alexpv73

PremiumRESISTANCE: $78.50 – $79.50 → Current supply zone capping upside SUPPORT ZONES: $73.00 – $74.00 → Immediate support $69.50 – $71.00 → Critical zone to hold structure GAP TARGET: $85.00 → Upside potential if earnings surprise Trendline: Strong bullish trend since May, still intact

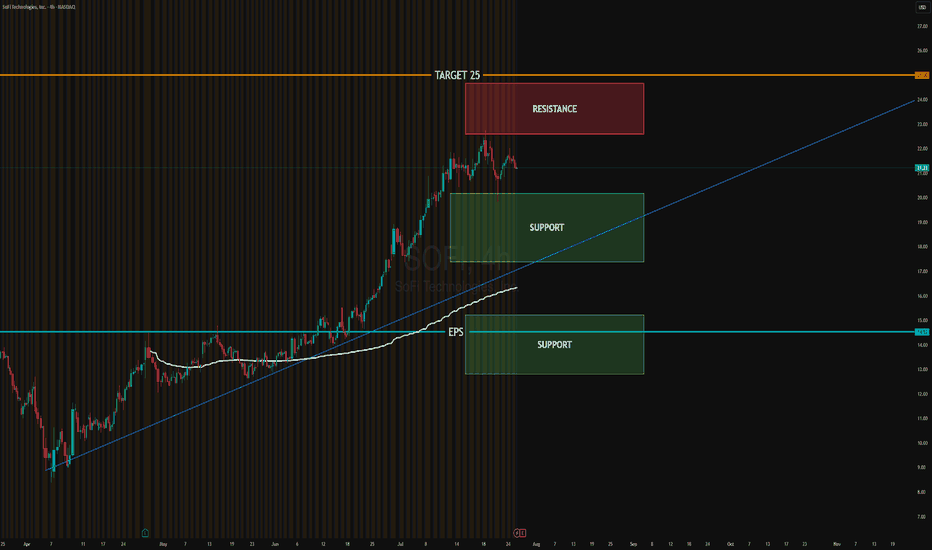

Resistance Zone: $22.50 – $24.00 Support Zone 1: $18.00 – $19.50 Support Zone 2 / EPS Breakout Line: $14.50 Bullish Target: $25.00 Trendline: Still intact — medium-term trend remains bullish

Tesla broke below the triangle formation, signaling a bearish continuation. Trend: Bearish breakdown from consolidation triangle. Key Support (SUP): $300 (now resistance on retest). Next Demand Zone: Strong block between $284–285. Accumulation Zone: $250–220, identified for potential long-term institutional accumulation. Resistance (RES): $300–350 remains a...

NASDAQ:NVDA SUP: 157 | RES: 159.7 – Triangle forming. NASDAQ:AMZN SUP: 220 | RES: 224 – Compression zone. NASDAQ:META SUP: 700 | RES: 739 – Needs reclaim to recover. NASDAQ:NFLX SUP: 1279 | RES: 1302 – Bullish dip hold. #trading #stocks #technicalanalysis #optionsflow #NVDA #AMZN #META #NFLX

Resistance: 630 – Strong supply zone, potential profit-taking area. Support Zone: Around 617 – Recently tested, holding as short-term support. Gap: 615.03 → If SPY loses 617, watch for a retracement to fill the gap toward 615. Major 4H Support: 610.17 – Institutional block. Losing this level would break the short-term bullish structure.

Strongest bullish setups: NVDA, AMZN, TSLA Watch for pullbacks: META (risk of lower lows), NFLX (overextended) Key upside targets: AAPL: $221 NVDA: $199 AMZN: $225 TSLA: $764 GOOGL: $190 MSFT: $450 Support zones to hold: META ($500), AAPL ($200), TSLA ($720)

Trend: Strong bullish continuation. Price just broke above the key 610 level, entering a momentum phase toward the projected 650 target. Structure: SPY is trading inside a rising channel. The upper bound aligns with the 650 level, suggesting this is the next liquidity zone. Support Zones: 610: Now a critical support. If it holds, buyers remain in...

SPY (4H) Trend: Bullish Current price: 604.32 Active resistance block: 604.33 Channel: Rising, intact Key support: 581.99 📈 Break above 604.33 could trigger fast move toward 610+ 🔹 QQQ (4H) Price: 536.25 Resistance: 536.45 Support: 509.95 Volume: Building under resistance 📊 Breakout expected if 537 is cleared with volume 🔹 VIX (4H) Level: 13.89 Trend:...

Long from $125 or $105 with confirmation. 📤 Short if $125 breaks and no absorption is seen. Key resistance: $150 / $165 Key support: $125 / $105

Institutional Swing Analysis – Jun 21, 2025 📈 AAPL Trend: Reversal attempt in downtrend Buy Zones (CALLs): 196 (accumulation) Sell Zones (PUTs): 199 (distribution) Support Block: — Resistance: 201 → 204 → 206 Scenario: Above 200 = continuation to 204–206. Below 198 = back to 195–194. 📈 NVDA Trend: Consolidating at resistance Buy Zones: 142.5 Gap Support:...

******** AAPL Block High: 212.09 Block Low: 194.80 PUT Active: Strike 200.17 CALL Active: Strike 196 Open Gap: 198.22 → 195.70 (likely support retest or fill) Channel: Bearish Scenario: Holding 195.70 = chance to fill gap to 198. If 194.80 breaks = risk drops to 190–186. ******** NVDA Block High: 145.00 Block Low: 137.46 PUT Active: Strike...

SPY ( AMEX:SPY ) – Multi-Timeframe Volatility Channel Analysis SPY remains inside a well-defined ascending volatility channel across all key timeframes (2h, 4h, Daily, Weekly), confirming a strong bullish structure with clear institutional control. 🔸 Short-Term (2h – 4h): Consolidating between 590 and 605, with recent rejection from upper bounds. Multiple PUT...

SPY – June Update SPY continues to trade within a well-defined ascending channel, with bullish momentum intact. Price is currently approaching a major resistance at 608, while holding above the key support at 590. Immediate upside target: 608, followed by potential extension toward the gap fill near 611. If price fails to hold above 590, downside pressure...

Tesla ( NASDAQ:TSLA ) rejected from the $305–$350 resistance zone after a strong rally. Price is now testing the lower end of the previous breakout range, with potential for deeper retracement. Below $305, the next key support lies in the $250–$220 accumulation zone, where $23B was previously bought. If this level breaks, watch for possible institutional defense...

GOOGL Technical Analysis (May 31, 2025) GOOGL remains in a bullish trend with key upside targets: Main target: 185 (gap resistance) Intermediate resistance: 180 Immediate support at 170 (distribution zone) Critical support: 160 (stop-loss level) If 160 breaks, next key supports are at 150, 140 (institutional buy zone 4B), and 130 (weekly support). As long...

Price is consolidating above the 105K level, confirming it as a key support zone. Next target: 125K. Technical support levels: 95K, 88K, 75K. #Bitcoin #crypto #trading #price #blockchain #cryptocurrency #btc #markets #investment #finance #money #economy #cryptoanalysis #altcoin #technicalanalysis