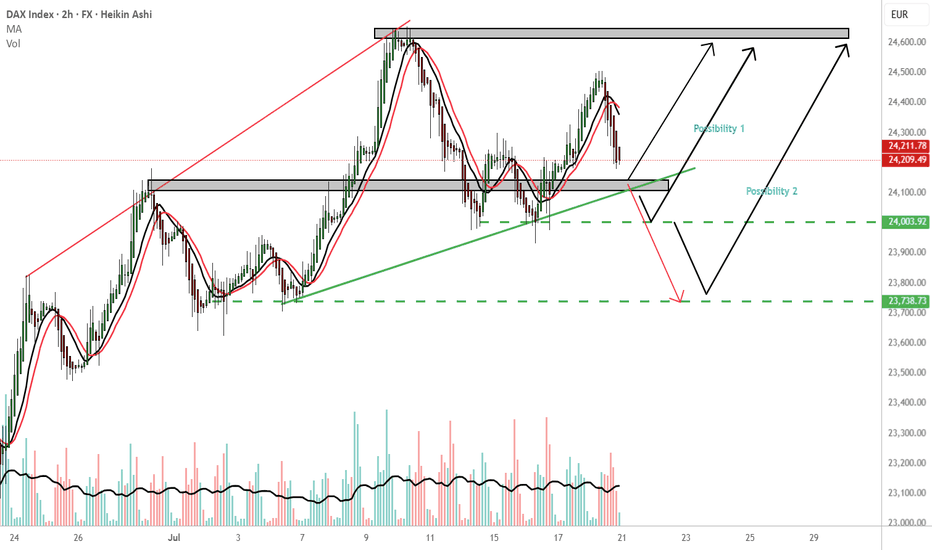

My most immediate outcome is reversal 24,140 price area. TP:24,600 Possibility 1: If Ger 30 holds the 24,000 price area i would consider a buy to 24,600. Possibility 2: If Ger30 holds the 23,730 price area that would be another possibility for a buy. TP 24,600. WCS: Worst case scenario, continuation downwards from the 24140 PL. Consider the red arrow. The...

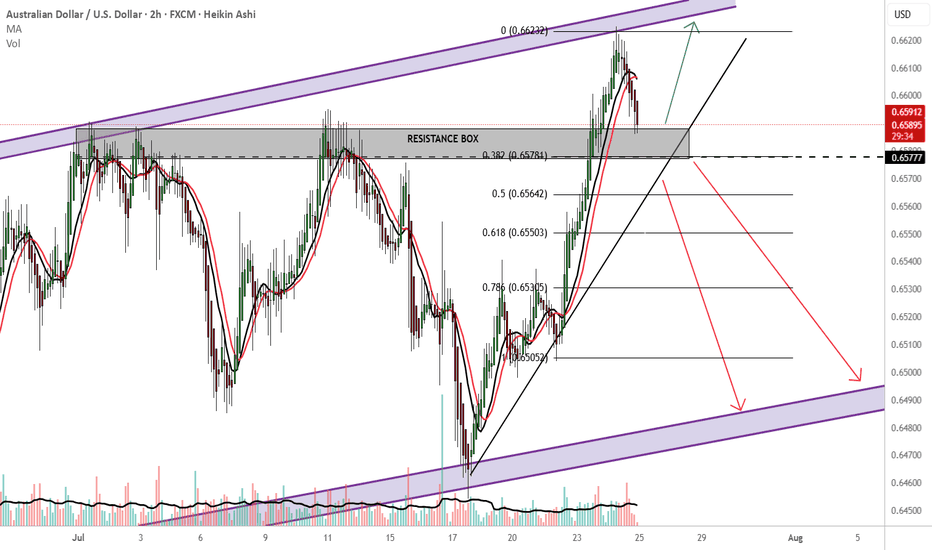

Still early days 20% in me: Unless strong bullish fundamentals present themselves or the big boys with the big bucks drive a bullish push anywhere from 0.65784 or resistance, I would be looking to sell. Buy outside the resistance box TP:0.66600 new immediate high? Please also consider price action as there are 2 previous rejections in the 0.65784 price...

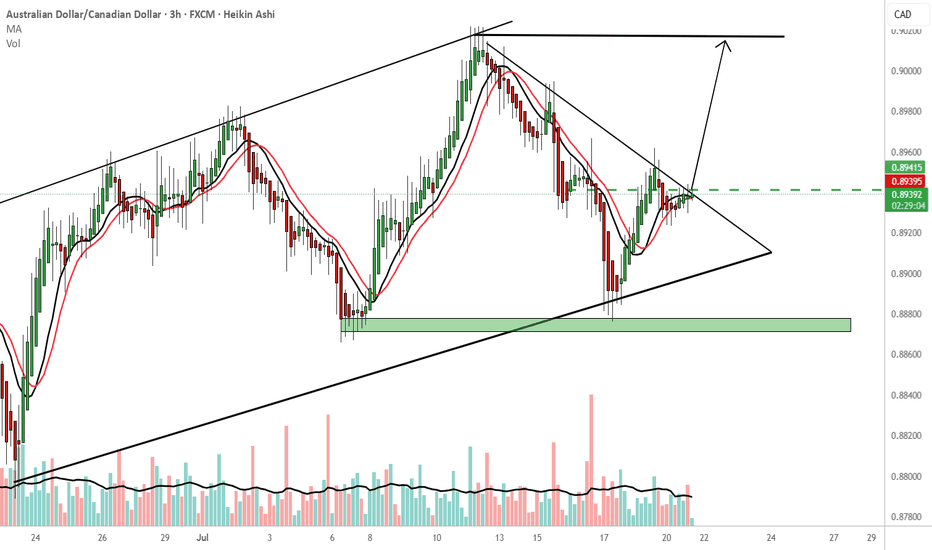

Looking for buys, consider the following confirmation. -Inverse Head and Shoulder formation, you can consider buys above the green broken line, you could wait for a retest @ 0.89420 before liftoff. -Consider 0.90200 as the first TP -TP 2: 0.91200

Short short short !!! -65.69 TP -64.72 TP2 As long as it's bearish and doesn't close above the red line, assume bearish. The green dotted lines also can suggest demand zones which could suggest a change in direction (bullish soldiers) will enter the battlefield. Trade with focus and follow your trading plan. THOUGHTS???????

A channel within a channel . Short-term bearish pressure to complete the 3-drives pattern, which ultimately suggests a long bullish setup. I'd only consider this setup if the trend continues to 198.000. side note 198.000 I'll be looking for buying opportunities to the upside probably until we hit the red channel trendline. That should guarantee approx....

Nasdaq has made a beautiful recovery since its plummet a few weeks back due to the Corona virus pandemic. It is currently trading a near 9481.0 price region. Consider this price level a very sensitive area because Nas100 is about to test its previous high of 9757.0 in the coming weeks. My current analysis is based on the H4 timeframe. There are two outcomes from...

-Possible H-S formation, currently trading at the right shoulder -If EURUSD holds its CTL and breaks below H-S neckline . Enter short position below 1.1538 and hold -If EURUSD fails to hold its CTL and the trend breaks to the Upside consider H-S formation invalid. -Target :1.1127 -Preferably wait for a pullback before re-entering.

US OIL bullish momentum undoubtedly strong and may still hold for quite some time. -Unless OPEC countries decided to reduce oil and petrol prices i'll be looking to long oil to its late 70's -Structure just recently tested CTL / Support line great time to long and hold.

Facebook is currently trading above the 50,100 & 200 moving average . - Facebook has tested the second resistance and will be looking to hit a new high . -Take note of the red vertical line as earnings report are due which could boost upside momentum if actual is greater than estimated. -Facebook is still quite volatile due to its data breach scandal but hopefully...

Bullish continuation: -Break above CTL (W Formation neckline) -Resistance box (expect consolidation) -200 M.A -TP:10000 LONG TERM Bearish continuation: -Consider HL & LL formation -Failure to break CTL (wait for pair to test & reject) -Consolidation (fails to continue bullish) - Fails to break the 200 M.A -TP:5600 OR NEW LOWER LOW -Could go bearish at anytime so...

-Gold currently trading bearish for the past 4 months. -Structure supports further downward momentum, trend currently trading below the CTL. -Gold is quite sensitive to Economic data especially Fed Talks and inflation data. -Possible Cup and handle formation brewing (Early Stages). Long entry : Consider this signals only if the trend fails to breakthrough the...