SteadyFund

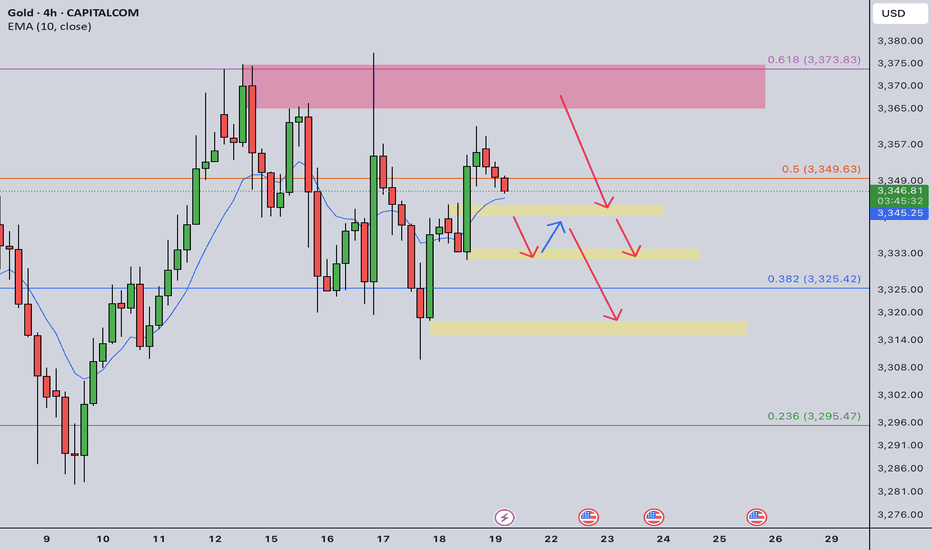

PremiumAs explained in my weekly post, I am bearish in gold as long as 3373 resistance holds. For today's setup, there could be two scenarios for selling opportunity: 1. If price tests 3365-3373 resistance and it holds, I will sell towards 3345, and final target is 3330 2. If 3340 is broken, upon retest, I will sell towards 3320.

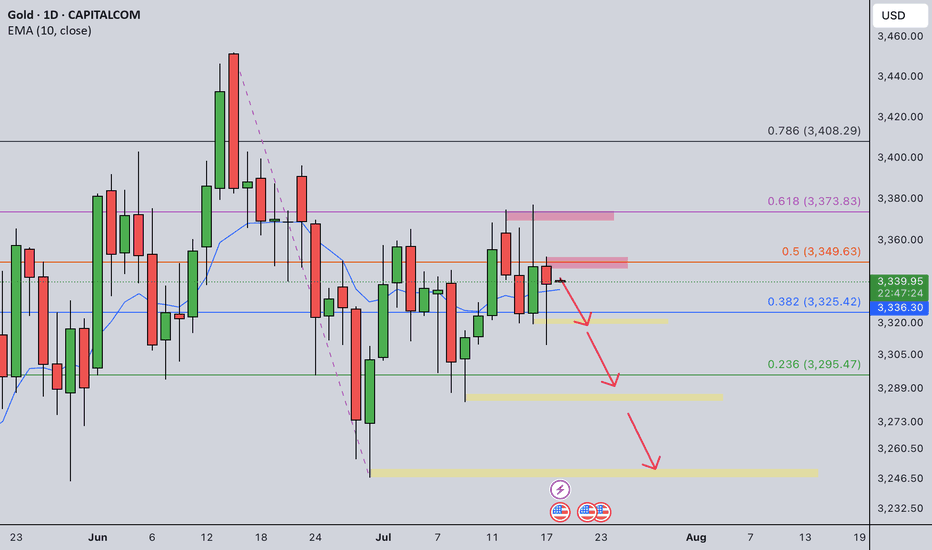

Gold has been very choppy these two weeks. As the 2W closes, the falling line indicated in the 2W chart still interacts. As long as this line is not broken, gold could retrace further. In weekly chart on the right, we are seeing a head and shoulder pattern has been formed. And the rejection level is aligning with 61.8% Fibo level retracement. From the above...

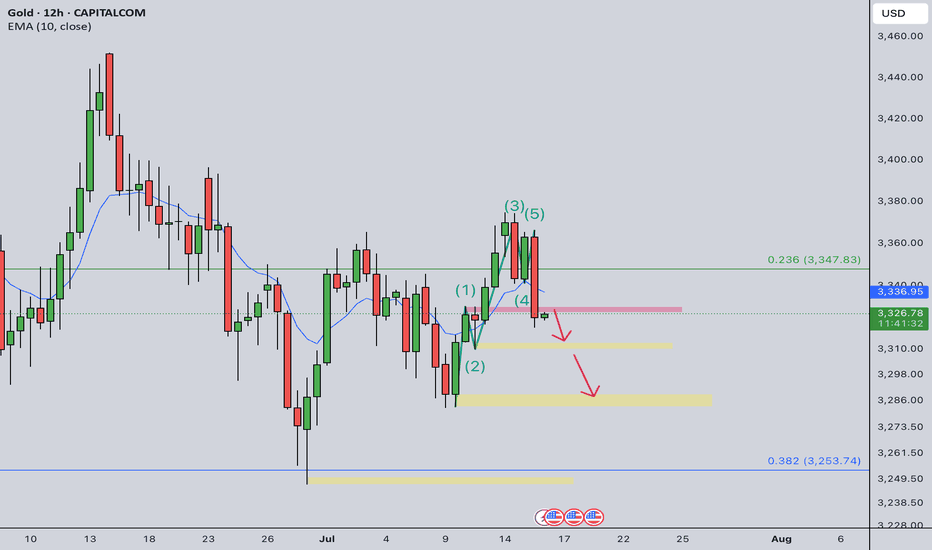

I should follow through my trading plan on weekly trend. Instead of rising up, gold fell through early yesterday and rose back above 3340 in late US session. I will trust my weekly analysis and based on the red daily candle, I expect gold continue to fall and it should break 2320 today. After that, we could see 2280 or even 2250 today.

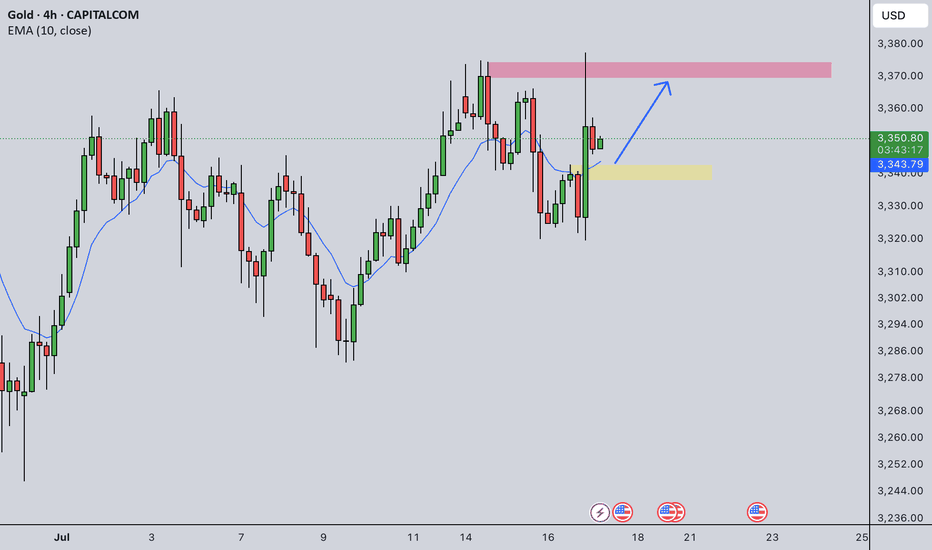

Yesterday I thought gold could drop to at least 3300. However, it seems to me the recent drop is just a correction. After dropping to 3320, it quickly went up and touched resistance of 3373. I am switching my view to bullish this week. I will look for buying opportunity from 3343, targeting 3373 today.

As expected yesterday, gold did dropped heavily although not from 3355 but 3365. It broke 3340 support and 3325 support. In 12hrly TF, its wave has just completed and started a new one. I will sell from 3330 today and initial target is 3310, final target is 3380.

Yesterday 3367 resistance worked well and gold bounced from there as expected and reached 3341. Currently price is consolidating at this level but could rise to 3355. I will look for selling opportunity from 3355, targeting 3325 today.

Although I am bearish in weekly TF, the trend is not yet reversed in smaller TFs. In 4hrly TF, gold is very bullish. There is no sign of slowing down. I will watch price closed in current level. If 3365 is broken, I will stay out for today. If 3365 holds, I will sell towards 3345. There could be some buying opportunities as well if 3345 support holds. Let's...

I did expect gold to drop last week due to the rising wedge in the chart. However, with initial drop during early last week, gold quickly recovered and reached 3367. Nevertheless, the trendline as indicated in the chart still holds. As long as this line holds, gold will most probably drop to 3180. I am expecting initial rise of gold next week, followed by heavy...

As expected yesterday, gold attempted to break 3330 for a few times but failed to do so. After retreat to 3310, it went up again. Right now it is testing the channel top. I will monitor the price closely at this level and the 4hrly close. If it close above 3330, I will buy towards 3365. If it close below 3317, I will sell towards 3270.

Gold has been very choppy recently. It seems not having any clear direction. Although in weekly post I am bearish in short term, there is lack of momentum for it to go down. Currently it is traded within a channel indicated in the chart. I am going to trade on the channel top. If the channel holds, I will sell around 3330, towards 3250. If the channel top is...

Gold didn't respect the head and shoulder pattern yesterday but also it didn't close the day under 3300, which makes it unclear for the move today. Therefore, I will trade the breakout today. If 3300 is broken, I will sell towards 3250. If 3320 is broken, I will buy towards 3340. Let's see what the market will give us today.

Although I am bearish in my weekly post, I can not ignore the formation of inverted head and shoulder pattern in daily TF. I am switching back to bullish view. Gold is continuing its bull drive. I will buy from 3320. 1st target 3360. Ultimate target for today 3400.

As explained in my weekly post, I am bearish in gold this week. Currently in 4hrly TF, it's still bullish. I am watching closely at 3330 and 3345 levels. If 3330 is broken, I will engage selling upon retest. Alternatively, I will sell on bearish signals from 3345. My target for today is 3300.

In my half year review, I expected next half year gold will continue its bullish drive. Overall picture shows a bullish momentum. However, the road is not straight and could be bumpy. In 2W TF, there is a three drive pattern indicated in the chart with three red arrows. An immediate price drop will follow from this pattern. Therefore, I am expecting the price to...

Yesterday Gold did move up from 3350 to 3365 local high and quickly dropped under 3330. But I see this drop as correction not trend reverse. Right now it has entered a consolidation zone. Therefore, I am looking to buy from 3300 and sell from 3330. Will trade between these two levels.

Although gold didn't go down to 3300 as I expected, inverted head and shoulder did form yesterday. Moreover, in 12hrly TF, the EMA is well respected. Therefore, price should continue to rise today. For today's setup, I will buy from 3350, targeting 3400.

As explained in my half year and monthly review, gold is still in bullish trend. The trendline has been broken and gold has regain its bullish power. Potentially it will form an inverted head and shoulder pattern. I will look for buying opportunity from 3300. 1st target 3350. ultimate target for today 3400.

As shown in the chart, as long as the trendline holds, I will not engage any long term buys. I am expecting price to drop from 3317-3325. 1st target 3255 2nd target 3200