Milad_ansari

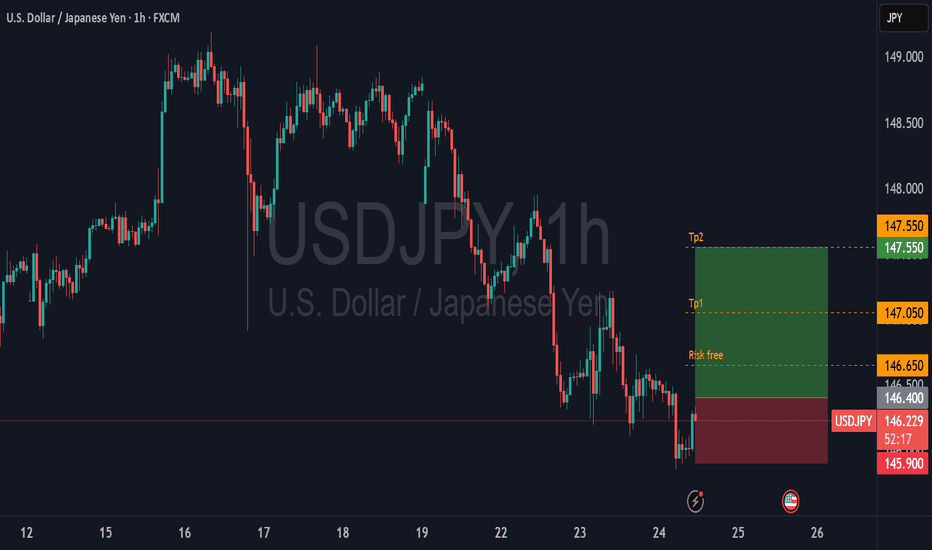

Buyers were unable to take control of the market and drive the price higher. As a result, the momentum remains bearish and we will enter a short position.

**Momentum strength** → Long bullish body with volume, no hesitation. **Structure shift** → Market rejected the bearish breakdown and reclaimed a higher zone.

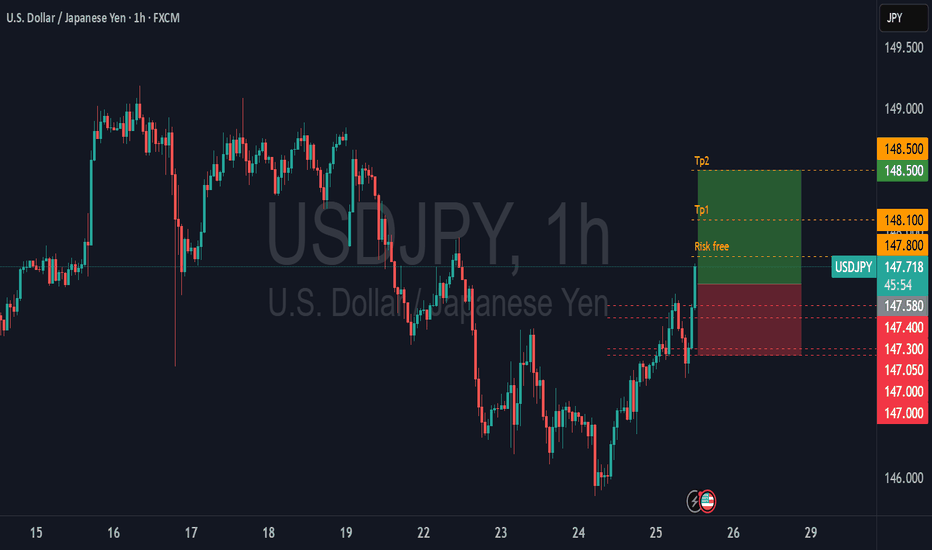

We had a good correction to a local number and the momentum quickly moved up and we re-entered.

If momentum increases above 147.350, it can reach a higher price. We are waiting for buyers to appear and hope for an upward growth.

With the momentum seen and key areas broken down, there is a high probability of continued downside movement.

The depth of price penetration is a good sign for the resumption of the buying scenario.

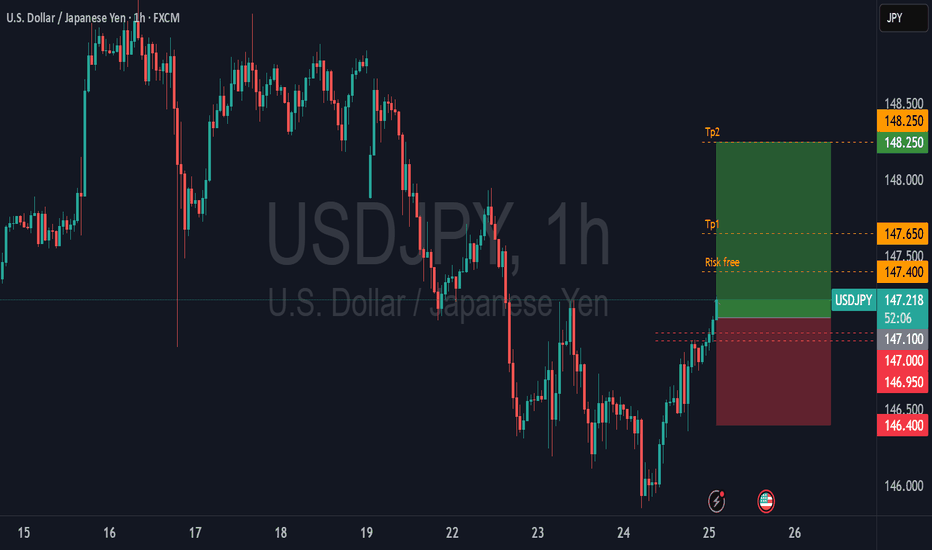

Daily/4H liquidity rests below **146.90**. Sweep of that low + sharp reversal = trap sellers and fuel a long to next supply.

If downward momentum occurs again, we can expect this position to be activated and be able to reach the target.

The movement will continue and we are friends with the trend.

I think there is enough volume in the market to push the price up. The 1-hour candle has good momentum.

* We set **entry above the current price**, at **147.150**, to avoid false breakouts and confirm bullish momentum continuation.

(Valid until price closes below 146.800 or conditions break) * Strong bearish engulfing candle invalidates structure

🔵 **147.000** | Respected beautifully – formed a clear bullish base. ✅ This is a **valid bullish break** of the 147.500–147.600 resistance block. ✅ Candle body is **strong**, suggesting momentum.

🔹 **Price closed above 148.600** 🔹 Volume on breakout is healthy

We are in the best position to enter a long position and will enter only with a minor correction. There is good potential for price growth and we will ride this wave to reach higher targets.

The 1-hour candle **closed cleanly and strongly** above the 147.050 resistance zone. No upper wick rejection, no weakness

* You **can enter now** or set a **pending buy at 146.400** if price pulls back slightly.