KnightsofGold

PremiumEnd of day update from us here at KOG: Yesterday we wanted a tap into the lower circled region to continue with the long trade into the higher level marked on the chart. We didn't get the lower level but managed to find intra-day support on the boxes and complete two Excalibur targets for a decent trade on gold. Now, we have support at the key level 3350-2...

Moving on from the previous chart we shared on DOW you can see our red box worked well and gave us the move we wanted upside, however, we stopped just short of the ideal target level. For that reason, and after looking at the liquidity indicator we will monitor the boxes here for a possible retracement. As always, trade safe. KOG

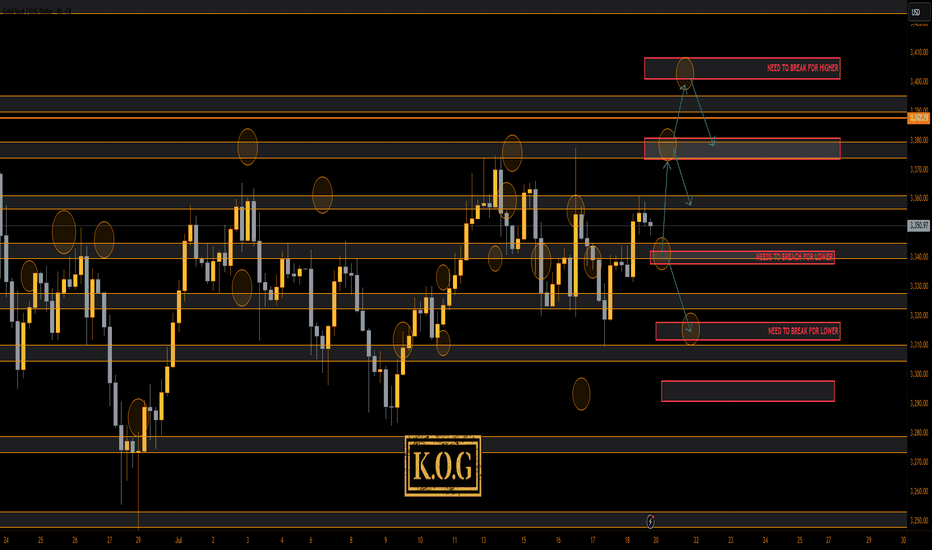

End of day update from us here at KOG: A frustrating day in terms of price action as we ranged between the two key levels, however, this did give us opportunities to capture a few scalps in the direction of Excalibur, so we can't complain. We now have resistance at the 3355 level with support at the 3333 level which will need to hold us up to go higher and clear...

End of day update from us here at KOG: We did not expect an open like that! Honestly, we were expecting a low volume day of ranging and choppy price action like last week, but from the get go, gold was off! It resistance the level we wanted, came down in to the 3370-5 level we wanted, gave us nearly 100pips, then continued to break through the bias level and...

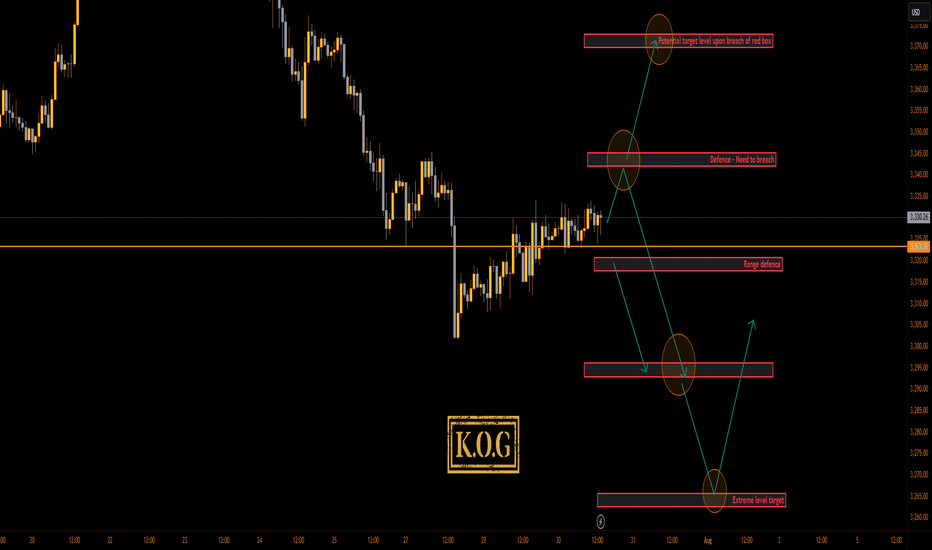

THE KOG REPORT: In last week’s KOG Report we shared the NFP chart and the KOG Report chart for the wider community. We said we would be looking for price to support below at the red box and then push upside into the higher levels and the red box targets. We also suggested the shorting region and the target level for that trade which as you can see worked well...

End of week update from us here at KOG: KOG’s bias for the week: Bullish above 3340 with targets above 3370✅, 3373✅, 3379✅ and above that 3384✅ Bearish on break of 3340 with targets below 3330, 3320 and below that 3310 RED BOXES: Break above 3365 for 3372✅, 3375✅, 3379✅, 3384✅ and 3390✅ in extension of the move Break below 3350 for 3346, 3340, 3335 and 3330 in...

End of day update from us here at KOG: Nice trade upside today from support which was shared yesterday. We managed to identify another set up on the indicators which performed well again on the long side but is not yet complete. The bias levels given this morning have worked well at playing the range but we haven't managed to break above or below so unless...

End of day update from us here at KOG: As anticipated in the morning review, low volume day which resulted in this range still in play and price just making the sideways up and down move. That's where we stand at the moment with no break above the red box for higher pricing at the moment. We managed to bag 3 decent set ups of 50pips each but we didn't get the...

End of day update from us here at KOG: What a mission with gold, swings one way, swing the other, taking liquidity within the range and yet sticking with the illustration posted. We managed to get the move upside, pin point short into the level we wanted and then a bounce from the 3350 level again! We had a target lower, but suggested we wait for the 3370-5...

DXY As we can see here we've hit and breached the target level we gave a few weeks ago on the dollar. We're now at a red box level that can cause a temporary tap and bounce unless it's broken, so we'll keep an eye on this. As always, trade safe. KOG

We hit the target nicely on this and then got the reversal trade we wanted which gave our traders and extra bonus. Now, we have key level below and a RED BOX lining up, if attempted, we may just test that level for a long on the retracement. As always, trade safe. KOG

End of day update from us here at KOG: Not a bad day at all on the markets with gold holding the 3345-50 support level and giving the push upside as we wanted. We managed to complete our Excalibur targets and hit the ideal target level which was share in the NFP KOG report to complete the move. Now, we need to play a little caution here as we have bounced the...

1H: This is the chart we used last week for the FOMC and NFP KOG Reports. From the chart we can see the low was captured for FOMC and NFP didn’t give us an undercut low. We’ve kept the potential target box from the Report and for now we’ll stick with it. Red box defence is active below at the 3340-5 level and the ideal target stands above in the oval as long...

THE KOG REPORT: Due to there being no KOG Report last week so we won’t reference it, however, we did post the FOMC and NFP reports for the wider community to help them navigate the moves, which as you can see from the pinned ideas worked well. So, what can we expect in the week ahead? After the move we observed for NFP on Friday we would like to see some...

THE KOG REPORT – NFP This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in...

End of FOMC Update: Thank you. RED BOX TARGETS: Break above 3335 for 3338, 3340, 3345, 3347 and 3357 in extension of the move Break below 3320 for 3310✅, 3306✅, 3302✅, 3297✅ and 3393✅ in extension of the move Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders...

THE KOG REPORT – FOMC This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in...

THE KOG REPORT: In last week’s KOG Report we said we would be looking for a price to attempt the higher level red box sitting around the 3370-75 region and if not breached, we felt an opportunity to short would be available from that region. We said if that failed and the move commenced, we would be looking at a complete correction of the move back down into the...