Tr8dingN3rd

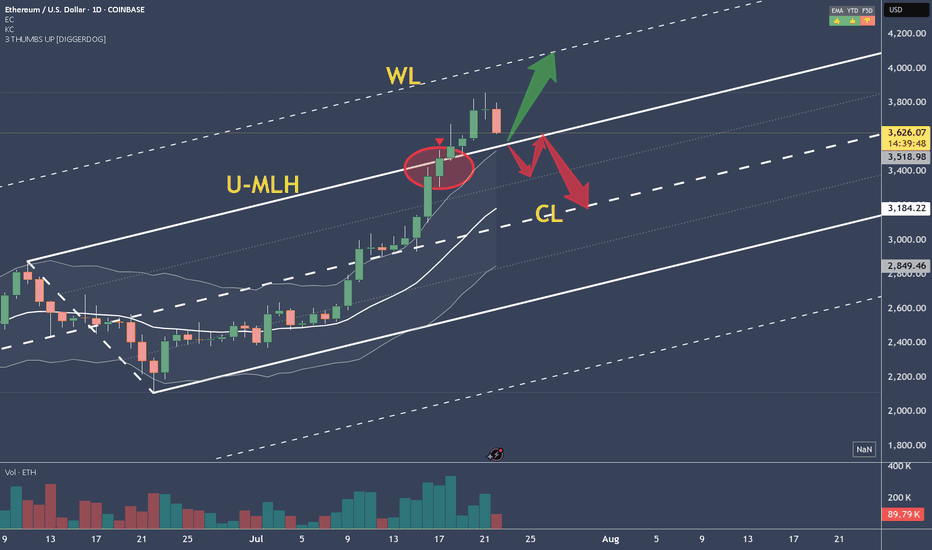

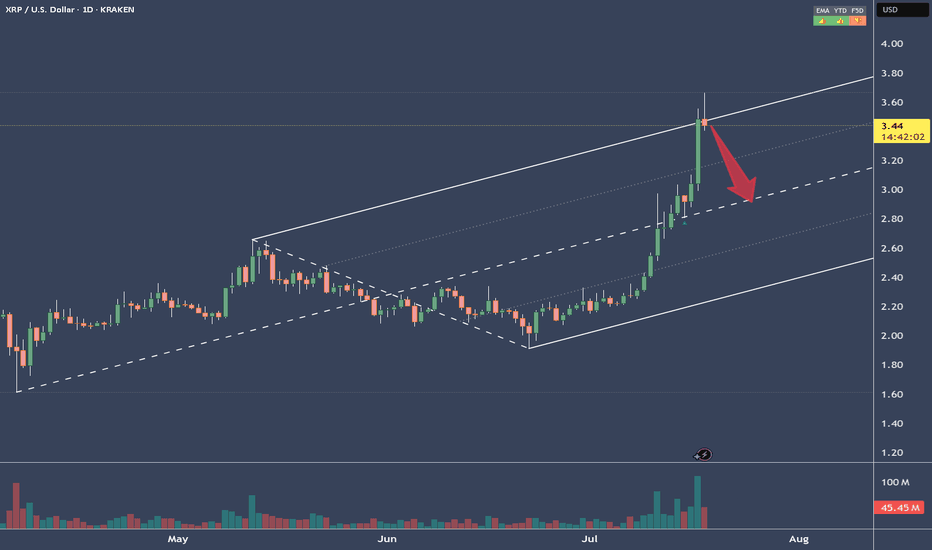

PremiumAfter reaching the Centerline, price eitheradvances to the Upper Extreme (U-MLH), or it reverses and it's target is the L-MLH, the lower Extreme of the Fork. An Open & Close below the Centerline would indicate further progress to the downside. A stop above the last high with a target around 2 would be the trade I would take.

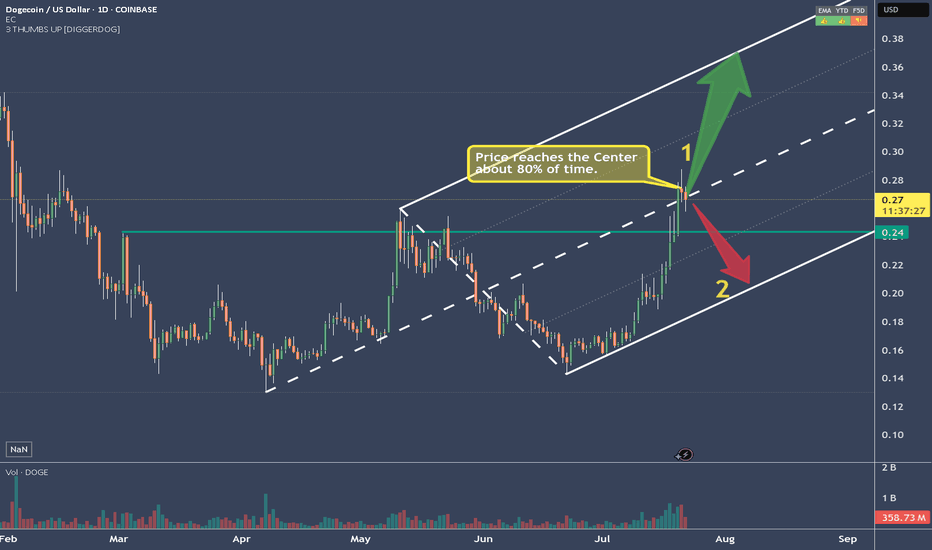

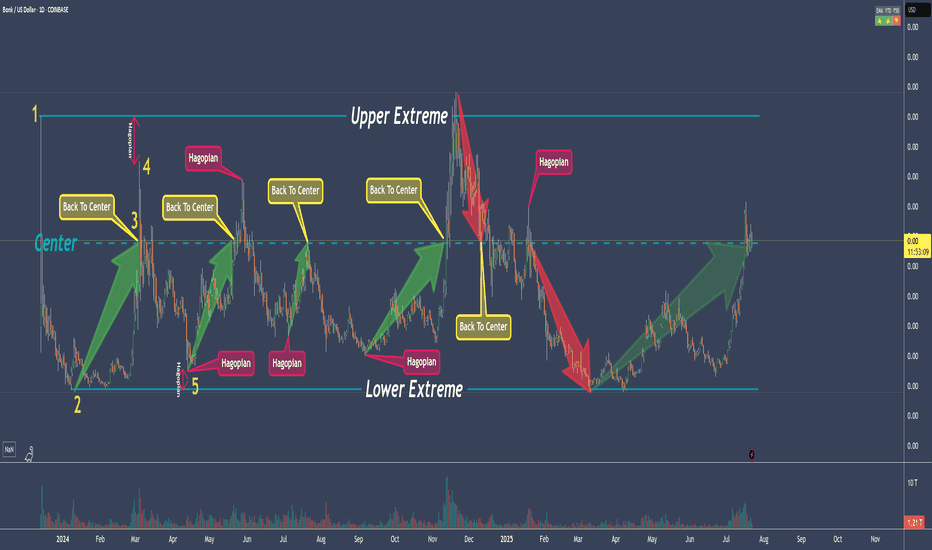

Do you want to know why trading with median lines, also known as pitchforks, can be so successful? It’s simple: Prices swing from one extreme back to the middle. From the middle, they often swing to the other extreme. What do we see on the chart? - The upper extreme - The center - The lower extreme So far, so good. Now let’s follow the price and learn a few...

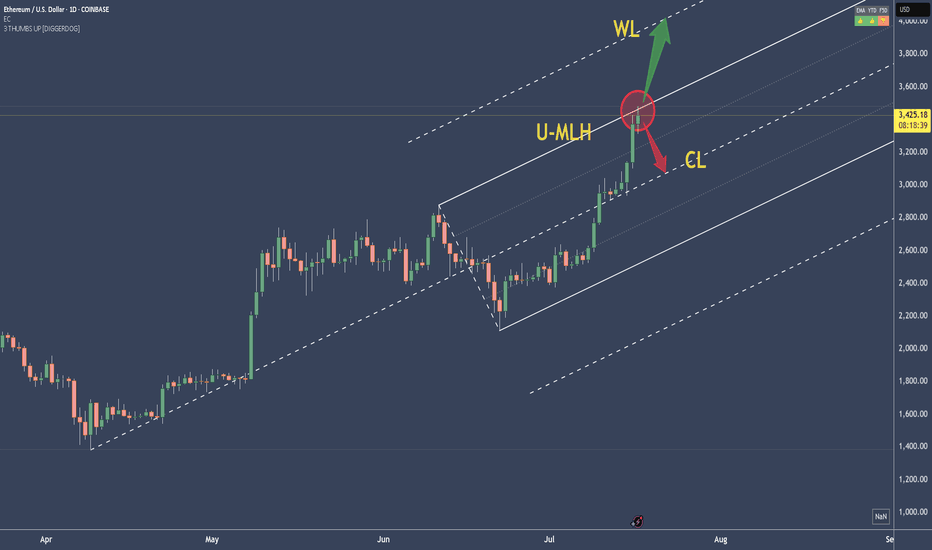

What do make of the current situation? What if you are long? Here's what to expect: a) support at the U-MLH, further advancing up to the WL b) open & close within the Fork. If so, there's a 95% Chance of price dumping down to the Centerline. Taking 50% off the table is never bad. 50% money in the pocket if price falls down to the Centerline. Or if it advances...

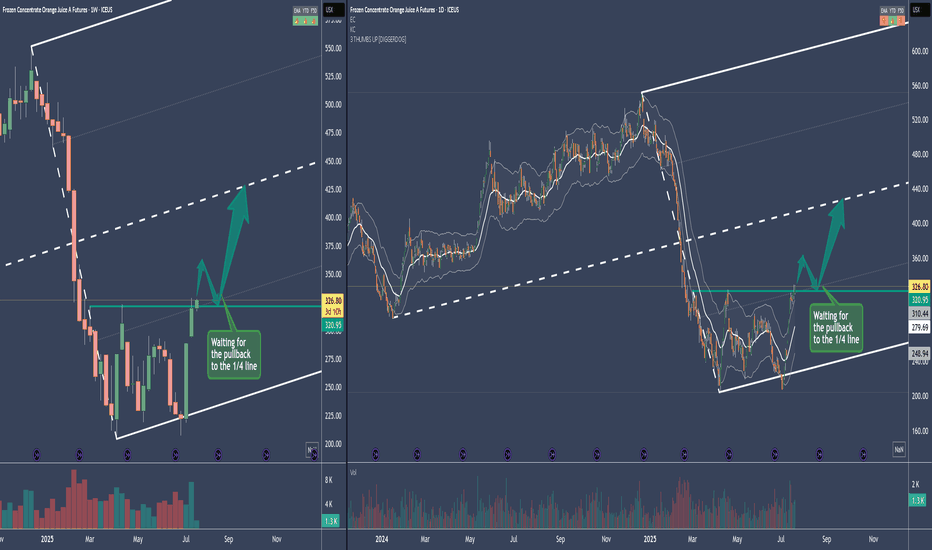

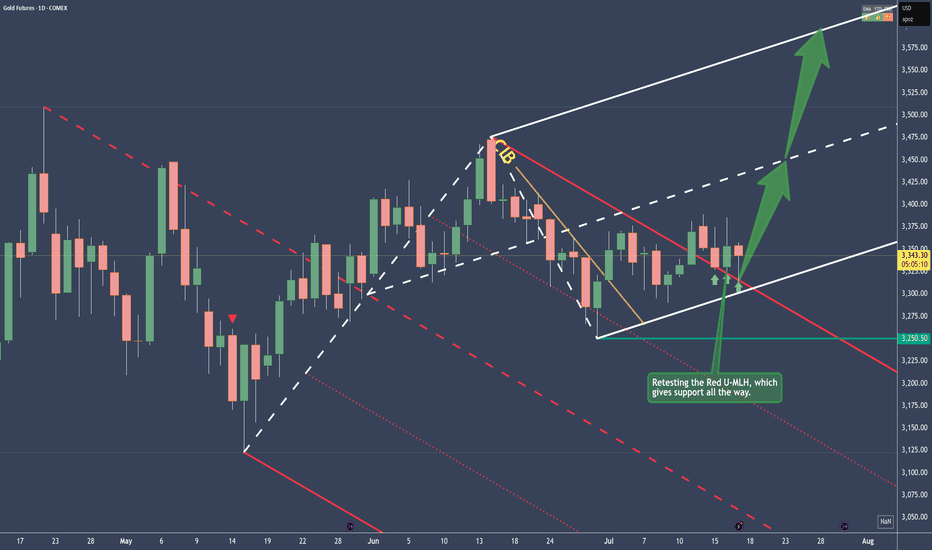

The Medianline se aka Fork, is a pullback Fork. So what we want to see is a reversion to the mean after this drop. The sideways action from Mar. to Jul. is a "loading" period, where Commercials load their boat. If we break the resistance, it's usual that there will be a pullback to the prior resistance - now support. Or even into the loading zone. Entries will...

Price traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior. From there on, sideways action, until the break of the Red U-MLH happened. After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long...

So, that was a nice long trade. Now price is stretched at the Upper Medianline Parallel (U-MLH). As of the time of writing, I already see price pulling back into the Fork. A open and close within the Fork would indicate a potential push to the south. Target would be the Centerline, as it is the level where natural Meanreversion is. Observation Hat ON! §8-)

Medianlines, aka "Forks" have a simple but effective ruleset inherent. These rules describe the movement in certain situations. And of course, the most probable path of wher price is trading to. Here we a rule in play that projects more movement to the upside, even if BTCUSD has had a strong pullback to the south. Let's see: If price is closing above a...

Price tagged the U-MLH, the stretch level. Think of it like the 2nd STDV. Now think Mean Reversion. With such a stretch, price has a high chance to revert to the mean - down to the Centerline (CL). What is this information good for? a) take profit (...or 50% partial) b) short on intrady signs But if it is open and close above the U-MLH, then there's a good...

BTCUSD got rejected at the Centerline the second time. This is super bearish. If it's closing below yesterdays low, that's a clear short signal to me. Taking 50% gains off the table is never bad. Because then you still have 50% if it's going up further. Otherwise, you got 50% booked. Don't let gree eat your brain §8-)

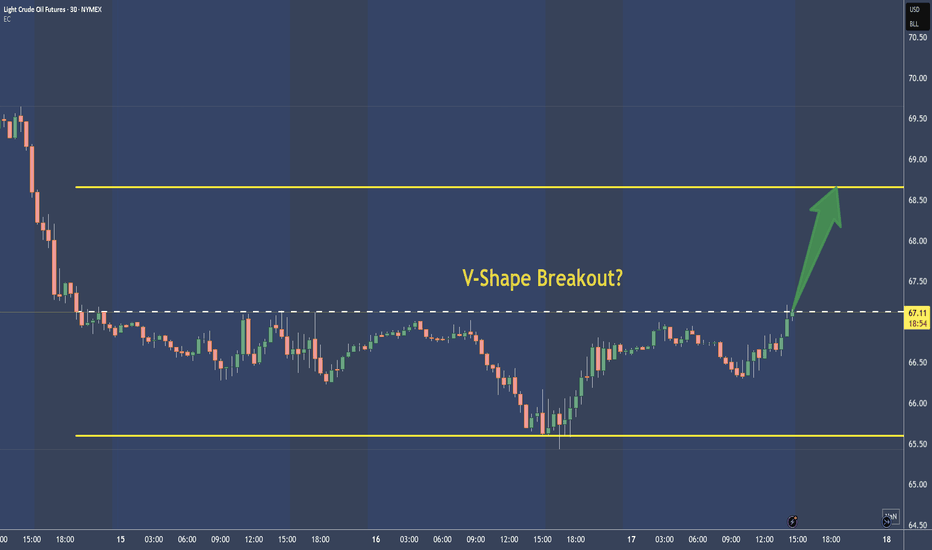

Not much to say here. To me it's just a BUY, with the target around the upper yellow line. Stop depends on movement. I add and remove Contracts, until there is a nice ternd or momentum established. Trade is toast below the V.

Price got rejected at the U-MLH. DXY shows some strenght too: A close below yesterdays low is a short for me.

If the current pullback can break above the Centerline, then massive upside is on the plate. But if it gets rejected, massiv downside is possible. We don't know yet. Just let the market tell you.

This is the weekly chart of NVDA. We can clearly see a 3-Drives pattern forming. If this pattern plays out, the centerline would be my target. Of course, it's still too early to short. But I’ve got my hunting hat on and I'm watching for signals on the daily chart. One would be a break of the slanted trendline—but there are a couple of other conditions that need...

Price retests the L-MLH. VI. - Price breaks upward, target is the centerline VII. - Price reverses again, then the target is the 1/4 line, with a subsequent extended target at the red centerline, and possibly even lower at the white dashed warning line. On a personal note: I was once again told that the price didn’t do what I had projected. ...yeah, really,...

In 2020, we had the action, and since 2024 the market's reaction. Just as Newton describes the universal law of Action/Reaction. However, we see that USFD has reached the centerline of the white Fork, which coincides with the reaction high and the upper median line (U-MLH) of the yellow fork! There is not much more to say about it. It's a clear Short to me, and...

WD-40 changed direction to the south after the 5/0 count. Soon it will become clear whether the support from (4) holds or not. But what is already apparent is that WDFC is struggling significantly at the trend barrier. No surprise, since this price level coincides with the natural resistance. To me, this seems like a cheap short, even though a new, true low...

To places where no stock price has ever gone before.. What makes VISA so special? The credit industry is currently staring into the abyss due to massively rising payment defaults. Why is VISA skyrocketing in price, breaking through every barrier as if they were made of butter? I don't know, and I'm very puzzled. What will happen if economic conditions become...

Price is still in upward mode. Why am I bearish? 1. Rejection in the Resistance Zone 2. Second Hagopian 3. Close below the Red Forks 1/4 Line PTG1 is the Center-Line. Potential further PTG's below at the 1/4 Line and then of course the L-MLH. Playing it with Options which give me much more leeway. For a hard Stop I would put it right behind the last high above the TB.