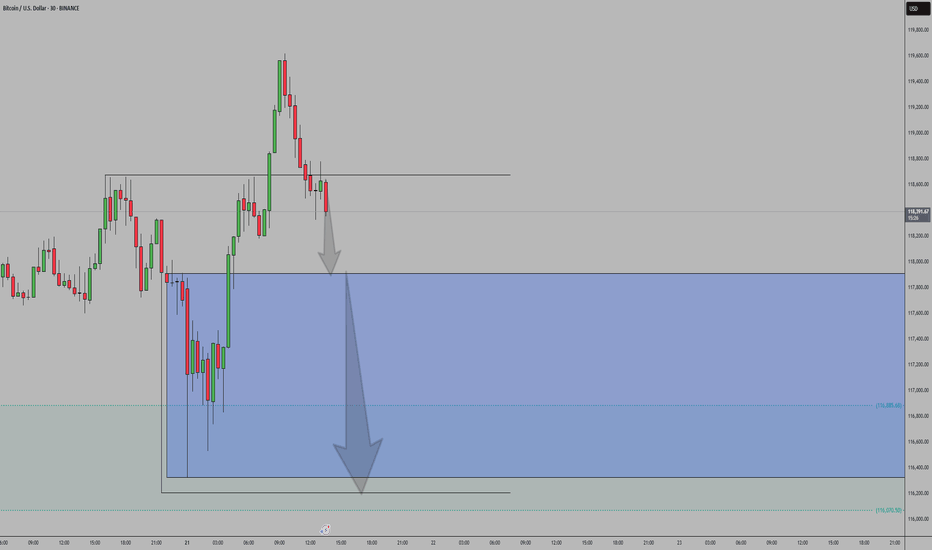

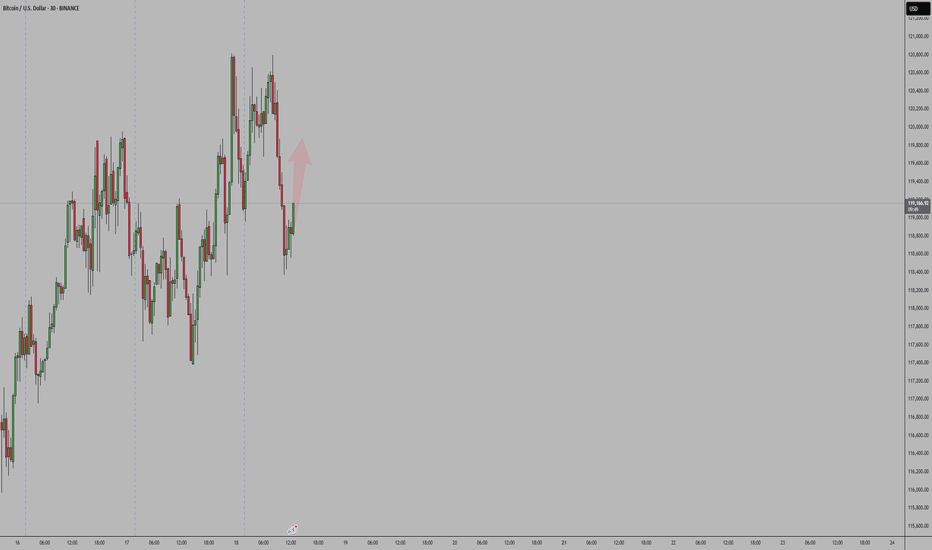

BTC net -50 = mild bearish or neutral bias Not strong enough alone to trade on — check price action, key levels, and other factors like ETF flows or macro news.

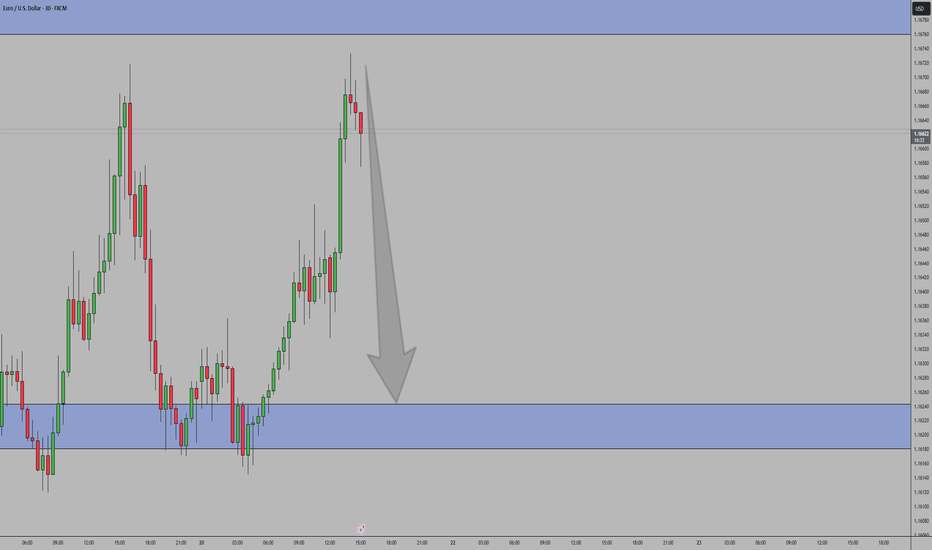

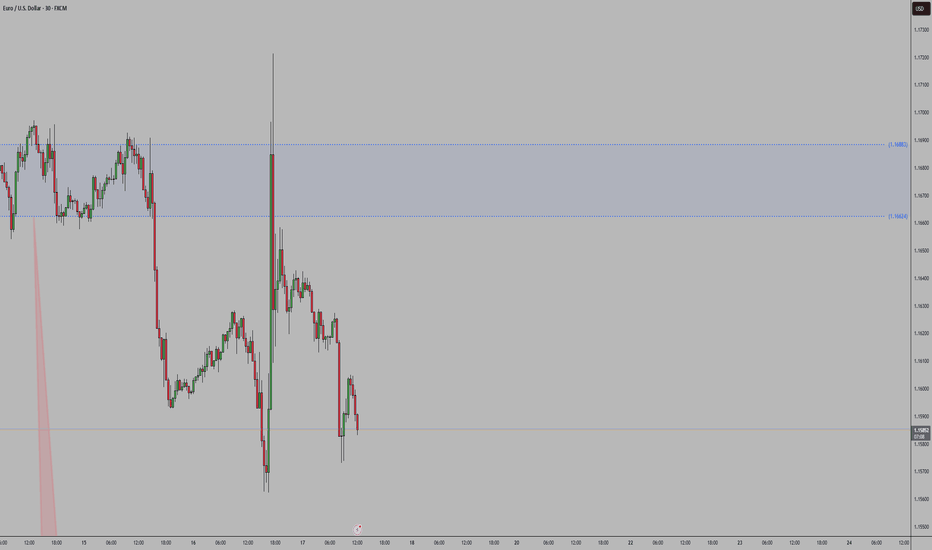

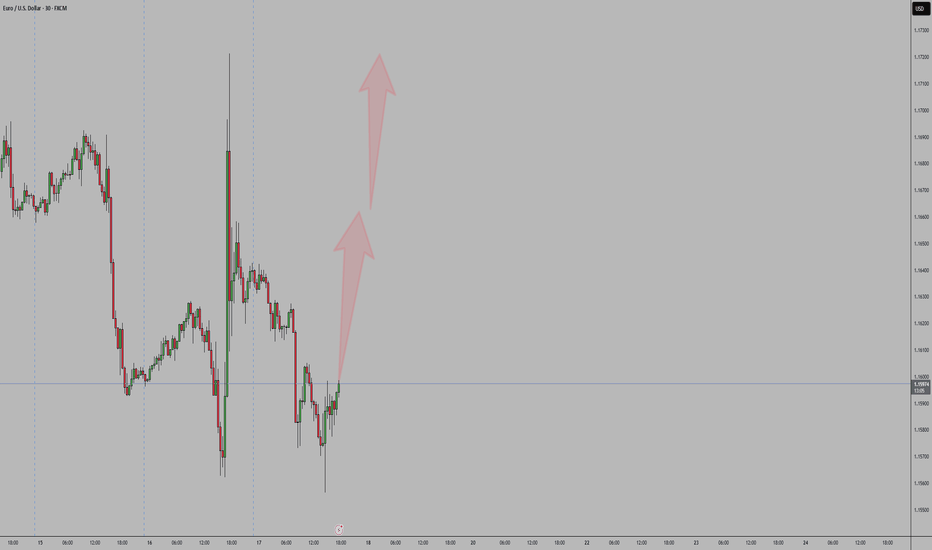

EUR/USD may show short-term bullish moves, but with the DXY (U.S. Dollar Index) showing strength and a bullish COT bias, the broader outlook for EUR/USD remains bearish. USD strength typically puts downward pressure on EUR/USD.

COT data shows a bearish bias on AUD with net short positioning (-605), while the USD holds a mild net long position (+321). This reflects institutional sentiment favoring USD strength over AUD, supporting a bearish outlook for AUD/USD.

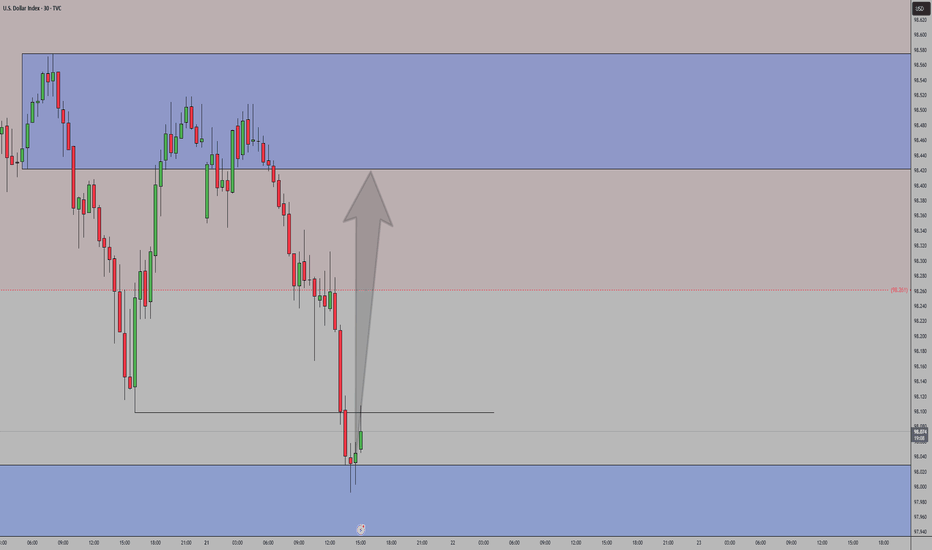

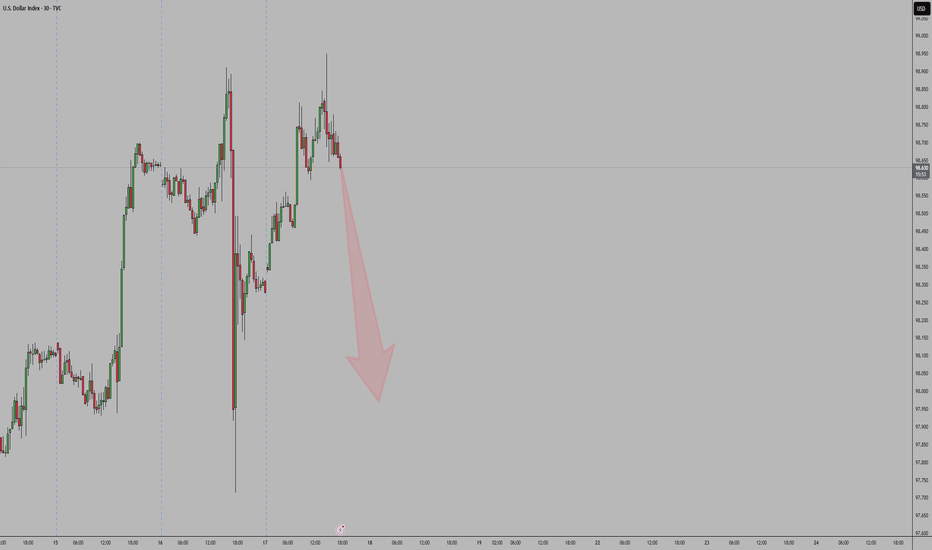

The current COT data shows a bullish bias for the U.S. Dollar, with institutional traders positioning net long. Although DXY is moving sideways, this positioning suggests a likely continuation of USD strength. If price breaks above key resistance levels, it would confirm the bullish sentiment reflected in the COT report.

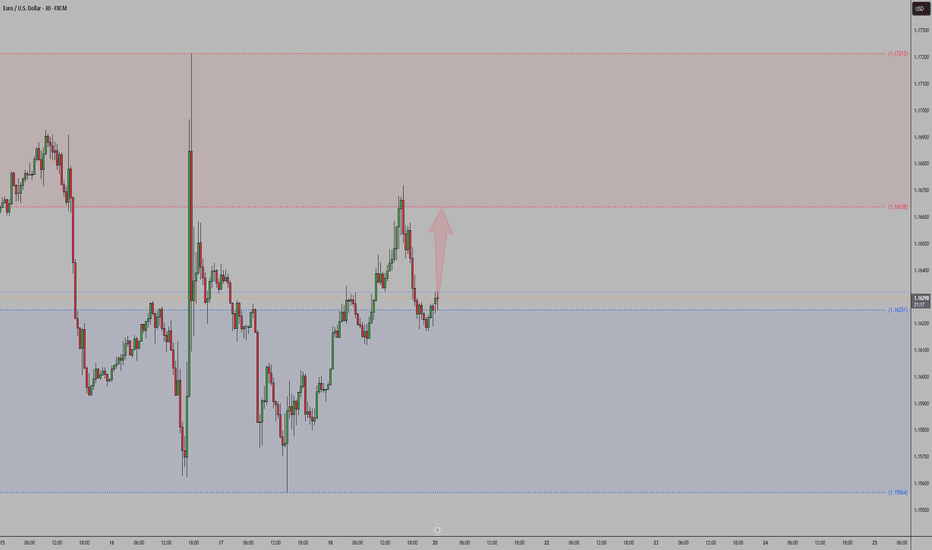

COT data shows increasing net long positions on the euro, signaling bullish sentiment from institutional traders. This shift suggests growing confidence in the EUR against the USD.

Short-Term Bearish DXY – Key Reasons 1. Rate Cut Expectations Markets are pricing in at least one Fed rate cut in Q3 2025 due to slowing inflation and weaker consumer data. Lower interest rates reduce demand for the dollar, pushing DXY lower.

Bullish momentum short term based as the initial direction is bearish movement. With cot report indicationg long term bearish momentum.

EUR/USD shows bullish COT (net longs), but USD’s individual COT is very strong (net longs), which usually means USD strength and EUR/USD bearish pressure. COT on the pair can lag or reflect speculative flows, while USD’s strength often has bigger impact.

Short-Term Bullish Outlook for EUR/USD 1. DXY Bearish Momentum As the dollar index (DXY) weakens due to rate cut expectations and political instability, EUR/USD benefits directly (EUR makes up ~58% of DXY). 2. ECB More Hawkish Than Fed (for Now) The European Central Bank has taken a more data-dependent and cautious tone, holding off on aggressive rate cuts. This...

GOLD – Entering a Power Phase Toward All-Time Highs XAU/USD is showing a clear bullish continuation pattern after holding strong above the $2,360 support zone. With the DXY breaking down, real yields slipping, and central banks continuing record purchases, gold remains in a perfect storm setup for further upside.

Net USD longs increased = Bullish sentiment Speculators adding longs / commercials reducing shorts Price broke previous weekly high = BOS ✅ Holding weekly demand zone Note: COT is supportive — align with technicals

Net long positions increased (speculators) Commercials reducing shorts = Bullish pressure building Technical Setup (1W TF): ✅ Price bounced from weekly demand zone ✅ Broke previous high = BOS confirmed COT supports continued upside

XAG/USD is currently exhibiting an increasingly bearish net position from major institutional players. Given this positioning, a continued bearish outlook is anticipated for the upcoming week.

Given the strong net long positioning on the U.S. Dollar (DXY) and the relatively weaker net positioning on the Japanese Yen (JPY) reflected in the latest COT report, we can anticipate a continued bullish outlook for USD/JPY.

Net long positions are decreasing, signaling that institutional speculators are reducing exposure. Commercials are increasing short positions, suggesting smart money expects downside in US equities. Price rejected strongly from a weekly supply zone, failing to break previous highs. A bearish break of structure (BOS) has occurred, with price forming a lower high...

Speculators are still net short on the U.S. Dollar Index. But the short bias has decreased → sentiment is less bearish than before. This shift could suggest a potential dollar rebound or profit-taking on bearish positions.

Speculators are still net-long USDZAR, but the position is shrinking. This suggests weakening bullish conviction → early bearish shift. Broad USD weakness across markets (possible Fed dovishness, softer inflation, etc.). mproved sentiment for emerging markets. Possible support from commodities and local rate differentials. So we very bearish.

Market Bias: Bearish USDJPY Recent price action shows weakening bullish momentum on USDJPY, with sellers stepping in near resistance zones. Key Drivers: – Broad USD softness amid dovish Fed tone and easing inflation pressures – JPY strength supported by rising BOJ tightening expectations or yield differentials narrowing – Risk-off sentiment potentially boosting...