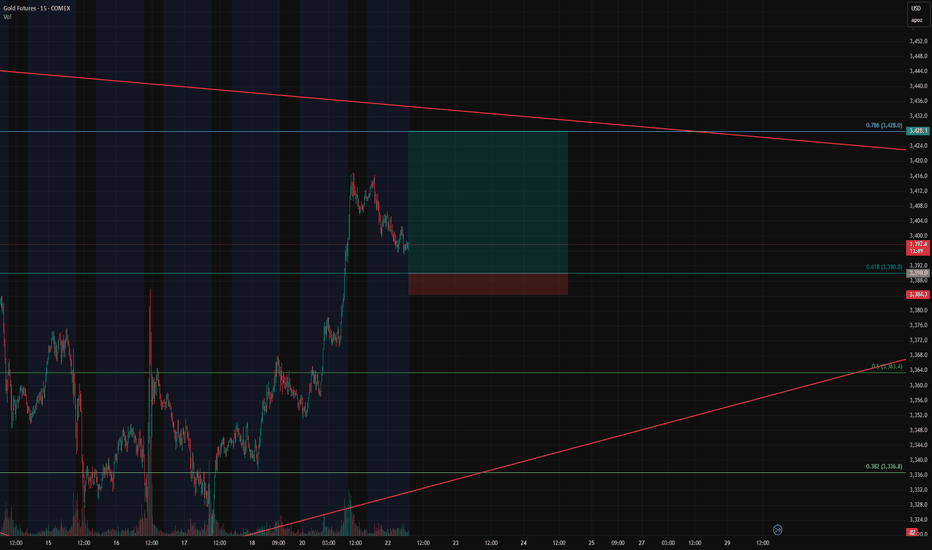

Gold Futures Long Setup – Breakout Continuation off the 0.618 Fib Instrument: Gold Futures – COMEX ( COMEX:GC1! ) Timeframe: 15-Minute Trade Type: Long – Breakout Continuation Entry Zone: 3390 (0.618 Fibonacci retracement) Take Profit: 3428 (0.786 Fib) Stop Loss: 3384 Risk/Reward Ratio: 6.68 Setup: Bullish Flag on Retest 🔍 Trade Thesis This trade is part of an...

🟡 Gold Futures ( COMEX:GC1! ) — US Session Setup: Bearish Retest from 0.618 Fib in Bullish Breakout Context ⏳ Pre-US Session Playbook We're currently watching Gold Futures ( COMEX:GC1! ) for a potential short opportunity into the US session open. While the broader structure has broken bullish, we're anticipating a bearish retest scenario from a key Fibonacci...

📉 CL1! Short Setup – Fading Into Volume Shelf 🔹 Context: Price just tapped into a heavy upper volume shelf (68.35–68.50) — the exact area where the prior breakdown started. This zone aligns with rejection highs and the upper edge of the VRVP profile. 📌 Setup Logic: 🔺 Entry: 68.36–68.50 (into supply zone) ⛔ Stop: 68.75 (above liquidity peak) 🎯 Target: ...

TSLA Short Setup – Fading the July 7 Gap Fill 📉 This short idea on TSLA builds off a key gap fill from Monday, July 7 , combined with a strong local volume profile and risk-reward alignment on the 15-minute chart. Entry: $312.76 Stop Loss: $314.81 (above gap resistance and local high) Target: $299.89 (gap base and volume shelf) RR: ~6.3R Why I'm...

Gold has been consolidating between $3,200 and $3,500, recently pressing against a descending resistance line that has rejected price several times. I was favoring the upside, but our long setup was invalidated — the stop loss at $3,330 was hit. Price is now retesting ascending support, and I'm shifting focus to a short opportunity, using our previous long entry...

Gold Trade Setup – Watching the Breakout Gold is currently consolidating between $3,200 and $3,500, with price action now pressing against a descending resistance line that has triggered multiple rejections in the past. We’re approaching a key decision point. I'm favoring the upside in this setup — the momentum and structure suggest a potential breakout —...

Many people have been confused by this Bitcoin cycle. Here I offer a different perspective taking into consideration both the halving dates and US Interest Rates. Keep in mind that interest rates tend to have a lagging effect on the market. Observations: - Slightly lagging behind interest rates higher rates seem to suppress Bitcoin's upward movement. Cause...

The first sign we got when RSI started breaking trend then we just got confirmation as price broke trend on daily as well. Let's see how high this cycle takes us.

EGLD is down 55% from it's ATH and is approaching it's descending resistance from it's base. We should see a breakout very soon.

I see bullish divergence in Stochastic Index and what I believe to be the same fractal pattern occurring from the last time BTC hit all time highs before going on it's bull run.

Keep an eye on the volume for a fakeout. If volume remains high we could see a huge movement on CVC 23 - 63% Entry: 0.605 TP1: 0.7401 TP2: 0.9800