WrightWayInvestments

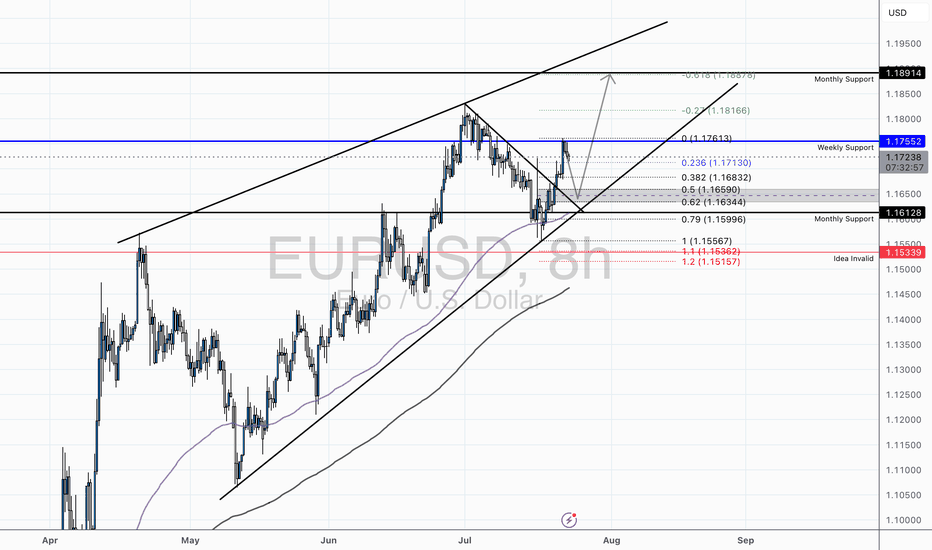

PremiumTechnical Overview: EUR/USD continues to respect its ascending channel structure, currently rebounding from the lower trendline support while trading above the 50 EMA and 200 EMA. After a healthy retracement to the monthly support (1.16128), the pair has shown strong buying interest, supported by bullish RSI divergence from oversold conditions on the 8H...

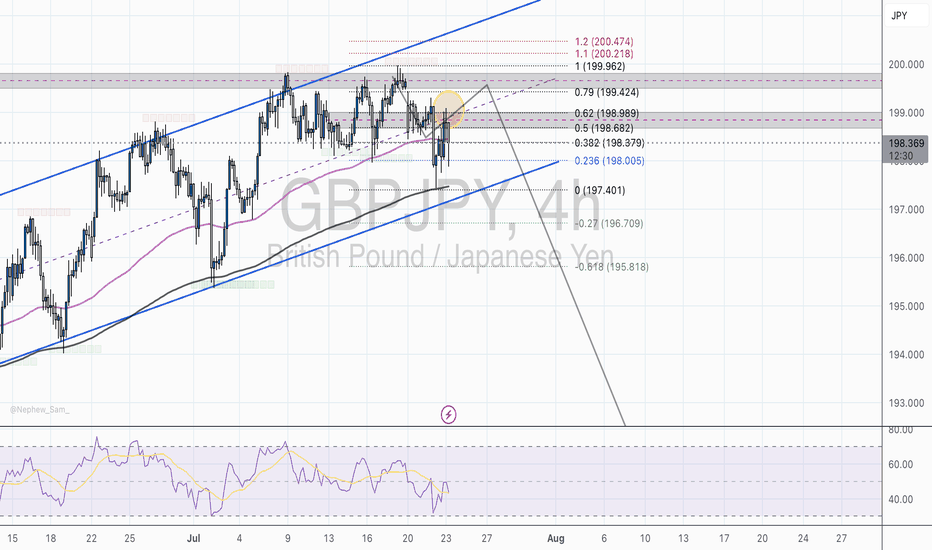

Overview: GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish. Market Structure Breakdown: * Price action failed to sustain...

🧠 Thesis: GBP/USD is showing early signs of a potential bullish reversal from a key confluence zone. While price has recently tested short-term descending channel, we’re currently testing a strong ascending trendline support and prior demand zone. This setup offers a favorable long-risk scenario — so long as price remains above 1.3335 (invalid level). 🔍...

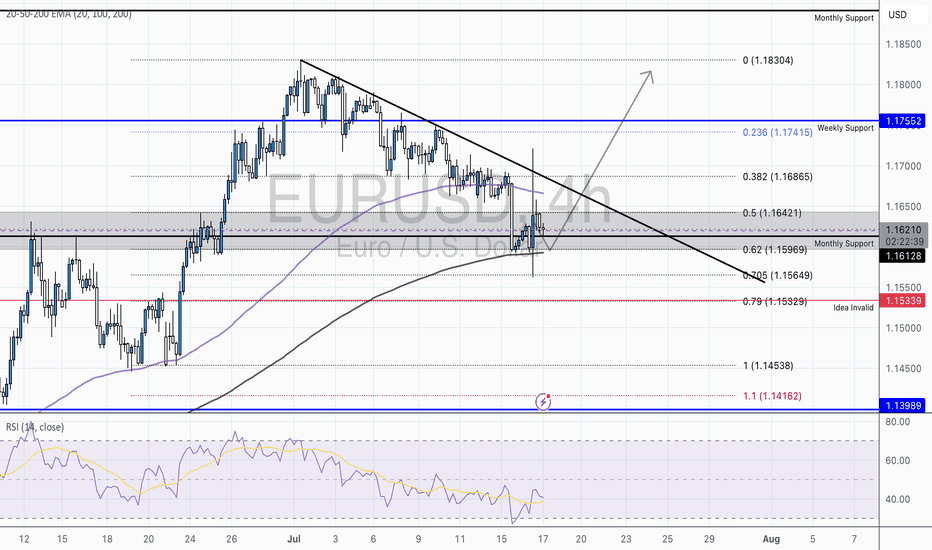

After a strong mid-June rally, EUR/USD has pulled back into a key fib cluster, showing early signs of reversal from a classic falling wedge pattern — often a precursor to bullish breakouts. Technical Breakdown: 📉 Descending Trendline 🔍 Fibonacci Confluence: Price is reacting from the 0.5-0.618 – 0.705 zone (1.16421-1.15969), aligning perfectly with historical...

If you’ve ever wondered how professional traders predict where price might pull back before continuing... the secret lies in Fibonacci Retracement. In this post, you’ll learn: What Fibonacci retracement is Why it works How to use it on your charts (step-by-step) Pro tips to increase accuracy in the market 🧠 What Is Fibonacci Retracement?: Fibonacci...

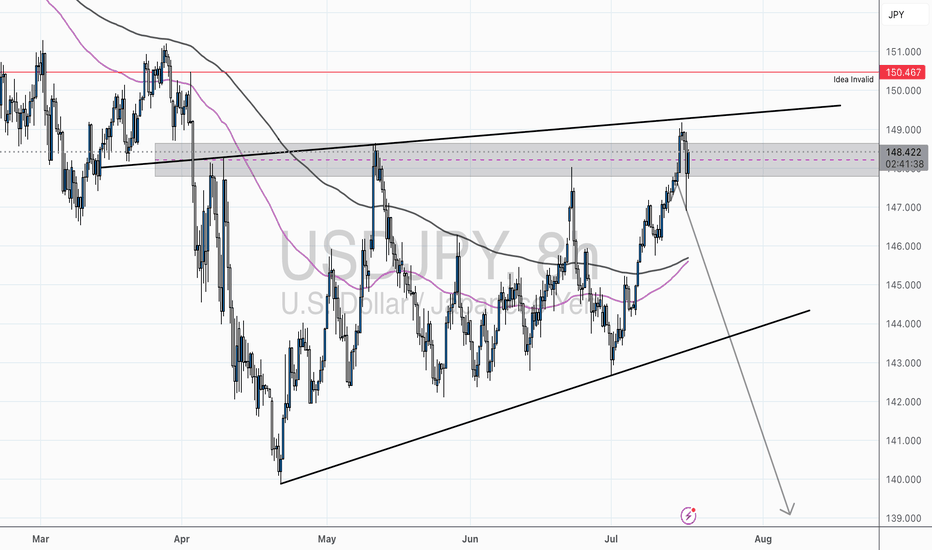

Chart Overview: USD/JPY is printing a textbook rising wedge formation, typically a bearish pattern—especially when occurring at the top of a major move. What makes this setup compelling: Price is testing the upper wedge resistance near the 148.50–149.00 region, a historically reactive zone. There’s clear confluence with the 200 SMA, horizontal resistance, and...

XAU/USD has officially broken out of a falling wedge pattern, triggering a classic bullish continuation setup. The rejection off the 0.618–0.705 fib retracement zone ($3,280–$3,290) acted as a powerful launchpad, pushing price above the mid-structure confluence and EMAs. ✅ Key Technical Highlights: Structure Break: Clear bullish breakout from descending wedge +...

USD/JPY has entered a critical supply zone near 148.700 an area that has historically acted as strong resistance. The confluence of trendline rejection, overextended RSI, and multiple moving average rejections suggest a potential short-term top is forming. 🔍 Technical Breakdown: Macro Pattern: Price is forming a broadening wedge with repeated rejections from...

Introduction to Elliott Wave Theory: Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology. At the core of Elliott’s theory...

4H Outlook by WrightWayInvestments Bitcoin just delivered a textbook breakout from the descending channel and is currently consolidating above the breakout trendline. This is a critical zone where market participants are deciding between continuation or a retest. 🧠 Technical Breakdown: 🔹 Breakout Confirmation – Clean bullish breakout above channel resistance 🔹...

Gold bulls made a strong push out of the descending channel, but now the real test begins. The market is currently in retracement mode after a sharp impulse, and the next move will be decisive. 🔹 Channel Breakout & Retest in Play: Price broke out of the descending channel with momentum and hit the $3,357 region before pulling back. We're now hovering around the...

Gold just gave us a critical reaction off a key confluence zone — and bulls might finally be waking up. Here's the breakdown: 🔹 Falling Wedge Breakout: Price respected the wedge support beautifully around the 0.382-0.5 Fib retracement and has now closed above the upper descending trendline. The falling wedge is a bullish reversal pattern, and we may be witnessing...

We’re seeing a beautiful textbook rejection off the 0.79Fib zone (0.8200), precisely where price tapped into a previous structure break and minor supply block. Price surged into the red zone, wicked just above the 200 EMA, and was instantly met with heavy sell-side pressure — a strong signal of institutional distribution. 📌 Technical Confluences at Play: Price...

USD/JPY is currently consolidating within a well-defined symmetrical triangle, respecting both the ascending and descending trendlines with clean touches. This structure typically precedes a volatile breakout, and the technical confluence here favors a bearish resolution. 🔍 Technical Breakdown: Price failed to hold above the 0.5 Fib level of the recent swing...

We’re currently monitoring what appears to be a textbook Elliott Wave 1-2 structure, with Wave (2) bottoming near $3,293. Price has since pushed up and consolidated above the 0.5–0.382 retracement zone, holding firm at key EMAs and structure. 🔍 Key Technical Highlights: Wave (1): Clean impulsive structure. Wave (2): Corrective decline finding strong support at...

USD/CHF is currently forming a textbook symmetrical triangle consolidation pattern just below key EMAs (20, 50, and 200), signaling potential exhaustion in bullish momentum. Price is compressing against the upper boundary of the triangle, failing to sustain above the 0.382 Fib retracement level (0.82302), which is aligned with the 50 EMA – a known area of dynamic...

Gold has completed a clean Wave (2) correction, bottoming at $3,292.30, respecting both structural demand and fib confluence. Price is now showing early signs of Wave (3) development to the upside. 📌 Key Structure: Wave (1) High: $3,403.30 Wave (2) Low: $3,292.30 (confirmed higher low structure) Market is now consolidating slightly above the 0.5 fib level...

Gold continues its bullish recovery, having completed Wave (4) at the channel low. We're now riding Wave (5) with strong momentum. 🔹 Entry Executed: Entered long at the 0.382 Fibonacci retracement – $3,272.57, a key confluence zone with the EMA and previous structure support. 📈 Bullish Targets: $3,396.89 (0.27 extension) $3,463.25 (0.618 extension) $3,499.84...