Tech_Trader88

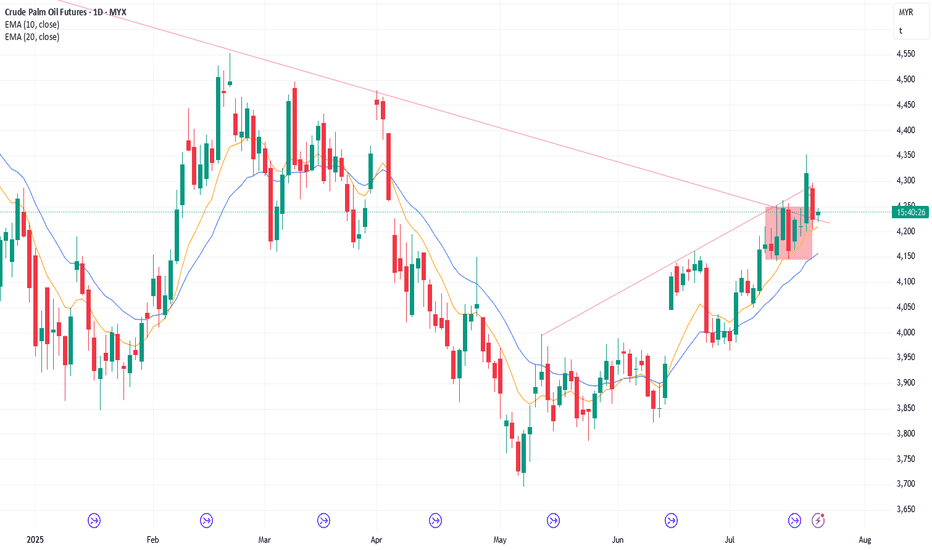

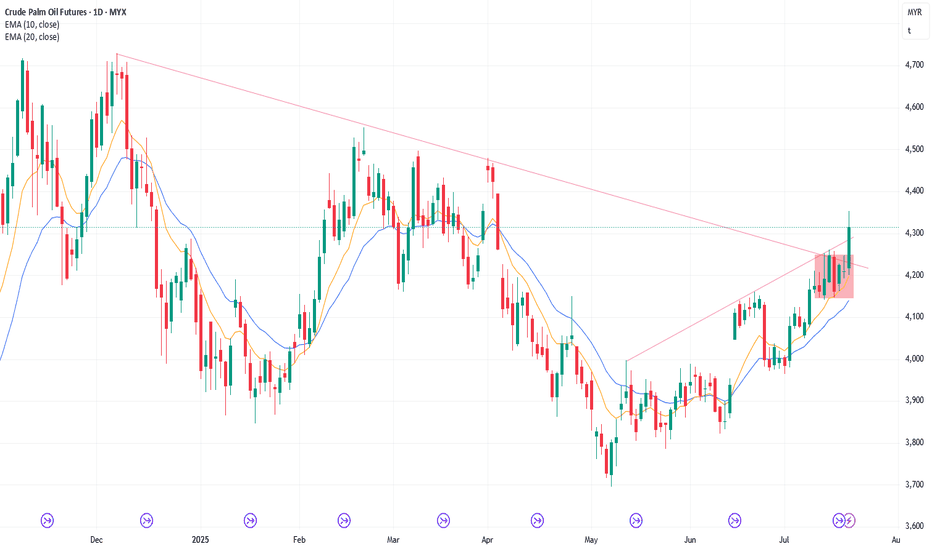

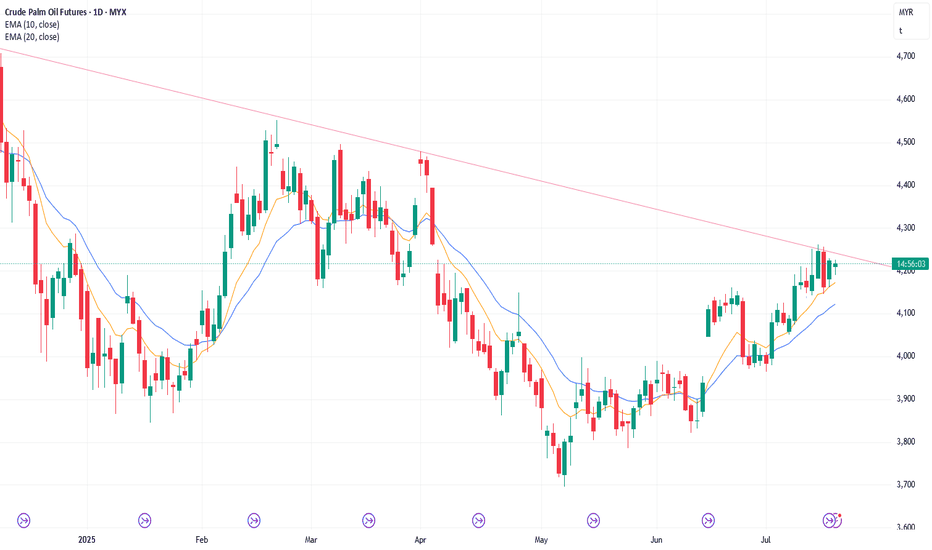

EssentialFriday’s candlestick (Aug 8) was a bull doji closing in its lower half with a long tail above. In our last report, we said traders would see if the bulls could create a strong bull bar breaking above the August 5 high, or if the market would trade higher but stall around or below the August 5 high, closing with a long tail or a bear body instead. The market...

Thursday’s candlestick (Aug 6) was a bear bar closing in its lower half with prominent tails above and below. In our last report, we stated that traders would determine whether the current pullback would remain sideways and overlap with Wednesday's range or if the bears would be able to create strong bear bars, closing below the 20-day EMA. The 20-day EMA...

Wednesday’s candlestick (Aug 5) was a bear doji closing in its upper half with a long tail below. In our last report, we said traders would see if the bulls could create follow-through buying, even if it is just a bull doji, or if the market would reverse down sharply below the 20-day EMA instead. The market formed a pullback. While it is not a...

Tuesday’s candlestick (Aug 5) was a big bull bar closing near its high and far above the 20-day EMA. In our last report, we said traders would see if the bulls could create a strong bull bar closing above the 20-day EMA, or if the market would trade higher but close with a long tail above and below the middle of its range instead. The market formed a strong...

Monday’s candlestick (Aug 4) was a bull doji closing around the middle of its range with prominent tails. In our last report, we said the market may gap down at the open. Traders would see if the bears could create follow-through selling, closing the day near its low, or if the market would lack follow-through selling and close with a long tail below or a...

Friday’s candlestick (Aug 1) was a bull bar closing bear its high with a long tail below. In our last report, we said traders would see if the bears could create a strong follow-through bear bar closing near its low, or if the market would trade lower, but close with a long tail below or a bull body instead. The market traded lower but reversed to close with...

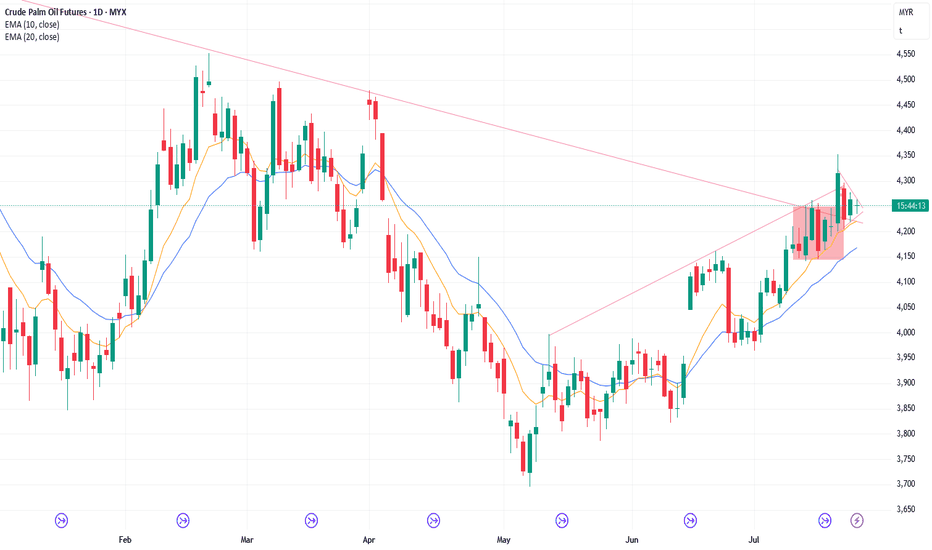

Thursday’s candlestick (Jul 31) was a bear bar closing near its low. In our last report, we said traders would see if the bears could create a strong retest of the July 29 low, or if the market would trade slightly lower, but find support around the 20-day EMA instead. The market traded lower and continued down in Thursday night's session, testing the 20-day...

Wednesday’s candlestick (Jul 30) was a small bull bar with a prominent tail above. In our last report, we said traders would see if the bulls could create a retest of the July 24 high and a breakout above, or if the market would trade slightly higher but stall around or below the July 24 high, forming bear bars instead. The market traded slightly higher for...

Tuesday’s candlestick (Jul 29) was a bull doji bar closing in its upper half with a long tail below. In our last report, we stated traders would see if the bears could create follow-through selling, or if the pullback phase would be weak and sideways, holding above or around the 20-day EMA instead. The market opened lower but traded sideways to up for the...

Monday’s candlestick (Jul 28) was a bear doji bar closing around the middle of its range with prominent tails. In our last report, we stated traders would see if the bears could create follow-through selling, or if the pullback phase would be weak and sideways instead. The market traded slightly lower. The bears got some follow-through selling, albeit still...

Friday’s candlestick (Jul 25) was a bear bar closing slightly below the middle of its range with a long tail below. In our last report, we stated that traders would assess whether the bulls could generate follow-through buying or if the bears would create a strong pullback, which would close the weekly candlestick with a bearish body, thereby creating more...

Thursday’s candlestick (Jul 24) was a bull doji closing slightly below the middle of its range with a long tail above. In our last report, we said the odds slightly favor sideways to up. Traders would see if the bulls could create follow-through buying, breaking above the July 18 high, or if the market would stall around or below the July 18 high area and...

Wednesday’s candlestick (Jul 22) was a bull bar closing near its high. In our last report, we said traders would see if the bulls could create follow-through buying and test near the July 18 high, or if the market would form a breakout below the triangle and ii (inside-inside) pattern instead. The market formed a breakout of the triangle to retest the July...

Tuesday’s candlestick (Jul 22) was an inside bull bar closing near its high. In our last report, we said traders would see if the bears could create follow-through selling, or if the market would trade higher and retest the July 18 high instead. The market traded higher for the day, and the bears failed to get follow-through selling, again. Previously, the...

Monday’s candlestick (Jul 21) was a big inside bear bar closing in its lower half with a prominent tail below. In our last report, we said traders would see if the bulls could create follow-through buying, or if the follow-through buying over the next 1-2 days would be limited. If this is the case, it can indicate that the bulls are not as strong as they had...

Friday’s candlestick (Jul 18) was a big bull bar closing in its upper half with a prominent tail above. In our last report, we said traders would see if the bulls could close the day's candlestick near its high, or if the daily candlestick would close with a long tail above or below the middle of its range instead. The market broke above the bear trend line...

Thursday’s candlestick (Jul 17) was a doji bar with a long tail above. In our last report, we said traders would see if the bulls could create a follow-through bull bar testing the July 14 high, or if the market would form a lower high (versus July 14) and be followed by some selling pressure instead. The market traded above Wednesday's high, but the...

Wednesday’s candlestick (Jul 16) was an inside bull bar closing near its high. In our last report, we stated that traders would observe whether the bears could create a follow-through bear bar, even if it were just a bear doji, or if the market would trade higher to retest the July 14 high. If this is the case, it will indicate the bears are not yet strong. ...