Robert_V12

After cooling off from its $150 highs, NVIDIA (NVDA) is consolidating in the $140–$145 zone. While some traders fear the AI hype has peaked, others see this as the calm before another rally. With solid fundamentals, continued leadership in AI, and strong institutional backing, NVDA remains a name to watch closely. 🎯 Trade Setup: Entry Points ✅ $142 – Current...

After an impressive run, META is taking a breather around $700. But let’s not forget—this stock was trading at $530 just a few months ago. With aggressive AI bets like the $14.8B stake in Scale AI and plans to develop superintelligent models, Meta isn’t just following the AI trend—it wants to lead it. Now here's the setup: We could see a healthy pullback before...

⚠️Just when it looked like Tesla was heading for a breakdown, we got a sharp bounce off the $290 level — and traders are watching closely. But here’s the twist: the move came after a headline-heavy week featuring none other than Trump vs. Elon. 🗞️ According to Politico, tensions flared after Trump made comments suggesting EVs were "doomed without government...

After posting record earnings and riding the AI momentum wave, NVIDIA has finally started to cool off a bit and honestly, it’s healthy. The stock had a massive run, and now we’re seeing some consolidation, which could set up the next solid entry for those of us who didn’t chase the highs. Here’s how I’m planning to approach it: 📍 Entry levels I’m...

🚀Tesla just keeps pushing. Now trading around $346, it's not just riding market momentum — it's building it. And with the robotaxi launch in Austin coming June 12, the narrative might be shifting from “just EVs” to mobility revolution.📍 Levels I’m Watching Possible entries: • $335–$325 – Looks like it’s consolidating here • $315–$290 – Clean retest zone if we...

📈Getting ready to start a new swing trade on SMCI, and I’ve mapped out my game plan with a tiered entry strategy and clear profit targets. Here’s how I’m setting it up: Entry Levels (Scaling In): $40.50 – First buy if it pulls back to this area. Looks like solid support, and I’ll test the waters here. $35.80 – Adding more if it dips further. This level has...

📈 NASDAQ:AMSC 🚀 American Superconductor (AMSC) is quietly showing strength, and it's time to pay attention. After bouncing off the support zone near $18.80–$19.30, the stock has reclaimed the $20.50–$21.10 entry range, with volume picking up as it challenges key resistance. 🧠 Why it's interesting now: ✅ 56% YoY revenue growth last quarter 📊 ✅ LSE:80M in...

Macro remains shaky (Fed minutes + inflation data ahead), but selective strength in AI and healthcare continues. Watching these 4 tickers for technical and news-driven setups this week: 🍏 AAPL (Apple) Apple’s holding up well, but facing some noise from EU antitrust investigations and softer iPhone demand in China. Still a solid name, but could move sideways...

🍏Apple’s trading around $205, and while it’s not at bargain basement levels, there’s real opportunity if you look beyond the headlines. 📰 What’s going on? Trump’s back in the news pushing for Apple to shift iPhone production back to the U.S. and markets don’t like it. But here’s the thing: Apple’s already working on reducing China risk by moving production to...

💊 Oversold Swing Play ⚠️ Risk Factor You're not trading a bounce—you’re stepping into a fire. Legal risk + uncertainty = extreme volatility. However, if markets stabilize, UNH could deliver a powerful mean-reversion move. UnitedHealth ( NYSE:UNH ) is trading in panic territory after: DOJ launched a criminal probe tied to Medicare Advantage billing Abrupt CEO...

NVIDIA is sitting around $135.57 right now, and yeah—fundamentally, it’s crushing it. Revenue growth is off the charts (over 114% YoY) and the data center segment alone pulled in $35B+ last quarter. AI is the fuel, and NVDA is the engine. That said… we’re getting into overheated territory. Technically, price is way above its 50/100/200 EMAs, and the RSI is up in...

🚀✈️ A major new defense contract is on the horizon — and if confirmed, it could skyrocket BA’s valuation to new heights. This could be the catalyst that propels the stock far beyond its current range. Boeing is showing renewed strength with a bullish setup developing. With multiple entry points and solid upside targets, this trade offers compelling potential for...

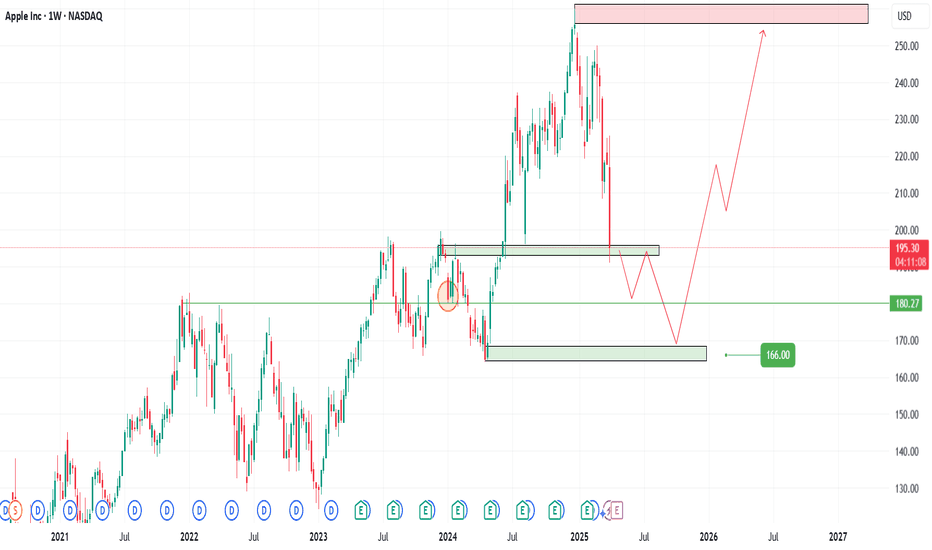

📊With global markets reacting to renewed tariff talk from Trump, Apple (AAPL) NASDAQ:AAPL could face short-term volatility—but that’s also opportunity. As fears of a trade war ripple across Asia and Europe, AAPL may temporarily dip, especially with supply chain exposure in China.🍏📉📈 📌 Entry Zones (Buy the fear, not the panic): 1️⃣ 194 – Light entry as weakness...

🚀 AMZN 2025 Trade Plan After an early 2025 rally to $240+, Amazon (AMZN) has pulled back sharply to around $167, opening the door to what could be one of the most attractive rebound setups of the year. With AWS still growing strong and net income nearly doubling in 2024, the fundamentals are on Amazon’s side. Add to that bullish analyst outlooks pointing to...

Fundamentally undervalued with a strong balance sheet, consistent earnings beats, and a low P/E ratio. Recent drop (~33% from 52-week highs) appears overdone relative to earnings strength likely due to short-term Medicaid cost concerns, not long-term deterioration. 📊 Position Type: ✅ Swing Trade to Core Position Start small and build over time if technicals...

Tesla (TSLA) just lit up the board with a +7% breakout, smashing past key resistance. Currently trading around $318, this move isn’t just noise, it’s backed by rising volume and a bullish macro environment favoring growth stocks and innovation plays. 🟢 Potential Entry Zones (on dip or continuation): • $312–$318 → Pullback entry near breakout zone • $290 → Retest...

TSLA has rallied from its previous consolidation zone and is approaching a potential resistance area between $290–$295. Momentum is solid, but RSI and volume trends may suggest we’re nearing short-term exhaustion. ✅ Strategy 1: Wait for the Pullback (Safer Play) Entry zone: • $240 – Ideal level near former resistance turned support • $215 – Strong support with...

🚨 🎢✨Disney (DIS) is pushing up and showing strength — are you watching this move? 👀 We’ve been eyeing entry levels between $91 and $81, but with the price at $96.30, this setup is heating up faster than expected! 🔥 Sometimes the perfect dip doesn’t come — and waiting too long can mean watching the rocket 🚀 from the sidelines. If you’re still tracking DIS, this...