Trend Direction Price is currently bullish overall (uptrend). We can see higher highs (HH) and higher lows (HL) forming until the recent consolidation. Market Structure After creating a strong impulsive move up to the marked Supply H1 zone (2.0850–2.0870 area), price got rejected and entered sideways movement. Currently, price is pulling back but hasn’t yet...

Gold (XAU/USD) remains in a bearish market structure on the M15 timeframe. Price has now tapped into the supply zone (3352 – 3356) and is showing signs of rejection. 🔎 Trade Idea: Bias: Bearish Sell Zone: 3352 – 3356 Stop Loss: Above 3360 Take Profit 1: 3340 – 3332 Take Profit 2: 3300 📌 Notes: Structure still favors sellers (lower highs and lower...

1. Trade Setup Entry Price: ~0.8235 Stop Loss (SL): ~0.82645 (about 29 pips above entry) Take Profit (TP): ~0.81138 (about 121 pips below entry) Risk-to-Reward Ratio: ~1:4 — this is favorable if the setup plays out. 2. Price Action Context Price had a strong bullish push before entry, likely hitting a previous resistance area (near 0.8240–0.8260). The short...

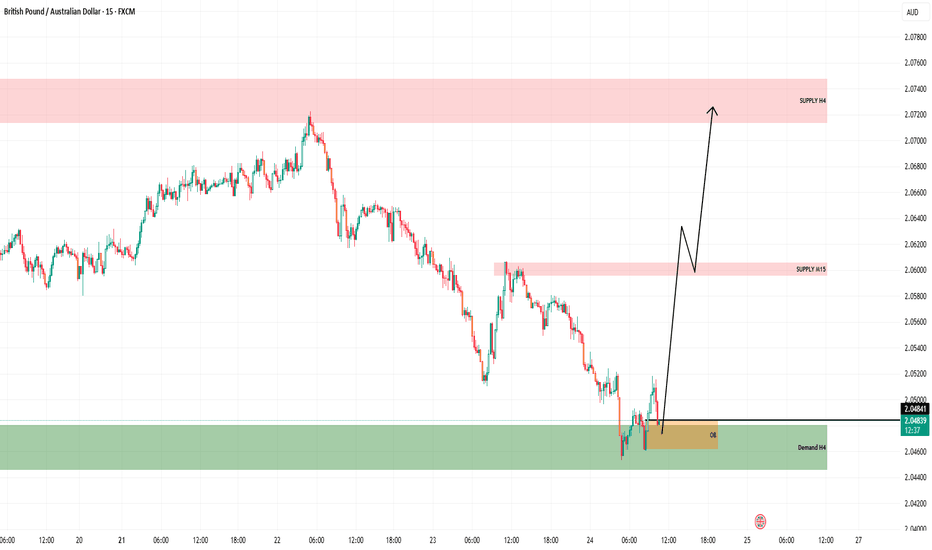

📊 Current Market Behavior: Price is retracing back toward the OB and FVG zone after a bullish move. A small pullback is expected (as shown by the downward leg of the arrow) to mitigate the OB/FVG. After mitigation, a strong bullish continuation is anticipated. ⚠️ Watch For: Bullish confirmation inside OB (e.g., bullish engulfing, strong rejection...

📈 Expected Price Action: Initial Reaction from Demand H4 & OB: Bullish rejection confirms buyers stepping in. Short-Term Target - Supply M15 (Red Zone): Around 2.0600 – Expect price to react or consolidate here temporarily. Final Target - Supply H4 Zone: Around 2.0720–2.0740, where higher-timeframe sellers may step in. ✅ Summary of Bias: Directional Bias:...

🟢 Current Trade Setup (Buy Position) Entry: Around 3,299.46 Take Profit (TP): 3,338.87 Stop Loss (SL): 3,285.64 Risk-Reward Ratio: ~1:3 ➜ This is a favorable R:R setup. Key Zone - Supply Area Marked as SUPPLY H4 (Higher Time Frame 4H supply zone). Price Range: ~3,350 to 3,368+ This is where sellers may aggressively enter the market. A potential reversal...

✅ Bias: Bullish You expect a reversal from the downside and a strong upward move toward the marked target. 🧱 Order Block (OB): A bullish Order Block is clearly marked around the 1.76800–1.76687 zone. This acts as your demand zone, where you anticipate institutional buying. 📉 FVG (Fair Value Gap): A Fair Value Gap is highlighted just above the OB. This...

🟨 Key Zones: POI: Identified as the Point of Interest (POI) or a 15m demand zone. Gray Box: Likely the true demand area (origin of the impulsive move), aligned with the red support line around $3,351.898 – $3,360.000. Lower Orange Zone: Labeled as 4H and Daily Demand, a major higher timeframe support zone. 🔄 Market Structure: The chart shows a clear uptrend,...

Market Structure Analysis: Trend: The market has been in a short-term downtrend but is showing signs of a potential reversal. Support Zone: Around 0.8800, where price has reacted strongly. Resistance Zone: Next target area is 0.8918, and a strong resistance is near 0.9030. Price Action: The price tested the 0.8800 level and is forming a bullish setup. The long...

Key Observations: Supply Zone (M15): The red-highlighted area marks a 15-minute supply zone where price previously reversed sharply, indicating strong seller presence. The price has tested this zone and reacted bearishly, suggesting a potential sell opportunity. Market Structure: The chart follows a higher high (HH) and higher low (HL) formation, but then...

Market Structure & Trend: The chart shows a strong bullish move followed by a correction. The price has reached a key resistance area near $2,816 - $2,829, where selling pressure is observed. A potential bearish setup is forming, indicating a possible price decline. Key Observations: Bearish Setup: A short trade setup is marked with a stop-loss above resistance...

Support Zone Identification: A strong rejection near $2736.55 highlights the presence of buyers at this level. This could act as a springboard for a bullish reversal. Trade Idea: Entry: A potential long trade is feasible near $2736.55, once the price shows confirmation of rejection and upward momentum. Stop-Loss: Below $2730.60, as a break below this level may...

Demand Zone (Green Area): A clearly marked demand zone lies below the current price level. This zone could potentially act as a strong support area where buyers are likely to step in. Price Movement Projection : The drawn path suggests that the price may drop into the demand zone and then reverse sharply upward toward the marked resistance level at...

Current Market Conditions: ** The price is currently hovering near 0.89393, close to the demand zone (yellow area: 0.89150–0.89300). ** The market is likely consolidating, as no strong bullish or bearish momentum is visible yet. Demand Zone (Support): ** The yellow zone represents a demand zone in the 1-hour timeframe. ** Buyers are expected to enter the...

Bearish Momentum: 1. A sharp move down (red arrow) is expected as price leaves the supply zone. 2. The confirmation of the bearish trend is seen in the breakdown of minor support levels. Trend: The current price action indicates a potential trend reversal from bullish to bearish. Key Risk: If the price breaks above the H1 supply zone, it invalidates the...

The supply zone near 96.674 is still marked as a key resistance area. Price is expected to test this zone before a potential reversal. The arrow suggests a bearish move from the supply zone down to the highlighted support level near 95.881. Enter short positions at 96.674 upon confirmation of bearish price action—place stop loss above the supply zone (around 96.800).

Supply Zone: The area between 1.26450 and 1.26500 represents a potential demand zone, likely to act as a support level. Price Action: The price has retraced after an upward movement, indicating a possible retest of the support zone. Bullish Signal: The arrow suggests that you anticipate the price will bounce from this zone and continue upward. Key...

Demand Zones (Yellow Boxes): The highlighted yellow zones indicate demand areas where buying interest is expected. Price might retrace to these zones before a potential move is higher. Imbalance and Price Targets : The chart illustrates an imbalance in price action, likely from a rapid bearish move (shown in the earlier left side). This is marked with a...