UA_CAPITAL

EssentialSOL | Solana Game Plan - Swing Long Idea 📊 Market Sentiment Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets continue to favor crypto assets. We’re currently seeing a minor retracement, primarily driven by the Nasdaq’s pullback — but...

ETH | Ethereum Game Plan - Swing Long Idea 📊 Market Sentiment Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets are favoring crypto assets in particular. 📈 Technical Analysis Price swept the range low (Weekly Fair Value Gap),...

📊 Market Sentiment Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets are favoring crypto assets in particular. 📈 Technical Analysis SUI recently gained bullish momentum, largely following Bitcoin's strength. We’re now seeing a healthy...

📈 Market Context: Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook. While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic. Greed has cooled off into a more neutral stance. Historically, August often...

📈 Market Context: Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook. While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic. Greed has cooled off into a more neutral stance. Historically, August often...

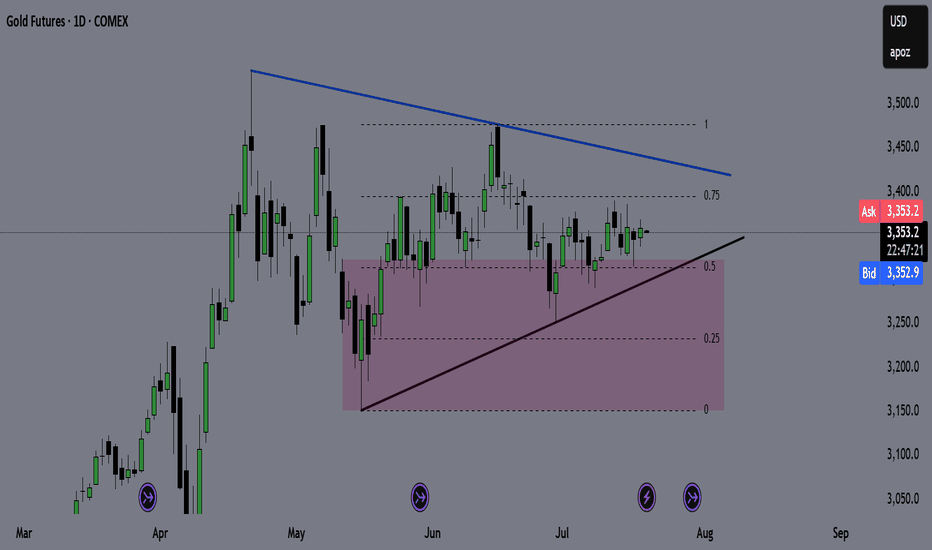

📈 Market Context: Gold is currently trading within an accumulation zone as the market begins to price in a potential 0.25% rate cut by the Fed. This macro expectation is supporting the broader bullish bias in the commodities market. 🧾 Weekly Recap: • Price broke below the HTF bullish trendline — a key sign of weakness and potential structural shift. • However,...

📈 Market Context: Traders are currently anticipating a possible 0.25% rate cut during the upcoming September FOMC meeting, which continues to support the broader bullish framework. Although the market pulled back after the Non-Farm Employment Change data came in below expectations, overall optimism remains. Sentiment has now cooled off from last week's greed and...

📈 Market Context: The market is pricing in a potential 0.25% rate cut in the September FOMC meeting, keeping the overall structure bullish. Although we saw a retracement after the Non-Farm Employment Change came in weaker than expected, bullish sentiment remains intact. Currently, market sentiment has shifted to neutral from last week’s greed. Augusts are often...

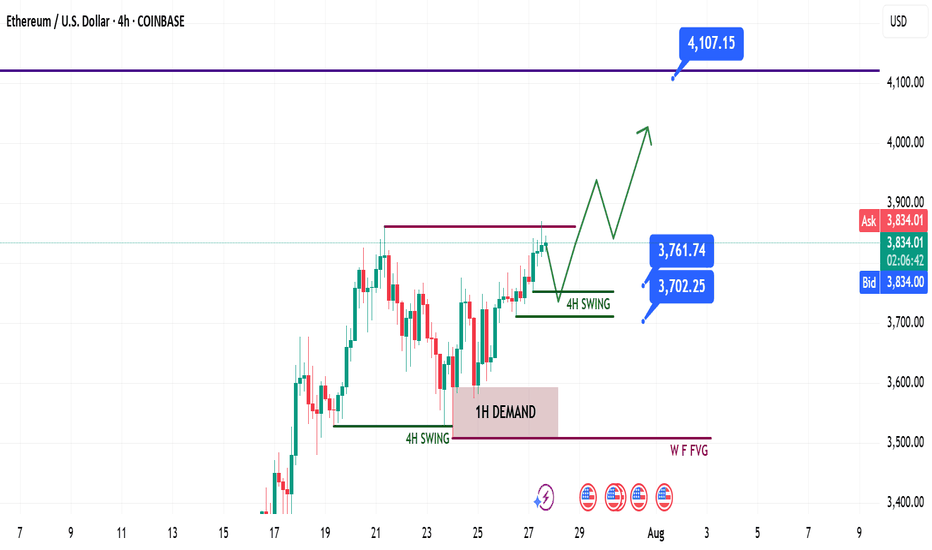

📈 Market Context: ETH remains in a healthy bullish structure. Despite the recent retracement, price action is still supported by strong demand zones on higher timeframes. No change in the overall sentiment from earlier this week. 🧾 Weekly Recap: • Price rejected from the Fibonacci 0.5 EQ level — a discounted zone in my model. • While doing so, it also ran 4H...

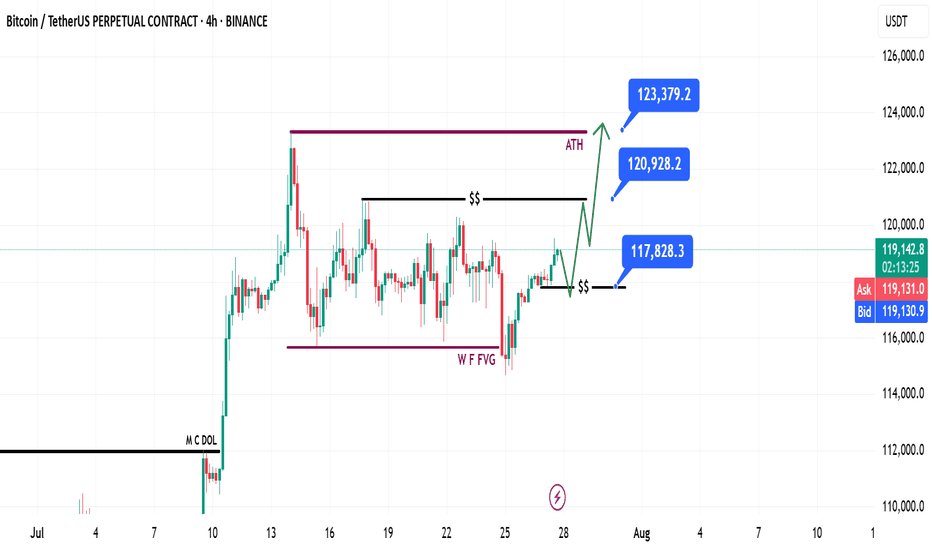

📈 Market Context: Bitcoin maintained its bullish momentum, driven by continued institutional demand and a supportive U.S. policy backdrop. Last week’s gameplan played out well — solid profits were captured (see linked chart below). 🧾 Weekly Recap: • Price made a bullish retracement into the Weekly FVG (purple line) exactly as projected in last week's post. • From...

📈 Market Context: ETH followed the broader crypto market momentum led by Bitcoin, supported by institutional demand and positive macro policies in the U.S. Last week’s plan played out cleanly — we saw strong gains from the 1H demand zone. 🧾 Weekly Recap: • Price swept 4H swing liquidity and formed a 1H bullish BOS • Created a solid 1H demand zone, from which...

🧾 Weekly Recap: • Price tapped into the 1H Demand Zone (red box) and ran the 4H swing liquidity before bouncing to clear internal range liquidity. • This move was followed by a retracement which led to a break of the bullish trendline. This may signal the beginning of a broader accumulation phase. Expect choppy price action targeting internal liquidity both...

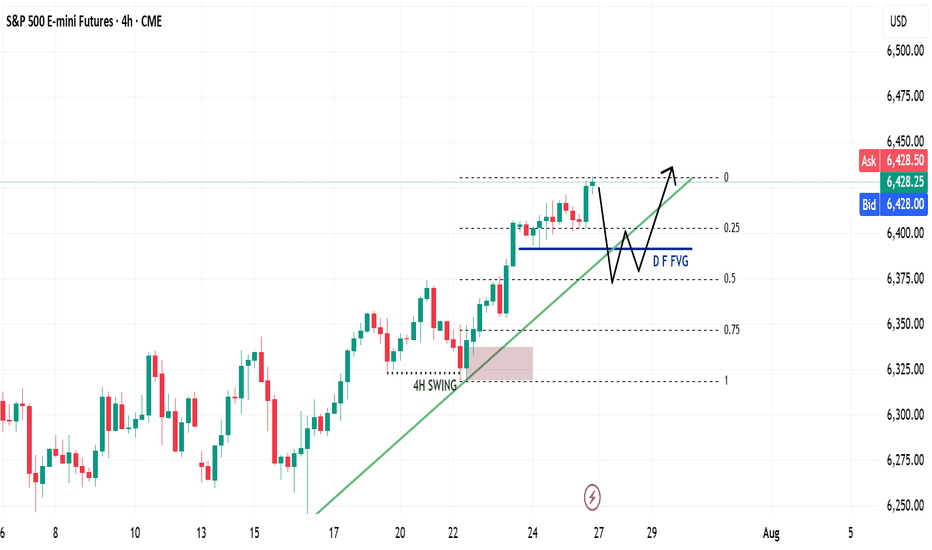

🧭 Market Sentiment The overall sentiment remains bullish, supported by: • Declining inflation figures • Trump’s pivot toward aggressive rate cuts This shift reinforces a risk-on environment across U.S. indices. 🔙 Previous Week Recap • ES continued its price discovery journey • Price ran the 4H swing liquidity and shifted market structure • A clean 1H demand zone...

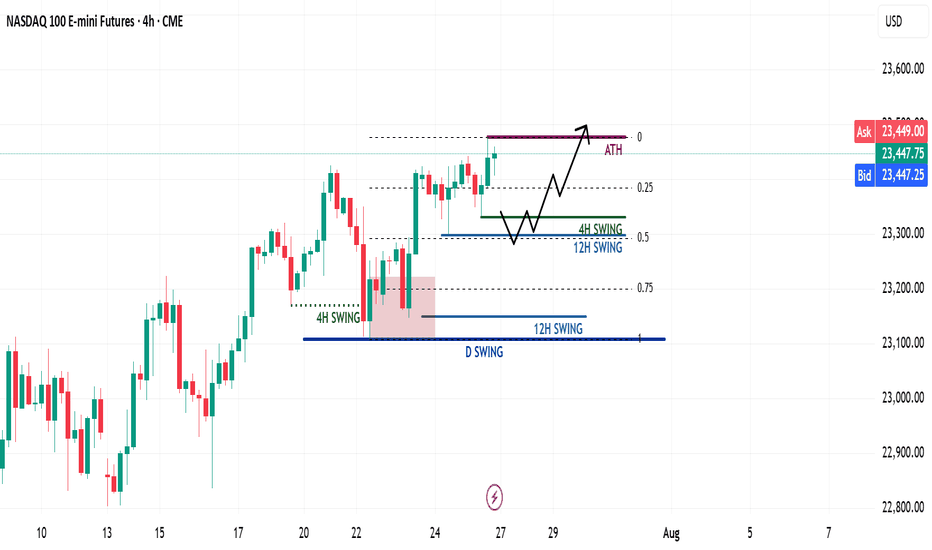

🧭 Market Sentiment The overall sentiment remains bullish, supported by: • Lower inflation data • Trump’s policy shift toward aggressive rate cuts This creates a strong risk-on environment across U.S. indices. 🔙 Previous Week Recap • NQ continued its price discovery phase • Price swept 4H swing liquidity and triggered a market structure shift • A new 1H demand...

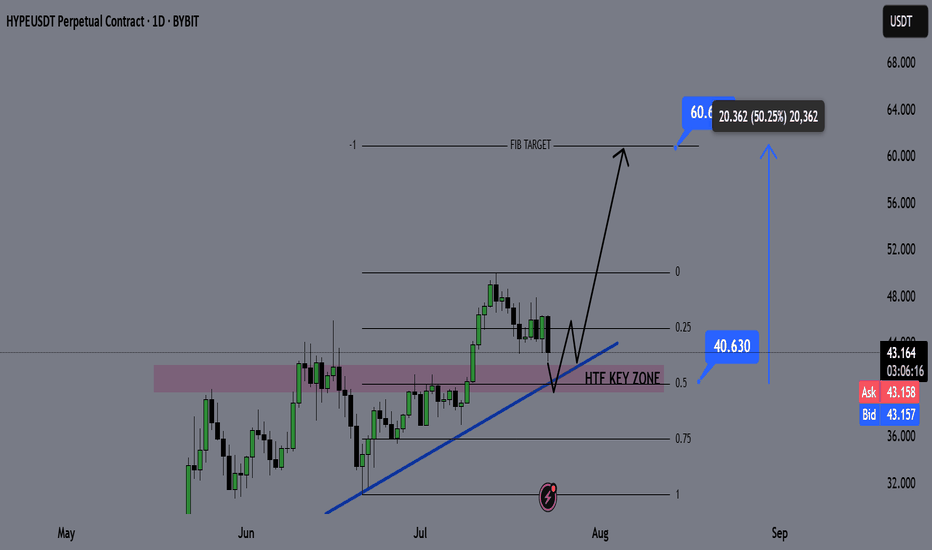

📌 Fundamental Sentiment: The crypto market — alongside broader risk assets — continues to gain traction. This momentum is largely fueled by rising expectations of policy shifts in the U.S., with Trump intensifying pressure on Jerome Powell and advocating for aggressive rate cuts from the Fed. 📌 Technical Analysis: HYPE is approaching a key HTF bullish...

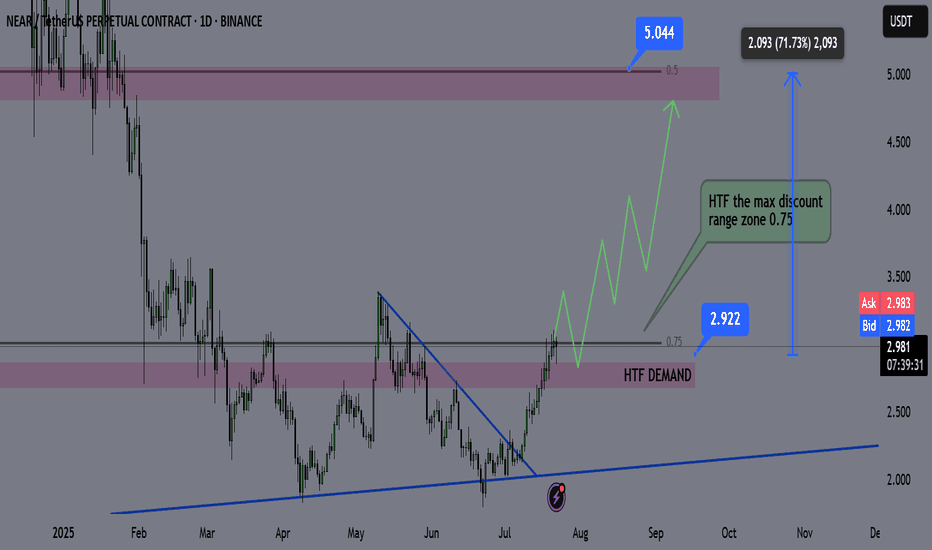

📌 Fundamental Sentiment: The entire crypto market is rallying, alongside other risk assets. This is mainly driven by U.S. policy expectations — Trump is pressuring Powell to resign and aggressively pushing for rate cuts from the Federal Reserve. 📌 Technical Analysis: NEAR has recently broken and closed above a significant HTF support/resistance...

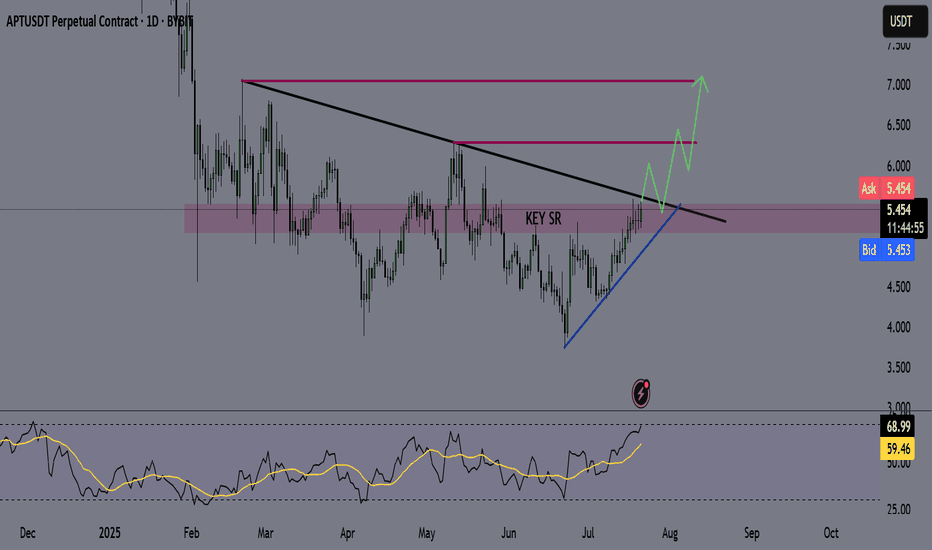

📌 Fundamental Sentiment: The entire crypto market is rallying, alongside other risk assets. This momentum is largely driven by U.S. policy expectations — specifically, Trump’s increasing pressure on Powell to resign and aggressively push for rate cuts from the Federal Reserve. 📌 Technical Analysis: Price is currently testing the HTF supply zone with strong...

🪙 GOLD (GC) Weekly Recap & Game Plan 📊 Market Context: Price is currently forming an accumulation pattern. The purple zone marks a key weekly demand zone, and I expect a potential bounce from that level. I'm closely watching for trendline deviations to determine the directional bias. 🎯 Game Plan: If price drops below the trendline and bounces from the weekly...