MoneyballAustin

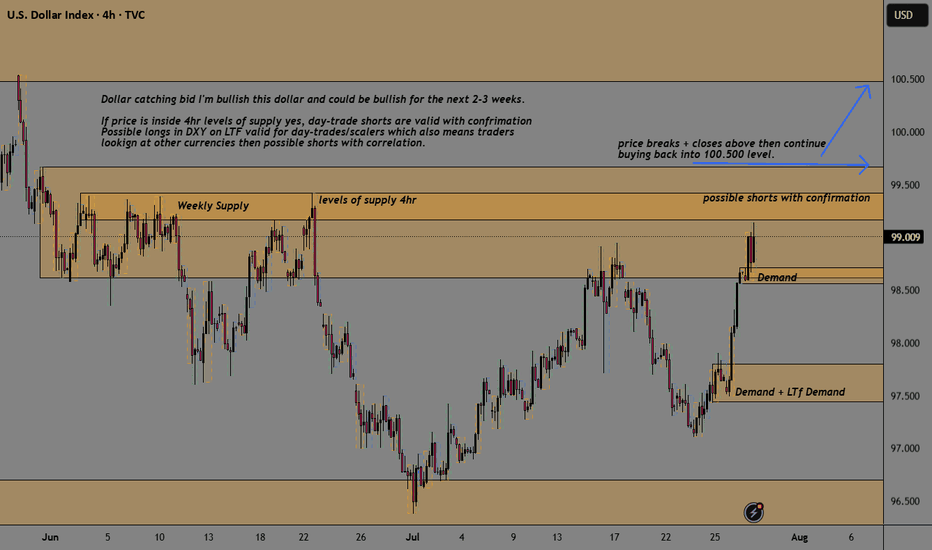

EssentialSee chart for top-down analysis. Looking at long if price pulls back into break-out level of demand with strong fundamentals, technicals, and sentiment COT reports.

Long-term fundamentals are bearish Long-term sentiment = bearish Long-term technicals = bearish Trump wants a weaker dollar + FED injecting endless amounts of cash into the markets driving stocks/ gold up, and the dollar down, losing purchasing power. My plan is to look for shorts on the 1hr-4hr timeframe with lower timeframe confirmation. Once price starts...

See chart for analysis but even with price sitting inside levels of supply, we could easily see stronger Fundamentals coming out to drive this dollar back up into 100.5 areas of monthly supply. Short-term I remain bullish with long term views to the downside.

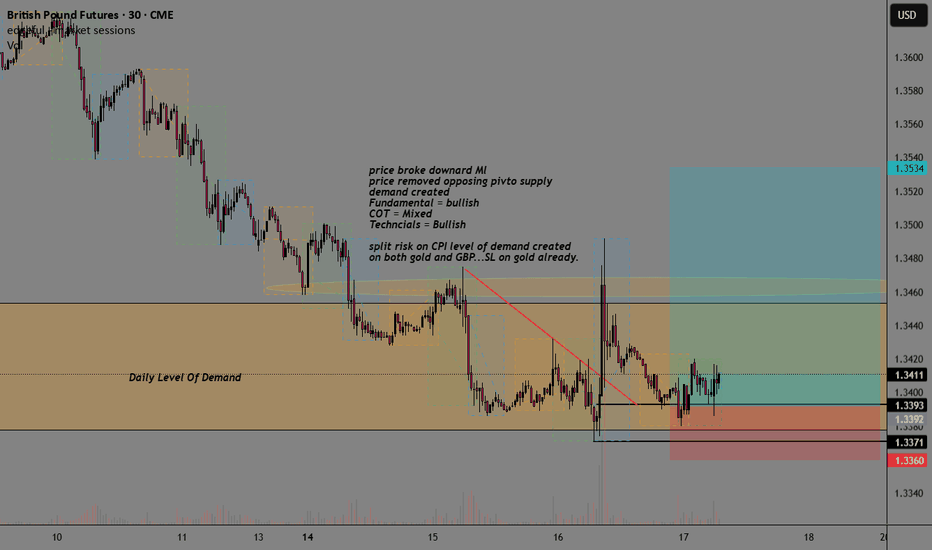

Higher Timeframe Analysis: - Price inside daily/Weekly level of demand + pivot - Long term trend = uptrend - Fundamentals Bullish - COT Mixed - Technicals Bullish Lowertimeframe: - Price broke downard ML - Price removed the opposing pivotal level of demand - DBR Demand created from CPI event - Split risk on GC + GBP This is a mix of using Sentiment, technical...

Price is expected to open not just 1, but inside 2 previous days. We have 2 options: 1) ICT silver bullet up my bum trader strategy traders are waiting for liquidity search breaking highs or lows then reversing. 2) Break-out trades waiting for price to break and close above or below 24hour range and trade in direction of break-out.

Looking at the 4-hour timeframe. Price is failing to make LL or HH, with pressure getting tighter and tighter. Personally, I'm not really interested in trading a market like this till price breaks out.

See picture for analysis. -DXY had long-term weak fundamentals + Technicals which will be bullish for CHF and other currencies. -Price broke downward trend line -Price removed opposing pivto supply zones structure -Demand created Options: 1) possible buy back into 1hr demand 2) Wait for price to reutn the wait for lower-timeframe confirmation buy setups.

See notes on chart for more detail. Price breaking downward trend line Price removed opposing resistnace/supply Demand created valid for pullback or wait for confirmation once price comes back.

1) See picture for full analysis... Higher Timframe: -Price inside supply -Trend = downtrend -Stochastic RSI overbought Lower Timeframe: -Need break to break support + break upward trend-line + quality supply created. - IF price does the following then possible pullback for short OR look for scalp/day-trade shorts to the downside with 1TF...

See Picture For Analysis and what I'm looking for as price is sitting inside higher timeframe supply with the overall trend = downtrend...Just wait for 3 different types of confirmation trade setups.

Where Price Going? -Price reacting off of 200MA -Price reacting off of Daily/Weekly Demand -Price reacting off of Major Support -Fears of Trump Tarriffs -Fears of slowing economy Price is at a critical level depending if buyers step in or if price breaks away below 200MA

-This might seem like a "troll trade" but Coffee is held this 50-year range since 1975. -Price is high on the range and straight-up shorting getting out at a 50% gain seems like a high probability trade. Thoughts?

-Price broke downward ML -Price removed opposing pivot supply and created new HH/HL -DBR demand created. -Swing buyers valid with 2x Stop loss locations I would consider OR Day-Traders can use 4hr demand as Higher timeframe and wait for new lower timeframe confirmation.

-Price inside daily/weekly supply + trend = sideways. -Buyers still in control wait for selling confirmation of price breaking upward trend lines + removing opposing pivot demand zones. -We could see price break to the upside and then reverse (liquidity search/stop run).

See Chart For Analysis HTF: -Price inside HTF demand -Trend on HTF = uptrend LTF: -Price broke downward ML -Price removed opposing pivot zones -DBR demand created

See chart for analysis. Options: 1) waiting for price to break falling wedge to the upside and catch the pullback. 2) if price breaks to the downside then consider looking for scalp shorts NOT swing shorts because how strong the metals market is.

See Chart For Analysis as we have 2x separate analysis for day-trades & swing trades.

See picture below for analysis valid buy setup with price inside monthy demand + confirmation but smaller risk as HTF is tested + counter-trend.