Rizwan-Ali

PremiumCurrently holding a short position on the US500 from the 6358 level, based on Smart Money Concepts. Price has tapped into a premium zone within a higher time frame supply area, showing clear signs of distribution. Liquidity has been swept above recent highs, and a shift in market structure confirms bearish intent. I’m targeting the 6205 level, expecting a rapid...

📊 Nasdaq 100 Smart Money Breakdown Current Price: 22,103 Target Price: 22,680 🔼 Upside Potential: +577 points The market is currently positioned for a premium retracement move after a recent liquidity sweep below short-term equal lows, which likely triggered sell-side liquidity. This setup hints at Smart Money Accumulation, with institutions entering long...

I'm seeing a clear downside setup on Nifty, with Smart Money indicating distribution and the market transitioning into a bearish trend. 📉 Target: 25,340 📍 Current Price: 25,474 🔍 Reasoning: Clear signs of institutional distribution and lower highs/lows forming. Smart Money is exiting, suggesting the beginning of a deeper correction. Will monitor closely for any...

In this update, I’m revisiting the setup I shared earlier that points towards NIFTY’s next potential target at 25,340. The analysis covers the key levels, price action structure, and the factors supporting this move. This setup is based on clear technical confirmations and disciplined risk management — not just speculation. Please remember to follow your own plan...

The directional bias is clear – bearish – and I'm currently waiting for a precise setup to present itself. Based on the Smart Money Concept, we could be looking at a potential short opportunity around the 24740 zone. 📍 Once the setup is confirmed, I’ll be sharing the exact entry and stop-loss levels with you. Stay tuned – patience here is key. Let the market come to us.

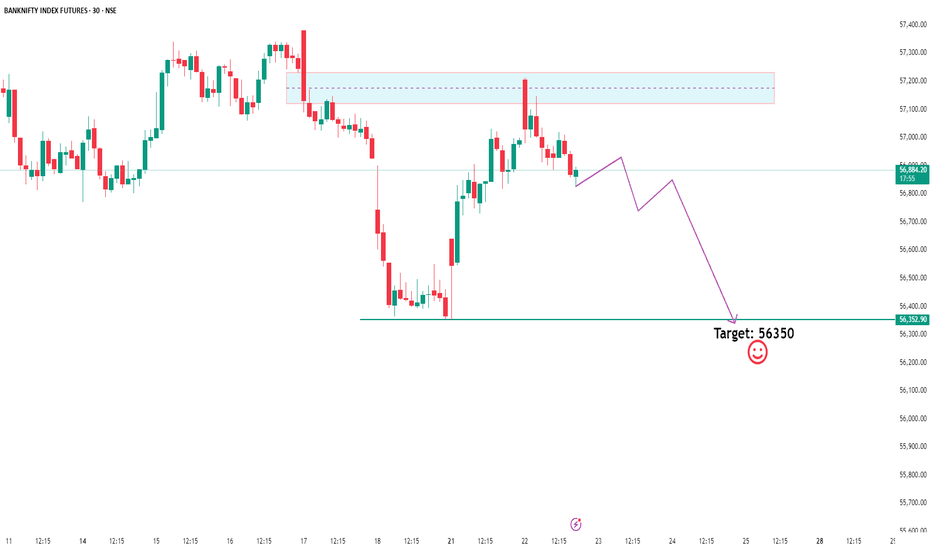

Bank Nifty is showing clear signs of distribution as Smart Money appears to be offloading positions near recent highs. Price has swept liquidity above the previous highs and is now rejecting key supply zones, confirming a potential sell-side shift in market structure. With a break in internal structure and premium zones being respected, we're now watching the...

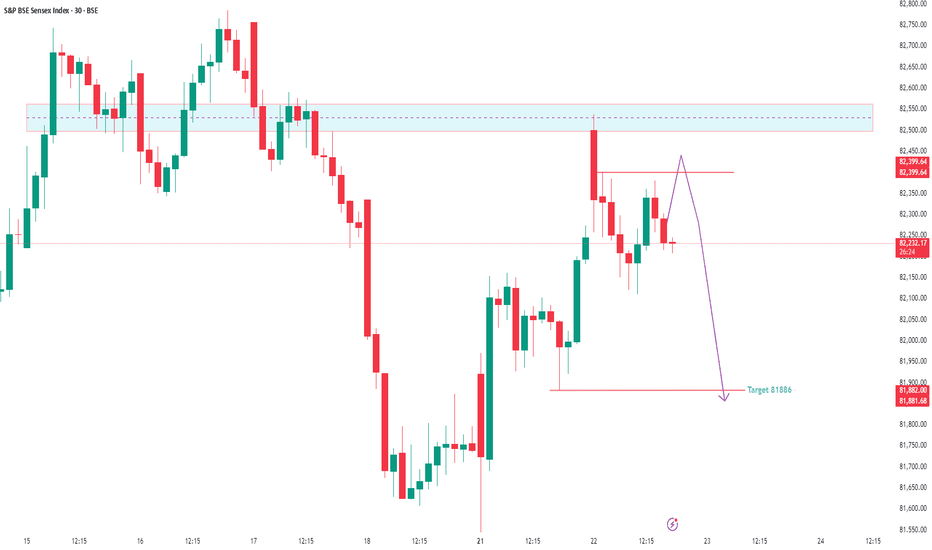

Sensex is currently trading at 82,220 and showing early signs of a potential sell-side move based on Smart Money dynamics. After grabbing buy-side liquidity above recent highs, we’ve now entered a distribution phase. Price has shown rejection from a premium zone, and a market structure shift is forming on lower timeframes — all pointing toward a probable move to...

In this update, I’m revisiting the setup I shared earlier that points towards NIFTY’s next potential target at 25,410. The analysis covers the key levels, price action structure, and the factors supporting this move. This setup is based on clear technical confirmations and disciplined risk management — not just speculation. Please remember to follow your own plan...

Hello Guys, A recent bullish shift in USDCHF has been monitored and we are in good levels to go long and TARGET 0.8585 level. as long as we are above 0.8250 level bias is bullish. Regards Rizwan Ali

ifty is showing signs of strength after a period of consolidation. Watch for a breakout confirmation. On a successful breakout, the next immediate target is 24,310. Maintain proper risk management—set your stop-loss just below the consolidation range. Plan: 🔹 Breakout Entry 🔹 Target: 24,310 🔹 SL: above consolidation Stay disciplined.

Nasdaq is looking to target the buyside and it will rally soon within a 2 days and it will target it faster than anything

Hello Guys, Wish you and Your Family a Very Happy Eid. I Found out one very easy to target GBPUSD trade setup for the week . here i can see GBPUSD is building a short term wave towards downside to target 1.2780 or below . As we have created a Higher time frame OTE model

Hello Guys recently we have seen a massive downward shift in the dax 30 . a quick solid setup with entry stoploss and targets outlined in the chart Risk less: we are in a NFP week where markets turns wild and choppy but this is a high probability trade setup Good luck

Eurusd trade setup which will trap and start to move downwards being in the NFP week and considering Thursday to be less risky, comparison to Friday, keeping a very minimum target which is high probability mentioned and outline in charts. Stay safe

Hello guys, A short quick update on dollar index, we are going to see a temporary upward rally in the dollar index, I am just posting the low hanging fruit target which is very high probability to achieve. and we will defiantly see the momentum changing from bearish to bullish. NFP protocol: Keep the risk low

In this trade I am anticipating a downside movement in NAS100 based on recent price action. the market structure suggest that we are entering a little bit more of a bearish phase, and i am positioning for a move lower. MARKET BIAS:- The NAS100 is...

🔸 XAU/USD (GOLD) Analysis 🔸 🔥 Gold Eyeing $2835! 🔥 📍 Current Status: Waiting for the setup to develop before executing a trade. No rush—patience is key! 📊 Key Level to Watch: $2835 🎯 ⚡ Market Structure: Monitoring price action for confirmations. 👀 Trade Plan: Will update once the setup aligns with Smart Money Concepts (SMC). 🚀 Stay tuned, traders! The best...

Hello Guys Here We have a long setup for the Euros where we are most likely to target above the retail resistance level 1.0535 and above, where all stoploss resides. i have uploaded the entry stoploss and target already to play out the long setup here. Good luck Good trading :)