Warrenducatz

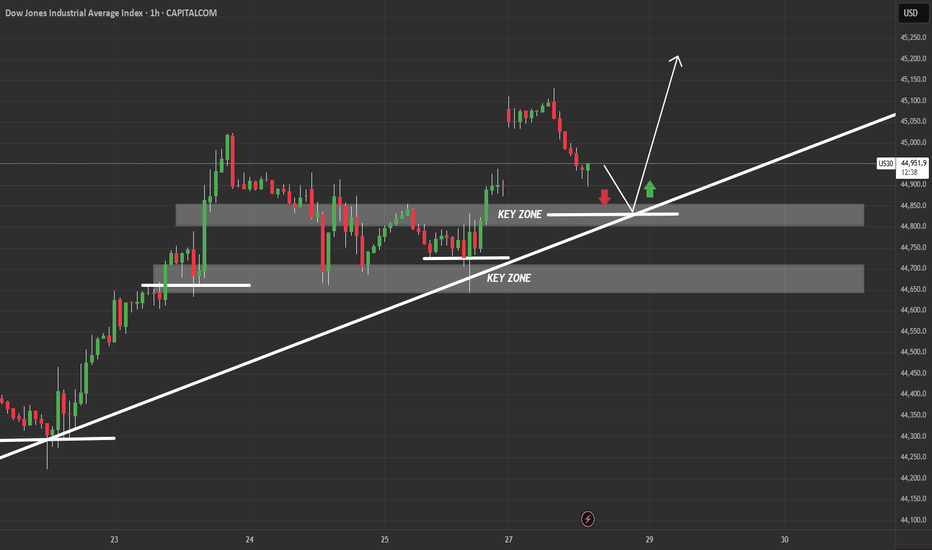

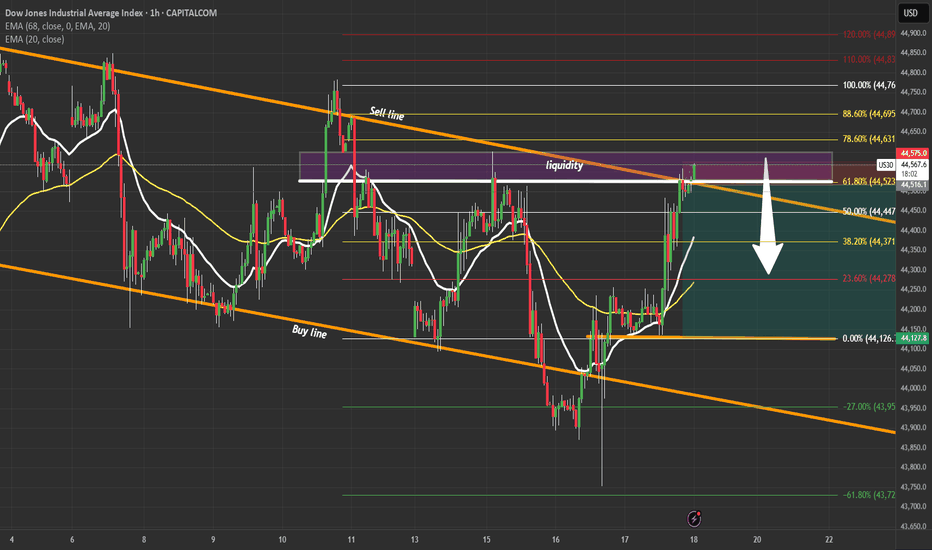

EssentialHope everyone had a great weekend! This chart outlines a critical US30 intraday structure with price currently pulling back into a key confluence zone composed of: A rising trendline from July 23rd Two stacked demand zones, the upper around 44,850 and lower near 44,700 Bullish Scenario (Preferred Bias): If price respects the trendline and upper key zone, we...

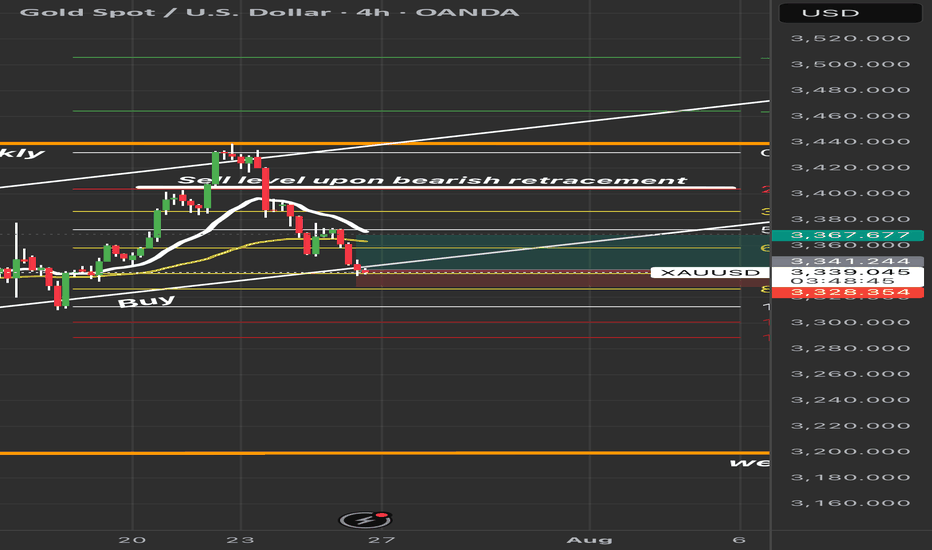

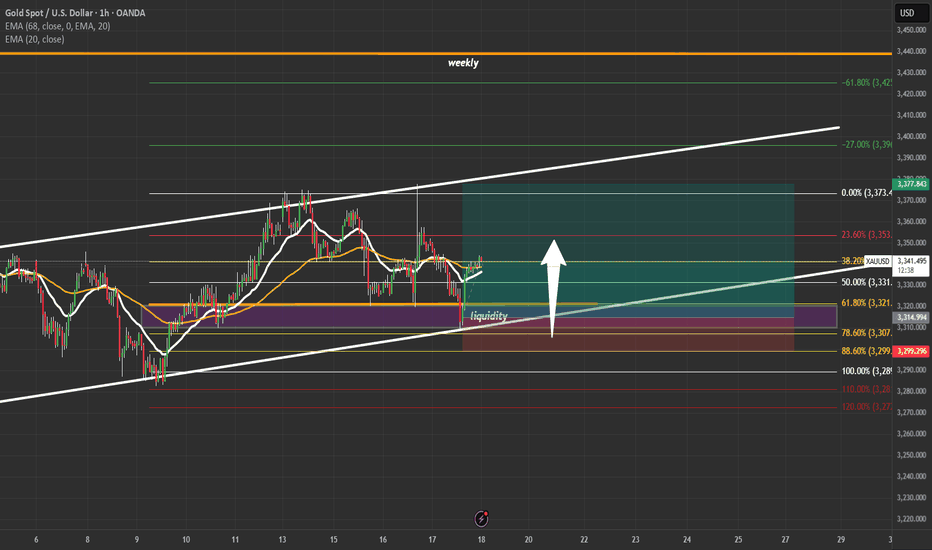

Gold is testing a key ascending trendline support around 3,340. If price holds this level, we could see a strong bullish reaction targeting 3,367 and potentially 3,400+. A break below 3,328 invalidates this setup.”

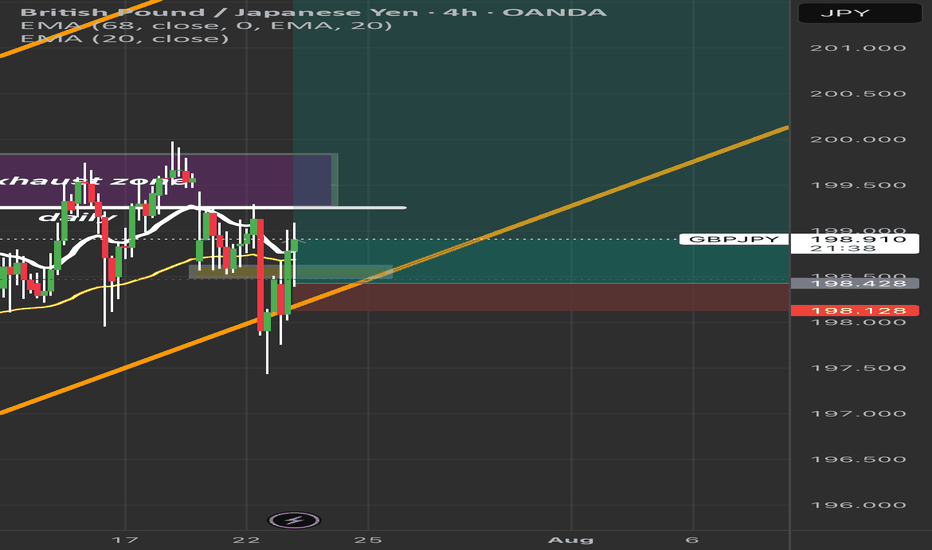

GBPJPY is sitting at a critical point inside an ascending channel. After rejecting the exhaustion zone multiple times, price is trying to reclaim bullish momentum. Key levels to watch: ✅ Bullish Bias: Hold above 198.400 and break past 199.200 for continuation toward 200.000+. ⚠️ Bearish Risk: A break below 198.400 could signal a deeper correction. The 20 EMA and...

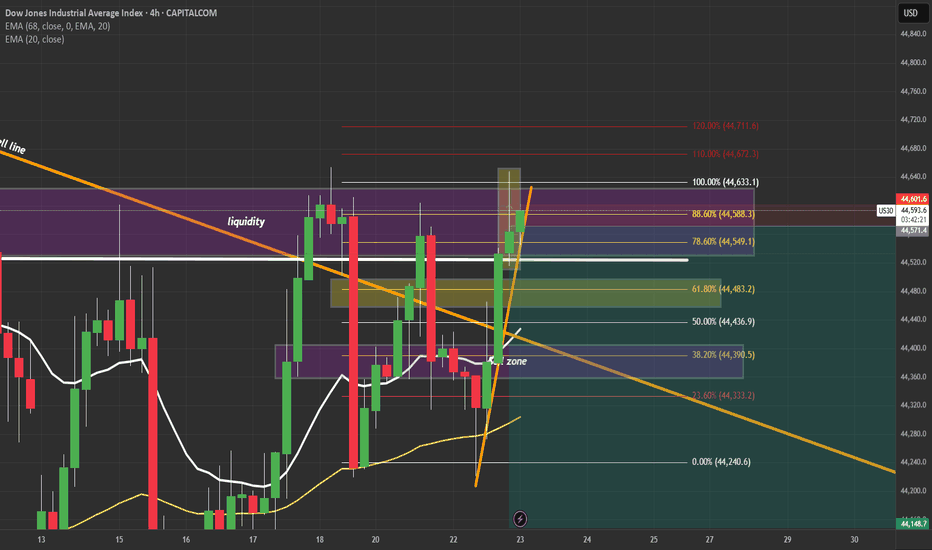

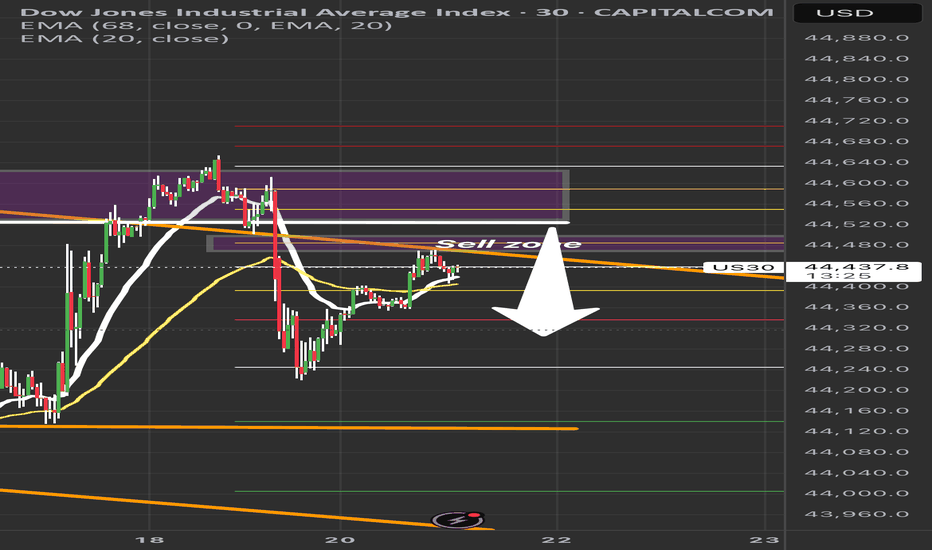

US30 just printed an inverted hammer on the 4H at a major supply zone (44,550–44,600). This is a critical decision point: ✅ Bearish Case: If price rejects and closes back below 44,530, sellers could take control with targets at 44,380 → 44,180 → 44,020. ✅ Bullish Fakeout: If price breaks and holds above 44,620, expect a push toward 44,700 and 44,900. 📌 What I’m...

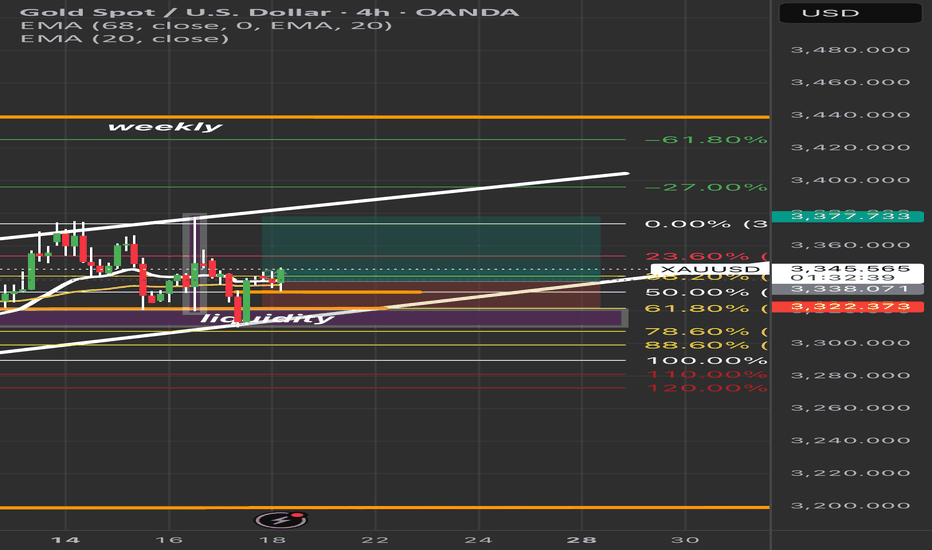

Price is holding above the key liquidity zone and bouncing near the 61.8% Fib retracement. Watching closely for a continuation toward 3,377 (0% Fib level) if structure holds. EMA alignment suggests potential short-term bullish momentum, but a break below 3,322 invalidates this bias. 📌 Key Levels: • Entry Zone: 50%-61.8% Fib • Target: 3,377 • Invalidation: 3,322

Price is pulling back into a key sell zone (44,480–44,550) after a strong bearish move. ✅ Confluences: • Previous liquidity zone • 50–61.8% Fib retracement • EMA rejection overhead Plan: Waiting for bearish confirmation before short entry. 🎯 Targets: TP1: 44,300 TP2: 44,150 TP3: 44,000 ❌ Invalidation: Break above 44,600. Patience = Precision. No confirmation,...

Gold (XAU/USD) | Liquidity Grab + Fib Zone Price swept liquidity and respected ascending channel support. If bulls hold above 3,330, next target = 3,377. 📊 Is this the reversal we’ve been waiting for? Are you long or short on gold? Let’s talk below 👇

US30 | Liquidity Grab at 61.8% Fib 🔍 Price tapped a major liquidity zone inside the descending channel near the 61.8% Fibonacci level. Plan: Waiting for confirmation to short toward 44,150. Breakout or rejection? Drop your thoughts below!

📉 Description: Gold is currently consolidating at the apex of a descending triangle / symmetrical squeeze, hovering between dynamic resistance from the EMA 20 and a confluence of horizontal supply + trendline. We’re seeing repeated rejections near $3,300, and price is now sitting below both the 20 EMA and the 68 EMA, showing a shift in short-term momentum. I’m...

📈 Description: Price is currently testing a key ascending trendline on the 4H, sitting just below the 38.2% Fib retracement after rejecting near the 0% level. I’m watching this area closely for either: ✅ A bullish bounce from the 38.2%–50% zone with confluence from EMA 20 and trendline support — targeting 0% then -27% extensions (around 21,750 to 22,200), or ❌ A...