LevelsBySBT

EssentialAfter retracing to the approx. 3370 - 3380 zone, gold still seems to exhibit signs of overall potential Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : CMP 3393 Stop Loss : 3286 TP : 3499 (Before All Time High)

EURGBP price action seems to exhibit signs of a potential Bullish Reversal on the shorter timeframes if the price action forms (and sustains) a credible Higher High with multiple confluences from key Fibonacci and Support levels. Trade Plan : Entry @ 0.8459 Stop Loss @ 0.8375 TP 0.9 - 1 @ 0.8534 - 0.8540

Gold seems to exhibit signs of overall potential Bullish momentum if the price action forms a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 3.403 Stop Loss : 3328 TP 1 : 3478

Ethereum price seems to exhibit signs of overall potential Bullish momentum if the price action forms a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 2950 Stop Loss : 2200 TP 1 : 3700

ONDO Finance seems to exhibit signs of overall potential Bullish momentum if the price action forms a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 1.3 Stop Loss : 0.47 TP 1 : 2.13

RENDER seems to exhibit signs of overall potential Bullish momentum if the price action forms a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 5.8 Stop Loss : 2.2 TP 1 : 9.4

NASDAQ price action seems to exhibit signs of potential Bullish momentum as the price action may form a credible Higher High (after tarriff delays on the EU) with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 21600 Stop Loss : 20550 TP 1: 22649

With potential developments towards the resolution of global tariffs and pharma being defensive in general, MRK price action seems to exhibit signs of a potential Bullish reversal breakout as the price action may form a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential Non-Leverage hold...

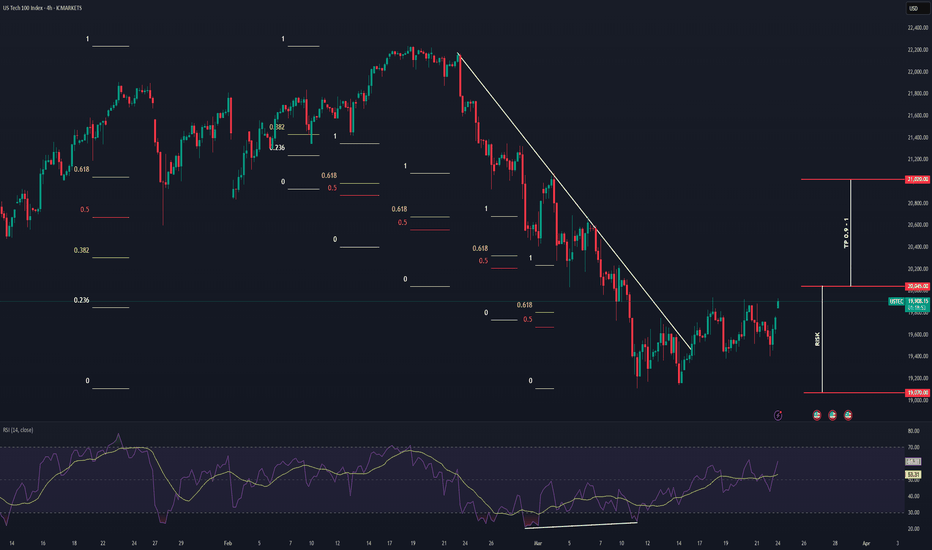

NASDAQ price action went through a massive correction during the global tariff war. However after potential recent developments, we may finally see a direction towards the resolution of widespread tariff based uncertainty across the macro economic landscape. This presents us with a potential Reversal opportunity if we see the formation of a credible Higher High...

With with continued global tariff war between USA and China, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 3178 Stop Loss : 2946 TP 0.9 - 1 : 3399 - 3408

New Zealand Dollar/Yen price seems to exhibit signs of potential bullish momentum as the price action may form a credible Higher Low on key Fibonacci and Support levels. Trade Plan : Entry @ 86.29 Stop Loss @ 84.85 TP 0.9 - 1 @ 87.586 - 87.730

Pound/Yen price seems to exhibit signs of potential bullish momentum as the price action may form a credible Higher Low on key Fibonacci and Support levels. Trade Plan : Entry @ 191.37 Stop Loss @ 189 TP 0.9 - 1 @ 193.499

After a considerable retracement, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : CMP 3220 Stop Loss : 2946 TP 0.9 - 1 : 3490

Gold price still seems to exhibit signs of potential Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 3389.8 Stop Loss : 3345 TP 0.9 - 1 : 3430 - 3434

Despite uncertainty still looming over the current global tariff based environment, TSLA price still seems to exhibit signs of a potential Bullish breakout as the price action may form a prominent Higher Low on the longer timeframes with multiple confluences through key Fibonacci and Support levels which presents us with a potential Non-Leverage hold...

With with continued global tariff panic between USA and China, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a prominent Higher High on the shorter timeframes with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 3363 Stop Loss...

With widespread panic about tariffs, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity. Trade Plan: Entry : 3131 Stop Loss : 3095 TP 1 : 3167

NASDAQ price action went through a massive correction with a drop from the top worth approx. 14%. However after the passing of the latest FOMC Meeting, we may finally see a direction towards the resolution of widespread tariff based uncertainty across the macro economic landscape. This presents us with a potential Reversal opportunity if we see the formation of...