KAS109

PremiumI noticed candles unable to break through resistance for several candles (wedge structure), plus double top compared to yesterdays (oct 18) chart. All markets trending down so I decided to take advantage here. $256.39 first target would be 50% fib retracement. Final target of $255. I bought at $257.70 with a stop loss @ 258.03 so 33 cent risk to gain $1.31 if I...

Above Moving averages, positive earnings, consolidating in pennant pattern. Overall upward trend. Low risk entry with good potential reward. Entry $9.37, Risking 35 cents

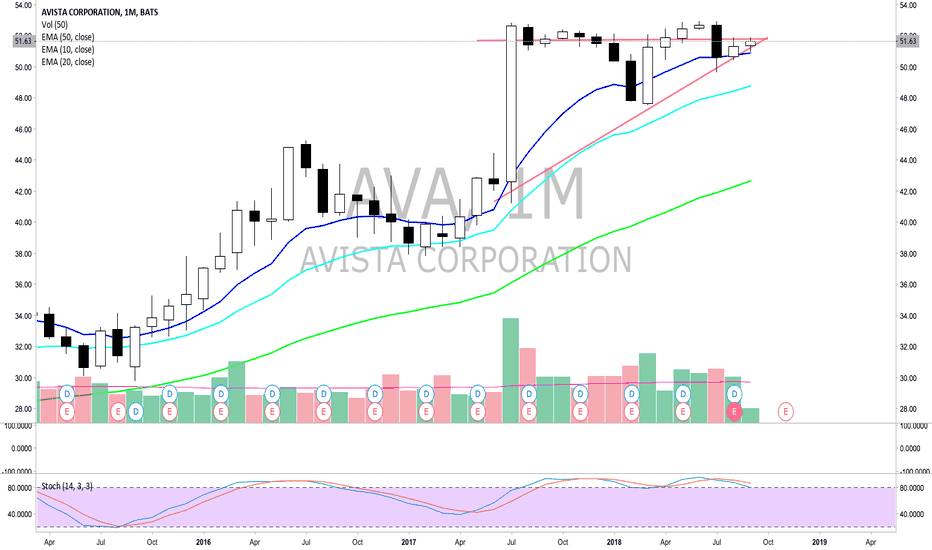

Bull Flag or Ascending triangle Pattern on the monthly, Low- Risk Entry, Accelerating Earnings, Dividend stock.

HIgher than normal volumes for past year. Higher volume on down days comparative to lower volume on up days. 3 to 4 Rallies Above 50 Day Average - Failed.. Railroad Tracks topper. Wide, loose cup with handle base indicative of late-stage. Watching for death cross and then straight to hell. Hope it doesn't happen, but hope is not a strategy.

Short idea. Wait for consolidation or pull-ups and go short. Small share sizes for overnight holds - gap downs. $AMAT looks similar.

Watch for intraday weakness. Bearish entry below $99.50 Target $92.25 @ 50 MA .Stop = 101.02

Stop - 27.20 Enter 27.45 or better. 1st Target 28.00 >>>>>Plan to ride 10 EMA until cross and stop out if trade works.

looks good on weekly and monthly too..Any thoughts on an entry?

Prior earnings had sell offs + Trump's tweets.. : D Target would be 0.5 - 0.62 Fib retrace. Tight stop loss.

Levels drawn according to weekly chart. Earnings will either confirm or negate a trade (4/26). Entry 39.03 Stop 37.62. Target > $42. Will be interesting to watch price action prior to earnings...

This looks like it's under distribution, it could get juicy if investors decide to flee. Under 50 MA!

Double Top. Short @ 59.40 Stop 59.90 1st. target = $58. Morgan Stanley Downgrade, Trade wars

COUP - earnings surprise. Expect resistance at $49.57. Hugging 10 EMA and above 20 SMA. Nice trending price action. I am in since yesterday. "The trend is your friend until it bends."

XOM has bounced off of daily demand area and has formed an upward trend on low and high timeframes. Trading volume increased significantly on Friday. 1st target around $76 and 2nd target $77.50. Let's not forget the attractiveness going long on a high dividend stock. If not a bounce, than further consolidation in $73-$74 range. I believe it would take a major...

Will watch to see how high DSW can climb before it's ex-dividend date on March 22. Consider looking for a top AFTER that date and a short sale. Stock is already more than 10% extended from 50 MA. Earnings are mixed - operating margin has increased and sales are mixed. Would expect profit taking at that point and a price decline. If stock goes above $22, I will...