MrAlex_17

The Japanese Yen selling remains unabated through the early European session on Thursday, which along with a goodish pickup in the US Dollar demand, lifts the USD/JPY pair to the 148.80 region in the last hour. Data released earlier today showed that Japan clocked a smaller-than-expected trade surplus in June.

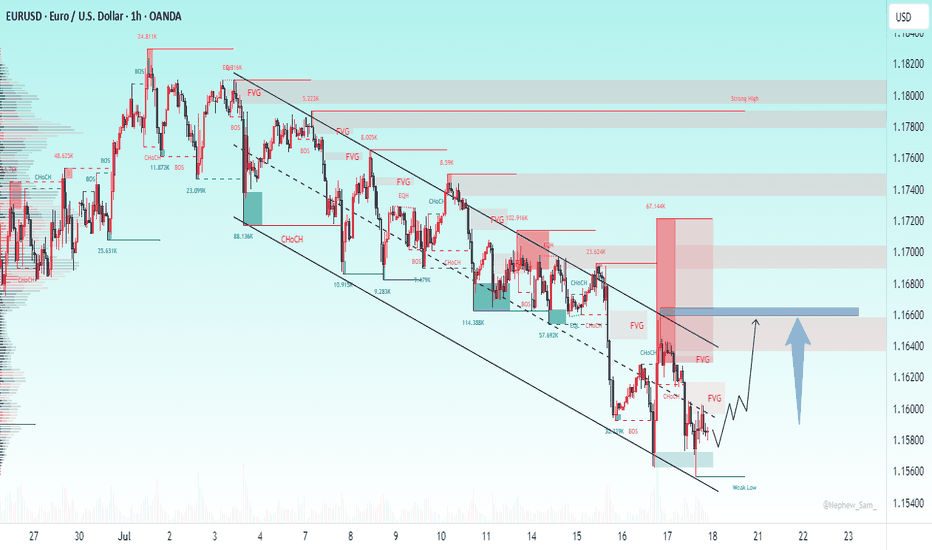

EUR/USD extends its daily slide and trades deep in the red below 1.1600 in the American session on Thursday. The US Dollar (USD) benefits from the better-than-expected Jobless Claims and Retail Sales data, not allowing the pair to hold its ground.

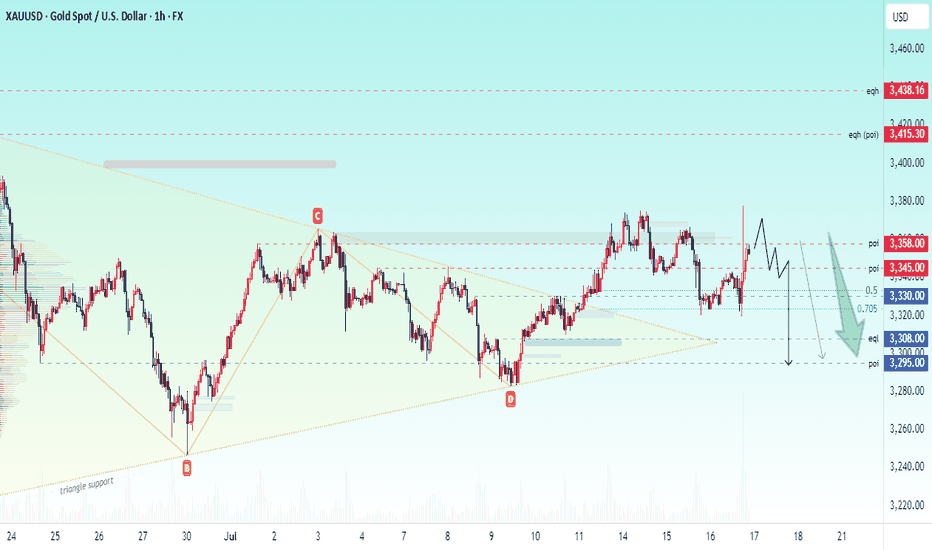

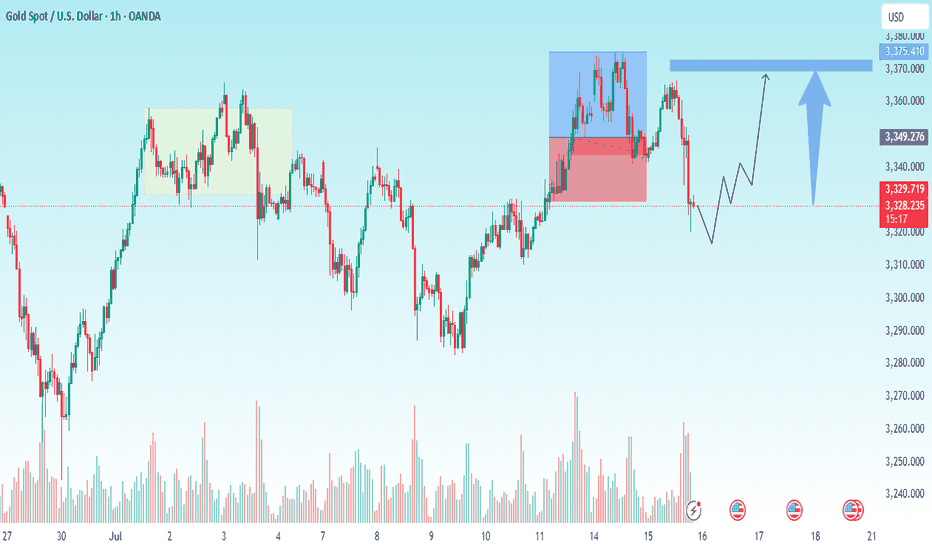

Gold now manages to leave behind the initial weakness and rapidly advances to the area of three-week peaks around the $3,380 mark per troy ounce as the US Dollar’s retracement gathers extra pace following another round of Trump-Powell effervescence.

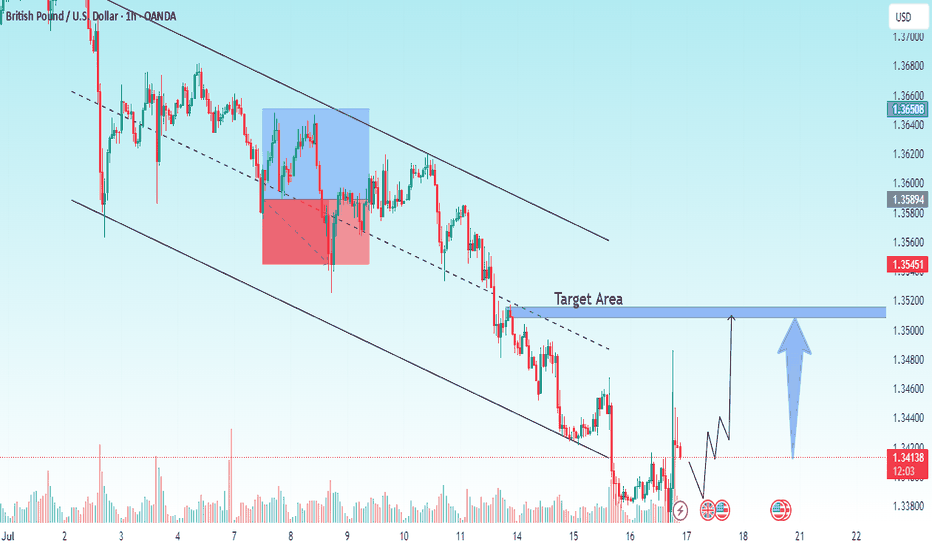

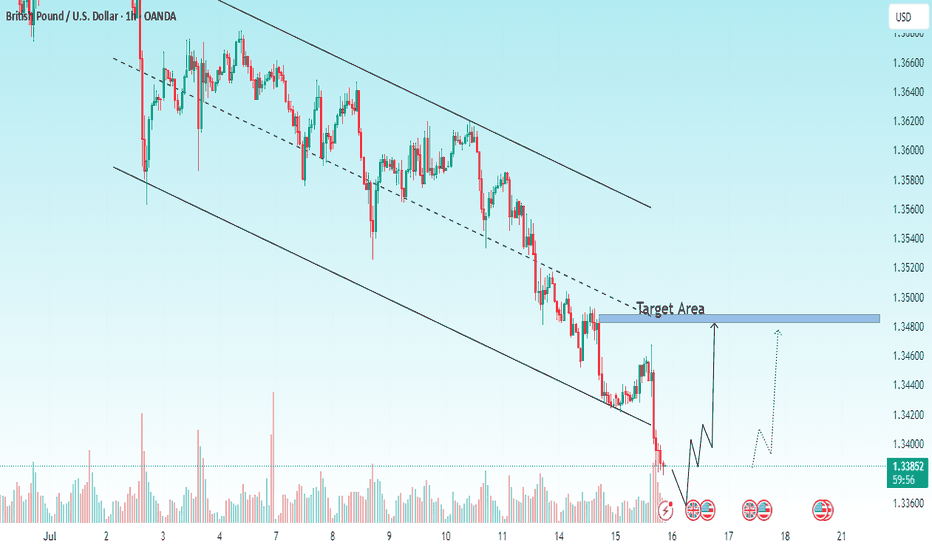

GBP/USD picks up pace and advances to daily peaks in the 1.3470 zone on the back of the increasing downward pressure on the US Dollar after President Trump asked politicians if he can fire Fed Chief Powell.

Gold prices rise in early trade as fears of a global economic slowdown due to widening trade tensions reinforce the precious metal's role as a defensive hedge and safe-haven asset. Futures are up 0.5% to $3,382.70 a troy ounce, their highest level in three weeks, after President Trump said he will charge a 30% tariff on goods from the EU and Mexico--two of the...

GBP/USD is on a gradual recovery from three-week lows, testing 1.3450 in Tuesday's European trading. A cautiously optimistic market mood combined with a broadly weaker US Dollar underpins the pair ahead of the critical US CPI data and BoE Governor Bailey's speech.

Gold price sticks to modest intraday gains around the $3,360 region heading into the European session and remains close to a three-week high touched the previous day. The US Dollar eases from a multi-week top amid some repositioning trade ahead of the crucial US consumer inflation figures, which is seen as a key factor acting as a tailwind for the commodity.

GBP/USD holds its winning streak for the fourth successive session, trading above 1.3700 in the European session on Thursday. The pair hangs close to three-year highs amid sustained US Dollar weakness, in light of US President Trump's fresh attack on the Fed's credibility. US data and BoE-speak awaited.

GBP/USD holds its winning streak for the fourth successive session, trading above 1.3700 in the European session on Thursday. The pair hangs close to three-year highs amid sustained US Dollar weakness, in light of US President Trump's fresh attack on the Fed's credibility. US data and BoE-speak awaited.

Despite rising selling pressure on the dollar and mixed US PCE numbers, Gold prices fell further on Thursday, reaching new four-week lows around $3,260 per troy ounce. Collaborating with the decline, recent improvements in the Israel-Iran conflict continue to fuel investor withdrawals from the safe haven region.

Gold price kicks off the week on a bearish note after facing rejection again near $3,350. US Dollar finds fresh haven demand amid renewed trade jitters as Trump’s tariff letter to go out on Monday. Gold price breaches the 50-day SMA support as the daily RSI pierces below the midline.

Gold price regains positive traction and reverses a part of Thursday’s upbeat NFP-inspired losses. US fiscal concerns weigh on the USD and lend support to the commodity amid trade uncertainties. Holiday-thinned liquidity might hold back the XAU/USD traders from placing fresh directional bets.

Bitcoin (BTC) price remains steady above a key support level, trading slightly above $106,000 at the time of writing on Friday. The uncertainty looms as geopolitical tensions between Iran and Israel show no sign yet of an exit strategy from either side.

Gold price trades with a mild positive for the second straight day on Thursday, though it lacks follow-through and remains below the $3,350 level through the early European session. Reports that US President Donald Trump was considering replacing Federal Reserve Chair Jerome Powell raised concerns over the future independence of the US central bank.

The EURUSD extended its recent uptrend yesterday, briefly pushing to the highest level since October 2021, but the move stalled just above 1.16297, the June high and the high for the year. Today’s price action again approached that high but was unable to break above, turning the market lower and back toward a familiar swing area that has defined recent resistance.

The EURUSD has broken to a new high for the month and the year. The price extended above highs from June between 1.1614 to 1.16297. The high price extended to 1.1641 so far. That represents the highest levels going back to October 2021. With the break, the next key target area comes between 1.1663 and 1.16916. That area corresponds with swing lows and swing highs...

Gold prices tumbled early on Tuesday with safe-haven demand easing as the United States and Iran backed away from hostilities while Tehran reached a shaky ceasefire agreement with Israel. Gold for August delivery was last seen down US$72.60 to US$3,322.40 per ounce, 3.8% below the June 13 record high of US$3,452.80.

Bitcoin (BTC) price remains steady above a key support level, trading slightly above $106,000 at the time of writing on Friday. The uncertainty looms as geopolitical tensions between Iran and Israel show no sign yet of an exit strategy from either side.