Resistance_King

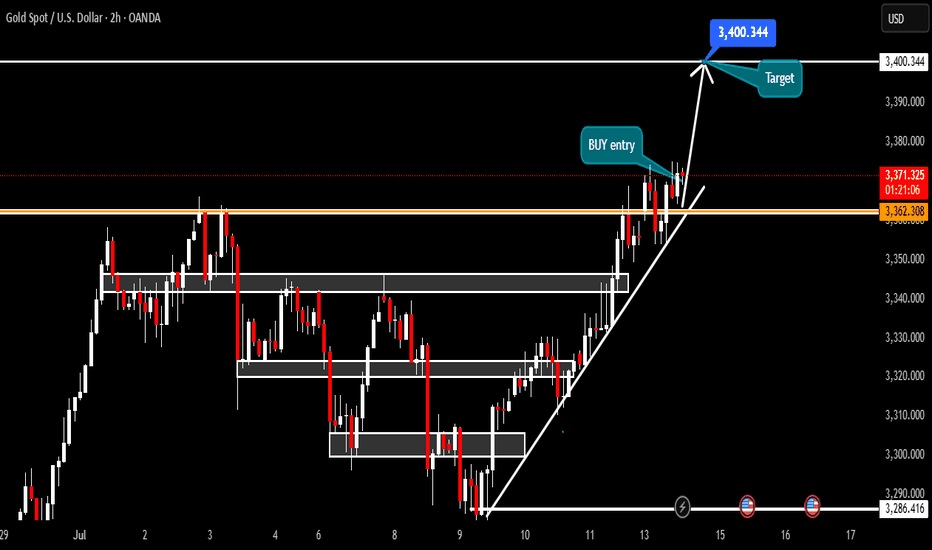

Gold has tested the global trend level is showing a rebound the price is testing the support level of 3368 if it maintain support level the growth will continue to 3400 level we suggest BUY XAUUSD 3368 entry point target point 3400

Timeframe:2H|Pattern: AB=CD| Bias: Bearish Reversal! Gold (XAUUSD) has completed a precise AB=CD pattern aligning perfectly with a strong resistance zone near 3340-3350 the symmetry of the harmonic pattern combined with historical rejection levels gives a strong signal for a potential downside move Trade setup idea: Sell entry: 3340-3350 target:1:...

Date/Time: July 9, 2025 – 08:21 UTC Platform: TradingView Pair: Gold Spot (XAU/USD) Timeframe: 15 minutes 🧭 Market Structure & Price Action Current Price: $3,285.39 Session High/Low: High: $3,289.64 Low: $3,284.47 Change: -3.775 (-0.11%) The market is currently in a short-term bearish momentum. Price has recently broken below the support level around $3,288,...

📅 Date: July 8, 2025 🕒 Timeframe: 15-Minute (M15) 💰 Pair: XAU/USD (Gold Spot) 📍 Current Price: $3,325.975 🔍 Chart Analysis Market Structure: Gold had a strong bullish rally leading into the $3,345+ zone but faced multiple rejections from overhead supply. Since then, price has shown a gradual decline with consistent lower highs. Supply Zones (Resistance): $3,333...

Current Price: 3341.58 Market Behavior: The price is ranging sideways, trading in a tight consolidation zone just below the resistance zone (around 3344). Key Resistance Levels: 3344 → Immediate resistance 3348 – 3352 → Next minor supply zone 3357 – 3360 → Strong resistance ahead (if breakout occurs) Key Support Levels: 3332 – 3330 → Short-term demand 3324...

XAU/USD – Bullish Trend Faces Resistance at $3,350 | Watch for Breakout or Pullback! 📅 Published on: Jul 01, 2025 ✍️ By: MR_MARK0 🧠 Market Context: Gold (XAU/USD) has been riding a strong bullish wave, pushing through multiple resistance levels. Currently, price is hovering just below the $3,350 resistance, which marks a critical level for either trend...