ScottBogatin

PremiumEight six 25 that I looked at about 4 or 5 markets today including gold and a few other markets. I focused on 1.272 extensions which are very effective and getting you out of the market before you lose your profits. I talked a little bit about a stop in reverse approach to the market which can be very profitable. I also talked about taking profits when...

8 5 25 in this video we're looking for some scalping trades the video gives my perception of where the buyers and sellers are and where the opportunity is for both buyers and sellers

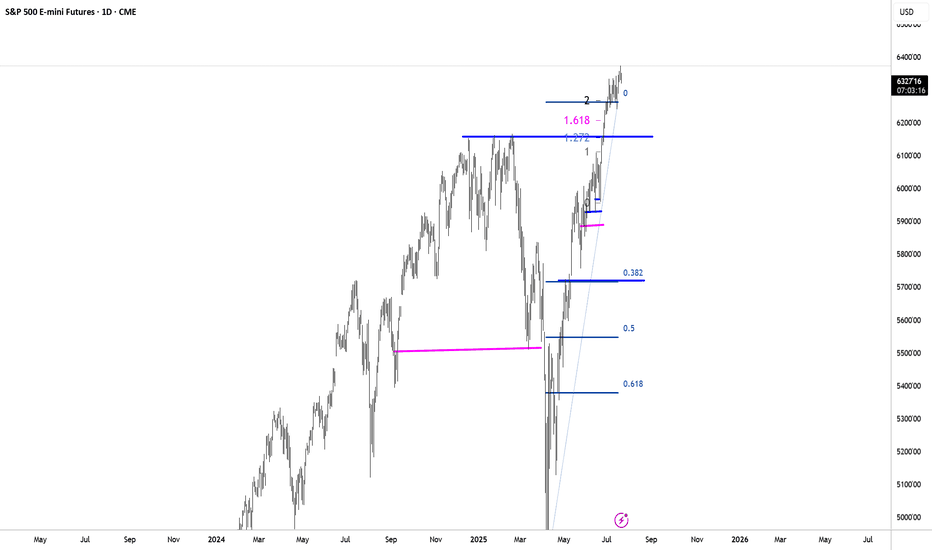

It's Sunday and you might want to look at the S&P when the Market opens later tonight. For 2 days the S&P went lower and I think you can categorize this as an expanding Market and it's very tradable. You can even miss the trade on Thursday and still make a good return on Friday. Also I would call this a spike pattern and my assumption is that the market had a...

7.22 2025 gold is at a pivotal Junction and it looks bullish but it's come to ABCD patterns and reversal patterns that indicate that it could go lower and the silver it doesn't look quite the same but it's moving to levels that it hasn't been for a long period of time so this may indicate the possibility of a breakout higher. There are more details in the video...

7.14 . 25 this is a great video because there are so many examples of patterns to look at and there weren't that many markets that I was following and about 3 or 4 of the markets actually had dramatic movement in the direction you would expect and this is an example of setting up your pattern and letting the pattern take care of you as it gives you the probable...

7 1 25 I made a few mistakes naming some of the markets but if you can deal with that then I explain what my concerns are regarding some of the patterns. most of the trades that I posted as trading opportunities have moved higher and did not require large stops. I spent time on a certain pattern that I don't really talk about but it influenced my Trading...

6 23 25 oil just went higher presumably from what happened with Tehran... and I heard several people say that oils going a lot higher. I really don't believe that but more importantly we can use some of the tools on the chart to decide when to take trades as a buyer and a seller. there's a clear difference between the S&P and the Russell and I would treat...

looking for a long trade on coffee. It's difficult to make it definitive decision about gold but it looks like it's going to go a little lower for the time being as the dollar is moving higher at the moment.

6.17. 25 an important change in oil to check out. we'll have to wait for some changes on gold to decide its direction.... it's not far below the high but it's not trading well... and I have some concern that the market could wash and rinse buyers and sellers.... so there needs to be more clarity for me to take a trade one way or the other.... it's no big deal...

Friday 13 there's no time to have a long discussion here the information is in the video important things are happening in these markets and they are explained in the video. there are some changes suggesting that the silver may not actually go lower at this point even though the gold is holding for the time being .

6 12 25 this is a long video hopefully it does not fail to upload. I mentioned a number of markets in this includes some advice to one of my students ( there is only one student right now) and that's perfectly fine for me.... but I wanted her to see a couple of markets that she might not be looking at but her worth looking at if she wants to trade more markets. I...

Friday I am showing you excruciating insights on Trading 2 bar setups and how they guide you to trading decisions that will send you off into the right direction and keep you out of decisions that will turn you in the wrong direction. you can only trade A two-bar reversal when it happens and sometimes the market doesn't have a two-bar setup and because of...

6 5 25 coffee is going ... it just did a two-bar reversal. Tesla is moving lower and was a good short trade.... It traded down to a support area which was also a 382 retracement. it's possible for Tesla to find some buyers but it's more likely that it will continue our to the 618 retracement pattern that's on the chart. my videos have not been...

November 2nd. gold looks bullish and may very well test the highs. I forgot to talk about silver as I was running out of time and that's trading very well and I will try to talk about silver tomorrow if I have time.

Friday evening May 30th went through a list of Marcus I follow and talk about.

I don't see the trigger yet.... but Tesla went well over 100 points higher from the low and it completed an ABCD pattern and it is trading up to where there were Sellers from the past even though we could have taken a trade 130 points higher before it got to this level I would be concerned that there could be a reversal I don't quite see it yet but you can look...

May 29th and went through the analysis of gold which I think is going higher. there is also a gartley pattern . gartly looked at that pattern which he called A 222 pattern as your second chance to get into a market that's reversed... and what I mean by that is that the goal had an impulse and went higher for quite a long. Of time and then after it hit its...

May 9th 2025 this is a follow-up on Tesla it just made a minor new high and now it's going to expand and go a lot higher.