THE-CHART-ALCHEMIST

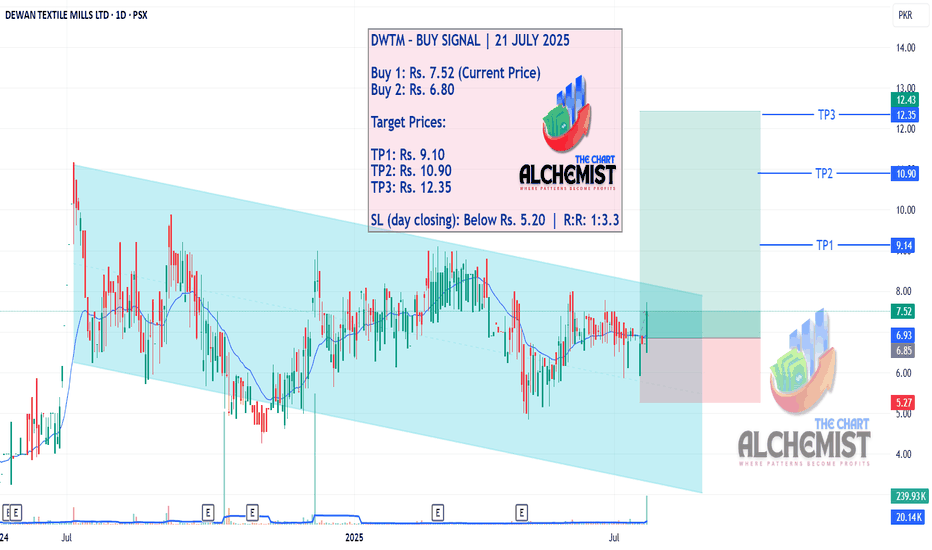

EssentialDWTM – BUY SIGNAL | 21 JULY 2025 DWTM has been gradually trending downward within a bearish channel, which structurally resembles a bull flag—a continuation pattern in an uptrend. The stock is now showing signs of breaking out from this formation, indicating a potential upward rally toward multiple quantified displacement targets.

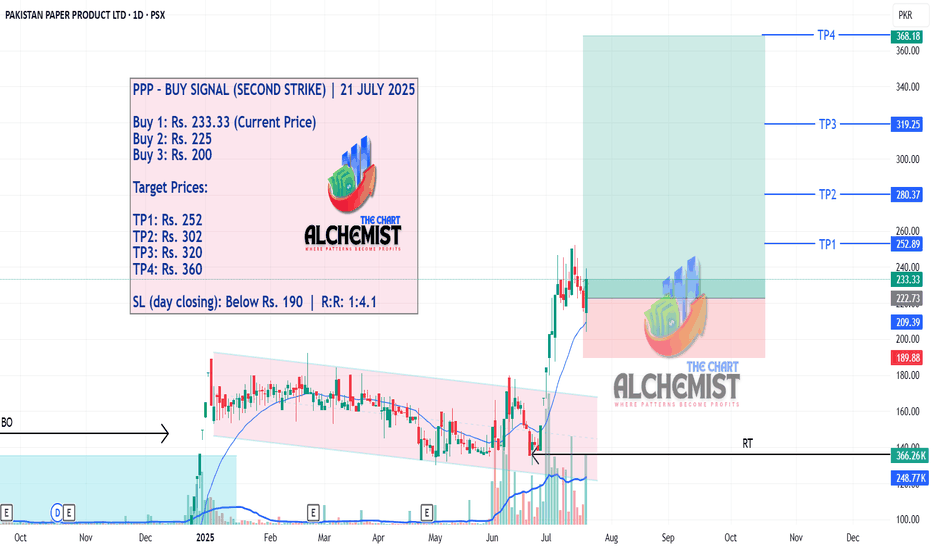

PPP – BUY SIGNAL (SECOND STRIKE) | 21 JULY 2025 After a prolonged accumulation within a light blue channel, PPP gave a breakout and surged to a high of Rs. 190. It then entered a structured pullback phase and eventually broke out of it, achieving all targets from our previous call.

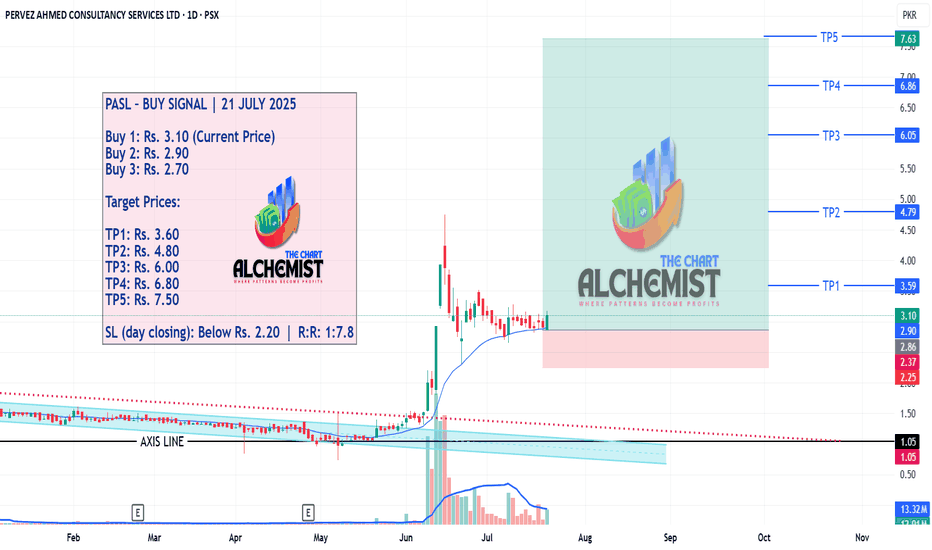

PASL – BUY SIGNAL | 21 JULY 2025 After conducting a spike phase that peaked at Rs. 4.76, PASL entered a gradual pullback phase. That pullback now appears to be complete, with price stabilizing and ready to launch toward multiple quantified displacement targets.

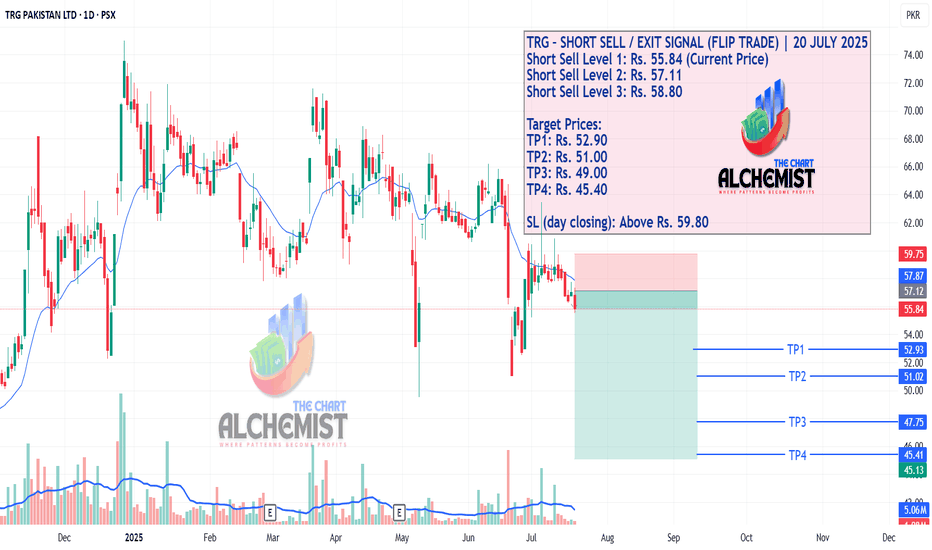

TRG – SHORT SELL / EXIT SIGNAL (FLIP TRADE) | 20 JULY 2025 TRG has maintained a bearish market structure, consistently printing lower highs and lower lows—confirming an established downtrend. After a short-term retracement to the 20 EMA, the stock has resumed its downward movement, suggesting that further downside is likely. This setup presents a clear opportunity...

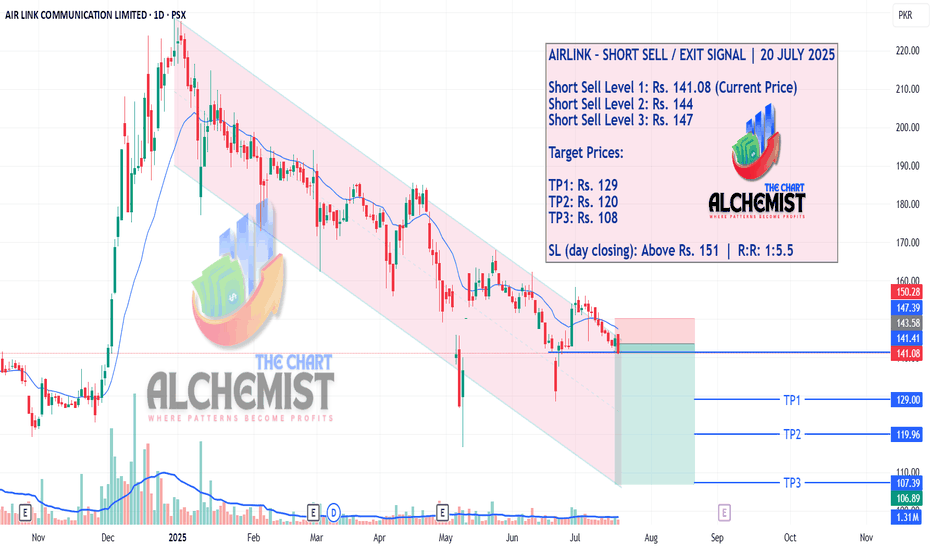

AIRLINK – SHORT SELL / EXIT SIGNAL | 20 JULY 2025 AIRLINK has been trading inside a defined downward bearish channel, shaded in light pink. The stock recently tested the 20 EMA and failed to sustain higher levels, indicating that it may now begin a fresh downward leg. This setup presents a high-probability short sell or exit opportunity with clearly mapped...

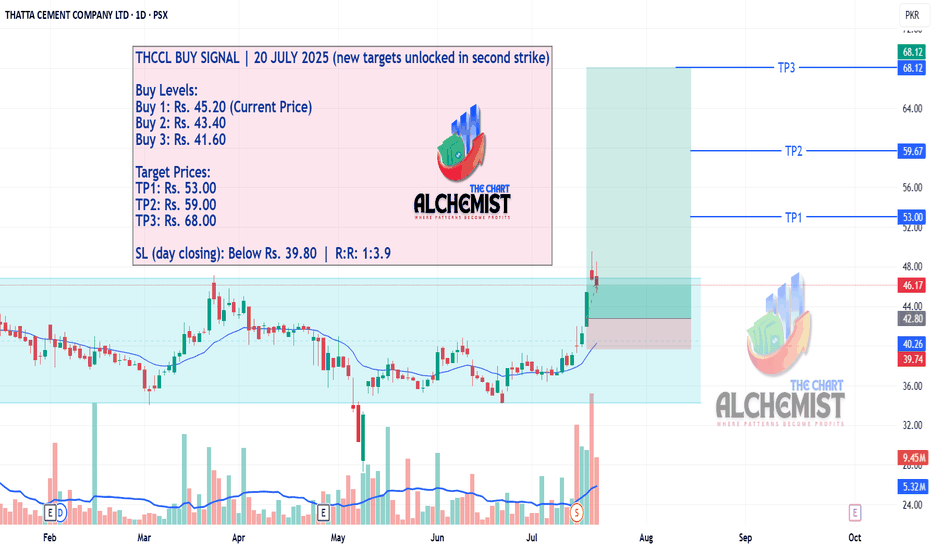

THCCL 20 July 2025 - with new target unlocked THCCL has formed an MB Bull Flag pattern on the post-split adjusted chart, and is poised for a breakout toward multiple upside targets.

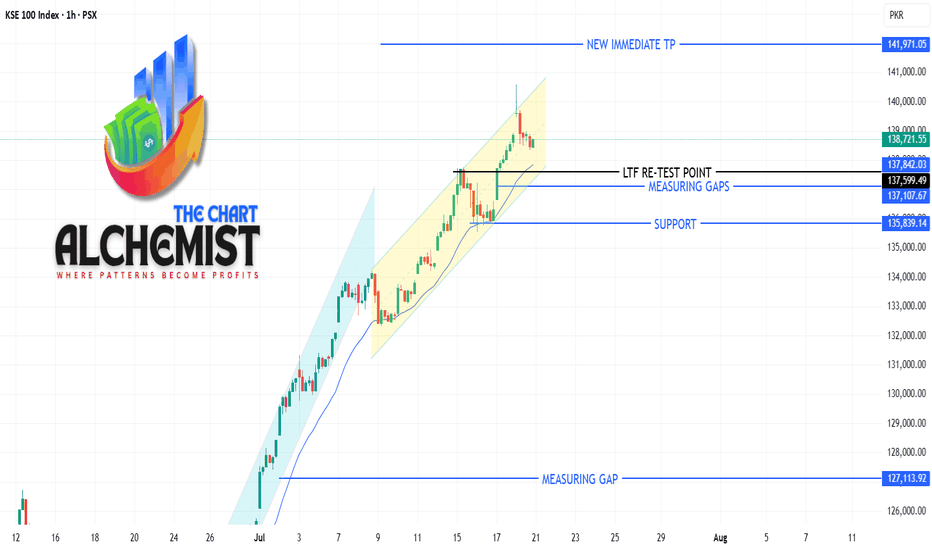

TECHNICAL ANALYSIS: KSE-100 (PSX) – 20 JULY 2025 The index has completed its spike phase marked in light blue color channel and has transitioned into a channel phase marked with yellow channel. This channel phase signifies deeper pullbacks and slower upward movement. The index recently gave a break of structure at around 137600 and marked a high of 140594. We...

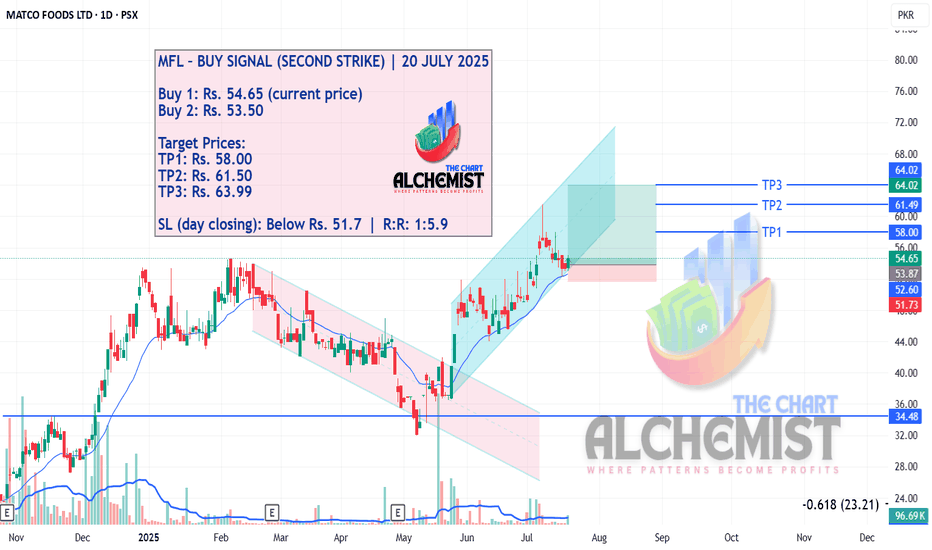

MFL – BUY SIGNAL (SECOND STRIKE) | 20 JULY 2025 MFL was previously moving in a downtrend (light pink channel), then gave a strong breakout and reached Rs. 51.70. After pulling back, our first buy call was triggered and all targets were hit as the stock made a higher high at Rs. 61.50. It has since retraced to the lower boundary of a new light blue channel and is...

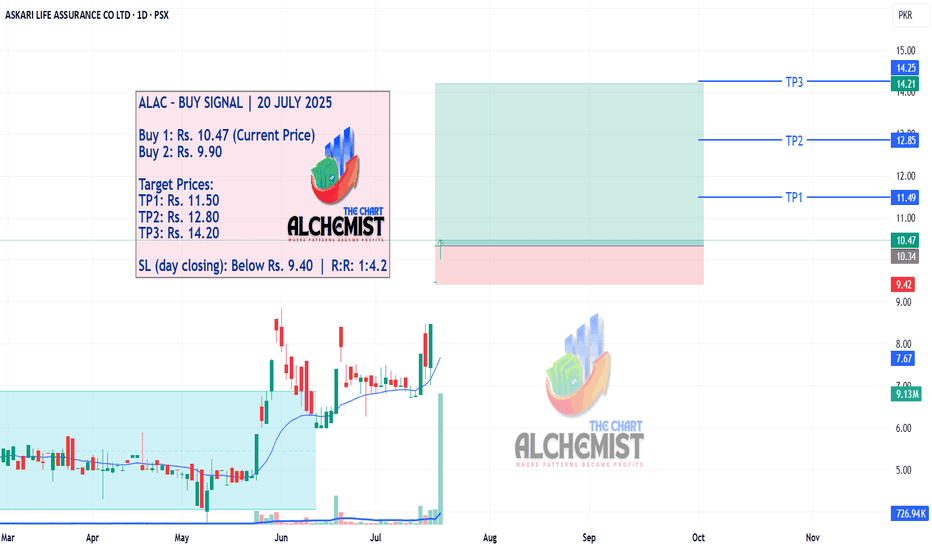

ALAC – BUY SIGNAL | 20 JULY 2025 After achieving TP1 from our previous call, ALAC has now entered a spike phase, breaking out from its trading range marked by a light blue channel. It has recently formed a bullish structure, which is likely to act as a strong support zone and continue driving the stock upward. This is a Second Strike opportunity.

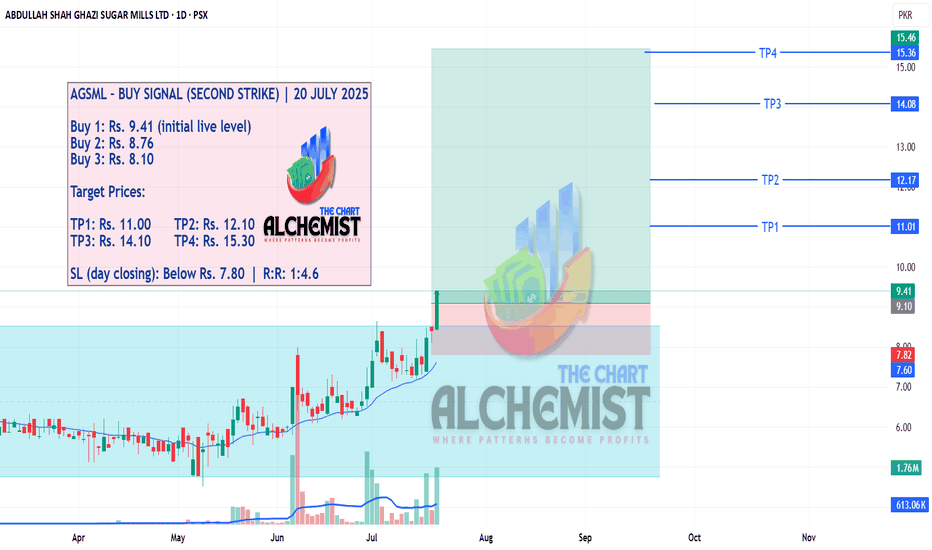

AGSML – BUY SIGNAL (SECOND STRIKE | 1H TIMEFRAME) | 20 JULY 2025 On the 1-hour chart, AGSML has been trading within a horizontal range defined by a light blue channel. After completing its previous up-leg and achieving all target levels, the stock formed another bullish structure. It has now broken out of its consolidation zone, suggesting a new upside phase is...

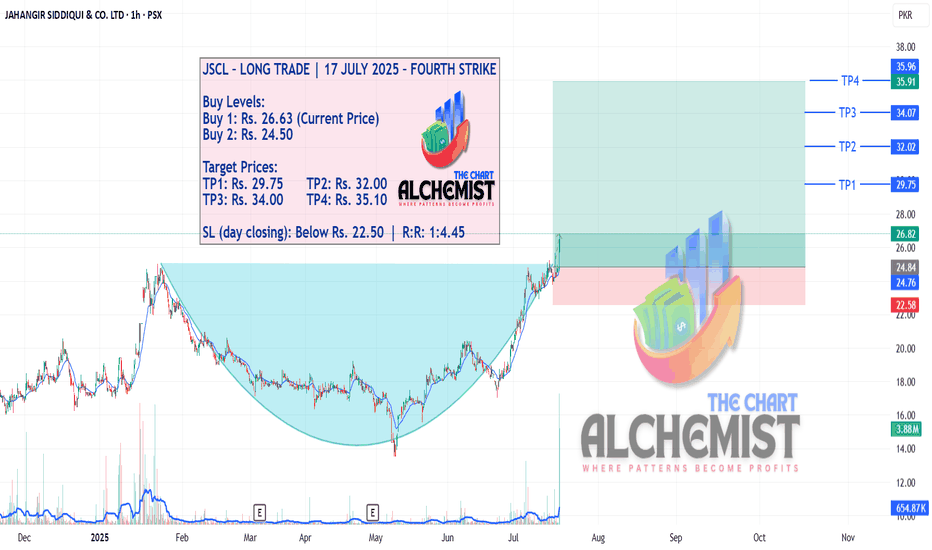

JSCL – LONG TRADE | 17 JULY 2025 – FOURTH STRIKE After three successful previous buy calls, JSCL is offering another opportunity. The stock has broken out of a SLOP formation, indicating potential continuation of the bullish trend with strong upside targets.

GOC – LONG TRADE | 17 JULY 2025 – FIRST STRIKE GOC broke structure to the bullish side, hit a high of Rs. 116, pulled back shallowly, and has now resumed its upward trajectory. The current setup provides a high-probability long opportunity.

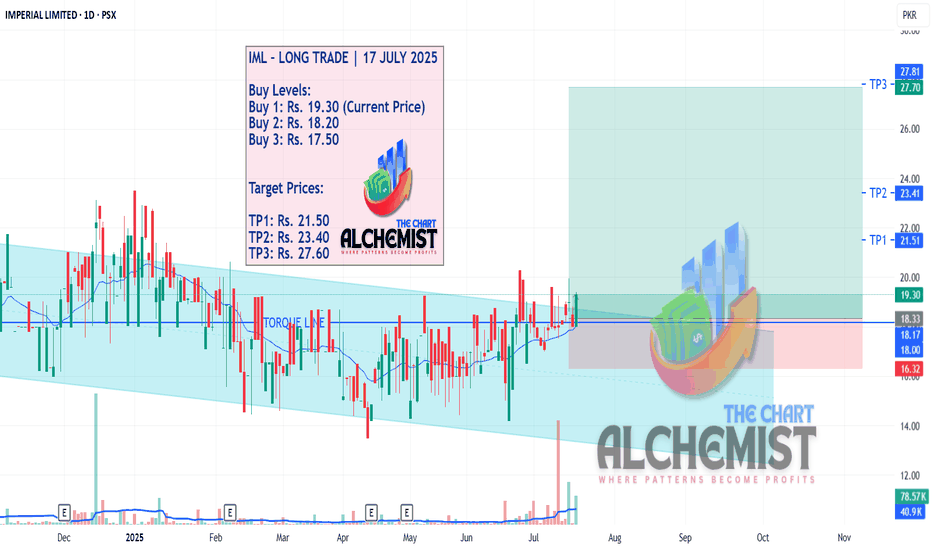

IML – LONG TRADE | 17 JULY 2025 IML broke out of a bull flag formation (marked in light blue channel) following a correction, signaling renewed upward momentum. This breakout suggests the start of a fresh leg up, supported by structural strength and volume confirmation. The setup offers a solid entry with multiple upside targets.

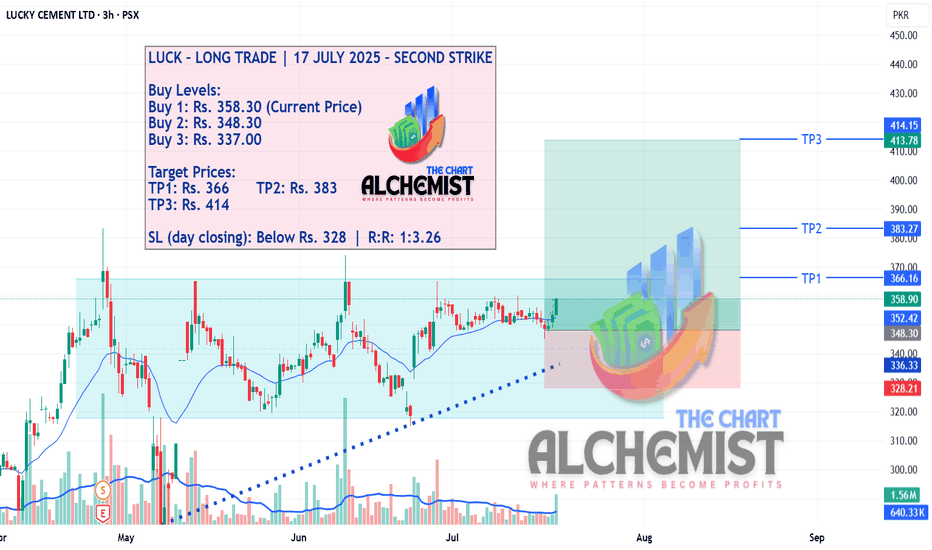

LUCK – LONG TRADE | 17 JULY 2025 – SECOND STRIKE LUCK has been in a consolidation phase within a trading range (marked by a light blue channel) since April 2025. The latest price action suggests strength and positioning for a breakout, offering a favorable entry with promising upside potential.

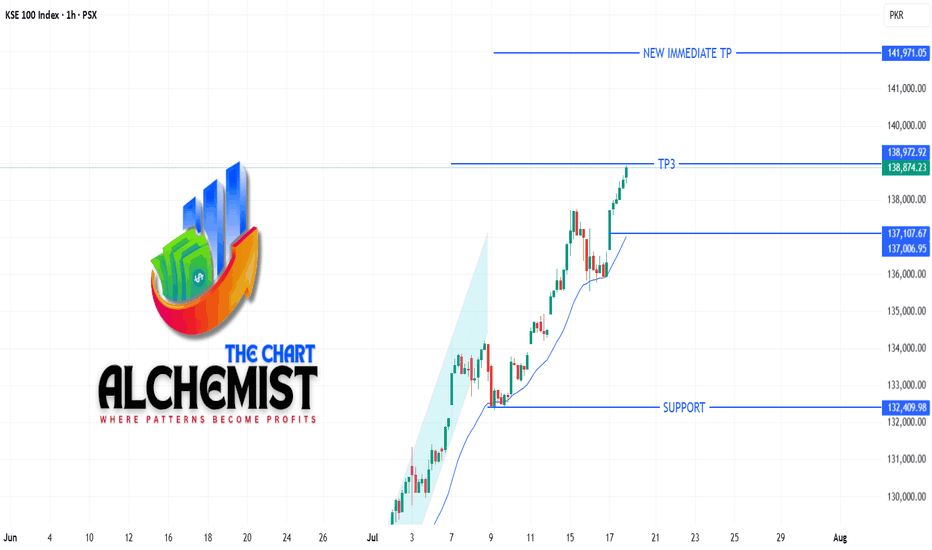

KSE-100 INDEX UPDATE | 17 JULY 2025 The KSE-100 continues its strong uptrend, hitting a high of 140,931 today—just shy of the immediate target at 141,970. As expected, the index is showing signs of deeper pullbacks within the channel structure, which remain healthy and present strong buying opportunities. The final upside target stays at 151,600, with the trend...

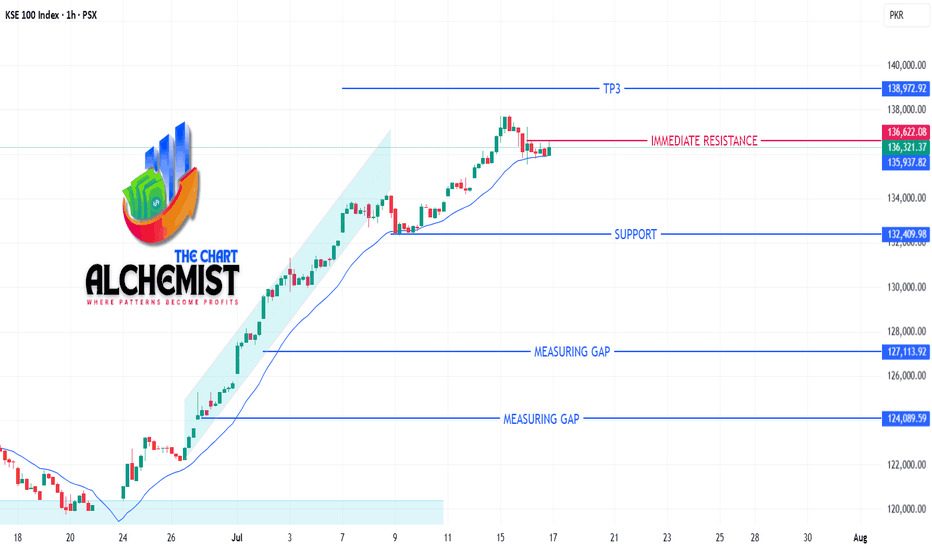

📊 KSE-100 ANALYSIS | 16 JULY 2025 As previously mentioned, KSE-100 completed its spike phase, marking a high of 134,240. The uptrend is now transitioning into a channel phase, with deeper pullbacks expected in the short term. KEY LEVELS: Support: 20 EMA (1-hour timeframe) Immediate Resistance: 136,620 OUTLOOK: Expected to take support from the 20 EMA and...

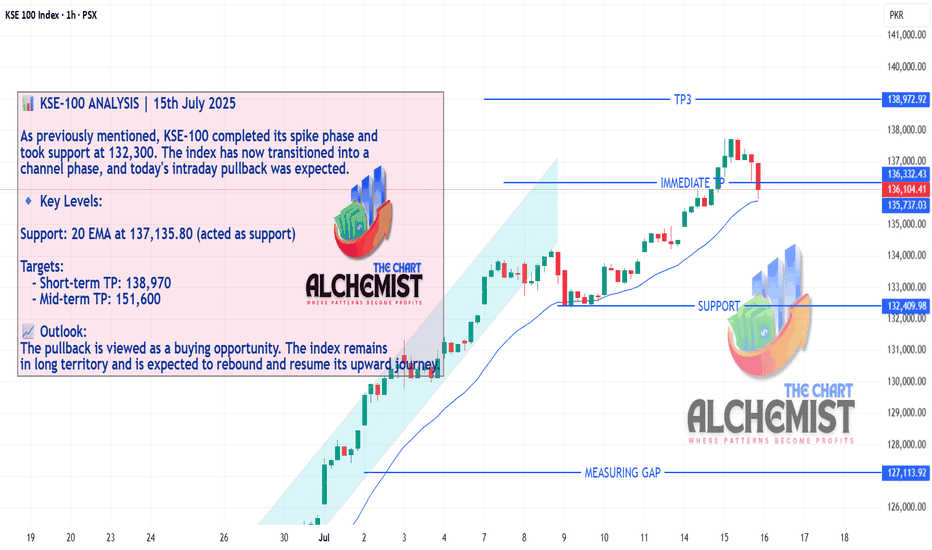

📊 KSE-100 ANALYSIS | 15th July 2025 As previously mentioned, KSE-100 completed its spike phase and took support at 132,300. The index has now transitioned into a channel phase, and today's intraday pullback was expected. 🔹 Key Levels: Support: 20 EMA at 137,135.80 (acted as support) Targets: - Short-term TP: 138,970 - Mid-term TP: 151,600 📈 Outlook: The...

GEMNETS – BUY SIGNAL | 14 JULY 2025 After a strong move from Rs. 12 to Rs. 20, GEMNETS entered a pullback phase, which has now transformed into a bullish flag and reaccumulation zone — a powerful structure setting up for another leg higher.