THE-CHART-ALCHEMIST

EssentialTPL – BUY SIGNAL (REVISIT) | 01 AUGUST 2025 The stock was previously moving within a bullish channel (marked light blue), but recently broke down from it, triggering a potential trap. However, it found strong structural support and formed a spring near the excess line , a classic Wyckoff reversal signal. With a reclaim of structure and confirmation of bullish...

KSE 100 Technical Analysis | 01-08-2025 The KSE 100 index has formed a trading range between 136000 and 140200. After breaching the previous resistance at 13900, the index retested this level in the final hour of trading. We expect the index to rise from this level, cross the upper limit of the trading range, and move towards a new target. Key Levels - *Support*:...

TOMCL – SHORT SELL / EXIT |1 AUGUST 2025 The stock has recently given a Change of Character (CHoCH) and, after achieving a low of Rs. 23.6, it moved into an upward channel that touched the order block, triggering a bearish CHoCH. The price has been moving within a bearish channel and has now touched the top, showing indications of a downward reversal.

KSE-100 INDEX TECHNICAL ANALYSIS | 31 JULY 2025 The KSE-100 Index has established a trading range between 136,000 and 140,200. After breaching the previous resistance at 139,000, the index successfully retested this level during the final hour of trading. This behavior suggests a likely continuation of the upward trend. We now anticipate the index to rise from...

BIPL – BUY SIGNAL | 29 JULY 2025 This is a revisit trade on BIPL after three previously successful strikes. The stock has completed an ABC correction and is now reacting from a bullish gap. This technical formation indicates potential for another upward move, making it a strong candidate for a fresh long entry.

CTM – BUY SIGNAL | 29 JULY 2025 CTM is trending within an upward channel (highlighted light blue). After a recent pullback, the stock has reversed direction and formed multiple bullish structures, suggesting strong upward potential. This setup provides a favorable entry point for a safe long trade with attractive short-term targets.

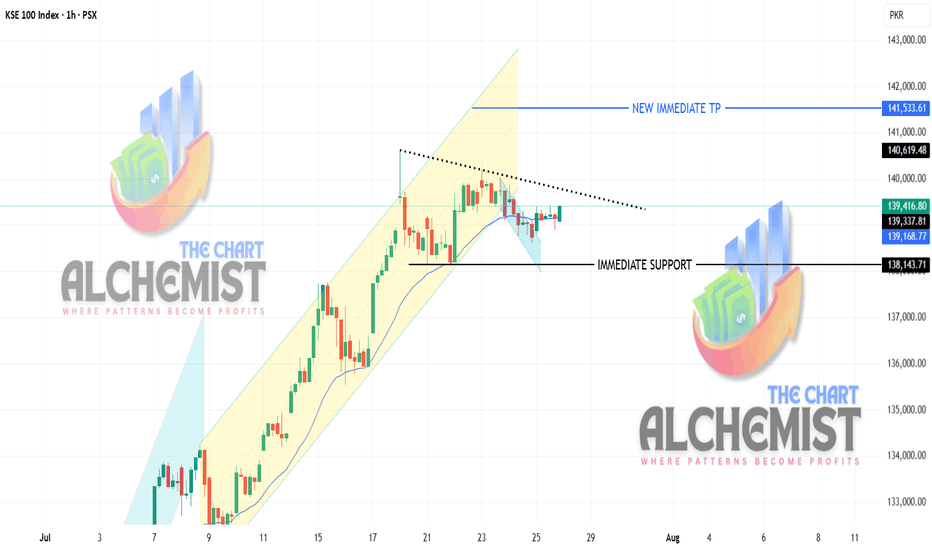

KSE100 Technical Analysis (1H Time Frame) 29-07-2025 The index displayed heavy selling pressure in the last two hours, with big bearish candles. However, it touched a bullish measuring gap at 137600 and showed a small sign of upward reversal. Key Observations - Expected reversal from the current level of 137600 or further down to the secondary support at 137100...

KSE-100 INDEX TECHNICAL ANALYSIS | 28 JULY 2025 The KSE-100 index has completed its pullback by trading above the bearish pullback channel (marked light below). It is now taking support from the trend line (dotted blue color line) and facing resistance from the inclined resistance line (dotted red color line). The market opened with a gap up, filled the gap, and...

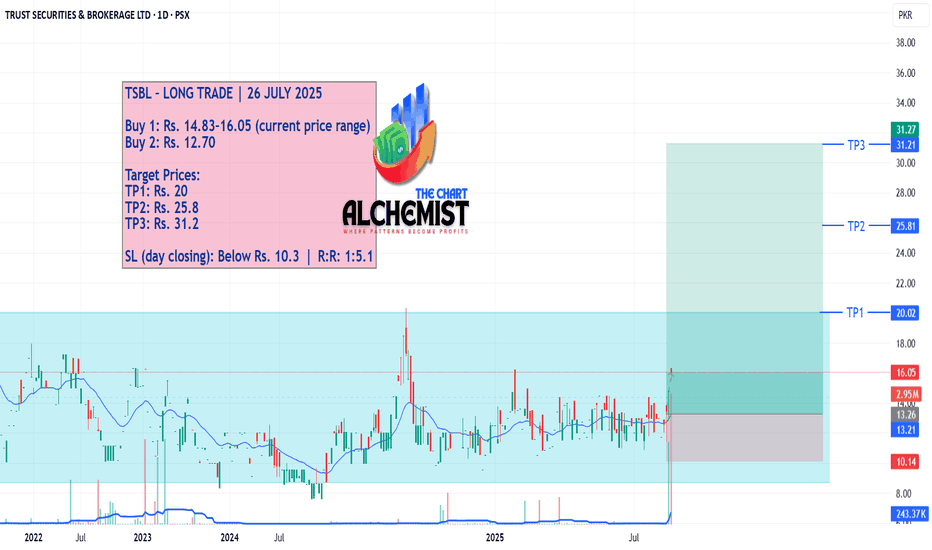

TSBL – LONG TRADE | 26 JULY 2025 TSBL has been consolidating within a broad trading range between Rs. 9 and Rs. 20 since April 2021. With today’s price action indicating a potential breakout, the setup now presents an ideal long entry opportunity with strong upside targets and a favorable risk-reward ratio.

📈 KSE 100 Index Technical Analysis 26-07-2025 The KSE 100 index is moving in an uptrend, albeit at a relatively slowed pace. Although it broke down from the upward channel (marked yellow color), it filled the measuring gap, marked a higher low, and completed its pullback. The index seems poised to resume its upward trajectory. Key Points Higher Low Formation:...

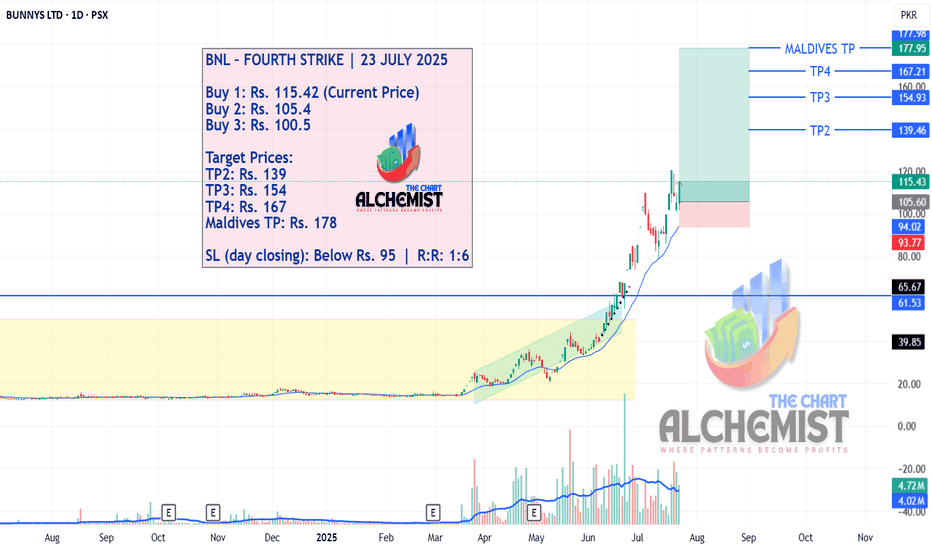

BNL – FOURTH STRIKE | 23 JULY 2025 After taking three strikes—with all targets achieved for two strikes and TP1 achieved for the third—BNL stock went into a pullback. However, the pullback is now over, and the stock is expected to rise again to achieve multiple quantified displacement targets.

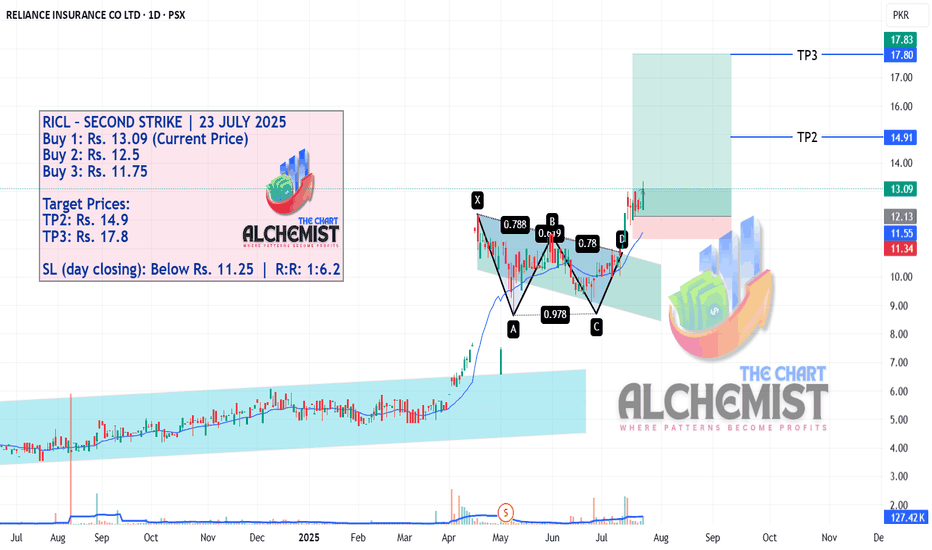

RICL – SECOND STRIKE | 23 JULY 2025 We previously gave a buy call for RICL stock, which has achieved one target, and the call is still valid. Our technical assessment suggested that the stock had formed a bullish flag and broken out of it with sufficient volume and volumetric distribution. The current price action offers a renewed long entry opportunity.

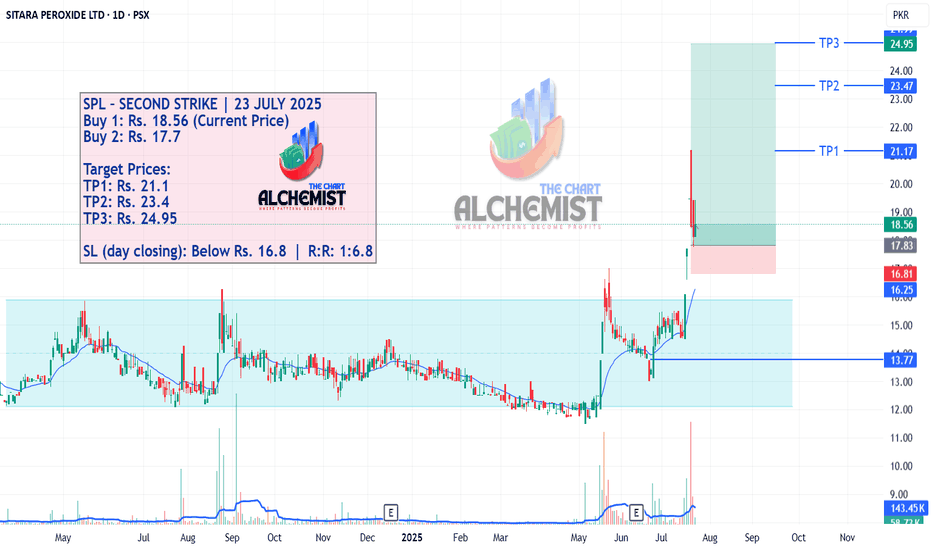

SPL – SECOND STRIKE | 23 JULY 2025 After achieving three out of four targets in our previous buy call, SPL stock went into a pullback. The previous call was based on the breakout from a long-term accumulation phase marked with a light blue channel. The pullback now seems to be over, offering a fresh high-probability long opportunity.

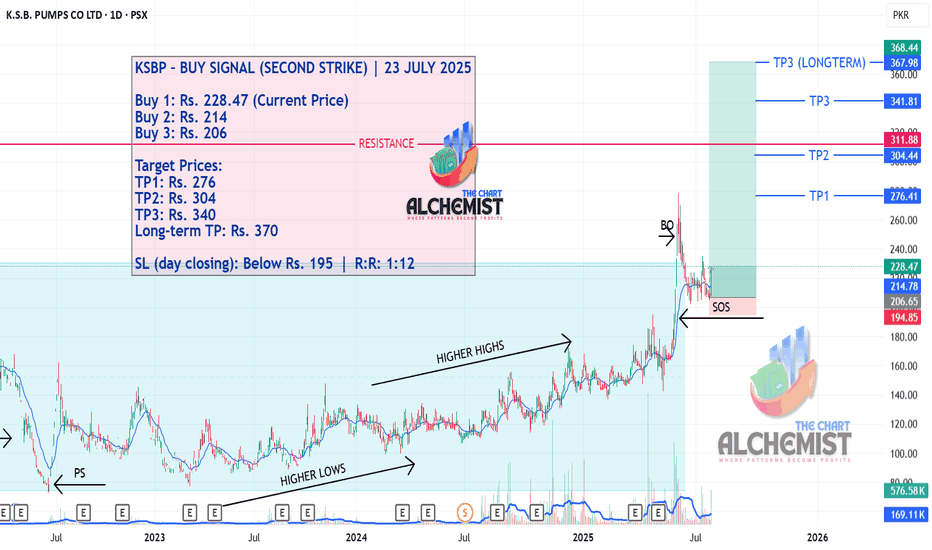

KSBP – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025 After completing a Wyckoff Re-accumulation Phase marked in a light blue color channel, KSBP stock broke out and achieved a high of Rs. 278 before entering a pullback. The pullback now seems to have ended, and the stock is poised to move higher toward several quantified upside targets.

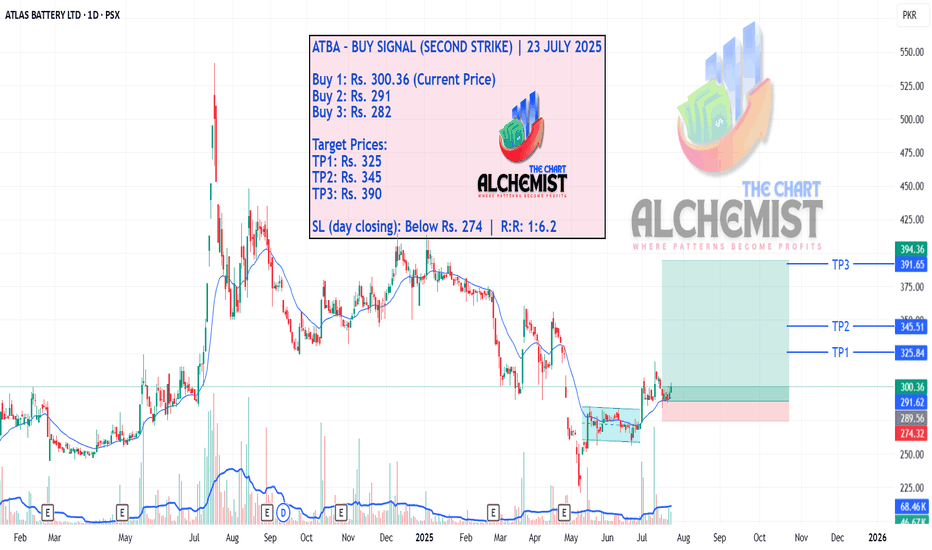

ATBA – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025 We previously gave a buy call for ATBA stock, which remains valid. However, the current price action has developed a new bullish structure, offering another high-probability opportunity for a second strike. This setup provides favorable entry levels aligned with strong quantified targets.

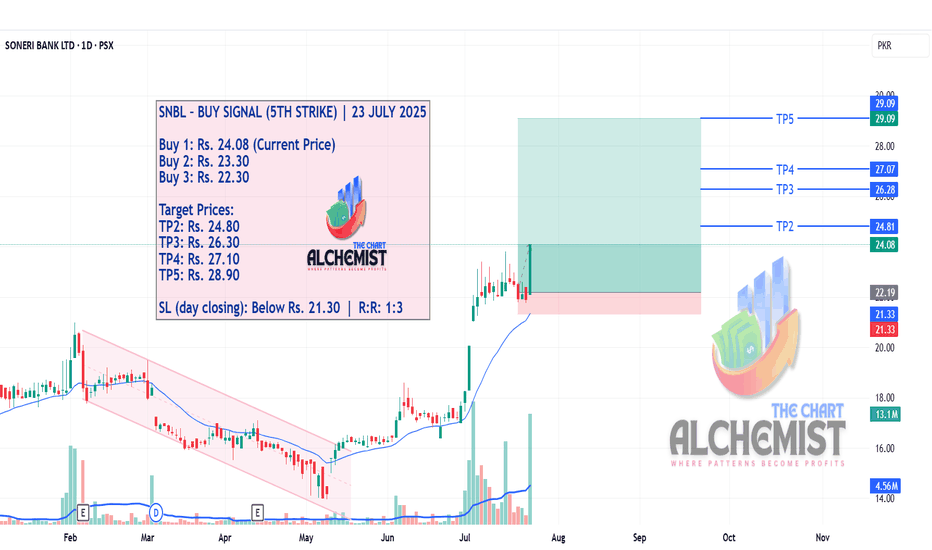

SNBL – BUY SIGNAL (5TH STRIKE) | 23 JULY 2025 After successfully achieving all targets of the first three strikes and TP1 of the fourth strike, SNBL now presents a fresh opportunity for a 5th strike. The stock continues to follow its upward trajectory, and the current bullish structure justifies another long entry setup targeting higher displacement levels.

SYM – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025 The previous signal on SYM remains valid, but the recent price structure has provided a renewed opportunity for a fresh long position. After completing a pullback in May 2025, the stock broke out from the pullback channel and confirmed the breakout with a retest around Rs. 12.8. With this structure reset, the ongoing...

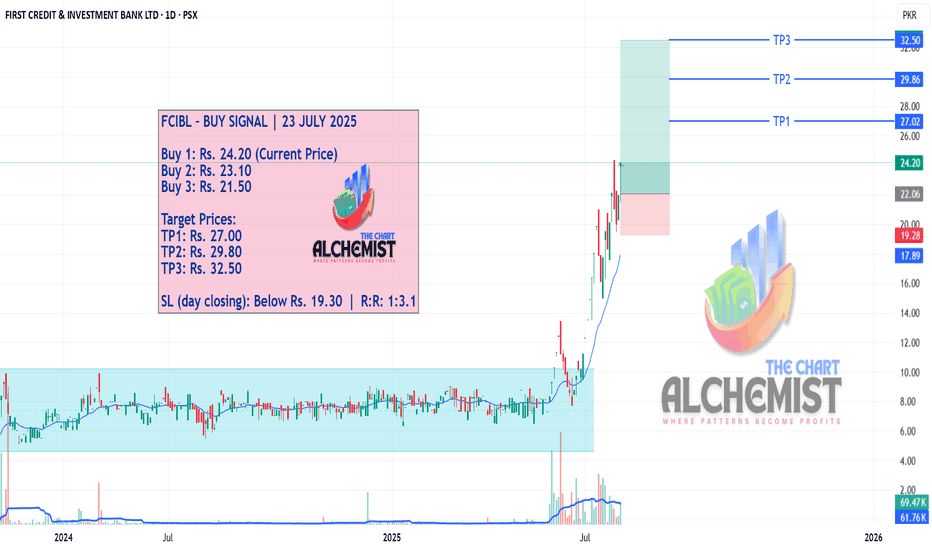

FCIBL – BUY SIGNAL | 23 JULY 2025 The stock was previously moving in a consolidation phase marked with a light blue color channel. After giving a breakout and marking a high of Rs. 13.35, FCIBL entered a pullback. Post-pullback, it surged sharply to Rs. 20.90. The uptrend remains intact, and we now expect it to continue toward multiple quantified displacement...