EUR/USD remains offered near 1.1550 after US ISM data EUR/USD is trading in negative territory on Tuesday, hovering around 1.1550 on the back of a decent comeback in the US Dollar. The data from the US showed that the ISM Services PMI edged lower to 50.1 in July from 50.8 in June, helping the pair limit its losses.

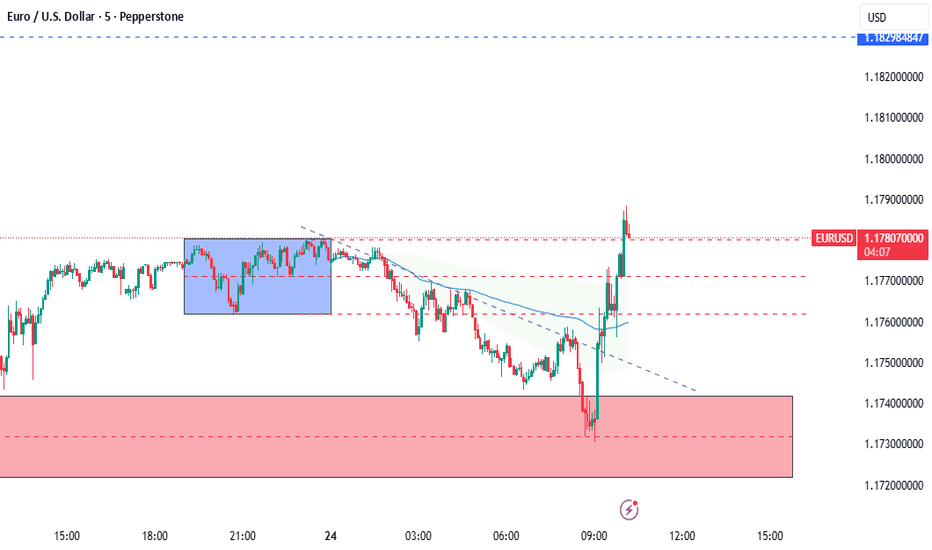

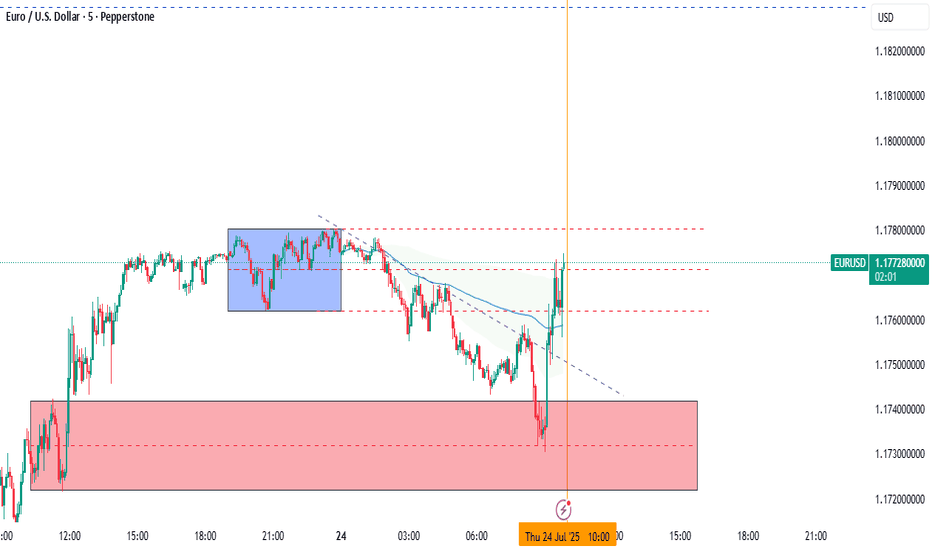

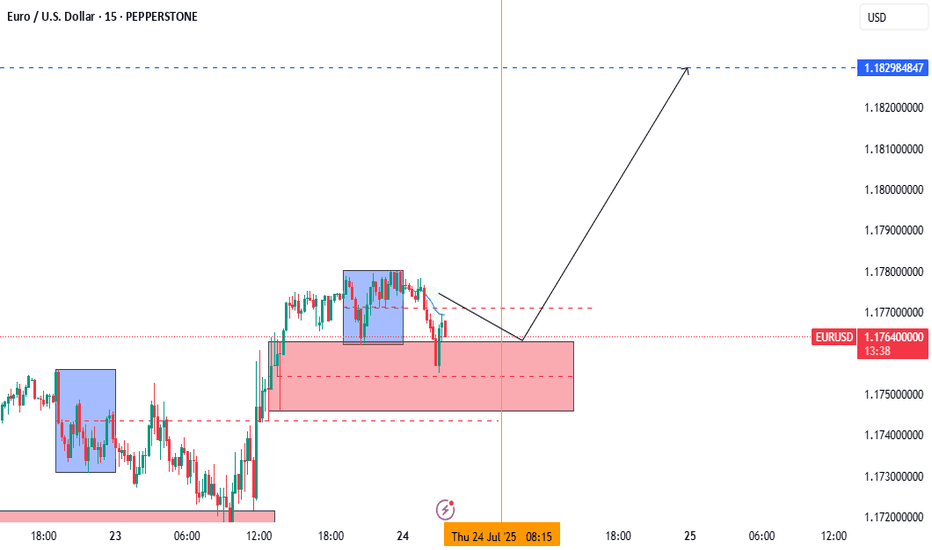

EUR/USD stays defensive below 1.1800 ahead of ECB decision EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

EUR/USD stays defensive below 1.1800 ahead of ECB decision EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

The European Central Bank is expected to hold key rates for the first time in over a year on Thursday. The Eurozone inflation rate has hit the ECB’s 2% target as the US-EU trade deal uncertainty lingers. The EUR/USD pair could experience intense volatility following the ECB policy announcements. The European Central Bank (ECB) is on track to leave its key interest...

EUR/USD climbs to two-week tops around 1.1760 EUR/USD now gathers extra steam and advances to new two-week peaks around 1.1760 on Tuesday. The increasing selling pressure continues to hurt the US Dollar amid steady trade concerns and rising effervescence surrounding the Trump-Powell spat.

Japanese Yen sticks to intraday gains; USD/JPY seems vulnerable near multi-week low The Japanese Yen retains its positive bias against a bearish US Dollar and currently trades near a three-week low touched during the Asian session earlier this Tuesday. The Bank of Japan's (BoJ) Tankan Survey showed that business confidence at large manufacturers in Japan improved...

EUR/USD eases below 1.1800 ahead of Eurozone inflation data EUR/USD is retreating below 1.1800 in the European morning on Tuesday. The pair faces headwinds from a pause in the US Dollar downtrend. Traders move on the sidelines ahead of the Eurozone prelim inflation data and central bank talks due later in the day.

Seven fundamentals for the week: Iran-Israel war, Fed to fire up tariff-troubled markets Premium When will the Fed cut interest rates? That question competes with the Israel-Iran war and the fate of the tariffs America slaps on its peers. US retail sales and interest rate decisions in Japan and the UK keep things lively as well.

Gold price sticks to positive bias as sustained safe-haven buying offsets modest USD strength Gold price sticks to its bullish tone for the third consecutive day on Friday and trades close to its highest level since April 22 through the first half of the European session. Against the backdrop of trade-related uncertainties, a further escalation of geopolitical...

Gold hold on to higher ground above $3,330 Despite last week's significant climb, Gold has begun the week on the back foot, with gains restricted around $3,350 per troy ounce. The recent surge in market mood makes it difficult for XAU/USD to regain momentum. Monday is Memorial Day, thus financial markets in the United States will be closed.

EUR/USD sticks to gains near 1.1400 as Trump extends EU tariff deadline EUR/USD consoldiates latest gains near 1.1400 in the European session on Monday. The pair draws support from persistent US Dollar weakness and US President Donald Trump's extension of the 50% tariff deadline on the European Union (EU) until July 9.

Gold price awaits acceptance above $3,300 as buyers return Gold price is extending its upswing into the third consecutive day in Asian trading on Wednesday. Buyers look to regain the $3,300 on a sustained basis amid persistent US Dollar weakness and heightened geopolitical tensions.

GBP/USD holds recovery gains near 1.3350 as US Dollar loses further ground GBP/USD is trading near 1.3350 in Wednesday’s European session, extending Tuesday's 1% rally. The pair capitalizes on renewed US Dollar sell-off even as risk sentiment turns negative. Fedspeak and trade talks remain in focus.

EUR/USD remains offered around 1.1350 EUR/USD trades well on the defensive for the second day in a row, revisinting the mid-1.1300s on the back of the continuation of the upside impulse in the US dollar. The move followed firmer US PMI data and news indicating the White House may be considering tariff cuts on Chinese imports.

EUR/USD holds steady above 1.1400 ahead of key US data EUR/USD struggles to gather recovery momentum but holds steady above 1.1400 on Wednesday following the mixed PMI data releases for the Eurozone and Germany. Markets await comments from central bankers and US PMI data.

EUR/USD holds steady above 1.1400 ahead of key US data EUR/USD struggles to gather recovery momentum but holds steady above 1.1400 on Wednesday following the mixed PMI data releases for the Eurozone and Germany. Markets await comments from central bankers and US PMI data.

USD/JPY Price Forecast: At make or a break around 140.00 USD/JPY pares some of its intraday losses as the US Dollar strives to gain a temporary ground. The US Dollar has remained weak due to multiple headwinds. The BoJ is expected to continue raising interest rates.

The current rate of CHFJPY is 174.095 JPY — it has increased by 0.14% in the past 24 hours. See more of CHFJPY rate dynamics on the detailed chart. How is CHFJPY exchange rate calculated? The value of the CHFJPY pair is quoted as 1 CHF per x JPY.