SteadyFund

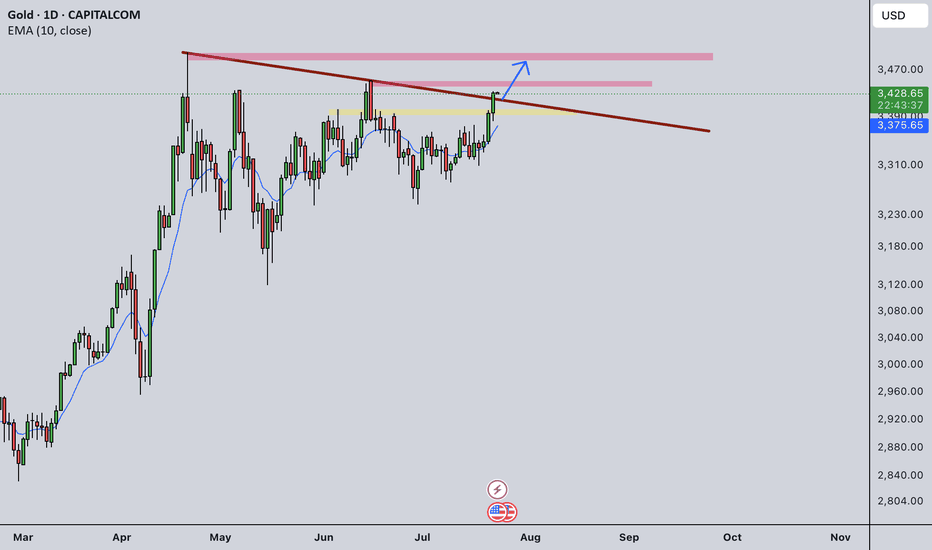

PremiumGold is trapped in a range from 3357 to 3385 right now. I will look for trading opportunity upon breaking of the resistance or support. If 3385 resistance is broken, I will buy toward 3417. If 3357 support is broken, I will sell toward 3315.

In 12hrly TF, gold seems to form bullish continuation pattern. Therefore, I will be cautious in engaging selling orders today. For today's trading plan, I will only sell if 3350 is broken. I will buy if there is rejection from 3350 or if 3385 resistance is broken.

Gold didn't retrace deep enough to 3333 yesterday but bounced from 3345 and touched 3385. The short term bullish trend is still valid right now but we could see sign of slowing down. If further slowing is observed, the drop followed may be very big. Therefore, I will execute strict management on buying order right now. I am looking for buying signals from 3365,...

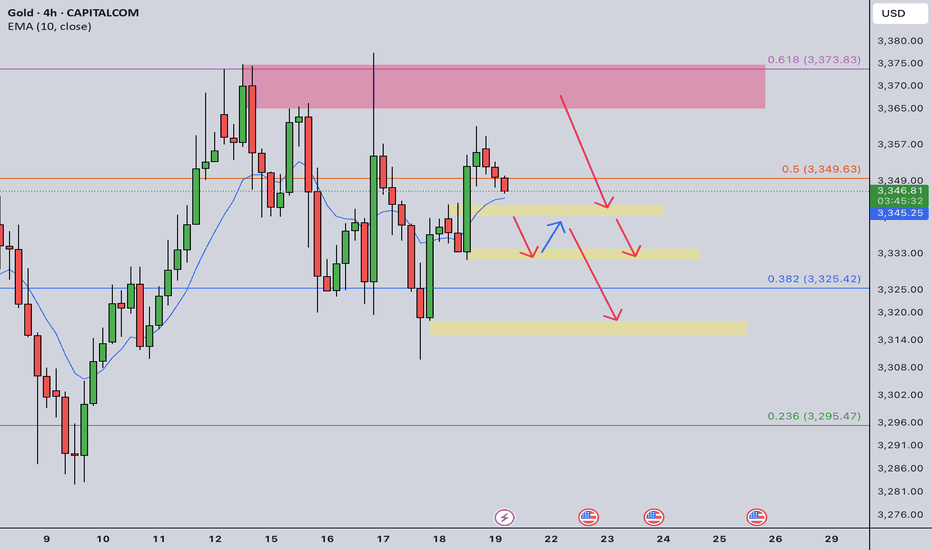

As explained in my weekly post, I expect gold to rise at the initial days of this week and drop at the later days. In lower TF, price also broke previous falling wedge pattern as shown in the chart. Therefore, I am looking to buy from 3333 today, first target 3377, ultimate target 3415.

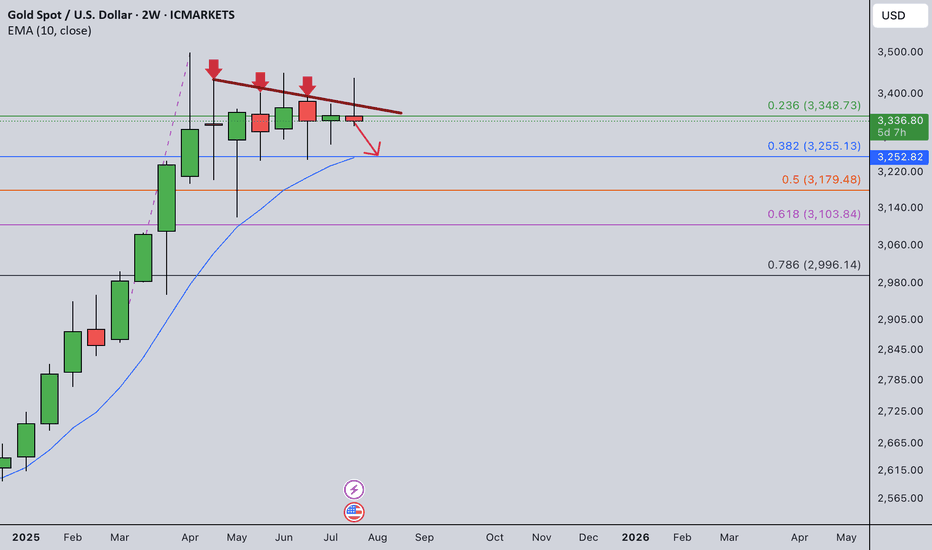

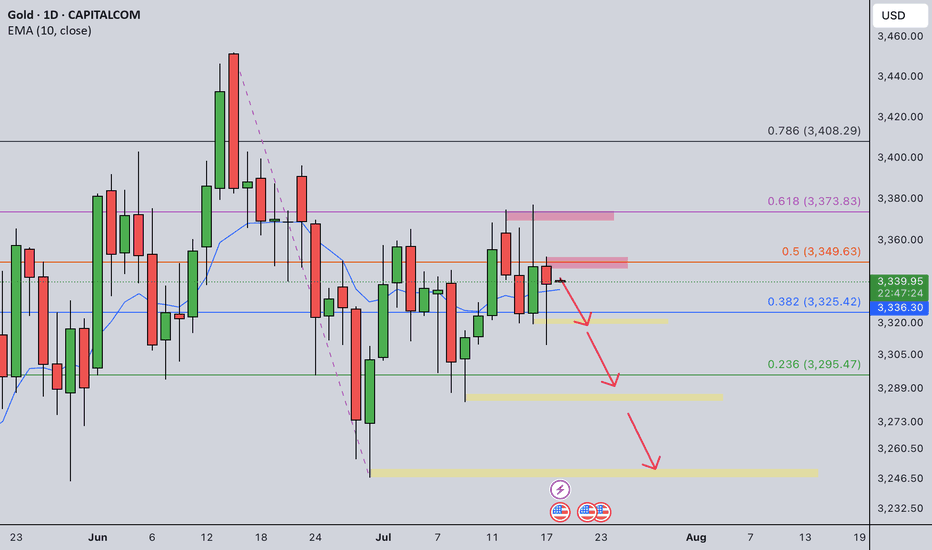

In monthly TF, gold has completed the full Elliot wave and it should go into a series of correction. But in 2W TF, it printed out a green bar. However, the trendline still valid. As long as the trendline is not broken, I am still bearish in gold in medium term. Therefore, for next week, gold should first go up and should be capped at 3410. Price could quickly...

Although yesterday's retracement is a bit too deep, I am still bearish in gold in medium term as long as 3333 resistance is not broken. Therefore, I will still look for selling opportunities today. Currently daily is in green bar while smaller timeframe shows bearish signs. If there is a double top formed near 3300, I will sell toward my weekly target at 3255.

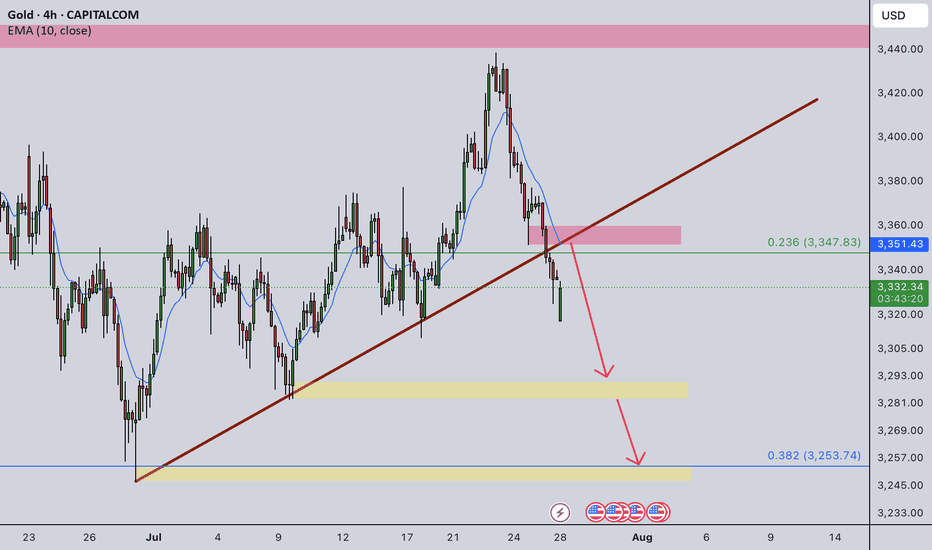

Gold behaved as expected yesterday. It broke the channel and fell heavily, breaking both 3300 and 3280 supports. The bearish momentum is very strong right now. I am looking for selling opportunity from 3300 and target 3255, which is my weekly target.

Gold is trapped within the channel as shown in the chart since yesterday. It enters a consolidation period. I am still bearish in gold. The consolidation is, in my opinion, gaining power for bears. Therefore, I am waiting for the breaking of the channel. Once it's broken, I will look for retesting for selling orders. First target for today is 3300. Ultimate target 3280.

Gold indeed fell as expected, although it didn't rose to 3352. I am expecting continuous dropping today as I don't see any sign of slowing down. I am looking to sell from 3325 today. 1st target 3300 Ultimate target 3255.

As explained in my weekly post, I am bearish on gold in short and medium term right now. Moreover, in smaller timeframe, the trendline has been broken. I am looking for selling opportunity from the retesting of the trendline, which is around 3352. My target for today is 3300, ultimate target for this week is 3252.

My last week's weekly post is still valid at this moment. I was expecting heavy drop for gold last week. However, the market doesn't follow my instruction. Rather we have to react to whatever it provides. Gold rose at the first few days and gave a false break. It quickly dropped back down below 3365 and closed the week with a red candle. This false break...

Gold closed the day right at the 3365-3373 support which was the previous resistance. It is also just at the EMA line. Yesterday it also tested the trendline support. The situation is very tricky right now. It seems it is testing the supports and trying to break down. I will be cautious to engage buying orders today. If I see it rejecting the supports again, I...

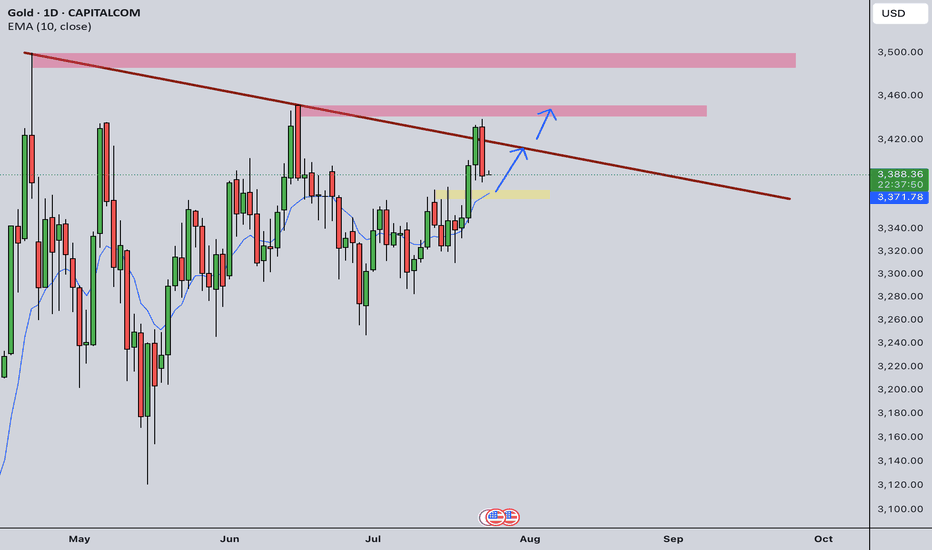

Yesterday in lower TF, gold was testing the resistance line for a couple of times but failed to maintain it. It quickly dropped back into the line and closed the day under 3400. Daily, it still looks bullish but in lower TF, it is still bearish. Therefore, I will be cautious in placing buying orders today. As long as 3373 still holds, I am still bullish in gold....

Gold rose yesterday as expected, although it didn't reach my target of 3450. With daily close above the resistance line drawn in the chart, we confirm the bullish momentum and it is strong. For today's setup, I will buy from the trendline support which is around 3420. 1st target 3450 Final target for today 3500

As pointed out yesterday, as long as 3373 holds, I am bearish on gold. However, yesterday, 3373 gave away and it closed the day just under 3400. Technically, I noticed the rising triangle as pointed out in the chart. The triangle line was rejected four times. So bad that I missed this structure. Nevertheless, bulls now regain the power. We should see another pump...

As explained in my weekly post, I am bearish in gold as long as 3373 resistance holds. For today's setup, there could be two scenarios for selling opportunity: 1. If price tests 3365-3373 resistance and it holds, I will sell towards 3345, and final target is 3330 2. If 3340 is broken, upon retest, I will sell towards 3320.

Gold has been very choppy these two weeks. As the 2W closes, the falling line indicated in the 2W chart still interacts. As long as this line is not broken, gold could retrace further. In weekly chart on the right, we are seeing a head and shoulder pattern has been formed. And the rejection level is aligning with 61.8% Fibo level retracement. From the above...

I should follow through my trading plan on weekly trend. Instead of rising up, gold fell through early yesterday and rose back above 3340 in late US session. I will trust my weekly analysis and based on the red daily candle, I expect gold continue to fall and it should break 2320 today. After that, we could see 2280 or even 2250 today.