TopGBanks

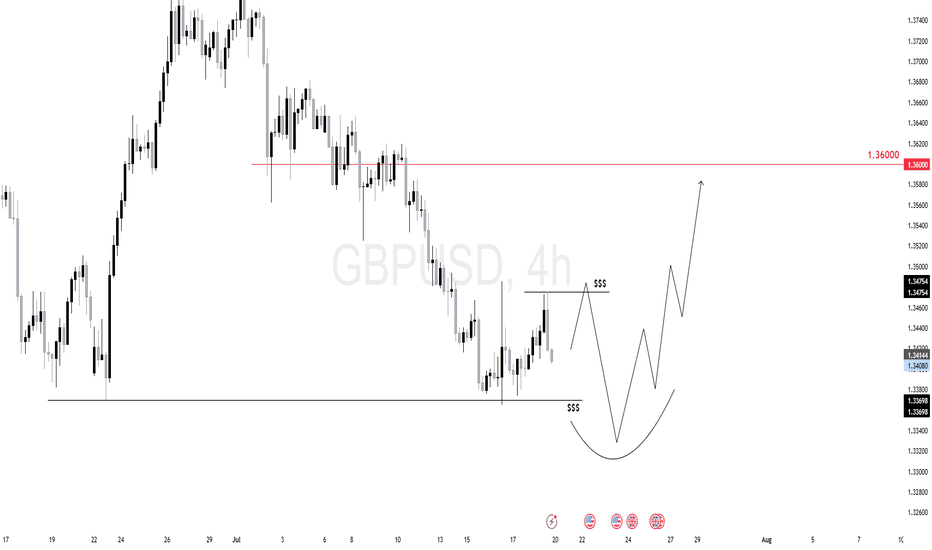

PremiumGBPUSD is forming a potential reversal structure with liquidity resting above and below the current range. We expect a move to grab short-term liquidity above 1.3475 followed by a sweep of lows near 1.3369. This would complete a rounded bottom structure, setting the stage for a bullish reversal. Once the low is swept and buyers step in, the target sits around...

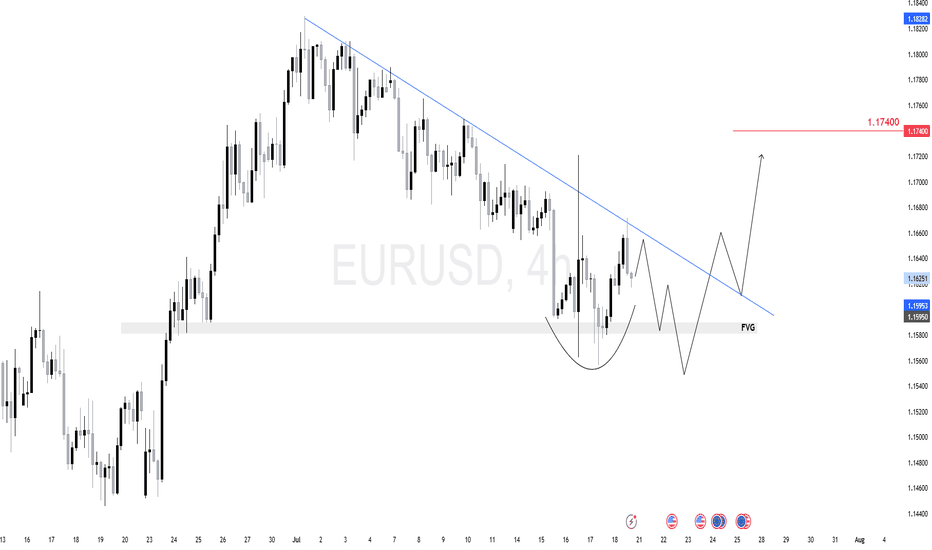

EURUSD is forming a potential inverse head-and-shoulders just above a 4H fair value gap (FVG). We expect one more dip toward the 1.1580–1.1595 zone to complete the right shoulder and tap demand. From there, a breakout above the descending trendline can target 1.1740 next. The key here is watching the reaction after the FVG test — if buyers step in strong, we ride it up.

DOGE just broke above the 0.25 key resistance. The daily chart shows a clean cup-and-handle formation with a potential continuation setup. Price might consolidate just above 0.25, creating a bullish base. Then we expect a continuation move toward 0.35 as next target.

Price spent several sessions consolidating below the $0.618 resistance zone. This horizontal level has been tested multiple times, building up buy-side liquidity above it. We're seeing a rounded base formation — a classic bullish continuation pattern. It signals strong demand and positioning by smart money. If $0.618 gets cleared with volume, we can anticipate...

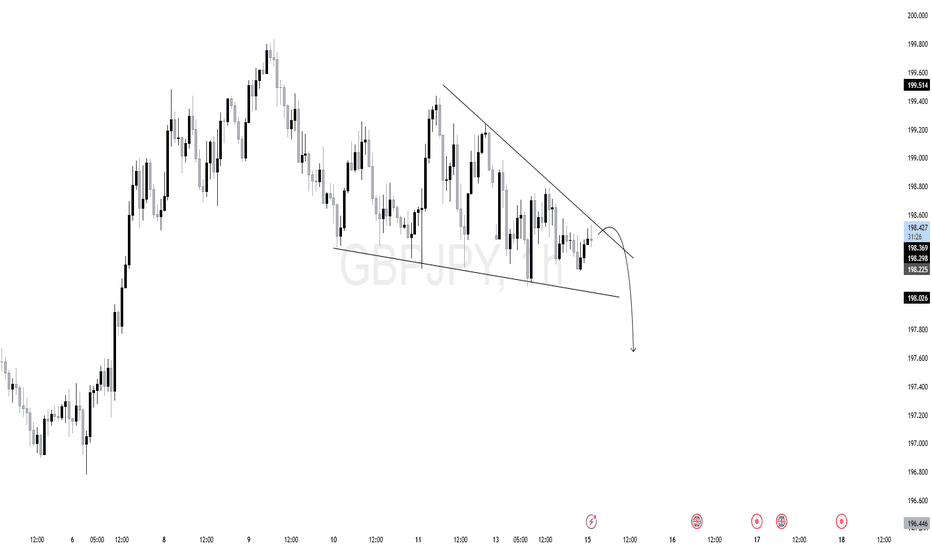

Price is currently forming a descending triangle pattern, with clear lower highs and a horizontal support zone. Trendline resistance is actively being respected. Liquidity is likely building below the horizontal support zone. A false breakout or sweep above the trendline followed by rejection could trigger institutional distribution. As long as the descending...

Price has been in an overall bullish structure, forming higher highs and higher lows. Price tapped into a premium zone, showing signs of exhaustion. After the liquidity run, we saw a rejection from the top, followed by a shift in structure. A bearish FVG has formed, and price has now retraced back into it, offering a potential sell opportunity. As long as...

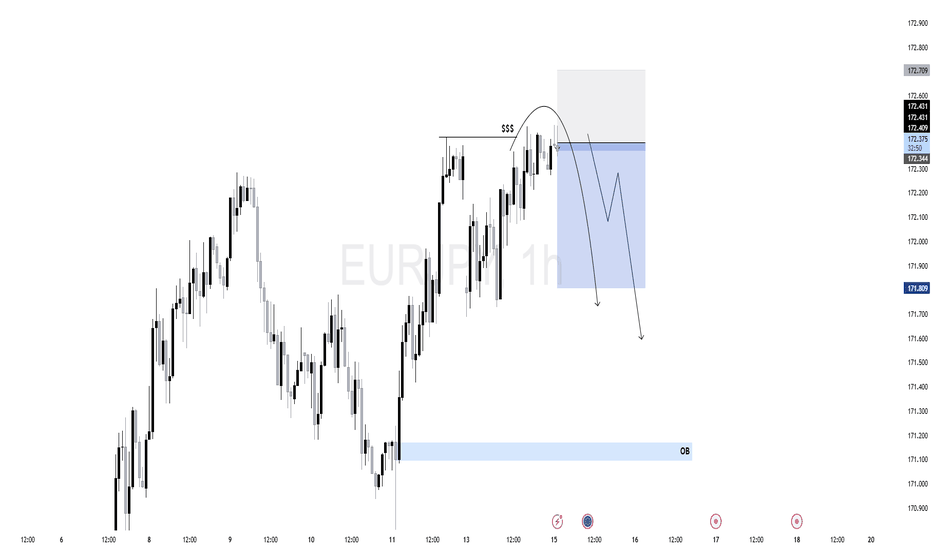

EURJPY recently showed a strong bullish rally off a key 1H Order Block (OB) near 171.200. This rally swept sell-side liquidity before shifting short-term structure. However, current price action shows signs of weakness — multiple rejection wicks near 172.350 and a potential shift in momentum. The corrective structure forming suggests the bullish move may have...

If price holds and reacts from the OB, expect a short-term bullish leg toward: Internal liquidity first (2.07400), Then external buy-side liquidity above 2.08000. Price has been in a clear bearish structure, printing lower highs and lower lows. Recently, price swept multiple layers of internal liquidity (marked as $$$) before tapping into a key Order Block (OB)...

Price has been consolidating after a previous sell-off and is now showing signs of accumulation above a defined demand zone (1.35600–1.35800). The price has respected the ascending internal trendline, forming higher lows — an early sign of bullish intent. Strong bullish rejection from this area confirms interest from smart money. Price tested it and immediately...

Price tapped into a 4H FVG (gray zone 146.800–146.300), a high-probability reversal zone when paired with liquidity sweep and break of structure. The bullish internal trendline was cleanly broken, signaling a short-term shift in momentum. Prior to the drop, price ran buy-side liquidity resting above previous highs (marked $$$), fulfilling liquidity objectives...

Price has been in a short-term downtrend with lower highs and lower lows. Recently, price tapped into a clear demand zone (marked gray at the bottom), showing strong bullish rejection and mitigation. A clean break of the descending trendline confirms a potential shift in market structure. Price has now retraced into a Fair Value Gap (FVG) after the breakout —...

Price previously rallied strongly from a Fair Value Gap (FVG) at the bottom of the chart, forming a bullish market structure. After a bullish displacement, BTC consolidated in a tight range (reaccumulation) and swept internal liquidity before breaking down. Now, price has returned to a critical discount zone around 107800–107600 First Target: 109,229 —...

Liquidity has been swept. Supply has been met. The price entered a previously established supply area (1.36950–1.36700) and showed early signs of rejection The break of the short-term trendline coupled with price failing to hold above the highs could signal a shift in structure toward a bearish leg. If the rejection confirms, price is likely to seek rebalancing...

EURUSD swept short-term sell-side liquidity and printed a strong displacement above the relative equal highs. Price is now in premium territory and likely hunting liquidity before rebalancing. Bias remains bearish if price fails to form higher-timeframe continuation. Ideal setup would be a short from signs of rejection toward 1.17163 FVG zone.

Gold swept short-term sell-side liquidity and tapped into a daily FVG, where price is currently consolidating. The 4H chart shows two potential paths: Retrace Scenario: Price may rally short-term into the 4H FVG zone for a premium-based entry — ideal area for shorting continuation aligned with the bearish daily and weekly narrative. Immediate Breakdown: If...

Price swept internal liquidity before dropping into a clear 1H Fair Value Gap (FVG), which acted as a draw on liquidity. Following the mitigation, GBPUSD is now retracing toward a high-probability supply zone. Expect potential rejection as price rebalances inefficiency and seeks sell-side liquidity. Watch for bearish confirmation inside the supply zone — ideal...

Bias: Bearish after liquidity grab at 1.14392 Setup: Wait for the sweep ➤ BOS ➤ Enter short Target: 1.13600 Price is forming a range-bound consolidation, but the internal structure shows liquidity building below and above. The market seems poised to run the 1.14392 high, grabbing buy stops above the short-term high. After that sweep,i see a rejection and...

Price rallied strongly into a bearish FVG (Fair Value Gap) around 3,335 after reclaiming demand...However, this rally lacked conviction and broke structure to the downside, forming a lower high and a weak low retest. Ideal short setup: Price returns into the FVG, rejects around 3,333–3,335, then shows signs of displacement downward. First target: Break below...