GRSE Chart idea is marked above! Wait for the confirmation.

Stock: Aerofle (AERF) Current Market Price (CMP): ₹194 Entry Point: ₹187 Target: ₹228 Final Target: ₹272 Stop Loss (SL): Below Support 2 Trade Setup with Stop Loss: Entry at ₹187: As mentioned earlier, you plan to enter at ₹187, which is lower than the current market price of ₹194. You're waiting for a pullback to this level, anticipating the stock will rebound...

A potential entry is identified at 0.46. The first target is 0.62, representing a +34.78% gain from the entry point. If the upward momentum continues, the long-term target is set at 0.87, offering a total potential gain of +89.13% from the initial entry. This trade presents a strong risk-to-reward profile for both short-term traders and long-term investors. Proper...

HINDZINC Is approaching a key support level at 440. This level is critical for determining the stock's next move. A breakdown below 440 could signal increased bearish momentum, potentially leading to further downside. On the other hand, if the 440 level holds strong and shows signs of support, it could mark the beginning of a bullish reversal. In that case,...

Kindly follow all key levels and resistance marked on the chart. Be patient — waiting is the key in trading.

Yeah, the stock’s looking bullish, but don’t jump into a moving train. Let it cool down a bit—around ₹95 looks like a solid entry. That’s when we hop on and ride the move safely.

For VMM, the market is currently at a crucial zone. There are two possible scenarios: either we break the high key level and continue the bullish momentum, or we drop below the current support, triggering a bearish move. At this point, there’s no clear trade setup. We’ll wait for confirmation in either direction before taking any position to minimize risk and...

The stock is currently trading inside a tight range, indicating a phase of consolidation. 📉 Buy Zone: ₹6.38 I’m planning to accumulate if price drops near this zone. From a technical view, it’s a strong demand area. However, for the bullish breakout to sustain, we’ll need strong fundamental support — like earnings, news, or sector momentum. 🔍 If fundamentals...

Cochin Shipyard is perfectly retracing to a key support zone, showing strength for a possible bounce. 🔹 Entry: ₹2149 🎯 Target 1: ₹2543 📈 Potential Gain: ~18.3% 🕒 Plan: Holding position unless structure shifts This setup aligns with the current trend — looking for a continuation after healthy retracement. Tight stop-loss recommended for capital protection. 💬...

HDFC seems to be building an accumulation range with: Range High: ₹1955 Range Low: ₹1908 Currently, price is consolidating within this zone. I'm biased to the sell side for now, expecting a potential breakdown below the ₹1908 level. ⚠️ No confirmation yet — it's a “wait and watch” scenario. A strong close below the range low could trigger momentum selling. 💬...

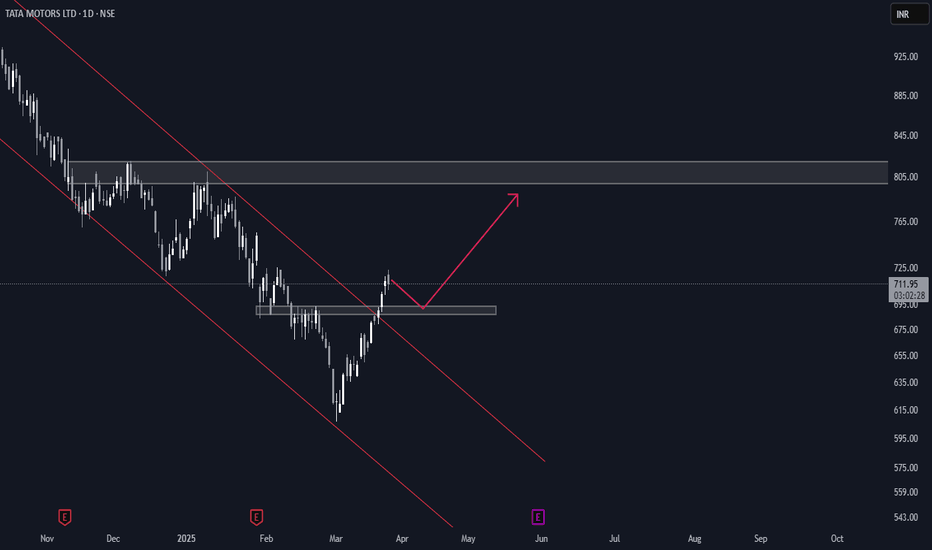

Consider buying Tata Motors stock below ₹713 with a long-term target of ₹799, offering a potential profit of approximately 12%.

I am feeling bullish on Tata Motors for the short term. Let's see how it reacts around the key level of ₹800. If it holds and shows strength, we can decide whether to stay bullish for the long term. For now, I remain bullish.

My Trade Idea My trade idea was simple: If EUR/USD breaks above a key level, I will look for a retest and enter a long position after confirming the entry with candlestick confirmation. If it breaks below, I will wait for a retest, confirm with a candlestick pattern, and enter a short position. This is a very short-term trade, so I’ll skip if the setup doesn’t...

My trade idea was simple: If GBP/JPY breaks above a key level, I will look for a retest and enter a long position. If it breaks below, I will wait for confirmation and enter a short position. The key is to follow the market, not predict it. Always trade what you see, not what you think will happen. Let the price action guide your entries.

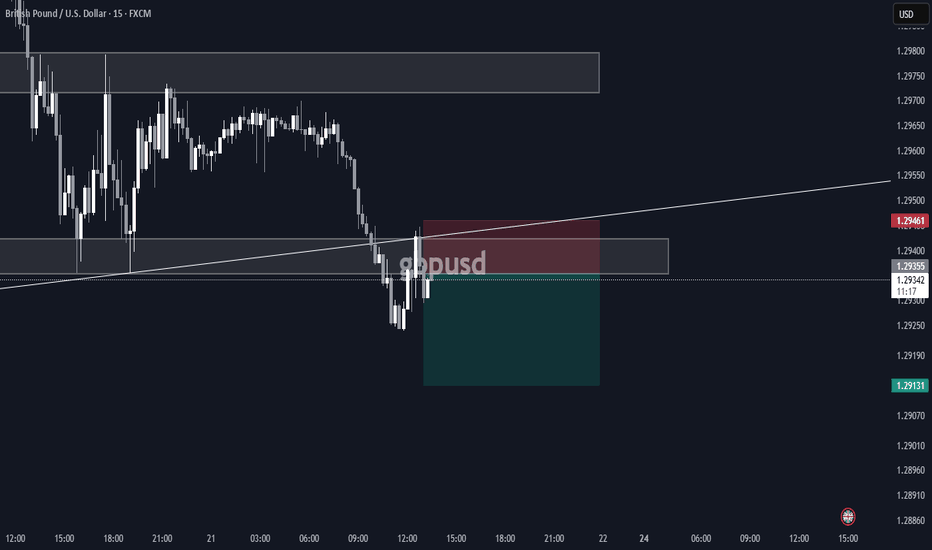

Just a quick trade—I'll update afterward. Follow for simple and effective trades faster! 1RR

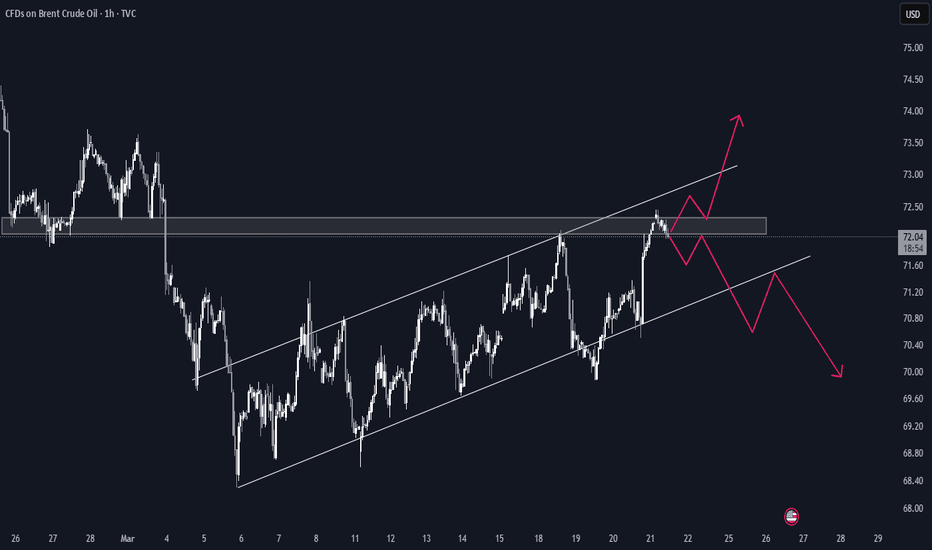

Just a straightforward textbook trade opportunity—let's see how it goes. #UKOIL

If you missed my previous XAU/USD 1:10 trade, don’t worry! There’s a great setup in NZD/USD for a short trade right now. Set your stop loss at 0.56252 and target the 15-minute swing low at 0.55428.

This trade setup is based on a confluence of key price action and market structure levels, with a focus on key support/resistance areas, price reactions, and trend confirmation across multiple timeframes.