artemfedorov

PremiumIn this Sunday's market crypto-market analysis, I'm sharing trend structures and key support zones for the total altcoin market cap (excluding BTC and ETH), as well as for ETH, XRP, BNB, SOL, HYPE, and BTC. I also outline my main scenarios for market movement through the end of August and the rest of the year. Key takeaways: - Impulsive structures are shifting to...

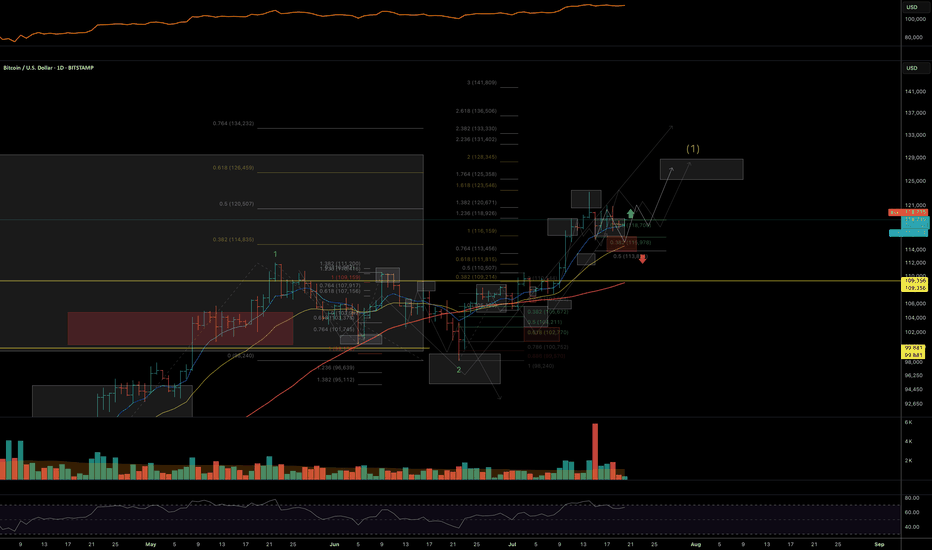

Prepared a new in-depth crypto market video update covering BTC, Ethereum, and key altcoins. Here’s a quick summary of the current landscape and what I’m tracking in the charts: We’ll begin with Bitcoin. After the Fed’s decision, BTC showed a constructive shakeout and has been consolidating tightly around the same range for three weeks. I previously anticipated...

Price has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished. Weekly As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years). 1h timeframe: Thank you for attention and best of luck to your trading!

Made a quick video going over some of the setups I see developing in Bitcoin and a few altcoins I personally track and trade. Thank you for your attention and I wish you successful trading decisions! If you’d like to hear my take on any other coin you’re following — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

New Crypto-Sunday market review video, where I share my current analysis on the trend structures of BTC, ETH, SOL, XRP, HYPE and other alt- and mem-coins of interest to my, highlighting key support and resistance zones to watch in the coming sessions. Charts featured in the video BTC ETH XRP (!) SOL (!) HYPE (!) TRUMP BRETT (!) FET ...

I was initially skeptical about the recovery structure unfolding since the April lows — it looked like a possible macro lower-high before deeper correction (as outlined in my previous idea). However, given the strength in underlying #BTC price action (covered in my recent video-idea on crypto trend structure) and clear signs of constructive consolidation and...

A new video update with insights on the intermediate trend structure with key support and resistance zones to keep on radar in the coming sessions Coins discussed in the video: CRYPTOCAP:BTC / CRYPTOCAP:ETH / CRYPTOCAP:XRP / GETTEX:HYPE / CRYPTOCAP:SOL / CRYPTOCAP:LINK / CRYPTOCAP:SUI / $BRETT / SEED_DONKEYDAN_MARKET_CAP:FLOKI and others Hope...

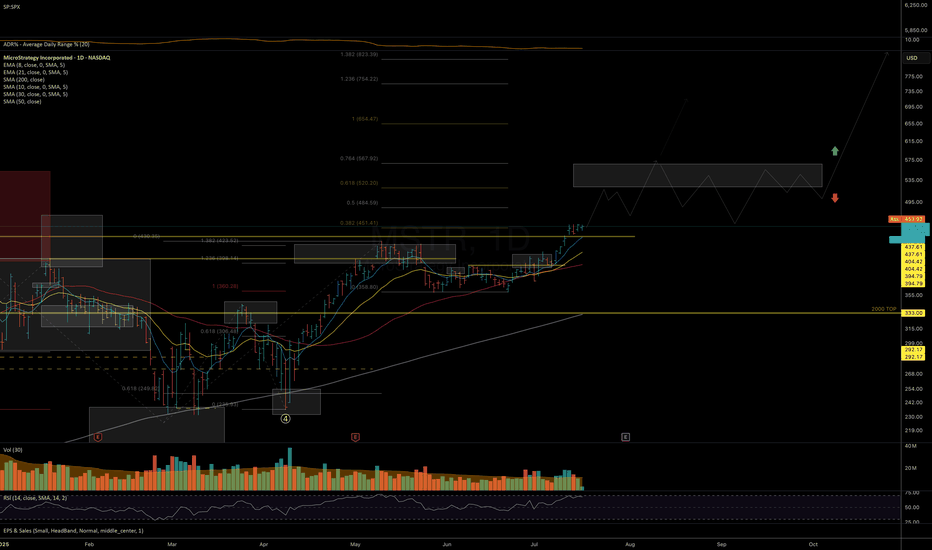

Price has reached a major resistance zone, with the 110 level marking an ideal spot where downside pressure may begin to dominate and a mid-term top could start forming. Macro support for the macro-uptrend structure is at the 80–65 area. Hedging near current levels may be prudent - especially ahead of earnings and while volatility remains relatively...

Back in April, I suggested the long-term uptrend from 2008 may have topped, shifting into a multi-year correction toward the 260–150 support zone. The decline unfolded faster than expected, with news-driven selling hitting the upper edge of that macro support — followed by a strong rebound. Apr mind www.tradingview.com Currently, price is consolidating...

Just recorded a new video overview of the crypto market and the current trend developments in major coins: CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , CRYPTOCAP:LINK , GETTEX:HYPE , BSE:SUPER , $FLOKI. Among the new assets on my radar I shared my view on the trend structure of $RENDER. In my personal investment planning, I continue to...

Updating my view on intermediate trend structures I am tracking in CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , GETTEX:HYPE , BSE:SUPER and SEED_DONKEYDAN_MARKET_CAP:FLOKI highlighting key support and resistance zones to watch in the coming sessions Charts featured in the video: BTC ETH XRP SOL HYPE SUPER ...

Sharing my current view on the macro price structure of Bitcoin, outlining both main and alternative scenarios based on trend wave analysis. Macro Trend Overview and Main scenario The uptrend from the Nov ’22 bottom shows a classic 5-wave impulsive structure, closely aligning with ideal Fibonacci proportions: Wave 3 peaked within the 1.382–1.618% zone Wave 4...

In this video, I share my current daily and weekly analysis on the trend structures of BTC, ETH, SOL, XRP, and HYPE, highlighting key support and resistance zones to watch in the coming sessions. Charts featured in the video: BTC ETH SOL XRP HYPE Thank you for your attention and I wish you successful trading decisions! If you’d like to hear...

Price is approaching a key level within the macro resistance zone (around 109). A mid-term correction may begin to unfold soon. Key support zone to watch for continuation of the macro uptrend: 77–61. Thank you for your attention and I wish you successful trading decisions!

Price is approaching a key macro support zone. However, as long as it remains below the $148 level, I cannot rule out the possibility of one more corrective leg toward the $76–$55 range before a medium-term bottom is established and a potential resumption of the broader uptrend begins. A breakout and sustained close above the $148 level would serve as the...

Price is showing a constructive, low-volume pullback into rising EMAs - a healthy sign within an ongoing uptrend as long as price is holding above 118-110 support zone. Daily trend structure: Macro trend structure (Weekly): Thank you for your attention and I wish you successful trading decisions!

Political uncertainty and questionable economic policies from the U.S. administration are eroding investor confidence globally, prompting a search for more reliable investment opportunities outside the U.S. Currently, the performance of European stock markets is outpacing that of the U.S. markets. For example, the ETF tracking major German stocks (ETF DAX) has...

Stock's fundamentals, price relative strength, and group action look strong. But the uptrend structure may have formed a mid-term top. Weekly: Downside potential remains as long as the price stays below the May 8th highs. Ideal macro support zone: 90–70. Daily: Thank you for your attention and I wish you successful trading decisions!

![Crypto market review [UPD]: set-ups in BTC and alt-coins RENDERUSDT: Crypto market review [UPD]: set-ups in BTC and alt-coins](https://s3.tradingview.com/n/nGYr7P74_mid.png)

![[UPD] BTC / ETH / XRP / SOL / HYPE and other alt and mem-coins BTCUSD: [UPD] BTC / ETH / XRP / SOL / HYPE and other alt and mem-coins](https://s3.tradingview.com/7/7mbSIn0K_mid.png)

![[UPD] Trend analysis: BTC / ETH / SOL / XRP and other BTCUSD: [UPD] Trend analysis: BTC / ETH / SOL / XRP and other](https://s3.tradingview.com/d/D0UPrJ49_mid.png)

![[UPD] BTC / ETH / SOL / XRP / HYPE / SUPER / FLOKI BTCUSD: [UPD] BTC / ETH / SOL / XRP / HYPE / SUPER / FLOKI](https://s3.tradingview.com/l/lH5raH4Y_mid.png)

![BTC: Macro Structure [Weekly Timeframe] BTCUSD: BTC: Macro Structure [Weekly Timeframe]](https://s3.tradingview.com/a/apXTbSqH_mid.png)