Robert_V12

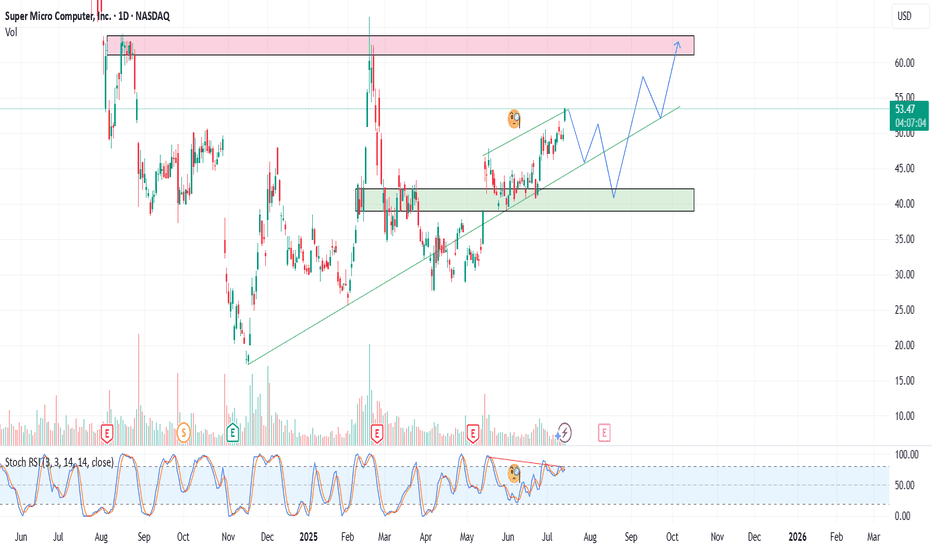

With SMCI approaching a key resistance zone around $64, I'm preparing for a potential pullback. If the price fails to break through that level convincingly, we could see a healthy dip — which I’ll use to re-enter. This is a classic “sell high to buy lower” setup — let the market breathe, then strike. 🟢 Entry Points (Buy the Dip): $49 $45 $40 🔴 Profit...

NVIDIA (NVDA) continues to dominate the AI semiconductor space and remains one of the strongest momentum names in the market. After reaching new highs, price action is now offering a clean multi-tiered entry opportunity for swing traders positioning for the next leg up. Entry Points ✅ $160 – Breakout retest zone ✅ $145 – Key technical support ✅ $130 – Strong...

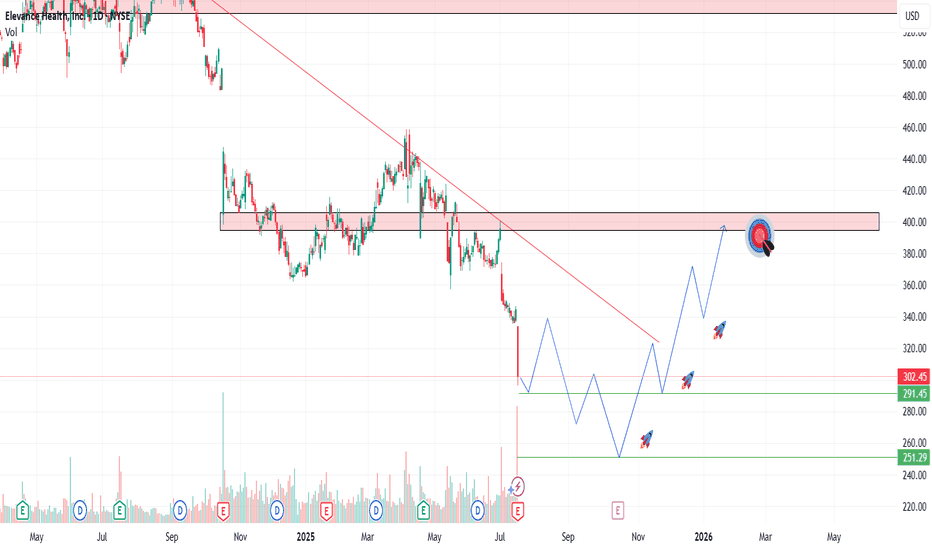

Elevance (ELV) just took a 12% hit after Q2 earnings missed estimates and full-year guidance was cut significantly. But here's the thing—the selloff may be overdone. The stock now trades at a forward P/E of ~10, well below industry peers, and is approaching multi-year support levels. 📥 Entry Plan : ✅ Entry 1: $302.45 (market price) ✅ Entry 2: $285 (historical...

Ethereum (ETH) continues to show resilience, currently trading around $1,790 after a strong bounce earlier this month. While the crypto market remains volatile, ETH is holding key technical levels that could fuel a major move in the coming weeks. 🎯 Entry Points: Market Price: $1,790 — Ideal for an early position, as ETH holds above critical support...

In the volatile world of trading, uncertainty is the only constant. Could prices dip to 75k before surging to 115k? Is such a drop a brief pullback or the start of a prolonged downturn? What technical or fundamental signals might indicate a recovery toward 115k? Disclaimer: This content is for informational purposes only and does not constitute financial advice....

SMCI continues to show strength as a key player in the AI infrastructure space. In this update, I present a new strategy with staggered entry zones at $49, $45, and $38 — designed to capture value during healthy pullbacks within a larger bullish trend. Entry Plan: 1) $49 2) $45 3) $38 Target: 1) $56 2) $61 3) $66 📉 If price dips back to $45 or $38, I will...

AMC has been a battlefield stock for retail traders, and while the meme frenzy has calmed, the chart shows signs of a long-term consolidation that may lead to a breakout. We’re not chasing hype we’re playing levels. The current zone offers asymmetric risk/reward for patient swing or position traders looking for a reversion move back toward key psychological and...

Nike (NKE) is under pressure — post-earnings volatility, macro noise, and sentiment all weighing in. But for swing traders, this looks like a textbook accumulation setup. 📌 Entry Zones I’m Targeting: 🔹 $70.00 🔹 $65.00 🔹 $60.00 Profit Targets (Taking wins before 88): ✅ $78.80 ✅ $82.50 Let the market come to you — no chasing, just precision. 💬 Drop your...

NVDA, After an explosive run powered by GenAI infrastructure and bullish earnings, the chart is setting up for either a bullish continuation or a healthy pullback. With volatility tightening and volume compressing, this is a great moment to prepare for either breakout or breakdown scenarios. 🎯 Trade Plan – Tiered Long Setup 📌 Entry Zones (Tiered Buying): 🔹 $150...

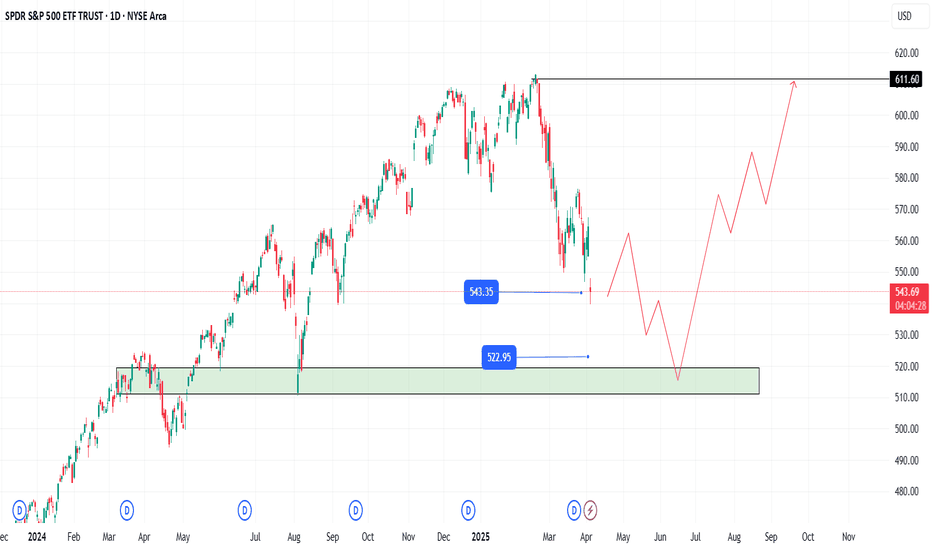

In the Shadow of Headlines: SPY’s Drop Could Be 2025’s Big Opportunity As markets react sharply to renewed tariff fears and Trump-related headlines, SPY continues its descent. Panic is setting in—but behind the noise, a strategic opportunity may be quietly forming. While many rush to exit, others are beginning to position for the bounce. A well-structured entry...

Bank of America (BAC) has been consolidating quietly, attracting attention as it sits near a key mid-range level. With a 52-week low of $33.06 and a 52-week high of $48.08, the stock currently trades around $36.92 – roughly 11% above its low and 23% below its high. This setup could be the calm before the move. 💥 Technical Outlook & Strategy With financials...

🔥Let’s talk numbers: 🧮 P/E: 9.78x 💸 P/S: 0.66x That’s deep value — Wall Street’s sleeping on this one. While everyone's chasing AI, Citigroup is trading at garage sale prices. 🧠 The Setup: If you're into swing plays with strong R/R and macro upside, C is worth a look. 🔑 Entry Zones: 1️⃣ Market price — for early bulls 2️⃣ $55 — breakout confirmation 3️⃣ $48 —...

Tesla (TSLA) is trading around $315, bouncing off recent lows, but this isn’t just a clean technical setup. With Elon Musk’s political drama escalating (hello, “America Party”) and ongoing tension with Trump, TSLA is becoming a battleground stock with serious volatility. As swing traders, that’s exactly where we thrive. 📍 Entry Plan ✅ Entry #1 – $315 ✅ Entry #2...

Nike is a blue-chip name going through a rough patch. But this recent dip, fueled by disappointing earnings and macro uncertainty, could present a classic oversold opportunity. The stock is now in a high-probability reversal zone where risk/reward becomes extremely attractive. 🎯 Updated Entry Plan: $58.00 – Soft support zone; start building a position $53.00 –...

AMD is quietly building momentum as a major AI contender, rivaling NASDAQ:NVDA with its upcoming MI400 GPU series and strong Q2 guidance potential. I'm watching this carefully for a medium-term swing with high reward potential based on both fundamental catalysts and technical structure. 🔍 Entry Points I'm Watching: ✅ $143 → Aggressive breakout entry if it...

Rising tensions between the United States and Iran are once again casting a shadow over global markets. From oil prices to defense contractors and transport stocks, this situation has the potential to ignite volatility across several key sectors. 🔍 What Traders Should Watch: Oil & Energy Stocks – If conflict escalates, crude oil prices could spike due to...

🚀Palantir (PLTR) has been riding the AI wave hard, reaching fresh highs recently on strong earnings and explosive momentum. But even rockets need to refuel and that’s where our strategy comes in. 📉📈 After tagging all-time highs, PLTR could enter a healthy pullback phase. That’s not weakness that’s opportunity for the smart trader. Here are the levels I’m watching...

📦Amazon (AMZN) is offering an interesting opportunity after a healthy correction from its 2025 highs. With continued AWS expansion and aggressive investment in AI infrastructure, the fundamentals remain solid — but short-term volatility opens the door for strategic entries. 🎯 Entry Points 🔹 $194 – First key support, ideal for early buyers 🔹 $187 – Strong...