Price has now completed the deeper pullback to 2.22091, which was our lower-level support target. On the 4H chart, price is beginning to form support here, suggesting potential upside continuation. If this level holds, I’ll be looking for staged buys from: 2.22091 (current support area) 2.23958 (previous key support/structure break) 2.24775 (resistance flip...

Yesterday was largely bearish as AUDCAD failed to break above 0.88453, forming a triple bottom around 0.88000, then bouncing about 40 pips. Today we’ve seen a clean break of 0.88453, followed by a 1H double top. I’ll be watching closely for a retest of 0.88453 — if price creates support, I’ll look to enter long: 🥇 First target: recent highs for ~30 pips 🥈...

During the Asian session, GBPJPY finally broke out of the bullish wedge we highlighted yesterday and is now breaching the key 192.000 buy level. We’re watching for a break + retest/continuation setup here on the lower timeframes. A clean confirmation opens the move toward 193.000 — a solid 100 pip range before reassessing.

Looking at the daily chart, USDCAD hasn’t done much in terms of our longer-term target but continues to reject 1.38618, which adds confluence to the bearish bias. That being said, the consistent failure to push higher makes me doubt we’ll see the deeper pullback to 1.39621—unless we get a strong fundamental catalyst. So for now: 📉 Current sell zones: – 1.37871 –...

Gold is still stuck in the range between 3333 and 3274, doing very little yesterday in terms of movement or entries. However, with high-impact news events this week including NFP on Friday, I expect more decisive price action starting today. 📌 Trading Plan Buy above 3333, target: 3356 (≈ 240 pips) Sell below 3274, target: 3230 (≈ 400 pips) Once either of these...

GBPNZD continues to trend bullish on the 4H, now forming new support at 2.24775 after rejecting 2.23958. 📌 Trade Plan: If we get another 30M close above 2.24775, we can look to scalp 60 pips to 2.25361 Break of 2.25361 opens the way to first daily target at 2.26228 Additional buy zones at 2.26228 and 2.27286 with final swing target at 2.28114 Pullbacks to...

AUDCAD remains stuck in a tight 50 pip range between 0.88499 and 0.88983 🌀 We’re still playing the same zones from yesterday’s analysis. 📌 Areas of interest remain: Break above 0.88983 for potential continuation Next key level: 0.89514 Until then, it's a waiting game.

USDCAD 🇺🇸🇨🇦 has created a new swing low at 1.37871 and is starting to bounce. However, my overall bias remains bearish toward the next major target of 1.34380 — an easy 300 pips from where we are now. 🟡 Sell interest zones: 1.39621 (pullback and rejection) 1.37871 (continuation) 1.36647 (breakdown) 1.35432 (breakdown) 🎯 Final target: 1.34380 before reassessing.

Since breaking out of the 0.88349–0.87716 range a few weeks ago, USDCHF 🇺🇸🇨🇭 fell over 400 pips, creating a new swing low at 0.83653 and then a lower low at 0.80862. Currently, we are seeing a pullback back into the 0.83653 intraday swing point. 👀 This is where I’m watching for rejection to stack into new sells, with additional sells to be added at 0.80862. 🎯...

USDCHF has officially broken out of the 0.82485 consolidation zone. Based on structure and momentum, we could be seeing a deeper pullback toward 0.83366, which has been a key level historically and would make sense for retesting the bearish structure. If price fails to reach that level or rejects sooner, I’ll be watching for continuation setups below 0.81394 and...

AUDCAD Update – April 23 We got the clean pullback to 0.88139, which held beautifully and gave the bullish continuation we expected. However, price is stalling now at the key level of 0.88879. A break above this opens up a 60-pip move to 0.89509. We're also pressing against the top of the daily trendline structure. Watch for either a breakout or a strong...

Yesterday’s price action and the Asian session saw Gold break cleanly through the 3225 and 3230 buy zones, pushing over 600 pips to a new all-time high of 3291. With this kind of extended move and news expected later today, Gold will stay on the watchlist until a proper pullback forms. Key levels to watch for buy setups are 3265 and a deeper retest around the 3238...

After rejecting 3196 yesterday, Gold (XAUUSD) has slowly crept back into bullish structure — with the 4H now showing clear higher highs and higher lows. Key levels to watch today: Buys above 3225 & 3230 → Targeting 3238 If we hold above 3220, bullish momentum remains intact However, a break below 3206 opens room for a deeper pullback to 3196 Today’s...

USDCHF Update – Swing Setup in Play After a massive 150+ pip move to the downside yesterday, USDCHF is now retesting the 0.84482 zone. This level will be key for the next leg: Sell Opportunity if 0.84482 holds as resistance Break of 0.83981 confirms continuation to the downside Target: 0.83366 (90+ pips from confirmation) ⚠️ A break back above 0.84482 could...

XAUUSD Analysis – 4H Outlook Gold briefly broke below 2988.00 following tariff headlines but quickly snapped back above the psychological 3000 level ahead of London open. The 4H candle just closed above 3013 — a strong resistance that’s held firm all week — indicating bullish pressure. A break of the previous 4H high opens up a move toward 3041 (+176 pips)....

AUDCAD Analysis AUDCAD has tapped and rejected its 3-quarter low of 0.85930, a level that’s held since April 2009. The 4H chart shows consolidation in a 50-pip range between 0.85930 and 0.85342. We’re watching for a bullish 4H candle close above 0.85930 for safer entries. The safest confirmation comes above 0.87060, which would confirm a break of both a key...

GBPNZD has maintained a strong bullish structure since 2023, forming consistent higher highs and higher lows. After each new high, we’ve seen 400–600 pip pullbacks before price continues bullish. With a fresh high now in at 2.26481 and signs of exhaustion showing, I’m eyeing potential swing sell setups to target the previous intrahigh at 2.17900 (approx. 550...

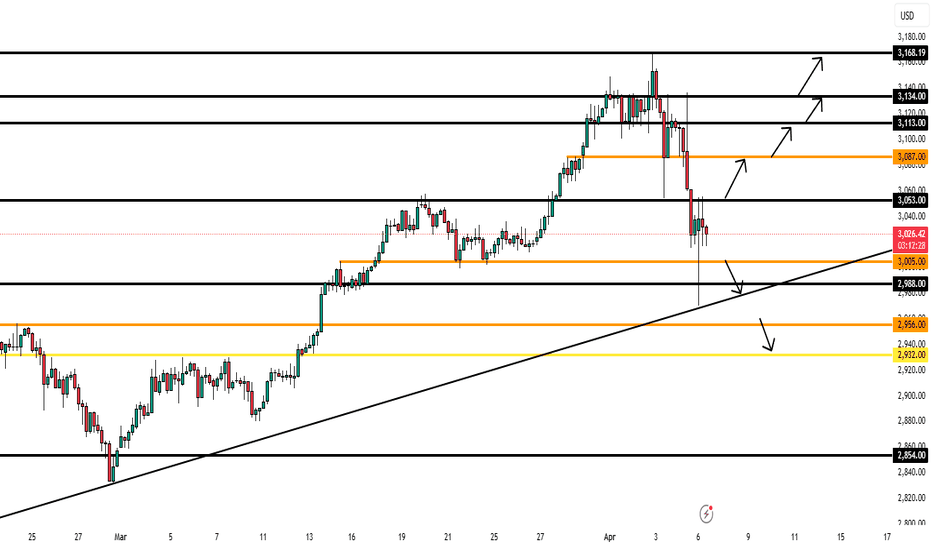

Gold (XAUUSD) Price has moved nearly 900 pips so far today with huge volatility. While the daily and higher timeframes remain bullish, lower timeframes show a bearish pullback after rejecting 3053. Bearish path: Targeting 3005–2998 if the pullback continues. Bullish path: A break/retest above 3053 opens 3087 as next target. No catalyst? We may see deeper...